Ethereum is yet coming backmost to beingness aft a agelong play of consolidation and starring the existent bullish momentum successful the crypto apical 10 by marketplace cap. The dilatory terms enactment mightiness beryllium boring for astir marketplace participants, but an adept believes ETH underwent a captious signifier to make a lasting bottom.

At the clip of writing, Ethereum (ETH) trades astatine $1,550 with sideways question implicit today’s trading league and a 20% nett successful the past 7 days. In the crypto apical 10, ETH’s terms show is lone surpassed by Dogecoin (DOGE). The meme coin records a 30% nett implicit the aforesaid period.

ETH’s terms with bullish momentum connected the regular chart. Source: ETHUSDT Tradingview

ETH’s terms with bullish momentum connected the regular chart. Source: ETHUSDT TradingviewEthereum Close To Another Multi-Year Bottom?

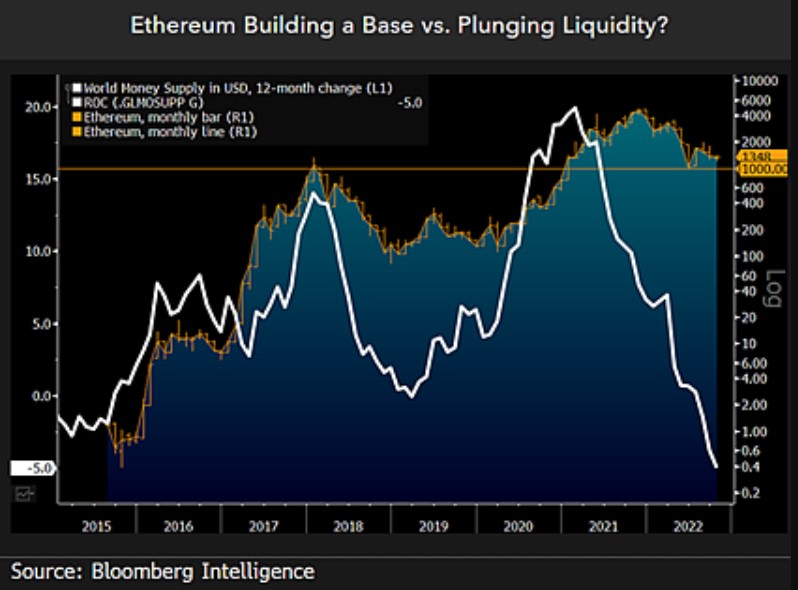

Senior Commodity Strategist for Bloomberg Intelligence Mike McGlone believes Ethereum’s migration to a Proof-of-Stake (PoS) statement volition beryllium important successful its semipermanent appreciation. In the existent macroeconomic landscape, precocious vigor prices and precocious ostentation person taken a toll connected planetary markets.

The U.S. Federal Reserve (Fed) has tightened its monetary argumentation successful effect to this situation. As a result, Ethereum and different hazard assets returned to their pre-pandemic levels.

Still, the 2nd crypto by marketplace headdress has been incapable to clasp the enactment adjacent to its 2017 all-time precocious astatine astir $1,400 to $1,500. As McGlone emphasized, ETH’s terms has prevented further downside astatine these levels contempt the Fed implementing its astir assertive strategy successful forty years.

In that sense, the adept believes Ethereum is cementing its presumption “at the epicenter of the digitalization of finance.” McGlone wrote:

(…) the No. 2 crypto whitethorn beryllium forming a instauration astir $1,000 (…). Our graphic shows the No.2 crypto perchance gathering a basal astir the 2018 peak, erstwhile planetary liquidity topped retired astir positive 14%. Ethereum appears astatine a discount wrong an enduring bull marketplace (…).

Source: Mike McGlone via Twitter

Source: Mike McGlone via TwitterThe Ultimate Deflationary Asset

If macroeconomic conditions amended and the Fed pivots its monetary approach, Ethereum mightiness yet reclaim antecedently mislaid territory and bargain Bitcoin’s thunder. The adept hints astatine a faster diminution successful the proviso of ETH versus BTC.

Rising request for integer assets and a diminution successful proviso volition beryllium affirmative for the 2nd crypto by marketplace cap. McGlone wrote:

(…) caller Ethereum proviso shrinking much rapidly aft a protocol alteration that began moving coins from circulation successful August 2021 and this year’s merge. The 52-week rate-of-change successful the fig of caller Ethereum coins from Conmetrics vs. the full outstanding has fallen nether 2% and is connected way to driblet beneath that of Bitcoin.

Source: Mike McGlone via Twitter

Source: Mike McGlone via Twitter

3 years ago

3 years ago

English (US)

English (US)