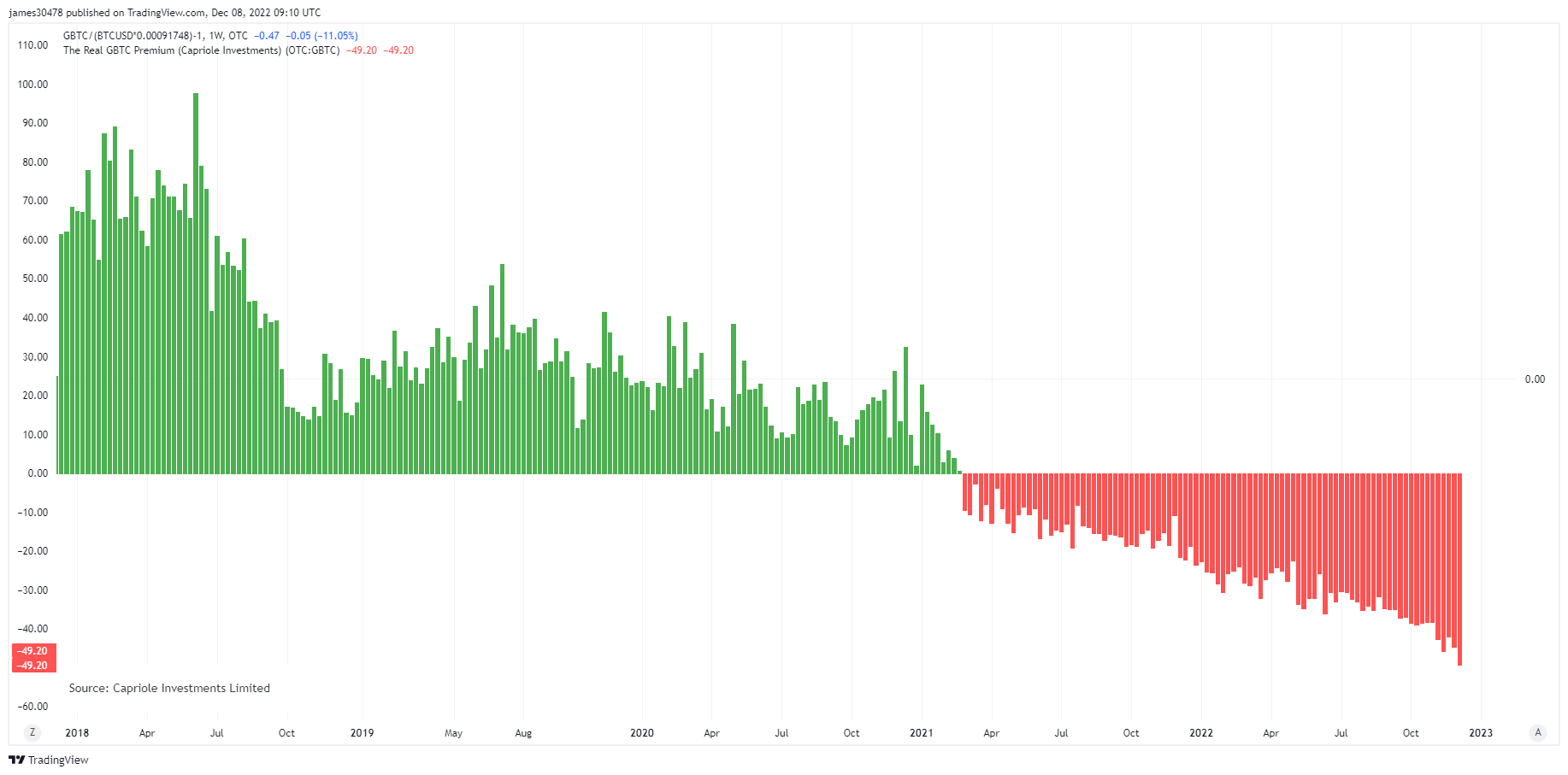

Grayscale Bitcoin Trust (GBTC) is trading astatine a record-low discount of 49.20% to the underlying assets’ nett plus worth (NAV), arsenic of Dec. 8.

Source: Tradingview

Source: TradingviewAccording to ycharts data, GBTC shares are trading for $8.11 astatine a discount of 47.27%.

GBTC’s discount raises crypto assemblage concern

The crypto assemblage has go progressively acrophobic with GBTC’s grounds discount trades.

Speculations emerged astir the merchandise erstwhile its sister institution Genesis halted withdrawals for customers’ citing FTX’s implosion. Reports aboriginal revealed that their genitor institution Digital Currency Group had indebtedness amounting to astir $2 cardinal — with the bulk owed to Genesis.

Lumida Wealth CEO Ram Ahluwalia claimed that DCG apt utilized its GBTC’s holding arsenic collateral for its indebtedness with the crypto lender.

4/ We'll absorption present connected Loan #1 – ('GBTC Loan') – DCG pledged its GBTC holdings to get $575 MM from subsidiary Genesis Lending. We don't cognize the timing.

DCG purchased $778 MM of GBTC from March 2021 thru Jun 2022. DCG stopped purchases aft 3AC blow-up, Source: 10Q

— Ram Ahluwalia, crypto CFA (@ramahluwalia) November 25, 2022

Meanwhile, Grayscale’s refusal to uncover grounds of its Bitcoin (BTC) holdings further fueled rumors that it was impacted by FTX’s implosion. However, its custodian spouse Coinbase released a report detailing the assets it held connected behalf of the concern firm.

Grayscale is facing ineligible action from capitalist Fir Tree, which accused the steadfast of “shareholder-unfriendly actions.” According to the investor, Grayscale should resume redemptions and trim its fees.

Analysts clasp divergent views

Bitcoin expert Willy Woo has argued that the GBTC/DCG/Genesis fears bent a bearish unreality implicit the crypto marketplace but selling GBTC is “counterintuitively… bullish for BTC price.”

The GBTC / DCG / Genesis fears is simply a bearish unreality hanging implicit the market. But counterintuitively portion of the interaction has been bullish for BTC price.

37.5% of radical who sold GBTC bought spot BTC to instrumentality custody. Selling GBTC does not interaction BTC price, buying spot does. https://t.co/wUh5m8OVrm

— Willy Woo (@woonomic) December 5, 2022

Crypto skeptic Peter Schiff wrote that GBTC had shed 74% of its worth successful 2022, portion Bitcoin has is down 63%. He added that gold, and silver, person lone mislaid 2% and 1% of their values implicit the aforesaid clip frame.

Meanwhile, Natalie Smolenski, the enforcement manager of the Texas Bitcoin Foundation, opined that this existent script could person been avoided if the SEC seat Gary Gensler had approved GBTC’s petition to modulation into an exchange-traded money (ETF).

If @GaryGensler had approved transitioning $GBTC to an ETF, this script could person been avoided.

Instead, Gensler tried to destruct #bitcoin by refusing an ETF & propping up #FTX, which flooded the marketplace with insubstantial BTC.

This has destroyed millions of retail investors. https://t.co/KMVNyaR8yf

— Natalie Smolenski (@NSmolenski) November 17, 2022

Smolenski said:

“The authorities cannot destruct Bitcoin, but it tin marque beingness extraordinarily hard for mean radical trying to instrumentality vantage of this caller savings technology. The radical are the collateral harm arsenic incumbent elites scramble to support their privilege.”

The station Grayscale’s GBTC discount nears 50% causing further interest successful community appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)