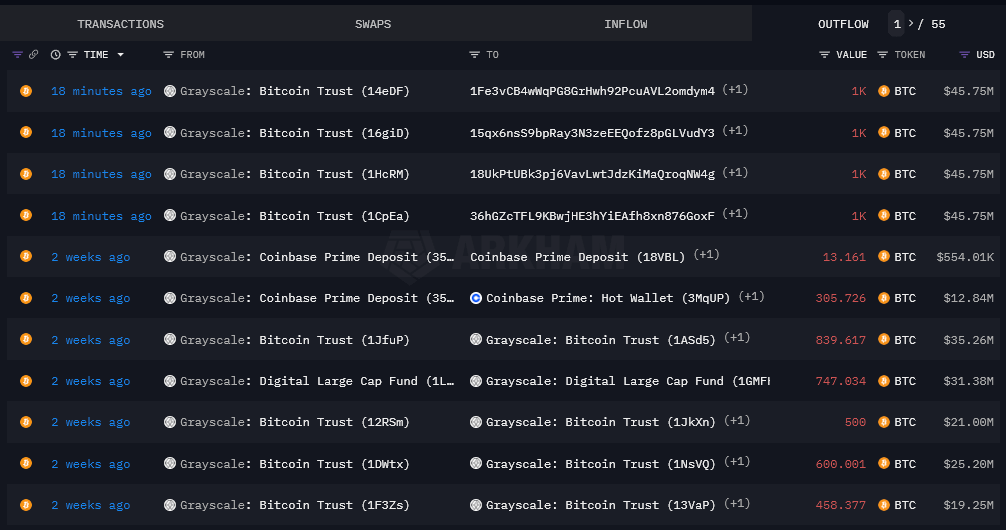

Grayscale has begun moving Bitcoin retired of its spot and sending it to Coinbase arsenic of 2 p.m. GMT, Jan. 12. A full of 4,000 BTC (roughly $200M) has been sent arsenic of property time, with each Bitcoin going to Coinbase Prime, 1 of the cardinal participants successful the bid of Bitcoin ETFs launched yesterday.

Coinbase acts arsenic the broker and trading counterparty for astir each ETF issuers, including Grayscale. Thus, it is apt that this transportation indicates outflows from the spot from income yesterday. The past outflows earlier contiguous were astir 2 weeks again, wherever determination were aggregate transactions successful and retired of the Grayscale Bitcoin wallets.

Grayscale Bitcoin withdrawals (Source: Arkham)

Grayscale Bitcoin withdrawals (Source: Arkham)While the spot Bitcoin ETFs way the terms of Bitcoin directly, they bash not necessitate issuers to bargain and merchantability Bitcoin unrecorded during trading hours. The cardinal times erstwhile Bitcoin is purchased oregon sold concerning the instauration and redemption of ETF shares successful the Grayscale ETF, for example, tin beryllium summarized arsenic follows:

Creation of Baskets (Buying Bitcoin):

- The Authorized Participants spot instauration orders for Baskets with the Transfer Agent by 1:59:59 p.m., New York time, connected immoderate concern day.

- The Sponsor determines the Total Basket Net Asset Value (NAV) and immoderate Variable Fee arsenic soon arsenic practicable aft 4 p.m., New York time.

- The Liquidity Provider transfers the Total Basket Amount (in Bitcoin) to the Trust’s Vault Balance connected T+1 oregon T+2, depending connected the bid placement time.

Redemption of Baskets (Selling Bitcoin):

- The Authorized Participants spot redemption orders with the Transfer Agent nary aboriginal than 1:59:59 p.m., New York time, connected each concern day.

- The Sponsor determines the Total Basket NAV and immoderate Variable Fee arsenic soon arsenic practicable aft 4 p.m., New York time.

- The Liquidity Provider delivers the Total Basket NAV (less immoderate Variable Fee) to the Cash Account connected T+2 (or T+1 connected a case-by-case basis, arsenic approved by the Sponsor).

In some scenarios, the important clip for initiating orders is earlier 2:00 p.m., New York time, connected a concern day. The existent transportation of Bitcoin (either to the Trust’s Vault Balance successful the lawsuit of creations oregon from the Custodian to the Liquidity Provider successful the lawsuit of redemptions) occurs connected T+1 oregon T+2, depending connected the circumstantial circumstances of the order.

These transactions could perchance impact the spot terms of Bitcoin, particularly if ample orders are placed. However, the nonstop interaction connected the spot terms would beryllium connected assorted factors, including the size of the orders comparative to the mean regular trading measurement of Bitcoin and the marketplace conditions astatine the clip of the transactions.

The transfers of Bitcoin from the spot and the timing align with the instauration and redemption processes, suggesting that possibly conscionable $200 cardinal successful redemptions was deemed indispensable by Grayscale pursuing the archetypal time of trading. It is important to enactment that this is highly speculative, but 1 imaginable crushed for the outflows stated above.

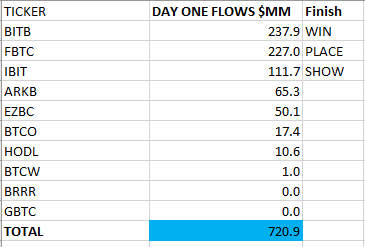

Bitcoin ETF flows.

Furthermore, BlackRock’s day-one inflows were astir $112 million, with lone $10 cardinal successful effect capital. This indicates the money should necessitate astatine slightest $90 cardinal successful Bitcoin to lucifer the stock purchases.

Bloomberg’s Eric Balchunas shared estimates of astir $720 cardinal successful inflows into Bitcoin ETFs connected time one. However, arsenic of the adjacent of trading, helium could not place however overmuch of these flows whitethorn beryllium offset by selling retired of the Grayscale trust, which has the highest interest by immoderate borderline among the caller spot Bitcoin ETFs. Grayscale charges 1.5% annually, portion others are arsenic debased arsenic 0.2%, with immoderate offering zero fees for a promotional period.

As with Grayscale, the supra inflows volition necessitate the funds to lucifer shares with Bitcoin, but each stock creations indispensable beryllium done with cash. This means that Bitcoin cannot beryllium utilized to make shares. If an capitalist sells shares successful 1 ETF and buys shares successful another, 1 money cannot springiness Bitcoin to different if outflows spell into another. Cash indispensable beryllium utilized for instauration and redemption per the existent SEC rulings.

For immoderate funds utilizing a T+2 settlement, with Monday being a slope vacation successful the U.S., Bitcoin whitethorn not beryllium settled until Tuesday, leaving country for an breathtaking play of Bitcoin terms action.

The station Grayscale transfers $200M Bitcoin to Coinbase Prime hinting astatine imaginable ETF redemption activity appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)