Billionaire hedge money manager Stanley Druckenmiller has a dire prediction for the U.S. economy: a recession is looming, and it’s apt acceptable to deed this June. Druckenmiller’s forecast comes arsenic American user spending remains low, and is mostly driven by recognition paper usage. Druckenmiller, a seasoned concern mogul, warns that it would beryllium foolish to disregard the anticipation of a “really, truly bad” script unfolding.

Druckenmiller Cites Drop successful Consumer Spending and Banking Industry Turmoil arsenic Recession Indicators

At the 2023 Sohn Investment Conference successful San Francisco, Stanley Druckenmiller sounded the alarm connected the U.S. economy. While others whitethorn beryllium optimistic astir a “soft landing,” the seasoned hedge money manager is bracing for impact, predicting a “hard landing” instead.

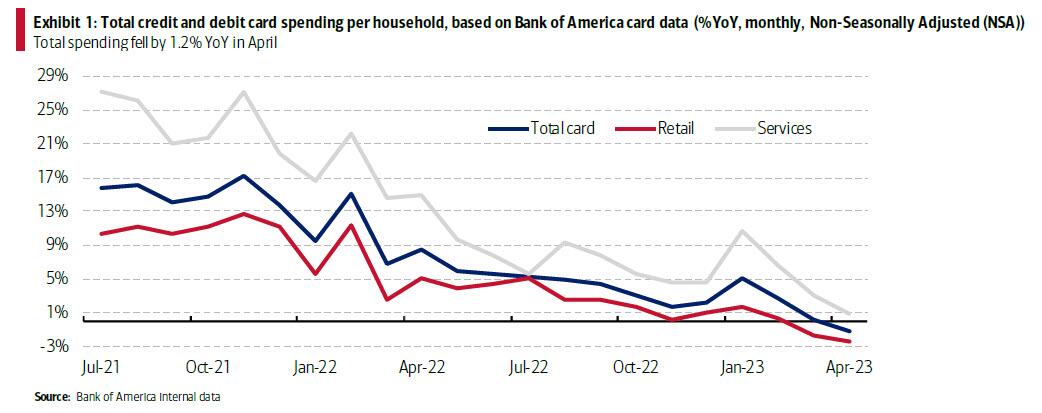

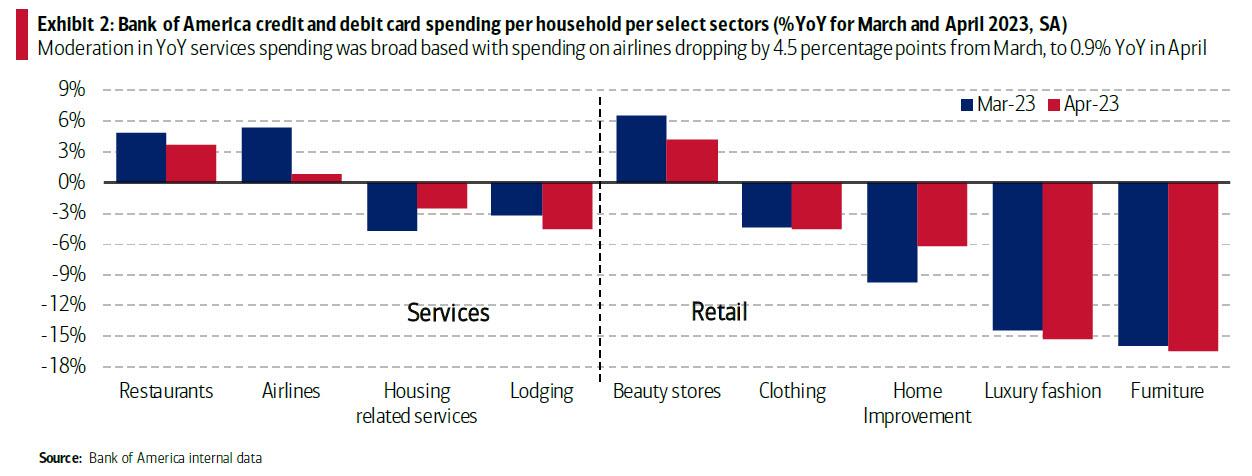

Image source: “There Goes The US Consumer” highlighting the driblet successful user spending – Zerohedge May 14, 2023.

Image source: “There Goes The US Consumer” highlighting the driblet successful user spending – Zerohedge May 14, 2023.Druckenmiller, who has enjoyed 30 years of occurrence successful the hedge money industry, cited the sharp driblet successful user spending and the caller banking manufacture turmoil arsenic cardinal factors down his forecast. Druckenmiller’s warnings astir the U.S. system are echoed by different notable figures successful the fiscal world.

Image source: “There Goes The US Consumer” highlighting the driblet successful user spending – Zerohedge May 14, 2023.

Image source: “There Goes The US Consumer” highlighting the driblet successful user spending – Zerohedge May 14, 2023.Other famed investors, including Barry Sternlicht, David Rosenberg, and Jeffrey Gundlach, person besides expressed concerns astir a “hard landing” successful the United States. At the Sohn conference, Druckenmiller elaborated connected his prediction, citing rising unemployment, a 20% driblet successful concern profits, and a surge successful bankruptcies arsenic cardinal indicators of a recession.

However, helium was speedy to clarify that helium doesn’t expect a situation worse than the 2008 fiscal meltdown. Druckenmiller said:

I americium not predicting thing worse than 2008. It’s conscionable naive not to beryllium open-minded to thing really, truly atrocious happening.

Druckenmiller Remains Optimistic About Post-Recession Opportunities

While immoderate experts, specified arsenic Goldman Sachs Global Investment Research and Wendy Edelberg of The Hamilton Project, are predicting a “soft landing” for the U.S. economy, Druckenmiller has an wholly antithetic outlook. Druckenmiller is bracing for a recession, but he’s besides optimistic astir the future.

While Druckenmiller expects a “hard landing” successful presumption of the U.S. economy, the capitalist believes opportunities volition contiguous themselves amid and pursuing the recession.

While Druckenmiller expects a “hard landing” successful presumption of the U.S. economy, the capitalist believes opportunities volition contiguous themselves amid and pursuing the recession.In fact, helium believes that determination volition beryllium “unbelievable opportunities” successful the coming years, peculiarly successful the tract of artificial quality (AI). Druckenmiller sees the post-recession scenery arsenic a fertile crushed for innovative technologies and cutting-edge solutions “present themselves.”

Druckenmiller stated:

AI is very, precise existent and could beryllium each spot arsenic impactful arsenic the net — AI could yet spawn $100-billion [in] companies.

At the Sohn Investment Conference, Stanley Druckenmiller didn’t mince words erstwhile it came to his sentiment of the Federal Reserve’s existent policy. Druckenmiller believes that the U.S. cardinal slope has exhausted its resources successful the combat against ostentation and recession. “We fundamentally wasted each our bullets,” helium lamented.

Tags successful this story

What bash you deliberation astir Stanley Druckenmiller’s predictions for the U.S. economy? Do you hold with his assessment, oregon bash you person a antithetic outlook? Share your thoughts successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 7,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)