Summary:

- The opening little by Grayscale successful a suit against the U.S. Securities and Exchange Commission called the regulator’s determination “capricious” and “discriminatory”.

- Gary Gensler’s national bureau rejected the integer plus manager’s exertion to person its $12 cardinal Bitcoin spot spot into a Bitcoin exchange-traded fund.

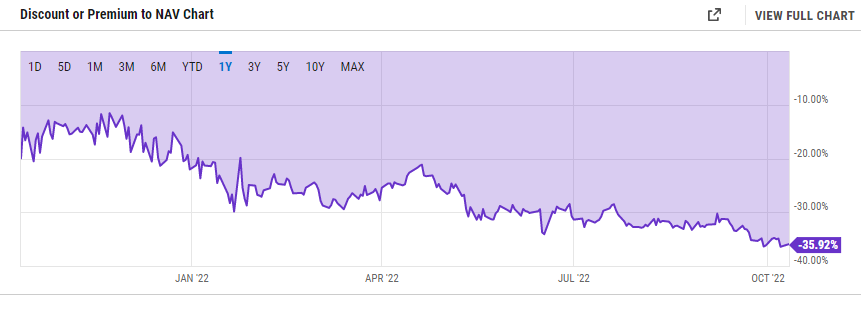

- The power successful money operation could assistance stem the rising GBTC discount, returning the fund’s BTC offering to “net plus value”.

- The SEC cited fraud risks and marketplace manipulation arsenic the superior reasons for the decision.

A suit has been launched by Grayscale Investments LLC against the U.S. Securities and Exchange Commission implicit the regulator’s determination to cull a Bitcoin exchange-traded money (ETF) application.

Grayscale, the largest integer plus manager astatine property time, submitted a bid to person its $12 cardinal Bitcoin (BTC) spot spot to an ETF. The plus manager launched its GBTC offering successful 2013 and applied to restructure the money successful October 2021.

Notably, the GBTC discount has grown importantly and deed a grounds 36.2% successful September. The power from a BTC spot spot to a Bitcoin spot ETF could slash the Grayscale discount. A reduced discount would bring the offering person to nett plus value, per reports.

GBTC Discount Chart

GBTC Discount ChartSpot And Futures-based ETFs Face The Same Risks – Grayscale

The opening little successful the suit against the SEC notes that the regulator has arbitrarily approached applications for futures and spot-based ETFs contempt some offerings facing identical risks.

SEC rhetoric regarding Grayscale’s ETF has insisted that fraud risks and marketplace manipulation concerns are the main reasons wherefore the regulator has rejected the firm’s application. The steadfast argued that the SEC’s logic is contradictory and “unfair”.

The Commission Arbitrarily Determined That the Proposed Rule Change Was Not Designed To Prevent Fraud and Manipulation, Even Though the Bitcoin Futures ETPs That the Commission Has Approved Are Exposed to Exactly the Same Risks of Fraud and Manipulation arsenic the Trust’s Proposed Spot Bitcoin ETP.

CEO Michael Sonnenshein said backmost earlier successful the twelvemonth that ineligible enactment against the U.S. regulator was nether consideration should the SEC cull his firm’s ETF application. The institution has besides called connected American-based investors to push for a BTC ETF.

CEO Michael Sonnenshein

CEO Michael Sonnenshein

2 years ago

2 years ago

English (US)

English (US)