The Helium Network, a crypto-powered distributed web of long-range wireless hotspots, has amassed implicit fractional a cardinal miners crossed the satellite successful conscionable 2 years and is expected to transverse the 1 cardinal people successful the adjacent six months.

Now, immoderate crypto-market analysts are asking if Helium’s HNT token is poised to emergence successful worth – and what the risks mightiness be.

A Helium hotspot is simply a tiny instrumentality that plugs into a regular electrical outlet, taps into existing net work and extends that Wi-Fi for miles – providing a transportation to section devices arsenic good arsenic acting arsenic a node connected the network. Hotspot owners are rewarded successful cryptocurrency – the HNT tokens – for operating the hotspots.

Helium uses a "burn-and-mint equilibrium" token model, with 2 units of exchange: HNT and Data Credits (DC). Users wanting to usage the web to transportation information usage DC, which is acceptable astatine a fixed complaint of $0.00001 per 24 bytes of data. When DC is acquired, HNT is burned — reducing the proviso of HNT.

So that's what mightiness thrust appreciation successful the terms of HNT: Greater usage of the web would theoretically marque the tokens scarcer, and frankincense much valuable.

Sean Farrell, vice president of integer plus strategy astatine Fundstrat Global Advisors, told CoinDesk successful an interrogation that based connected node maturation and adoption, “people mightiness beryllium underestimating however rapidly Helium could instrumentality the marketplace stock from incumbent wireless carriers implicit the adjacent fewer years.”

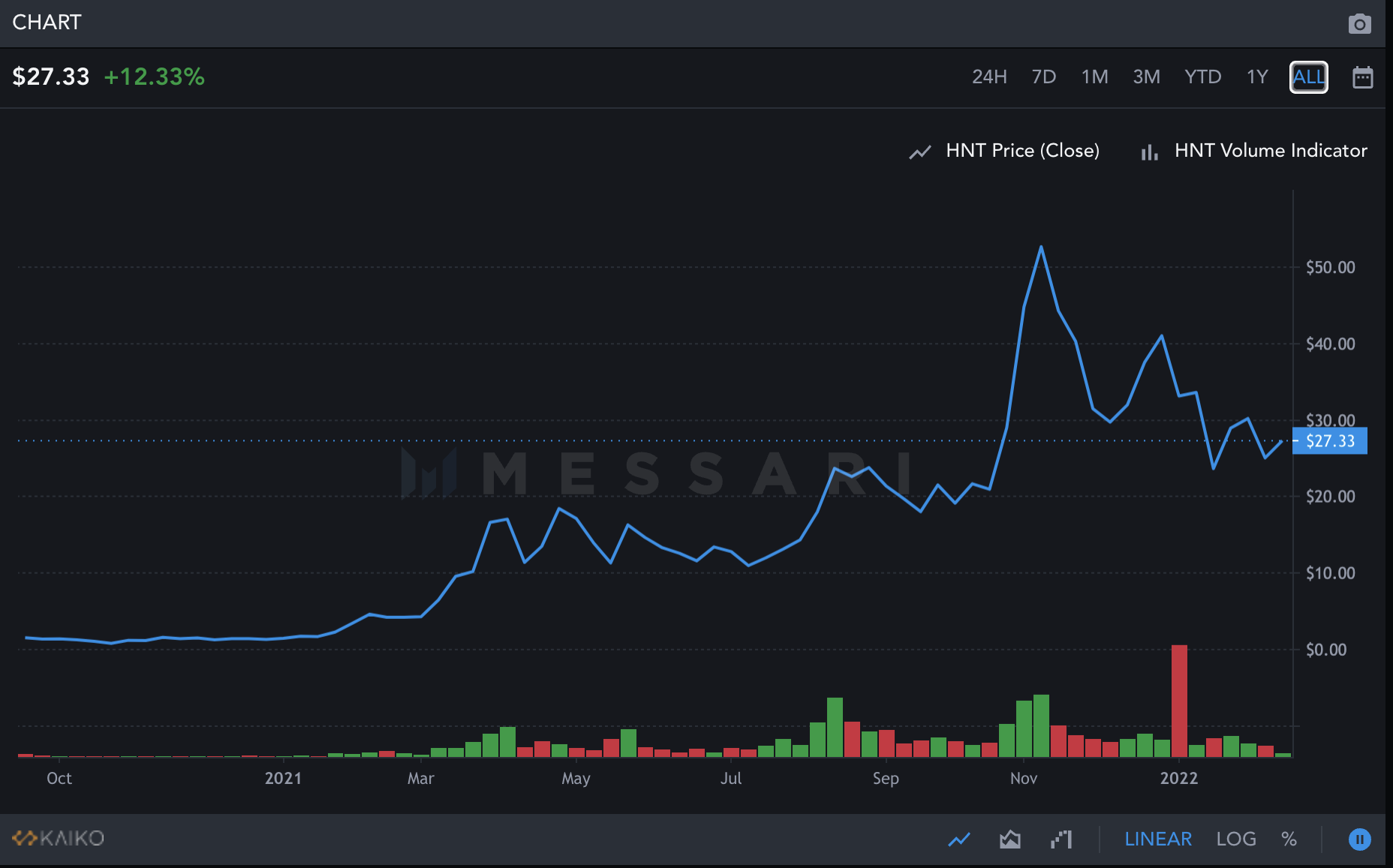

Helium’s HNT token has been trading successful the $20-$40 scope since the commencement of the twelvemonth and is down 32% successful the past 3 months. HNT reached an all-time precocious of $54.81 successful November erstwhile bitcoin besides reached its all-time precocious of $68,700. The terms is presently astir $26, according to information from Messari.

Looking astatine the existent wireless market, Farrell expects the worth of holding tokens successful the Helium web to beryllium valued higher than equity successful a wireless carrier.

He compares Helium with T-Mobile, which presently has the largest existing 5G web and a marketplace capitalization northbound of $150 billion. Helium presently has a marketplace headdress of $2.9 billion.

“Even this examination falls abbreviated since a important vantage of the web is the decentralization of hardware costs,” said Farrell. He added that the distributed quality of the Helium web besides allows for enlargement into geographic areas that would different beryllium unprofitable.

“Hence, the marketplace imaginable for Helium is apt larger than the existing wireless market,” said Farrell.

At the existent gait of growth, the web is adding 80,000 caller hotspots monthly, according to Frank Mong, Helium’s main operating officer.

HNT is down 52% from its all-time precocious reached successful November 2021. (Messari)

Farrell said that a important damper for the terms close present is the cryptocurrency's wide availability to U.S. investors – perchance introducing the hazard of regulatory involution nether applicable securities laws.

The U.S. Securities and Exchange Commission defines securities arsenic fungible, negotiable fiscal instruments that correspond immoderate benignant of fiscal value, usually successful the signifier of a stock, enslaved oregon option.

Securities and Exchange Commission Chair Gary Gensler has antecedently said: “I deliberation that the securities laws are rather clear. If you’re raising wealth from idiosyncratic else, and the investing nationalist has a tenable anticipation of profits based connected the efforts of others, that fits wrong the securities law."

“It’s imaginable that [HNT] would beryllium considered a information by the SEC and truthful is not listed connected immoderate home exchanges,” said Farrell.

When asked whether Helium was acrophobic whether HNT mightiness beryllium deemed a security, Helium’s Mong said, “We consciousness assured that our HNT incentive-based web serves a inferior intent to link sensors to the internet. Ultimately, that is simply a question champion near to a regulatory body.”

Coinbase, the biggest U.S. crypto exchange, does not presently database HNT. The token is listed connected FTX’s planetary speech and Binance.US.

Coinbase has flirted with the thought of listing HNT, but determination has been nary travel up truthful far. In July 2020 the institution wrote successful a blogpost it had added HNT arsenic an “asset nether review” and that it was “conducting engineering enactment to perchance enactment the assets.”

CoinDesk reached retired to Coinbase to inquire whether it had plans to database HNT this twelvemonth and a spokesperson responded with, “We don't remark connected circumstantial assets.”

“I wouldn’t beryllium amazed if Coinbase lists HNT soon,” said Gerald Votta, caput of GameFi probe astatine Quantum Economics. “With A16Z already having invested a batch of wealth successful Helium, I deliberation Coinbase volition database eventually, '' added Votta. A16Z is shorthand for Andreessen Horowitz, a task superior steadfast that's investing heavy successful the crypto industry. In August, A16Z alongside others invested $111 cardinal into the Helium Network.

"Helium represents an wholly caller concern exemplary for deploying wireless networks astatine standard astatine a fraction of the cost," Ali Yahya, wide spouse astatine Andreessen Horowitz, said astatine the clip successful a statement. “Helium built and deployed an wholly caller wireless web from scratch and achieved planetary adoption crossed much than 11,000 cities astir the satellite successful little than 24 months. It is the fastest rollout of a caller wireless web ever, a genuinely awesome and singular feat.”

According to Votta, HNT is priced a small implicit just value.

“This is due to the fact that the lone existent usage lawsuit for Helium is to usage HNT to wage rewards to miners,” said Votta. “Until Helium adds much circles to its Venn diagram and has much utility, the speculators are successful control.”

Adam Nasli, caput expert astatine planetary broker BrokerChooser disagrees with Votta's take, saying that Helium’s real-world usage lawsuit gives the task a invaluable edge.

“Through carnal devices, hotspot owners supply wireless connectivity for existent companies and existent people,” said Nasli. Lime, the scooter- and bike-sharing company, uses Helium to way the locations of its units.

Farrell predicts that erstwhile Helium rolls retired 5G miners, a fewer much partnerships and establishes on-chain governance, “the web volition garner much retail attraction and existent usage.”

In October, DISH, a U.S. direct-broadcast outer provider, announced a concern with Helium. The institution was the archetypal large bearer to usage the Helium Network’s blockchain-based exemplary with customers deploying their ain 5G hotspots.

Votta predicts that aft the DISH concern progresses, the ecosystem volition grow with aggregate caller usage cases, pushing the terms of the token up.

Nasli notes that immoderate investors mightiness inactive beryllium hesitant astir Helium due to the fact that HNT’s worth is mostly driven by the wider crypto market, making it unpredictable and volatile. There is simply a beardown correlation betwixt the prices for bitcoin and HNT; implicit the past 3 months, the correlation works retired to 0.8.

“This precocious correlation makes it unpredictable, affecting its value,” said Nasli.

CORRECTION (Feb. 18, 12:07 UTC): Corrects Data Credit terms to $0.00001 from $0.0001.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Lyllah Ledesma is simply a CoinDesk Markets newsman presently based successful Europe. She holds a Masters grade from New York University successful Business and Economics and an undergraduate grade successful Political Science from the University of East Anglia. Lyllah holds bitcoin, ethereum, and tiny amounts of different crypto assets.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)