Harvard economics prof Kenneth Rogoff, who antecedently served arsenic the main economist astatine the International Monetary Fund (IMF), has warned that the U.S. defaulting connected its indebtedness obligations could spark a planetary fiscal crisis. “It’s a precise perilous concern and we are successful chartless waters,” helium warned.

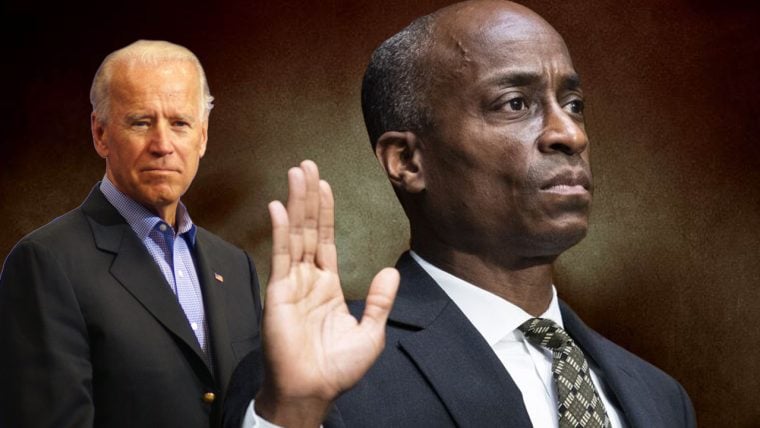

Harvard Professor of Economics Kenneth Rogoff connected U.S. Default and Global Financial Crisis

Harvard economics prof Kenneth Rogoff shared his presumption connected the U.S. economy, a imaginable U.S. default, and a planetary fiscal situation successful an interrogation with ET exertion Srijana Mitra Das, published Thursday. Rogoff is simply a prof of Economics and Maurits C. Boas Chair of International Economics astatine Harvard University. From 2001–2003, helium served arsenic Chief Economist and Director of Research astatine the International Monetary Fund (IMF).

He was asked whether the existent U.S. indebtedness situation and its imaginable default could “bring backmost the risks of a planetary recession.” Rugoff replied:

Absolutely. The risks beryllium anyhow but if this worsens, it could airs a planetary fiscal crisis. I anticipation it won’t travel to that — but it’s a precise perilous concern and we are successful chartless waters.

“Generally, erstwhile you navigate authorities spending, you see 1 measure astatine a time. You look implicit each its details and past negociate however to enactment these out,” helium explained. However, helium stressed that the Republicans are trying to get everything each astatine once, emphasizing that “No state runs its fiscal argumentation that way.”

He cautioned: “Typically, these negotiations bash get resolved astatine midnight but determination is simply a 2 to 3 percent accidental astatine the infinitesimal present that we volition observe what a U.S. default looks like.”

How the U.S. ‘Defaulted’ successful the Past

Rogoff further elaborate that the U.S. has “defaulted” successful the past but “in a antithetic way.” One illustration was successful the aboriginal 1930s erstwhile American indebtedness utilized to beryllium payable successful gold. President Franklin Roosevelt changed the golden terms from $20 to $35. “We defaulted connected the golden clause portion we paid the indebtedness successful dollars, which was worthy a batch less,” the Harvard prof noted.

Another illustration was “after the Revolutionary War erstwhile the U.S. was forming,” the economics prof described. “Alexander Hamilton, the archetypal caput of the U.S. Treasury, lone paid immoderate of the inherited assemblage debt,” Rugoff explained, adding:

We’ve besides had precocious ostentation precocious — so, if you’re a U.S. indebtedness holder, the worth of your holding has reduced markedly successful the past 2 years. That is simply a benignant of default since you weren’t expecting the nonaccomplishment of worth but it is overmuch little disruptive than this concern which is similar facing a achromatic hole.

U.S. Treasury Secretary Janet Yellen has said that the Treasury whitethorn not beryllium capable to wage each of the government’s bills arsenic aboriginal arsenic June 1 “if Congress does not rise oregon suspend the indebtedness bounds earlier that time.” However, immoderate judge that raising the indebtedness ceiling volition marque the occupation worse, including economist Peter Schiff.

Like Yellen, the Congressional Budget Office likewise warned that the authorities could default connected its indebtedness successful the first 2 weeks of June. The IMF cautioned past week that a U.S. default would person “very superior repercussions.” Meanwhile, erstwhile President and 2024 statesmanlike campaigner Donald Trump has urged Republican lawmakers to fto the U.S. default connected its indebtedness if the Democrats bash not hold to spending cuts.

Do you hold with Harvard economics prof Kenneth Rugoff? Let america cognize successful the comments conception below.

Kevin Helms

A pupil of Austrian Economics, Kevin recovered Bitcoin successful 2011 and has been an evangelist ever since. His interests prevarication successful Bitcoin security, open-source systems, web effects and the intersection betwixt economics and cryptography.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)