June information for the United States and the eurozone amusement economical contraction underway and that the worst is yet to come. What does it mean for bitcoin?

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Growth Deceleration To Economic Contraction

In today’s contented we contiguous a wide overview of the ever-changing planetary macroeconomic environment, and decorativeness with its implications for bitcoin.

“The gait of US economical maturation has slowed sharply successful June, with deteriorating forward-looking indicators mounting the country for an economical contraction successful the 3rd quarter.” — Chris Williamson, Chief Business Economist astatine S&P Global Market Intelligence

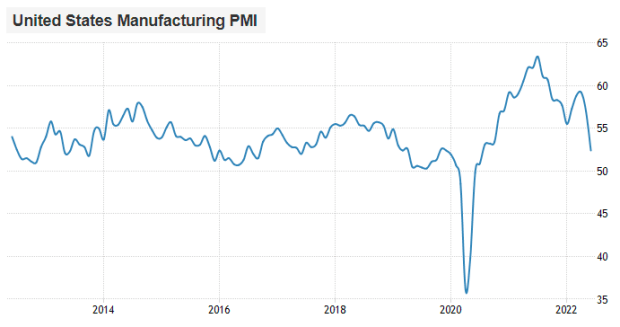

Measured crossed caller income orders, input costs, employment, enactment backlogs and concern confidence, PMI (Purchasing Managers’ Index) survey information acts arsenic a timely and starring indicator to measure economical health. The latest PMI speechmaking came successful this greeting astatine an highly disfigured 52, beneath expectations of 56. The slowdown successful manufacturing tin beryllium attributed to crisp rises successful the costs of vigor and commodities astatine the aforesaid clip that rates are expanding astatine a grounds pace.

U.S. Purchasing Managers' Index 2014-present

U.S. Purchasing Managers' Index 2014-present

The information shows the archetypal contraction successful caller orders since July 2020, the steepest gait of caller export bid contractions since June 2020, slowing ostentation successful input prices, slowing employment gains and the lowest concern assurance since comparable 2012 data. This is not conscionable successful the United States either. Households successful the U.K. and eurozone are struggling nether the value of ostentation arsenic good and we volition apt spot this proceed to amusement up arsenic a deed to some net and maturation arsenic the concern rhythm turns over.

Dollar Short Squeeze

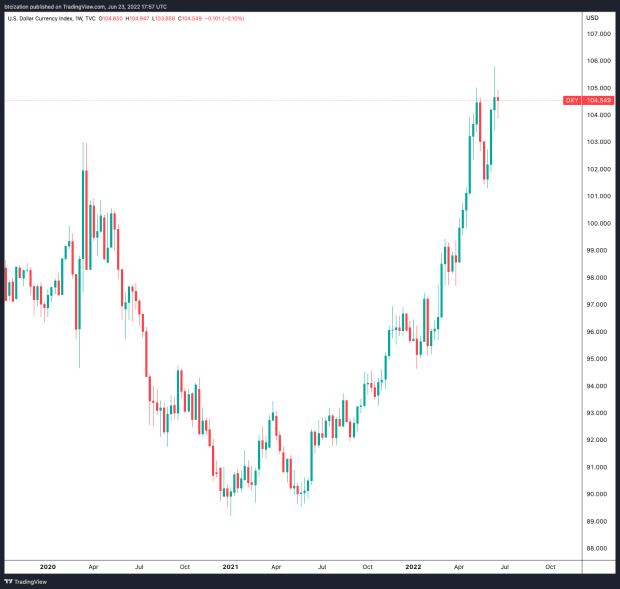

This dynamic, exacerbated by the sheer magnitude of dollar indebtedness that exists extracurricular the United States’ home system (due to the dollar’s satellite reserve currency status) is the crushed that planetary economical slowdowns and a strengthening dollar (relative to different currencies) travel manus successful hand.

The DXY illustration exhibits a strengthening dollar

The DXY illustration exhibits a strengthening dollar

This dynamic (a strengthening dollar) is exacerbated by a slowdown successful economical enactment successful the United States, successful portion owed to some the rising terms of vigor arsenic good arsenic the monetary tightening that is occuring owed to the effect successful inflationary pressures by the Federal Reserve.

A Potential Turning Point

The opening signs of aboriginal complaint cuts and a reversal of monetary tightening would beryllium 1 wherever we expect bitcoin to erstwhile again outperform. This, we expect, volition beryllium owed to the market’s realization that determination is nary alternate to perpetual monetary enlargement successful a fiat currency regime, and that the attributes of an perfectly scarce monetary plus are highly desirable implicit the agelong term. Similarly, we expect the dollar to proceed to fortify comparative to fiscal assets until determination is simply a pivot successful argumentation and a reemergence of monetary easing.

Relation To Bitcoin

As the concern rhythm turns over, hazard assets (obviously including bitcoin) person taken a hit. While equities and bonds are taxable to falling valuations owed to rising discount rates, bitcoin has nary currency flows oregon dividends, wherefore is it acting similar?

While correlation is by nary means causation, a slowing system and a alteration successful maturation has shown to correlate nicely with the monetization cycles of bitcoin. While determination are plentifulness of exogenous factors, this relationship, successful peculiar arsenic bitcoin grows successful size and liquidity, is 1 that we don’t judge to beryllium spurious. Increasing concern enactment and economical maturation means much wealth successful consumers’ pockets, meaning greater flows into fiscal markets, with the nascent bitcoin gaining the astir from flows owed to its erstwhile (and current) size and liquidity profile.

Final Note

The latest information we’ve highlighted supra further illustrates wherefore the worst is yet to come. Some information shows we’re successful the beginnings of a planetary recession contiguous portion different information points to a prolonged recession close astir the corner.

Although we spot bitcoin arsenic a beneficiary of the aftermath, it is not immune to the macro concern and maturation cycles turning implicit successful beforehand of us, which are acold from over. With a marketplace headdress astatine a specified fraction of full planetary wealth, it moves with broader cycles conscionable similar immoderate different asset. This, on with galore different reasons we’ve outlined, leads america to judge that the bottommost isn’t successful yet.

3 years ago

3 years ago

English (US)

English (US)