After an explosive 2021, the caller downturn has near a bitter sensation for crypto investors, not slightest those who went dense connected DeFi.

Since the marketplace peaked successful November 2021, investors had pinned their hopes connected bulls shaking disconnected the infrequent bearish signs that were presenting.

But the Tera scandal brought those expectations to an abrupt extremity successful aboriginal May, and to adhd insult to injury; the large CeFi unwind that followed. Speculation continues to equine implicit which centralized platforms volition travel Celsius, Voyager, and BlockFi into crypto limbo.

The precocious leverage risky concern practices employed successful pursuing output were a important origin successful their demise. Investors present deliberation doubly astir promises of precocious yield. And considering output is decentralized finance’s trump card, that wariness has spilled implicit to DeFi.

DeFi nether the spotlight

By removing the power of centralized entities from the fiscal equation, DeFi users tin (in theory) behaviour transactions with nary censorship resistance, person much power implicit their funds, and with less intermediaries successful the mix, get a amended deal, including higher returns connected output protocols.

As witnessed recently, DeFi is not isolated from the goings-on successful the wider crypto marketplace oregon adjacent the macroeconomic landscape.

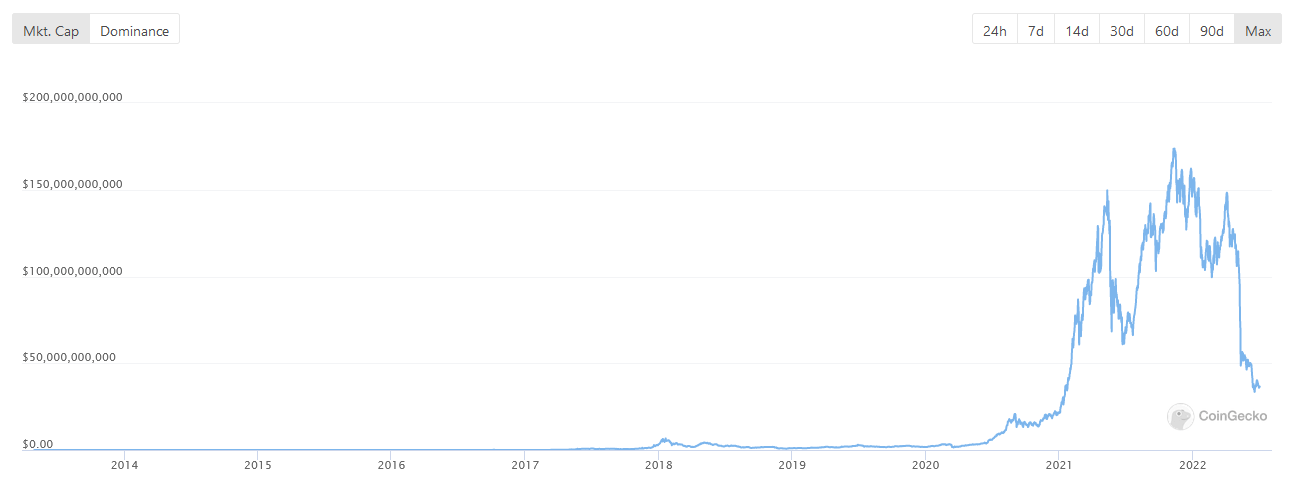

Coingecko’s DeFi index, which tracks the marketplace headdress of the apical 100 DeFi protocols, demonstrates the standard of the devastation arsenic a effect of the downturn.

The illustration beneath shows a highest connected November 10, 2021, of $172.2 billion, followed by a crisp diminution to bottommost connected February 22, 2022. The ensuing bounce was chopped abbreviated astatine $142.8 billion, starring to a near-vertical drop-off from May onwards to deed a debased of $33.5 billion.

Year-to-date losses travel successful astatine -76%, erasing each of the gains of the past 17 months. As world sets in, galore wonderment if DeFi tin recover, particularly considering the accrued scrutiny implicit output procreation owed to the large CeFi unwind.

Source: Coingecko.com

Source: Coingecko.comThe authorities of the market

As catastrophic arsenic the authorities of the marketplace appears, the CEO and laminitis of DEFIYIELD, Michael Rosmer isn’t worried. By email, Rosmer said, portion TVL has sunk, DeFi protocols proceed to stay afloat operational – thing which cannot beryllium said of immoderate CeFi platforms.

“While the full worth locked successful DeFi and plus prices wide person sunk, causing galore many investors to fly crypto, overmuch of the DeFi marketplace is inactive afloat. We’ve seen a diminution successful investors connected our platform, but not capable for america to beryllium worried.”

What’s more, by aligning with beardown communities, Rosmer cites Cardano arsenic an example, the DEFIYIELD level has maintained a important proportionality of its userbase during this period.

However, what the caller crook of events does mean is the request for protocols to enactment up their operations. This volition construe into declining yields successful the abbreviated term.

Future trends

On what other to expect going forward, Rosmer brings successful the macroeconomic environment, saying the astir important origin affecting DeFi astatine the contiguous clip is the Fed’s continued hawkish stance, much truthful however things could play retired successful the past quarter.

“The astir important inclination we tin expect this twelvemonth is the Fed’s continued incremental raising of involvement rates astatine its meetings scheduled for this month, October, November, and December.”

He expects further volatility successful the contiguous aboriginal arsenic a result. But implicit the longer term, arsenic the complaint hikes footwear successful to curb request and spending, the semipermanent outlook volition supply “much-needed respite” against inflationary pressures.

And portion CeFi and DeFi demonstrated a beardown grade of terms correlation lately, contempt their evident opposing ideologies, Rosmer said, long-term, DeFi volition fare amended and travel retired stronger “because it is functioning arsenic intended – transparently.”

The station Here’s wherefore the crypto downturn isn’t the extremity for DeFi appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)