On Wednesday, U.S. President Joe Biden issued a long-awaited enforcement order directing assorted national agencies to coordinate connected argumentation for integer assets. The verbatim substance from the White House briefing country appears below.

By the authorization vested successful maine arsenic president by the Constitution and the laws of the United States of America, it is hereby ordered arsenic follows:

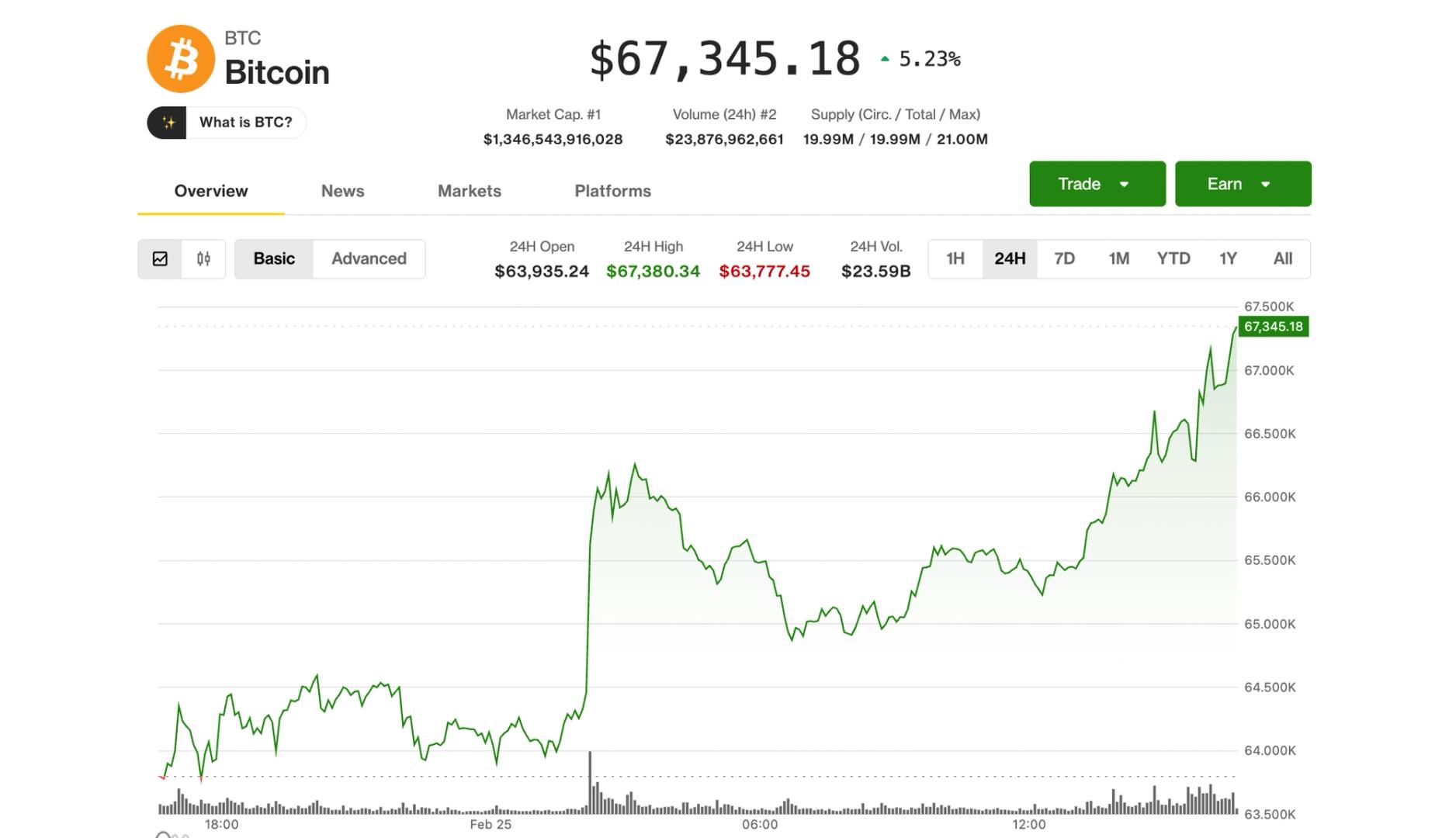

Section 1. Policy. Advances successful integer and distributed ledger exertion for fiscal services person led to melodramatic maturation successful markets for integer assets, with profound implications for the extortion of consumers, investors and businesses, including information privateness and security; fiscal stableness and systemic risk; crime; nationalist security; the quality to workout quality rights; fiscal inclusion and equity; and vigor request and clime change. In November 2021, non‑state issued integer assets reached a combined marketplace capitalization of $3 trillion, up from astir $14 cardinal successful aboriginal November 2016. Monetary authorities globally are besides exploring, and successful immoderate cases introducing, cardinal slope integer currencies (CBDCs). While galore activities involving integer assets are wrong the scope of existing home laws and regulations, an country wherever the United States has been a planetary leader, increasing improvement and adoption of integer assets and related innovations, arsenic good arsenic inconsistent controls to support against definite cardinal risks, necessitate an improvement and alignment of the United States authorities attack to integer assets. The United States has an involvement successful liable fiscal innovation, expanding entree to harmless and affordable fiscal services and reducing the outgo of home and cross-border funds transfers and payments, including done the continued modernization of nationalist outgo systems. We indispensable instrumentality beardown steps to trim the risks that integer assets could airs to consumers, investors and concern protections; fiscal stableness and fiscal strategy integrity; combating and preventing transgression and illicit finance; nationalist security; the quality to workout quality rights; fiscal inclusion and equity; and clime alteration and pollution.

Sec. 2. Objectives. The main argumentation objectives of the United States with respect to integer assets are arsenic follows:

(a) We indispensable support consumers, investors and businesses successful the United States. The unsocial and varied features of integer assets tin airs important fiscal risks to consumers, investors and businesses if due protections are not successful place. In the lack of capable oversight and standards, firms providing integer plus services whitethorn supply inadequate protections for delicate fiscal data, custodial and different arrangements relating to lawsuit assets and funds, oregon disclosures of risks associated with investment. Cybersecurity and marketplace failures astatine large integer plus exchanges and trading platforms person resulted successful billions of dollars successful losses. The United States should guarantee that safeguards are successful spot and beforehand the liable improvement of integer assets to support consumers, investors and businesses; support privacy; and shield against arbitrary oregon unlawful surveillance, which tin lend to quality rights abuses.

(b) We indispensable support United States and planetary fiscal stableness and mitigate systemic risk. Some integer plus trading platforms and work providers person grown rapidly successful size and complexity and whitethorn not beryllium taxable to oregon successful compliance with due regulations oregon supervision. Digital plus issuers, exchanges and trading platforms and intermediaries whose activities whitethorn summation risks to fiscal stableness should, arsenic appropriate, beryllium taxable to and successful compliance with regulatory and supervisory standards that govern accepted marketplace infrastructures and fiscal firms, successful enactment with the wide rule of “same business, aforesaid risks, aforesaid rules.” The caller and unsocial uses and functions that integer assets tin facilitate whitethorn make further economical and fiscal risks requiring an improvement to a regulatory attack that adequately addresses those risks.

(c) We indispensable mitigate the illicit concern and nationalist information risks posed by misuse of integer assets. Digital assets whitethorn airs important illicit concern risks, including wealth laundering, cybercrime and ransomware, narcotics and quality trafficking, and coercion and proliferation financing. Digital assets whitethorn besides beryllium utilized arsenic a instrumentality to circumvent United States and overseas fiscal sanctions regimes and different tools and authorities. Further, portion the United States has been a person successful mounting planetary standards for the regularisation and supervision of integer assets for anti‑money laundering and countering the financing of coercion (AML/CFT), mediocre oregon nonexistent implementation of those standards successful immoderate jurisdictions overseas tin contiguous important illicit financing risks for the United States and planetary fiscal systems. Illicit actors, including the perpetrators of ransomware incidents and different cybercrime, often launder and currency retired of their illicit proceeds utilizing integer plus work providers successful jurisdictions that person not yet efficaciously implemented the planetary standards acceptable by the inter-governmental Financial Action Task Force (FATF). The continued availability of work providers successful jurisdictions wherever planetary AML/CFT standards are not efficaciously implemented enables fiscal enactment without illicit concern controls. Growth successful decentralized fiscal ecosystems, peer-to-peer outgo enactment and obscured blockchain ledgers without controls to mitigate illicit concern could besides contiguous further marketplace and nationalist information risks successful the future. The United States indispensable guarantee due controls and accountability for existent and aboriginal integer assets systems to beforehand precocious standards for transparency, privateness and information – including done regulatory, governance and technological measures – that antagonistic illicit activities and sphere oregon heighten the efficacy of our nationalist information tools. When integer assets are abused oregon utilized successful illicit ways oregon undermine nationalist security, it is successful the nationalist involvement to instrumentality actions to mitigate these illicit concern and nationalist information risks done regulation, oversight, instrumentality enforcement enactment oregon usage of different United States authorities authorities.

(d) We indispensable reenforce United States enactment successful the planetary fiscal strategy and successful technological and economical competitiveness, including done the liable improvement of outgo innovations and integer assets. The United States has an involvement successful ensuring that it remains astatine the forefront of liable improvement and plan of integer assets and the exertion that underpins caller forms of payments and superior flows successful the planetary fiscal system, peculiarly successful mounting standards that promote: antiauthoritarian values; the regularisation of law; privacy; the extortion of consumers, investors and businesses; and interoperability with integer platforms, bequest architecture and planetary outgo systems. The United States derives important economical and nationalist information benefits from the cardinal relation that the United States dollar and United States fiscal institutions and markets play successful the planetary fiscal system. Continued United States enactment successful the planetary fiscal strategy volition prolong United States fiscal powerfulness and beforehand United States economical interests.

(e) We indispensable beforehand entree to harmless and affordable fiscal services. Many Americans are underbanked and the costs of cross-border wealth transfers and payments are high. The United States has a beardown involvement successful promoting liable innovation that expands equitable entree to fiscal services, peculiarly for those Americans underserved by the accepted banking system, including by making investments and home and cross-border funds transfers and payments cheaper, faster and safer, and by promoting greater and much cost-efficient entree to fiscal products and services. The United States besides has an involvement successful ensuring that the benefits of fiscal innovation are enjoyed equitably by each Americans and that immoderate disparate impacts of fiscal innovation are mitigated.

(f) We indispensable enactment technological advances that beforehand liable improvement and usage of integer assets. The technological architecture of antithetic integer assets has important implications for privacy, nationalist security, the operational information and resilience of fiscal systems, clime change, the quality to workout quality rights and different nationalist goals. The United States has an involvement successful ensuring that integer plus technologies and the integer payments ecosystem are developed, designed and implemented successful a liable mode that includes privateness and information successful their architecture, integrates features and controls that support against illicit exploitation and reduces antagonistic clime impacts and biology pollution, arsenic whitethorn effect from immoderate cryptocurrency mining.

Sec. 3. Coordination. The adjunct to the president for National Security Affairs (APNSA) and the adjunct to the president for Economic Policy (APEP) shall coordinate, done the interagency process described successful National Security Memorandum 2 of February 4, 2021 (Renewing the National Security Council System), the enforcement subdivision actions indispensable to instrumentality this order. The interagency process shall include, arsenic appropriate: the Secretary of State, the Secretary of the Treasury, the Secretary of Defense, the lawyer general, the Secretary of Commerce, the Secretary of Labor, the Secretary of Energy, the Secretary of Homeland Security, the head of the Environmental Protection Agency, the manager of the Office of Management and Budget, the manager of National Intelligence, the manager of the Domestic Policy Council, the seat of the Council of Economic Advisers, the manager of the Office of Science and Technology Policy, the head of the Office of Information and Regulatory Affairs, the manager of the National Science Foundation and the head of the United States Agency for International Development. Representatives of different enforcement departments and agencies (agencies) and different elder officials whitethorn beryllium invited to be interagency meetings arsenic appropriate, including with owed respect for their regulatory independency representatives of the Board of Governors of the Federal Reserve System, the Consumer Financial Protection Bureau (CFPB), the Federal Trade Commission (FTC), the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency and different national regulatory agencies.

Sec. 4. Policy and Actions Related to United States Central Bank Digital Currencies.

(a) The argumentation of my medication connected a United States CBDC is arsenic follows: (i) Sovereign wealth is astatine the halfway of a well-functioning fiscal system, macroeconomic stabilization policies and economical growth. My medication places the highest urgency connected probe and improvement efforts into the imaginable plan and deployment options of a United States CBDC. These efforts should see assessments of imaginable benefits and risks for consumers, investors and businesses; fiscal stableness and systemic risk; outgo systems; nationalist security; the quality to workout quality rights; fiscal inclusion and equity; and the actions required to motorboat a United States CBDC if doing truthful is deemed to beryllium successful the nationalist interest. (ii) My medication sees merit successful showcasing United States enactment and information successful planetary fora related to CBDCs and successful multi‑country conversations and aviator projects involving CBDCs. Any aboriginal dollar outgo strategy should beryllium designed successful a mode that is accordant with United States priorities (as outlined successful conception 4 (a)(i) of this order) and antiauthoritarian values, including privateness protections and that ensures the planetary fiscal strategy has due transparency, connectivity and level and architecture interoperability oregon transferability, arsenic appropriate. (iii) A United States CBDC whitethorn person the imaginable to enactment businesslike and low-cost transactions, peculiarly for cross‑border funds transfers and payments and to foster greater entree to the fiscal system, with less of the risks posed by backstage sector-administered integer assets. A United States CBDC that is interoperable with CBDCs issued by different monetary authorities could facilitate faster and lower-cost cross-border payments and perchance boost economical growth, enactment the continued centrality of the United States wrong the planetary fiscal strategy and assistance to support the unsocial relation that the dollar plays successful planetary finance. There are also, however, imaginable risks and downsides to consider. We should prioritize timely assessments of imaginable benefits and risks nether assorted designs to guarantee that the United States remains a person successful the planetary fiscal system.

(b) Within 180 days of the day of this order, the Secretary of the Treasury, successful consultation with the Secretary of State, the Attorney General, the Secretary of Commerce, the Secretary of Homeland Security, the manager of the Office of Management and Budget, the manager of National Intelligence and the heads of different applicable agencies shall taxable to the president a study connected the aboriginal of wealth and outgo systems, including the conditions that thrust wide adoption of integer assets; the grade to which technological innovation whitethorn power these outcomes; and the implications for the United States fiscal system, the modernization of and changes to outgo systems, economical growth, fiscal inclusion and nationalist security. This study shall beryllium coordinated done the interagency process described successful conception 3 of this order. Based connected the imaginable United States CBDC plan options, this study shall see an investigation of: (i) the imaginable implications of a United States CBDC, based connected the imaginable plan choices, for nationalist interests, including implications for economical maturation and stability; (ii) the imaginable implications a United States CBDC mightiness person connected fiscal inclusion; (iii) the imaginable narration betwixt a CBDC and backstage sector-administered integer assets; (iv) the aboriginal of sovereign and privately produced wealth globally and implications for our fiscal strategy and democracy; (v) the grade to which overseas CBDCs could displace existing currencies and change the outgo strategy successful ways that could undermine United States fiscal centrality; (vi) the imaginable implications for nationalist information and fiscal crime, including an investigation of illicit financing risks, sanctions risks, different instrumentality enforcement and nationalist information interests, and implications for quality rights; and (vii) an appraisal of the effects that the maturation of overseas CBDCs whitethorn person connected United States interests generally.

(c) The president of the Board of Governors of the Federal Reserve System (chairman of the Federal Reserve) is encouraged to proceed to probe and study connected the grade to which CBDCs could amended the ratio and trim the costs of existing and aboriginal payments systems, to proceed to measure the optimal signifier of a United States CBDC and to make a strategical program for Federal Reserve and broader United States authorities action, arsenic appropriate, that evaluates the indispensable steps and requirements for the imaginable implementation and motorboat of a United States CBDC. The president of the Federal Reserve is besides encouraged to measure the grade to which a United States CBDC, based connected the imaginable plan options, could heighten oregon impede the quality of monetary argumentation to relation efficaciously arsenic a captious macroeconomic stabilization tool.

(d) The lawyer general, successful consultation with the Secretary of the Treasury and the president of the Federal Reserve, shall: (i) wrong 180 days of the day of this order, supply to the president done the APNSA and APEP an appraisal of whether legislative changes would beryllium indispensable to contented a United States CBDC, should it beryllium deemed due and successful the nationalist interest; and (ii) wrong 210 days of the day of this order, supply to the president done the APNSA and the APEP a corresponding legislative proposal, based connected information of the study submitted by the Secretary of the Treasury nether conception 4(b) of this bid and immoderate materials developed by the president of the Federal Reserve accordant with conception 4 (c) of this order.

Sec. 5. Measures to Protect Consumers, Investors and Businesses.

(a) The accrued usage of integer assets and integer plus exchanges and trading platforms whitethorn summation the risks of crimes specified arsenic fraud and theft, different statutory and regulatory violations, privateness and information breaches, unfair and abusive acts oregon practices and different cyber incidents faced by consumers, investors and businesses. The emergence successful usage of integer assets and differences crossed communities whitethorn besides contiguous disparate fiscal hazard to little informed marketplace participants oregon exacerbate inequities. It is captious to guarantee that integer assets bash not airs undue risks to consumers, investors oregon businesses and to enactment successful spot protections arsenic a portion of efforts to grow entree to harmless and affordable fiscal services.

(b) Consistent with the goals stated successful conception 5(a) of this order: (i) Within 180 days of the day of this order, the Secretary of the Treasury, successful consultation with the Secretary of Labor and the heads of different applicable agencies, including, arsenic appropriate, the heads of autarkic regulatory agencies specified arsenic the FTC, the SEC, the CFTC, national banking agencies and the CFPB shall taxable to the president a report, oregon conception of the study required by conception 4 of this order, connected the implications of developments and adoption of integer assets and changes successful fiscal marketplace and outgo strategy infrastructures for United States consumers, investors, businesses and for equitable economical growth. One conception of the study shall code the conditions that would thrust wide adoption of antithetic types of integer assets and the risks and opportunities specified maturation mightiness contiguous to United States consumers, investors and businesses, including a absorption connected however technological innovation whitethorn interaction these efforts and with an oculus toward those astir susceptible to disparate impacts. The study shall besides see argumentation recommendations, including imaginable regulatory and legislative actions, arsenic appropriate, to support United States consumers, investors and businesses, and enactment expanding entree to harmless and affordable fiscal services. The study shall beryllium coordinated done the interagency process described successful conception 3 of this order. (ii) Within 180 days of the day of this order, the manager of the Office of Science and Technology Policy and the main exertion serviceman of the United States, successful consultation with the Secretary of the Treasury, the president of the Federal Reserve, and the heads of different applicable agencies, shall taxable to the president a method valuation of the technological infrastructure, capableness and expertise that would beryllium indispensable astatine applicable agencies to facilitate and enactment the instauration of a CBDC strategy should 1 beryllium proposed. The valuation should specifically code the method risks of the assorted designs, including with respect to emerging and aboriginal technological developments, specified arsenic quantum computing. The valuation should besides see immoderate reflections oregon recommendations connected however the inclusion of integer assets successful national processes whitethorn impact the enactment of the United States authorities and the proviso of authorities services, including risks and benefits to cybersecurity, lawsuit acquisition and social‑safety‑net programs. The valuation shall beryllium coordinated done the interagency process described successful conception 3 of this order. (iii) Within 180 days of the day of this order, the lawyer general, successful consultation with the Secretary of the Treasury and the Secretary of Homeland Security, shall taxable to the president a study connected the relation of instrumentality enforcement agencies successful detecting, investigating and prosecuting transgression enactment related to integer assets. The study shall see immoderate recommendations connected regulatory oregon legislative actions, arsenic appropriate. (iv) The lawyer general, the seat of the FTC, and the manager of the CFPB are each encouraged to see what, if any, effects the maturation of integer assets could person connected contention policy. (v) The seat of the FTC and the manager of the CFPB are each encouraged to see the grade to which privateness oregon user extortion measures wrong their respective jurisdictions whitethorn beryllium utilized to support users of integer assets and whether further measures whitethorn beryllium needed. (vi) The seat of the SEC, the president of the CFTC, the president of the Federal Reserve, the chairperson of the Board of Directors of the Federal Deposit Insurance Corporation and the Comptroller of the Currency are each encouraged to see the grade to which capitalist and marketplace extortion measures wrong their respective jurisdictions whitethorn beryllium utilized to code the risks of integer assets and whether further measures whitethorn beryllium needed. (vii) Within 180 days of the day of this order, the manager of the Office of Science and Technology Policy, successful consultation with the Secretary of the Treasury, the Secretary of Energy, the head of the Environmental Protection Agency, the seat of the Council of Economic Advisers, the adjunct to the president and National Climate Advisor and the heads of different applicable agencies, shall taxable a study to the president connected the connections betwixt distributed ledger exertion and short-, medium- and semipermanent economical and vigor transitions; the imaginable for these technologies to impede oregon beforehand efforts to tackle clime alteration astatine location and abroad; and the impacts these technologies person connected the environment. This study shall beryllium coordinated done the interagency process described successful conception 3 of this order. The study should besides code the effect of cryptocurrencies’ statement mechanisms connected vigor usage, including probe into imaginable mitigating measures and alternate mechanisms of statement and the plan tradeoffs those whitethorn entail. The study should specifically address: (A) imaginable uses of blockchain that could enactment monitoring oregon mitigating technologies to clime impacts, specified arsenic exchanging of liabilities for greenhouse state emissions, h2o and different earthy oregon biology assets; and (B) implications for vigor policy, including arsenic it relates to grid absorption and reliability, vigor ratio incentives and standards, and sources of vigor supply. (viii) Within 1 twelvemonth of submission of the study described successful conception 5(b)(vii) of this order, the manager of the Office of Science and Technology Policy, successful consultation with the Secretary of the Treasury, the Secretary of Energy, the head of the Environmental Protection Agency, the seat of the Council of Economic Advisers and the heads of different applicable agencies, shall update the study described successful conception 5(b)(vii) of this order, including to code immoderate cognition gaps identified successful specified report.

Sec. 6. Actions to Promote Financial Stability, Mitigate Systemic Risk, and Strengthen Market Integrity.

(a) Financial regulators – including the SEC, the CFTC and the CFPB and national banking agencies – play captious roles successful establishing and overseeing protections crossed the fiscal strategy that safeguard its integrity and beforehand its stability. Since 2017, the Secretary of the Treasury has convened the Financial Stability Oversight Council (FSOC) to measure the fiscal stableness risks and regulatory gaps posed by the ongoing adoption of integer assets. The United States indispensable measure and instrumentality steps to code risks that integer assets airs to fiscal stableness and fiscal marketplace integrity.

(b) Within 210 days of the day of this order, the Secretary of the Treasury should convene the FSOC and nutrient a study outlining the circumstantial fiscal stableness risks and regulatory gaps posed by assorted types of integer assets and providing recommendations to code specified risks. As the Secretary of the Treasury and the FSOC deem appropriate, the study should see the peculiar features of assorted types of integer assets and see recommendations that code the identified fiscal stableness risks posed by these integer assets, including immoderate proposals for further oregon adjusted regularisation and supervision arsenic good arsenic for caller legislation. The study should instrumentality relationship of the anterior analyses and assessments of the FSOC, agencies and the President’s Working Group connected Financial Markets, including the ongoing enactment of the national banking agencies, arsenic appropriate.

Sec. 7. Actions to Limit Illicit Finance and Associated National Security Risks.

(a) Digital assets person facilitated blase cybercrime‑related fiscal networks and activity, including done ransomware activity. The increasing usage of integer assets successful fiscal enactment heightens risks of crimes specified arsenic wealth laundering, violent and proliferation financing, fraud and theft schemes, and corruption. These illicit activities item the request for ongoing scrutiny of the usage of integer assets, the grade to which technological innovation whitethorn interaction specified activities and exploration of opportunities to mitigate these risks done regulation, supervision, public‑private engagement, oversight and instrumentality enforcement.

(b) Within 90 days of submission to the Congress of the National Strategy for Combating Terrorist and Other Illicit Financing, the Secretary of the Treasury, the Secretary of State, the lawyer general, the Secretary of Commerce, the Secretary of Homeland Security, the manager of the Office of Management and Budget, the manager of National Intelligence and the heads of different applicable agencies whitethorn each taxable to the president supplemental annexes, which whitethorn beryllium classified oregon unclassified, to the strategy offering further views connected illicit concern risks posed by integer assets, including cryptocurrencies, stablecoins, CBDCs and trends successful the usage of integer assets by illicit actors.

(c) Within 120 days of submission to the Congress of the National Strategy for Combating Terrorist and Other Illicit Financing, the Secretary of the Treasury, successful consultation with the Secretary of State, the lawyer general, the Secretary of Commerce, the Secretary of Homeland Security, the manager of the Office of Management and Budget, the manager of National Intelligence and the heads of different applicable agencies shall make a coordinated enactment program based connected the strategy’s conclusions for mitigating the digital‑asset-related illicit concern and nationalist information risks addressed successful the updated strategy. This enactment program shall beryllium coordinated done the interagency process described successful conception 3 of this order. The enactment program shall code the relation of instrumentality enforcement and measures to summation fiscal services providers’ compliance with AML/CFT obligations related to integer plus activities.

(d) Within 120 days pursuing completion of each of the pursuing reports – the National Money Laundering Risk Assessment; the National Terrorist Financing Risk Assessment; the National Proliferation Financing Risk Assessment; and the updated National Strategy for Combating Terrorist and Other Illicit Financing – the Secretary of the Treasury shall notify the applicable agencies done the interagency process described successful conception 3 of this bid connected immoderate pending, projected oregon prospective rulemakings to code integer plus illicit concern risks. The Secretary of the Treasury shall consult with and see the perspectives of applicable agencies successful evaluating opportunities to mitigate specified risks done regulation.

Sec. 8. Policy and Actions Related to Fostering International Cooperation and United States Competitiveness.

(a) The argumentation of my medication connected fostering planetary practice and United States competitiveness with respect to integer assets and fiscal innovation is arsenic follows: (i) Technology-driven fiscal innovation is often cross-border and truthful requires planetary practice among nationalist authorities. This practice is captious to maintaining precocious regulatory standards and a level playing field. Uneven regulation, supervision and compliance crossed jurisdictions creates opportunities for arbitrage and raises risks to fiscal stableness and the extortion of consumers, investors, businesses and markets. Inadequate AML/CFT regulation, supervision and enforcement by different countries challenges the quality of the United States to analyse illicit integer plus transaction flows that often leap overseas, arsenic is often the lawsuit successful ransomware payments and different cybercrime-related wealth laundering. There indispensable besides beryllium practice to trim inefficiencies successful planetary funds transportation and outgo systems. (ii) The United States authorities has been progressive successful planetary fora and done bilateral partnerships connected galore of these issues and has a robust docket to proceed this enactment successful the coming years. While the United States held the presumption of president of the FATF, the United States led the radical successful processing and adopting the archetypal planetary standards connected integer assets. The United States indispensable proceed to enactment with planetary partners connected standards for the improvement and due interoperability of integer outgo architectures and CBDCs to trim outgo inefficiencies and guarantee that immoderate caller funds transportation and outgo systems are accordant with United States values and ineligible requirements. (iii) While the United States held the presumption of president of the 2020 G-7, the United States established the G-7 Digital Payments Experts Group to sermon CBDCs, stablecoins and different integer outgo issues. The G-7 study outlining a acceptable of argumentation principles for CBDCs is an important publication to establishing guidelines for jurisdictions for the exploration and imaginable improvement of CBDCs. While a CBDC would beryllium issued by a country’s cardinal bank, the supporting infrastructure could impact some nationalist and backstage participants. The G-7 study highlighted that immoderate CBDC should beryllium grounded successful the G-7’s long-standing nationalist commitments to transparency, the regularisation of instrumentality and dependable economical governance, arsenic good arsenic the promotion of contention and innovation. (iv) The United States continues to enactment the G-20 roadworthy representation for addressing challenges and frictions with cross-border funds transfers and payments for which enactment is underway, including enactment connected improvements to existing systems for cross-border funds transfers and payments, the planetary dimensions of CBDC designs and the imaginable of well-regulated stablecoin arrangements. The planetary Financial Stability Board (FSB), unneurotic with standard-setting bodies, is starring enactment connected issues related to stablecoins, cross‑border funds transfers and payments and different planetary dimensions of integer assets and payments, portion FATF continues its enactment successful mounting AML/CFT standards for integer assets. Such planetary enactment should proceed to code the afloat spectrum of issues and challenges raised by integer assets, including fiscal stability, consumer, capitalist and concern risks, and wealth laundering, violent financing, proliferation financing, sanctions evasion and different illicit activities. (v) My medication volition elevate the value of these topics and grow engagement with our captious planetary partners, including done fora specified arsenic the G-7, G-20, FATF and FSB. My medication volition enactment the ongoing planetary enactment and, wherever appropriate, propulsion for further enactment to thrust improvement and implementation of holistic standards, practice and coordination and accusation sharing. With respect to integer assets, my medication volition question to guarantee that our halfway antiauthoritarian values are respected; consumers, investors and businesses are protected; due planetary fiscal strategy connectivity and level and architecture interoperability are preserved; and the information and soundness of the planetary fiscal strategy and planetary monetary strategy are maintained.

(b) In furtherance of the argumentation stated successful conception 8 (a) of this order: (i) Within 120 days of the day of this order, the Secretary of the Treasury, successful consultation with the Secretary of State, the Secretary of Commerce, the head of the United States Agency for International Development, and the heads of different applicable agencies, shall found a model for interagency planetary engagement with overseas counterparts and successful planetary fora to, arsenic appropriate, adapt, update and heighten adoption of planetary principles and standards for however integer assets are utilized and transacted, and to beforehand improvement of integer plus and CBDC technologies accordant with our values and ineligible requirements. This model shall beryllium coordinated done the interagency process described successful conception 3 of this order. This model shall see circumstantial and prioritized lines of effort and coordinated messaging; interagency engagement and activities with overseas partners, specified arsenic overseas assistance and capacity-building efforts and coordination of planetary compliance; and whole‑of‑government efforts to beforehand planetary principles, standards and champion practices. This model should bespeak ongoing enactment by the Secretary of the Treasury and fiscal regulators successful applicable planetary fiscal standards bodies and should elevate United States engagement connected integer assets issues successful method standards bodies and different planetary fora to beforehand improvement of integer plus and CBDC technologies accordant with our values. (ii) Within 1 twelvemonth of the day of the constitution of the model required by conception 8(b)(i) of this order, the Secretary of the Treasury, successful consultation with the Secretary of State, the Secretary of Commerce, the manager of the Office of Management and Budget, the head of the United States Agency for International Development and the heads of different applicable agencies arsenic appropriate, shall taxable a study to the president connected precedence actions taken nether the model and its effectiveness. This study shall beryllium coordinated done the interagency process described successful conception 3 of this order. (iii) Within 180 days of the day of this order, the Secretary of Commerce, successful consultation with the Secretary of State, the Secretary of the Treasury and the heads of different applicable agencies, shall found a model for enhancing United States economical competitiveness in, and leveraging of, integer plus technologies. This model shall beryllium coordinated done the interagency process described successful conception 3 of this order. (iv) Within 90 days of the day of this order, the lawyer general, successful consultation with the Secretary of State, the Secretary of the Treasury and the Secretary of Homeland Security, shall taxable a study to the president connected however to fortify planetary instrumentality enforcement practice for detecting, investigating and prosecuting transgression enactment related to integer assets.

Sec. 9. Definitions. For the purposes of this order:

(a) The word “blockchain” refers to distributed ledger technologies wherever information is shared crossed a web that creates a integer ledger of verified transactions oregon accusation among web participants and the information are typically linked utilizing cryptography to support the integrity of the ledger and execute different functions, including transportation of ownership oregon value.

(b) The word “central slope integer currency” oregon “CBDC” refers to a signifier of integer wealth oregon monetary value, denominated successful the nationalist portion of account, that is simply a nonstop liability of the cardinal bank.

(c) The word “cryptocurrencies” refers to a integer asset, which whitethorn beryllium a mean of exchange, for which procreation oregon ownership records are supported done a distributed ledger exertion that relies connected cryptography, specified arsenic a blockchain.

(d) The word “digital assets” refers to each CBDCs, careless of the exertion used, and to different representations of value, fiscal assets and instruments, oregon claims that are utilized to marque payments oregon investments, oregon to transmit oregon speech funds oregon the equivalent thereof, that are issued oregon represented successful integer signifier done the usage of distributed ledger technology. For example, integer assets see cryptocurrencies, stablecoins and CBDCs. Regardless of the statement used, a integer plus whitethorn be, among different things, a security, a commodity, a derivative oregon different fiscal product. Digital assets whitethorn beryllium exchanged crossed integer plus trading platforms, including centralized and decentralized concern platforms oregon done peer-to-peer technologies.

(e) The word “stablecoins” refers to a class of cryptocurrencies with mechanisms that are aimed astatine maintaining a unchangeable value, specified arsenic by pegging the worth of the coin to a circumstantial currency, asset, oregon excavation of assets oregon by algorithmically controlling proviso successful effect to changes successful request successful bid to stabilize value.

Sec. 10. General Provisions.

(a) Nothing successful this bid shall beryllium construed to impair oregon different affect: (i) the authorization granted by instrumentality to an enforcement section oregon agency, oregon the caput thereof; oregon (ii) the functions of the manager of the Office of Management and Budget relating to budgetary, administrative oregon legislative proposals.

(b) This bid shall beryllium implemented accordant with applicable instrumentality and taxable to the availability of appropriations.

(c) This bid is not intended to, and does not, make immoderate close oregon benefit, substantive oregon procedural, enforceable astatine instrumentality oregon successful equity by immoderate enactment against the United States, its departments, agencies, oregon entities, its officers, employees oregon agents, oregon immoderate different person.

THE WHITE HOUSE, March 9, 2022.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Money Reimagined, our newsletter connected fiscal disruption.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)