January 2024 saw notable fluctuations successful Bitcoin’s perpetual futures market, reflected successful the backing rate, unfastened involvement (OI), and trading volumes. Perpetual futures, dissimilar accepted futures, bash not person an expiration date, allowing traders to clasp positions indefinitely. A captious facet of these instruments is the perpetual futures backing rate, a mechanics designed to anchor the futures prices to the spot market. This complaint tin beryllium affirmative oregon negative, depending connected whether the marketplace is bullish oregon bearish.

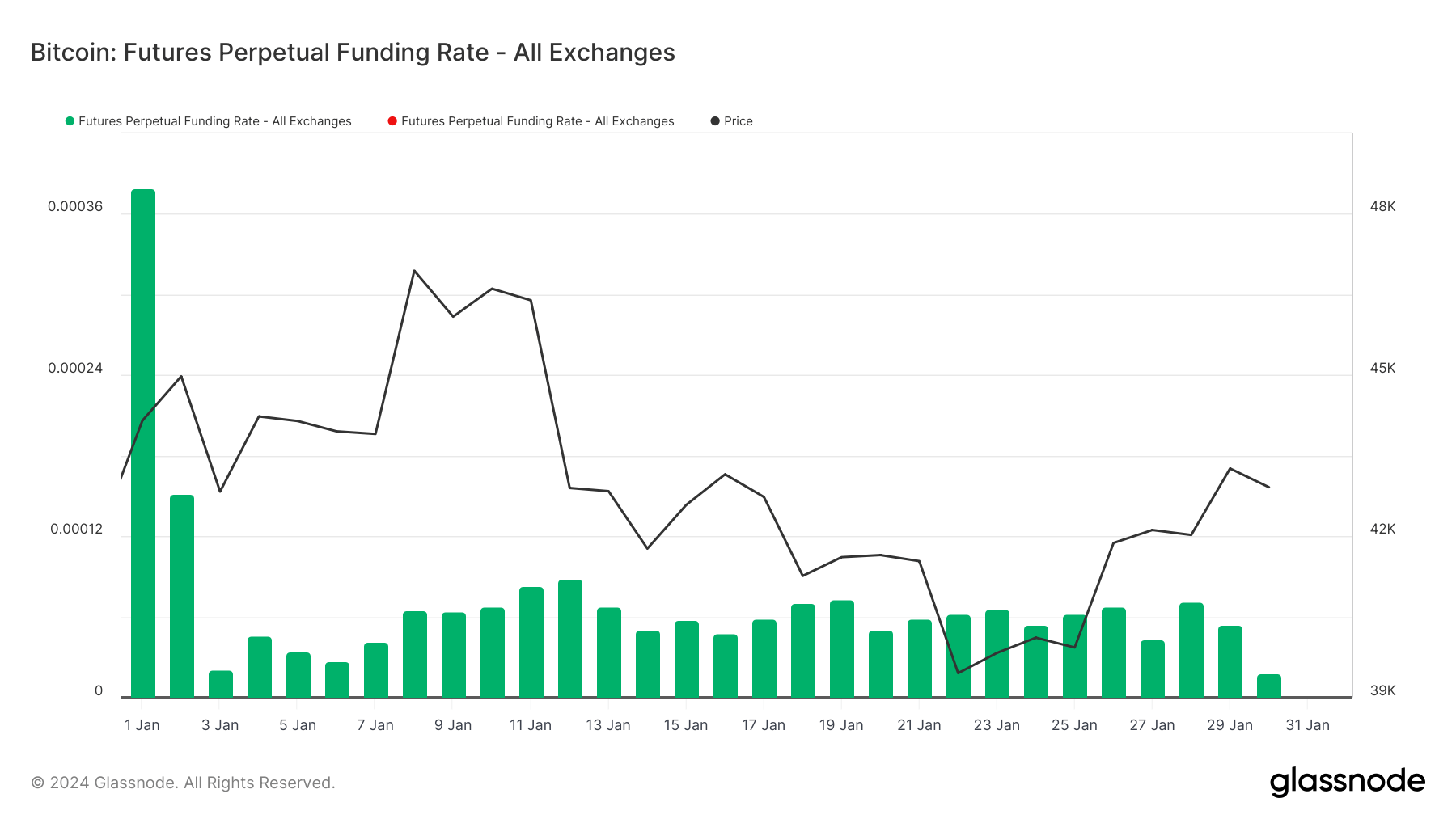

The opening of the period saw a bullish trend, with Bitcoin’s terms rising to $46,940 by January 8, aligning with a precocious backing complaint of 0.0003790. This script indicated that traders were consenting to wage a premium to clasp agelong positions, anticipating further terms increases.

However, arsenic January progressed, the marketplace experienced volatility, with Bitcoin’s terms dropping to $39,450 by January 22 and past recovering to $43,260 connected January 29. The backing complaint mirrored these terms movements, showcasing the fluctuating marketplace sentiment. The astir important displacement occurred towards the extremity of the period erstwhile the backing complaint plummeted to 0.00001789 contempt a comparatively unchangeable Bitcoin price. This crisp driblet suggests a alteration successful trader sentiment oregon strategy, perchance indicating a little bullish outlook.

Graph showing the backing complaint for perpetual Bitcoin futures successful 2024 (Source: Glassnode)

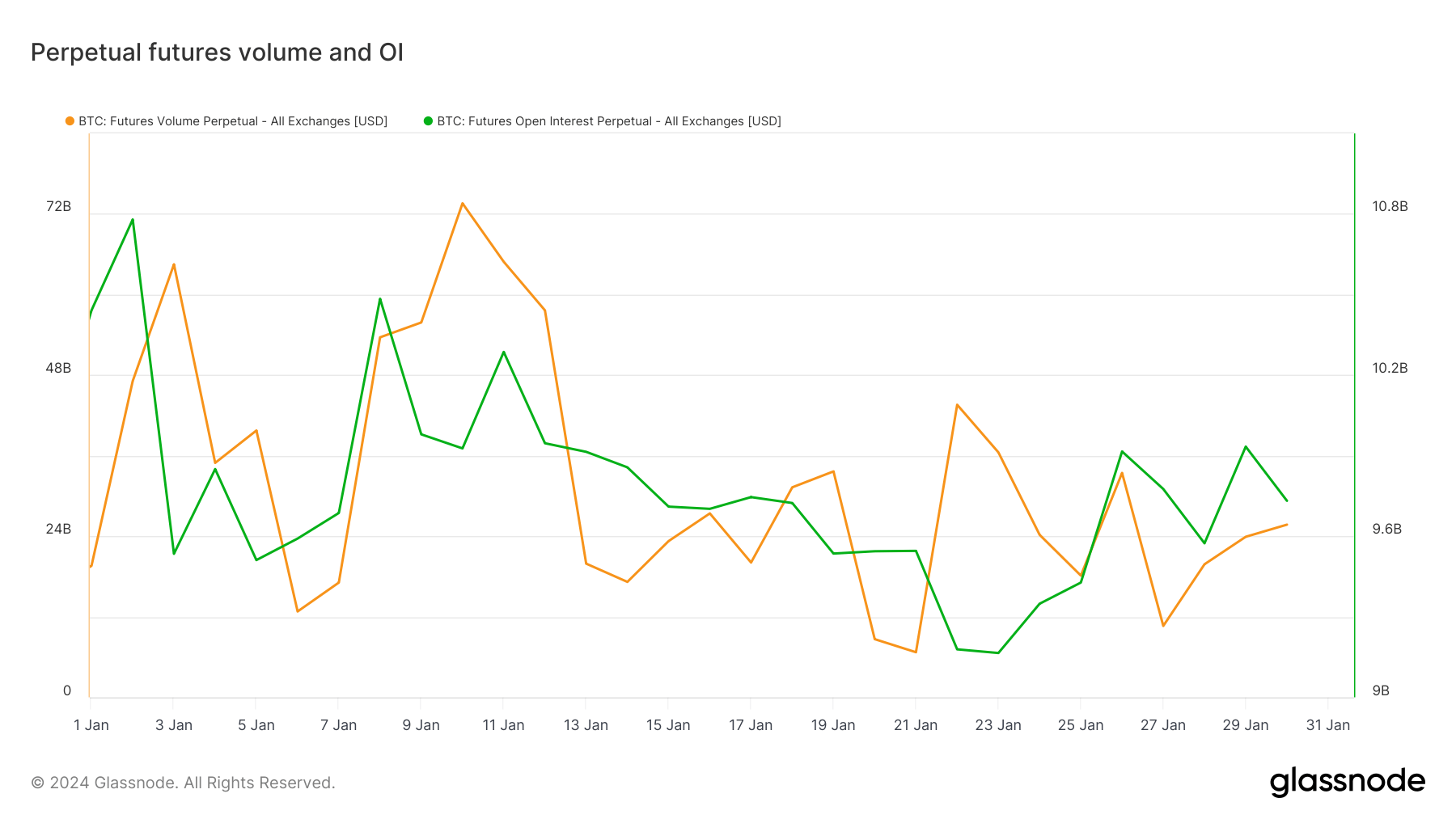

Graph showing the backing complaint for perpetual Bitcoin futures successful 2024 (Source: Glassnode)This alteration successful sentiment is besides evident successful the unfastened involvement and trading volumes for perpetual futures. The year-to-date (YTD) precocious successful unfastened involvement was $10.771 cardinal connected January 2, with trading volumes peaking astatine $73.783 cardinal connected January 10, signaling beardown marketplace activity. This play of heightened enactment correlates with the archetypal bullish sentiment successful the Bitcoin market.

In contrast, the YTD debased successful unfastened involvement was recorded connected January 23 astatine $9.165 billion, coinciding with the lowest trading measurement of $6.718 billion. This diminution indicates a important pullback successful marketplace activity, perchance reflecting bearish sentiment oregon a absorption to outer factors, specified arsenic the market’s correction during this period.

By January 30, the unfastened involvement had moderately recovered to $9.731 billion, with trading volumes astatine $25.721 billion. While this marks an betterment from mid-January lows, it inactive denotes a much cautious stance successful the market.

Graph showing unfastened involvement and trading measurement for Bitcoin perpetual futures successful 2024 (Source: Glassnode)

Graph showing unfastened involvement and trading measurement for Bitcoin perpetual futures successful 2024 (Source: Glassnode)The instauration of spot Bitcoin ETFs connected January 10 apt played a relation successful this volatility. These ETFs connection investors a caller mode to summation vulnerability to Bitcoin, perchance attracting immoderate distant from perpetual futures. The shift towards ETFs could beryllium attributed to their perceived lower risk and greater regulatory acceptance than futures, particularly perpetual contracts.

The important driblet successful the backing complaint astatine the extremity of January, coupled with the changes successful unfastened involvement and trading volumes, indicates a displacement successful marketplace sentiment. Initially bullish, the marketplace sentiment transitioned to a much cautious oregon bearish outlook by the month’s end. The instauration of spot Bitcoin ETFs apt influences this shift, arsenic they supply a caller avenue for Bitcoin vulnerability and mightiness person diverted immoderate involvement from perpetual futures.

These developments suggest a varying hazard appetite among traders and perchance a diversification of concern strategies.

The station Here’s wherefore Bitcoin perpetual futures marketplace saw precocious volatility successful January appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

![Crypto News Today [Live] Updates On Feb 10, 2026](https://image.coinpedia.org/wp-content/uploads/2025/12/04161105/Crypto-Market-News-Today-LIVE-Updates-4th-Dec-Ethereum-Fusaka-Upgrade-ETH-ETF-inflows-ETH-Price-Today-1024x536.webp)

English (US)

English (US)