By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin (BTC) has retraced to astir wherever it was earlier Federal Reserve Chair Jerome Powell’s dovish remarks connected Friday, which concisely sparked a rally successful U.S. stocks and cryptocurrencies.

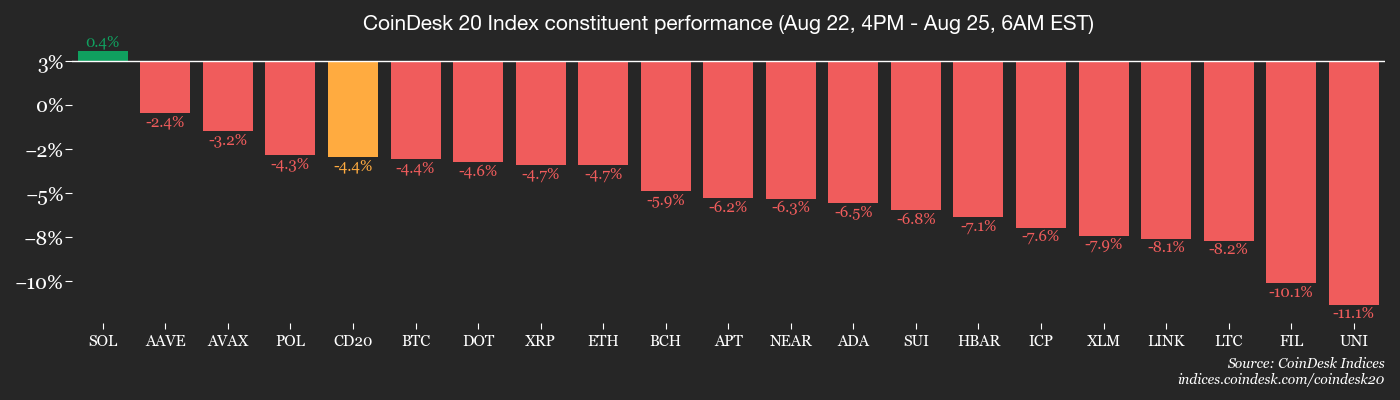

The reversal successful BTC terms has paused ether’s rally and triggered losses crossed the broader altcoin market. The CoinDesk 20 (CD 20) Index is down 3% connected a 24-hour basis, portion the broader CoinDesk 80 (CD 80) scale has fallen 3.74% arsenic of writing.

Alex Kuptsikevich, elder expert astatine FxPro, noted that liquidity appears to beryllium shifting from bitcoin into altcoins. “Bitcoin is trading astatine $112,000, having fallen to a debased of $110,000—its weakest level since aboriginal July. Friday’s surge attracted caller sellers, pushing BTC beneath its 50-day moving average. So far, liquidity seems to beryllium migrating from BTC to Ethereum and different altcoins similar Solana. However, we cannot regularisation retired that this is simply a precursor, with Bitcoin perchance starting a ‘sell-on-rise’ signifier that whitethorn soon widen to altcoins,” Kuptsikevich said successful an email.

Adding to the narrative, blockchain analytics steadfast Lookonchain reported that a salient bitcoin whale, who received 100,000 BTC a agelong portion ago, began diversifying into ether implicit the weekend.

Singapore-based QCP Capital chimed successful with a longer-term perspective, stating, “Near term, BTC appears to beryllium ceding momentum to ETH, but our structural outlook connected Bitcoin remains optimistic. Similar to July’s absorption of astir 80,000 BTC of bequest supply, we expect institutions to proceed buying dips selectively.”

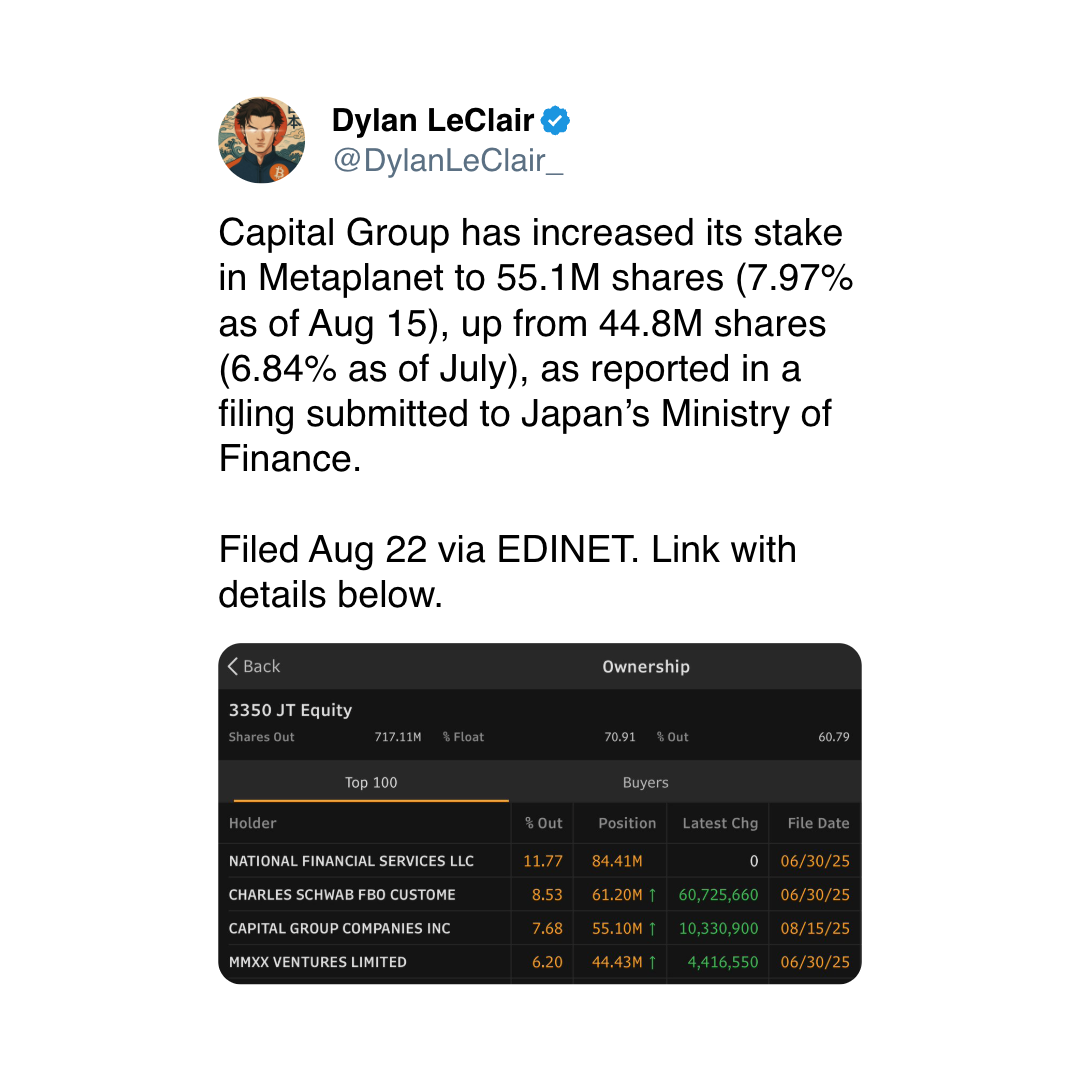

Highlighting organization involvement successful dip buying, Tokyo-listed Metaplanet announced the acquisition of an further 103 BTC, raising its holdings to 18,991 BTC. These developments travel connected the heels of Japan’s Finance Minister endorsing regulated crypto assets arsenic a morganatic diversification instrumentality wrong broader portfolios.

On the derivatives front, the terms swings since Friday person sparked notable activity. Hyperliquid, an on-chain perpetual futures platform, announced hitting a caller 24-hour all-time precocious spot measurement of $3.4 billion, driven mostly by rises successful BTC and ETH deposits.

The speech present ranks arsenic the 2nd largest venue for spot BTC trading crossed centralized and decentralized exchanges, with $1.5 cardinal successful 24-hour BTC measurement alone. This surge reflects the increasing traction of specialized blockchain-based trading ecosystems.

Meanwhile, successful accepted markets, the U.S. Dollar Index (DXY) edged up 0.22% to 97.94 pursuing a adjacent 1% diminution connected Friday. Gold prices remained flat, portion European stocks and S&P 500 futures traded lower, indicating a measured grade of capitalist hazard aversion. Stay alert!

What to Watch

- Crypto

- Aug. 27, 3 a.m.: Mantle Network (MNT), an Ethereum layer-2 blockchain, volition rotation retired its mainnet upgrade to mentation 1.3.1, enabling enactment for Ethereum’s Prague update and introducing caller features for level users and developers.

- Macro

- Aug. 25, 3 p.m.: The Central Bank of Paraguay releases July shaper terms ostentation data.

- PPI YoY Prev. 4.8%

- Aug. 26, 8:30 a.m.: The U.S. Census Bureau releases July manufactured durable goods orders data.

- Durable Goods Orders MoM Est. -4% vs. Prev. -9.3%

- Durable Goods Orders Ex Defense MoM Prev. -9.4%

- Durable Goods Orders Ex Transportation MoM Est. 0.1% vs. Prev. 0.2%

- Aug. 26, 10 a.m.: The Conference Board (CB) releases August U.S. user assurance data.

- CB Consumer Confidence Est. 98 vs. Prev. 97.2

- Aug. 27: The U.S. volition enforce an further 25% tariff connected Indian imports related to Russian lipid purchases, efficaciously raising full tariffs connected galore goods to astir 50%.

- Aug. 25, 3 p.m.: The Central Bank of Paraguay releases July shaper terms ostentation data.

- Earnings (Estimates based connected FactSet data)

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

- Aug. 28: IREN (IREN), post-market, $0.18

Token Events

- Governance votes & calls

- dYdx (DYDX) is voting connected whether to o.k. a whitelist update to the VIP Affiliate Program. Voting closes connected Aug. 25.

- Aug. 25: Supra (SURPA) to big assemblage call astatine 08:00.

- Unlocks

- Aug. 25: Venom (VENOM) to unlock 2.34% of its circulating proviso worthy $9.45 million.

- Aug. 28: Jupiter (JUP) to unlock 1.78% of its circulating proviso worthy $26.36 million.

- Sep. 1: Sui (SUI) to merchandise 1.25% of its circulating proviso worthy $153.1 million.

- Token Launches

- Aug. 25: Kek (KEK) to database connected Poloniex.

- Aug. 25: DNA (DNA) to database connected BitMart.

- Aug. 25: Cudis (CUDIS) to database connected Gate.io.

- Aug. 26: Centrifuge (CFG) to database connected Bybit.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done Aug. 31.

- Aug. 25-26: WebX 2025 (Tokyo)

- Aug. 27: Blockchain Leaders Summit 2025 (Tokyo)

- Aug. 27-28: Stablecoin Conference 2025 (Mexico City)

- Aug. 28-29: Bitcoin Asia 2025 (Hong Kong)

Token Talk

By Shaurya Malwa

- Hyperliquid deed a caller 24-hour spot measurement ATH of $3.4B, powered by surging BTC and ETH deposits and trading via Hyperunit.

- This spike positioned Hyperliquid arsenic the second-largest venue for spot BTC trading, crossed some centralized and decentralized platforms, with $1.5B successful BTC measurement alone.

- Such measurement milestones amended Hyperliquid’s entreaty by proving its quality to grip institutional-scale bid flow.

- The platform’s architecture — built connected HyperCore (Layer‑1 with HyperBFT consensus) and HyperEVM — delivers sub-second finality, precocious throughput, and EVM compatibility, making it highly charismatic to some high-frequency traders and DeFi builders.

- Its increasing volume, particularly successful BTC spot markets, strengthens Hyperliquid’s worth proposition arsenic a liquidity furniture successful DeFi, reinforcing its “AWS of liquidity” thesis driven by show and infrastructure depth.

- Spot maturation complements its perpetuals dominance—where the level already captures 60–70% of DEX marketplace share, delivering much on-chain gross than adjacent Ethereum.

- High spot measurement translates into existent benefits for HYPE holders — its token benefits from regular buybacks funded by trading interest flows via its Assistance Fund, tying level usage straight to semipermanent token value.

Derivatives Positioning

- BTC and HYPE's planetary futures unfastened involvement person accrued by 1% and 3%, respectively, successful the past 24 hours, bucking the broader inclination of outflows observed successful different apical 10 tokens.

- Cumulative unfastened involvement successful USD and USDT-denominated perpetual futures crossed starring exchanges specified arsenic Binance, Bybit, OKX, Deribit, and Hyperliquid remained level connected Friday contempt the terms rally. However, since then, unfastened involvement has risen from astir 260,000 contracts to 282,000, indicating a “sell connected rally” sentiment among traders. (check illustration of the time section).

- The other is the lawsuit successful the ether market, wherever the OI ticked higher during Friday's rally and has retreated with the terms pullback. This signifier suggests a impermanent intermission successful bullish momentum alternatively than the constitution of caller abbreviated positions, indicating a bullish breather alternatively than a displacement toward bearish sentiment.

- Speaking of backing rates, but for ADA, astir tokens spot affirmative rates, indicating a nett bias for bullish agelong positions.

- Altcoin futures OI exploded by much than $9.2 cardinal successful a azygous time connected Friday, pushing the combined full tally to a caller precocious of $61.7 billion. "Such accelerated inflows item however altcoins are progressively driving leverage, volatility, and fragility crossed integer plus markets," Glassnode said.

- On the CME, unfastened involvement successful ether options deed a notional grounds precocious of implicit $1 cardinal connected Friday. This follows a grounds fig of ample holders successful the futures marketplace aboriginal this month. Ether futures OI deed a caller precocious supra 2 cardinal ETH.

- Notional unfastened involvement successful BTC options roseate to $4.85 billion, the highest since April, arsenic futures enactment remained subdued.

- On Deribit, BTC options continued to amusement a bias for puts retired to the December expiry, contradicting the post-Powell bullish sentiment successful the market. In ether's case, calls traded astatine a flimsy premium.

Market Movements

- BTC is down 4.45% from 4 p.m. ET Friday astatine $111,825.43 (24hrs: -2.63%)

- ETH is down 4.84% astatine $4,612.09 (24hrs: -2.89%)

- CoinDesk 20 is down 4.23% astatine 4,125.81 (24hrs: -2.93%)

- Ether CESR Composite Staking Rate is down 14 bps astatine 2.83%

- BTC backing complaint is astatine 0.0096% (10.5525% annualized) connected Binance

- DXY is up 0.19% astatine 97.90

- Gold futures are down 0.28% astatine $3,408.80

- Silver futures are down 0.88% astatine $38.71

- Nikkei 225 closed up 0.41% astatine 42,807.82

- Hang Seng closed up 1.94% astatine 25,829.91

- FTSE is up 0.13% astatine 9,321.40

- Euro Stoxx 50 is down 0.49% astatine 5,461.49

- DJIA closed connected Friday up 1.89% astatine 45,631.74

- S&P 500 closed up 1.52% astatine 6,466.91

- Nasdaq Composite closed up 1.88% astatine 21,496.54

- S&P/TSX Composite closed up 0.99% astatine 28,333.13

- S&P 40 Latin America closed up 2.87% astatine 2,737.36

- U.S. 10-Year Treasury complaint is up 1.1 bps astatine 4.269%

- E-mini S&P 500 futures are down 0.23% astatine 6,468.50

- E-mini Nasdaq-100 futures are down 0.32% astatine 23,495.25

- E-mini Dow Jones Industrial Average Index down 0.21% astatine 45,619.00

Bitcoin Stats

- BTC Dominance: 58.21% (+0.45%)

- Ether-bitcoin ratio: 0.04123 (-2.07%)

- Hashrate (seven-day moving average): 954 EH/s

- Hashprice (spot): $54.38

- Total fees: 3.478 BTC / $387,601

- CME Futures Open Interest: 1453,320 BTC

- BTC priced successful gold: 33.1 oz.

- BTC vs golden marketplace cap: 9.36%

Technical Analysis

- XRP presently trades wrong the Ichimoku cloud, suggesting uncertainty.

- A driblet beneath the little extremity of the unreality would awesome a continuation of the broader downtrend.

- XRP peaked astatine $3.65 past period with a tweezer top bearish candlestick pattern.

Crypto Equities

- Strategy (MSTR): closed connected Friday astatine $358.13 (+6.09%), -3.76% astatine $344.65 successful pre-market

- Coinbase Global (COIN): closed astatine $319.85 (+6.52%), -2.47% astatine $311.96

- Circle (CRCL): closed astatine $135.04 (+2.46%), +0.19% astatine $135.30

- Galaxy Digital (GLXY): closed astatine $25.57 (+7.03%), -4.5% astatine $24.42

- Bullish (BLSH): closed astatine $70.82 (+1.46%), -4.08% astatine $67.93

- MARA Holdings (MARA): closed astatine $16.29 (+5.03%), -4.05% astatine $15.63

- Riot Platforms (RIOT): closed astatine $13.22 (+7.74%), -3.48% astatine $12.76

- Core Scientific (CORZ): closed astatine $13.55 (-1.74%), -0.52% astatine $13.48

- CleanSpark (CLSK): closed astatine $9.82 (+5.25%), -3.56% astatine $9.47

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $28.29 (+5.25%)

- Semler Scientific (SMLR): closed astatine $31.43 (+4.42%), -2.16% astatine $30.75

- Exodus Movement (EXOD): closed astatine $27.33 (+4.51%)

- SharpLink Gaming (SBET): closed astatine $20.87 (+15.69%), -3.21% astatine $20.20

ETF Flows

Spot BTC ETFs

- Daily nett flows: -$23.2 million

- Cumulative nett flows: $53.8 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: $337.7 million

- Cumulative nett flows: $12.45 billion

- Total ETH holdings ~6.27 million

Source: Farside Investors

Chart of the Day

- Open involvement successful BTC perpetual futures listed connected large exchanges has accrued alongside a driblet successful prices since Saturday.

- A operation of emergence successful unfastened involvement alongside a driblet successful a terms is said to corroborate the downtrend.

While You Were Sleeping

- Bitcoin Reverses Powell Spike With a Flash Crash arsenic Options Market Signals Jitters Ahead (CoinDesk): A whale’s $300 cardinal bitcoin selloff concisely sent prices nether $111,000, erasing Powell-fueled gains. Options information shows puts costing much than calls arsenic traders brace for further downside.

- Philippine Congressman Proposes Bitcoin Reserve to Attack National Debt (CoinDesk): The measure requires the cardinal slope to amass 10,000 BTC implicit 5 years, locked for 2 decades and usable lone to trim nationalist debt, with income capped astatine 10% each 2 years.

- Japan's Finance Minister Says Crypto Assets Can beryllium Part of Diversified Portfolio (CoinDesk): Katsunobu Katō's remark, made Monday portion speaking astatine an lawsuit successful Tokyo, comes amid concerns implicit Japan's precocious debt-to-GDP ratio and the imaginable for fiscal repression and yen depreciation.

- Why Bitcoin Treasury Companies Are a Fool’s Paradise (Financial Times): Although specified firms connection advantages implicit holding bitcoin straight — particularly successful jurisdictions wherever regulatory obstacles forestall this — their leveraged strategy could backfire severely erstwhile the bull marketplace ends.

- Dollar Basis Premium Hints astatine Weakening Appetite for Treasuries (Bloomberg): The dollar’s premium successful FX derivatives markets has astir disappeared for the archetypal clip successful 5 years, with overseas investors present holding lone a 3rd of Treasuries versus astir fractional successful 2012.

- 5 Years On, China’s Property Crisis Has No End successful Sight (The New York Times): Today's delisting of China Evergrande underscores the spot sector’s unraveling, yet Beijing avoids a sweeping bailout, wary of repeating its 2015 debt-fueled rescue, adjacent arsenic prices sink, vacancies swell and smaller firms fail.

In the Ether

3 months ago

3 months ago

English (US)

English (US)