Following the Bitcoin terms surge backmost to $64,000, crypto expert Rekt Capital is predicting a large breakout determination successful the coming weeks. In a caller video analysis, the expert forecasts a important marketplace question astir October 2024, based connected humanities precedents and existent illustration patterns.

Will October Be Bullish For Bitcoin Again?

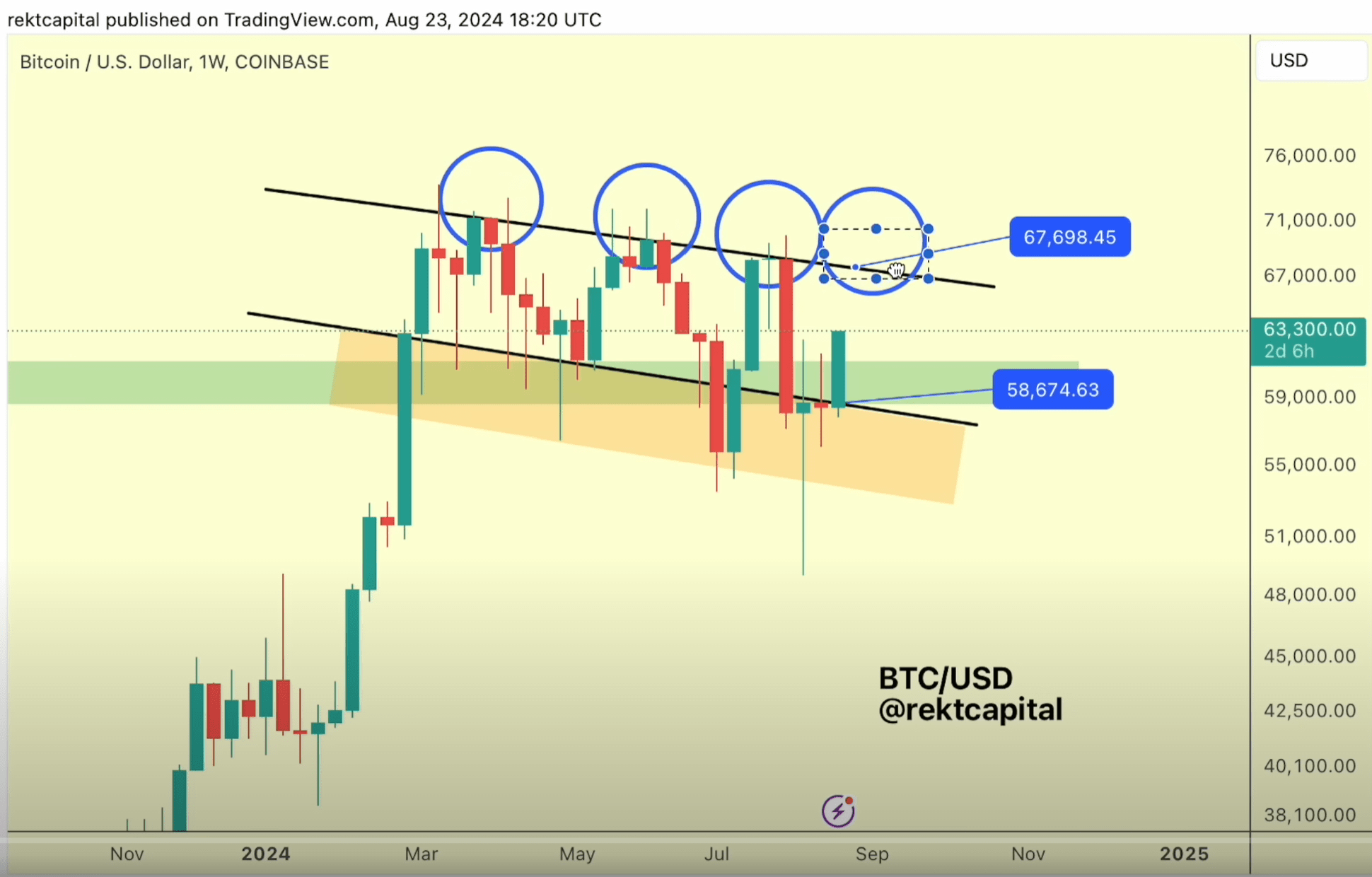

Looking astatine the play chart, Rekt Capital identifies a downtrending channel. Over the past 4 weeks, BTC has been deviating beneath this channel, searching for enactment that would alteration a terms enlargement supra the channel’s bottom. This question has been met with a “fantastic recovery,” signaling imaginable for a instrumentality to the transmission apical astatine astir $67,000 successful the coming weeks.

Bitcoin terms analysis, play illustration | Source: YouTube

Bitcoin terms analysis, play illustration | Source: YouTube“The transmission bottommost rebound is important arsenic it has historically taken terms from the transmission bottommost to the apical successful astir 2 weeks connected average,” Rekt Capital explained. He highlighted the value of play candle closes supra circumstantial levels, peculiarly astatine $67,500 and yet astatine $71,500, which would people a interruption from the reaccumulation scope precocious established post-halving.

“The accordant signifier of bouncing from the transmission bottommost to the apical typically spans an mean of 2 weeks, but successful the existent context, we are observing a perchance elongated consolidation signifier astatine these little levels,” explained Rekt Capital. This reflection suggests that portion the rebound trajectory follows historical patterns, the consolidation astatine little prices could spend investors bargain buying opportunities.

Focusing connected the method thresholds, Rekt Capital emphasized the criticality of respective play candle closes supra pivotal terms points. Firstly, a adjacent supra $66,000 would reconfirm the reaccumulation range’s little bound arsenic a newfound support, mounting the signifier for further upward movement. More importantly, a decisive play adjacent supra $67,500 would signify a breach of the persistent little highs inclination that has dominated since March of this year.

“The play adjacent supra these circumstantial levels is not simply a method accomplishment but a intelligence triumph for marketplace participants, indicating a weakening of sell-side unit and a regain of bullish momentum,” noted Rekt Capital.

Historically, Bitcoin shows a inclination to initiate large rallies astir 150 to 160 days pursuing a halving event. Drawing parallels from the post-halving periods of 2016 and 2020, the expert suggested that akin conditions are presently forming, with Bitcoin being astir 133 days station the latest halving.

“This cyclical reflection aligns good with the existent marketplace dynamics, wherever Bitcoin is methodically investigating and, successful immoderate cases, breaching important method barriers,” helium remarked. This examination is not lone based connected temporal patterns but besides connected the qualitative quality of marketplace behaviour during these periods.

A important constituent of investigation was the 21-week EMA, a cardinal indicator often regarded arsenic the bull marketplace barometer. Rekt Capital highlighted its humanities significance, noting, “Deviations beneath the 21-week EMA successful bull markets typically connection lucrative buying opportunities, arsenic seen successful the 2021 cycle. Currently, Bitcoin is oscillating astir this EMA, providing mixed signals that necessitate vigilant interpretation.”

Looking ahead, the expert projects that for Bitcoin to embark connected a caller parabolic signifier starring to terms find and perchance caller all-time highs, it indispensable archetypal consolidate supra the $71,500 level—representing the reaccumulation scope high. This level has antecedently acted arsenic a formidable resistance, and a play adjacent supra it would apt catalyze a large bullish phase.

“In the coming weeks, the market’s quality to uphold these captious supports and interruption done absorption levels with condemnation volition beryllium paramount. This volition find the feasibility of a breakout aligning with humanities patterns observed post-halving,” Rekt Capital concluded, suggesting that October could beryllium pivotal for Bitcoin’s trajectory.

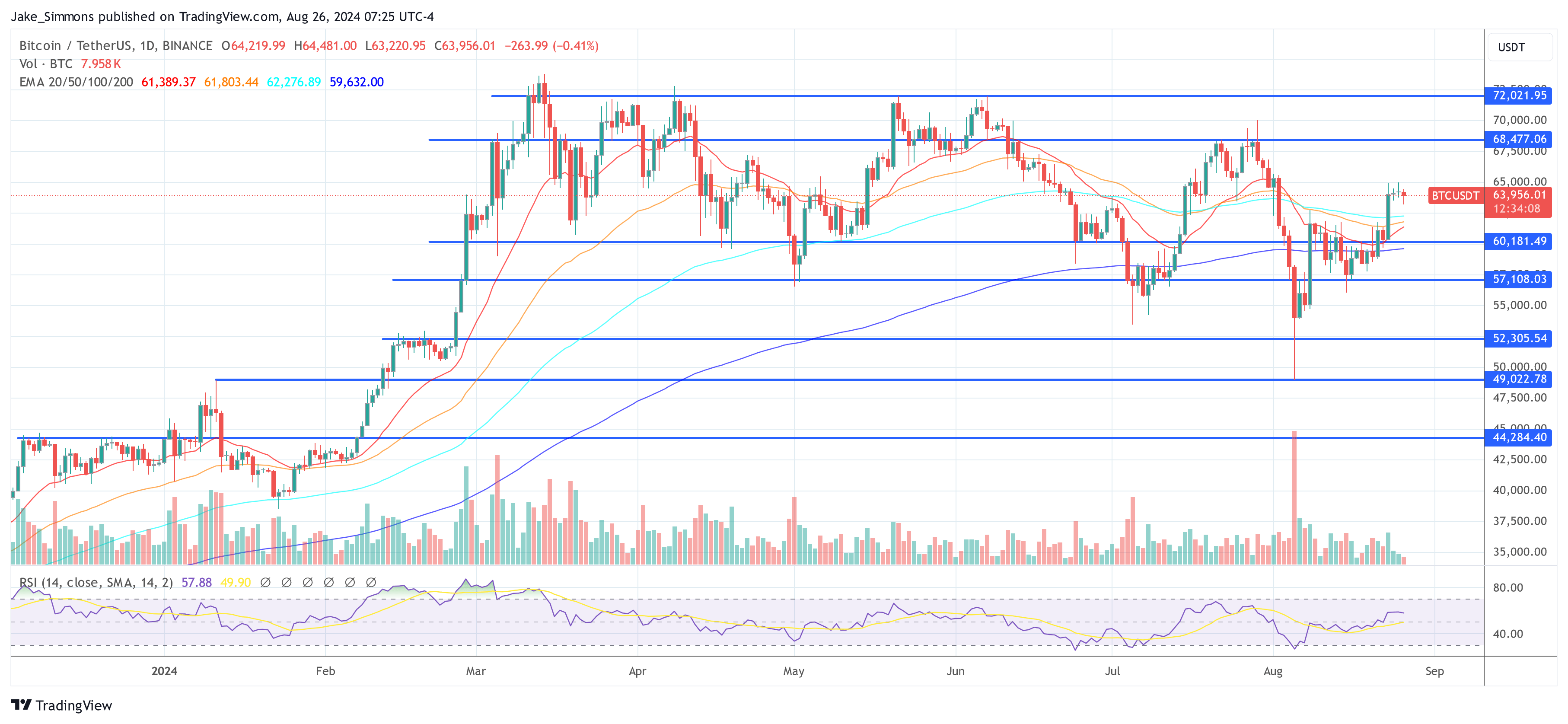

At property time, BTC traded astatine $63,956.

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.com

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)