The Bitcoin marketplace is erstwhile again successful turmoil, and the crushed is an aged acquaintance: no, not the US Federal Reserve, but the worries and rumors astir Tether’s stablecoin, USDT. Anyone who has been progressive successful the Bitcoin and crypto marketplace for a portion knows that rumors astir USDT’s deficiency of backing are portion of each carnivore market. And this carnivore marketplace seems to mean it peculiarly “well” arsenic the Tether FUD is present making a reappearance successful this cycle.

As NewsBTC reported earlier today, USDT has somewhat mislaid its peg to the US dollar arsenic the Curve 3Pool has mislaid its balance. The crushed for this is that whales are selling USDT and trading it for USDC arsenic good arsenic DAI. However, according to Tether CTO Paolo Arduino, the institution is “ready to redeem immoderate magnitude 1:1 against US dollars”.

Historically, the de-pegging of USDT is not an uncommon occurrence. Samson Mow, CEO of Bitcoin focused institution JAN3, writes:

Tether FUD is ever the FUD bottom. It’s what they propulsion retired erstwhile there’s thing left. Up soon.

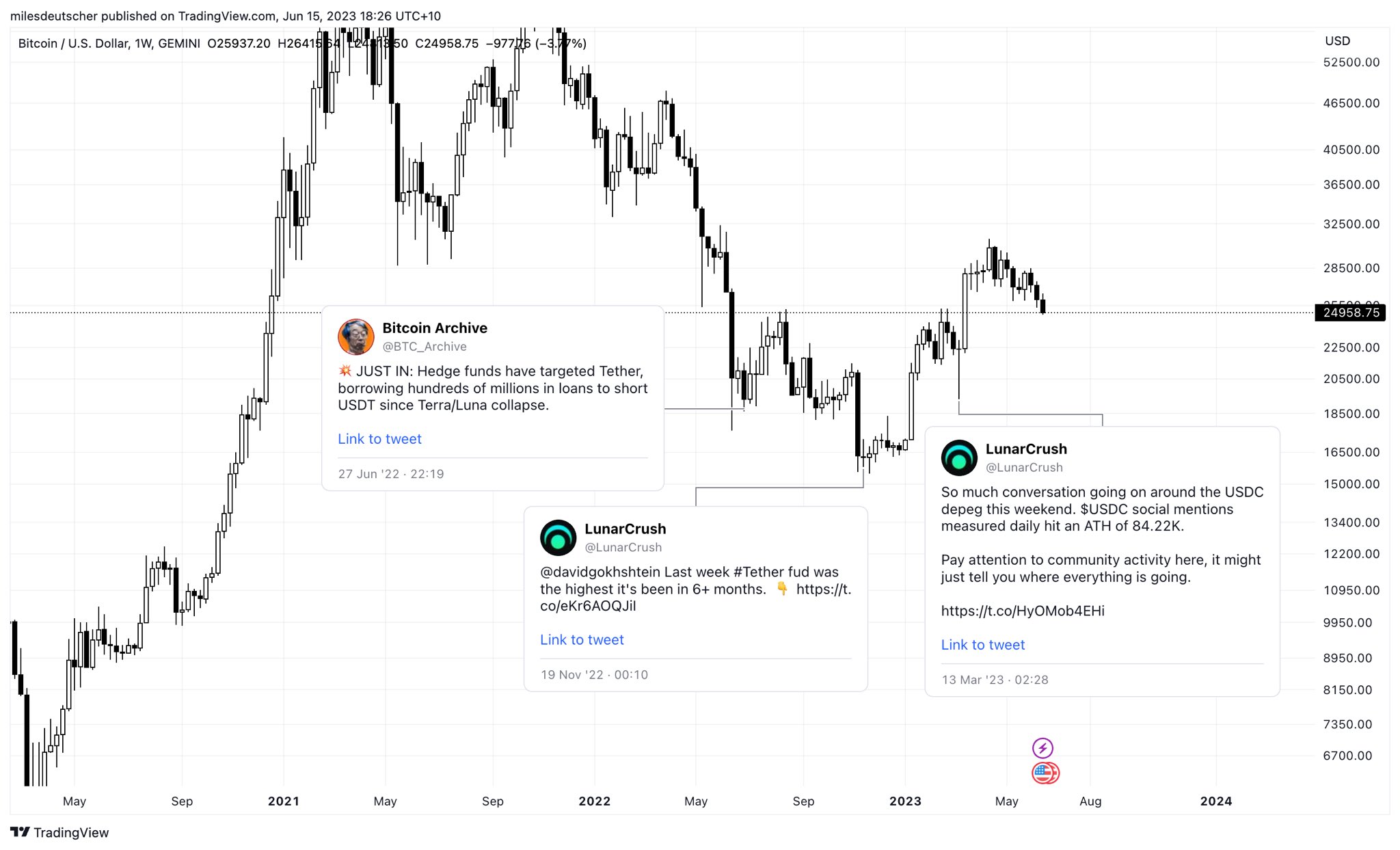

Analyst Miles Deutscher has a akin view. He explained: “Fun Fact: Stablecoin FUD often marks section bottoms,” and shared the pursuing chart.

Stablecoin FUD marking the section bottom? | Source: Twitter @milesdeutscher

Stablecoin FUD marking the section bottom? | Source: Twitter @milesdeutscherBottom Signal For The Bitcoin Price?

As tin beryllium seen successful the chart, the Tether FUD archetypal surfaced astatine the extremity of June 2022. At the time, quality emerged that hedge money Fir Tree Capital Management was shorting Tether aft the Terra ecosystem stablecoin Terra USD collapsed. Contrary to speculation, however, Tether was capable to process each USDT redemptions, adjacent though the worth of USDT had fallen to $0.9520 temporarily.

In mid-November 2022, the cryptocurrency speech FTX went bankrupt aft its rival Binance backed retired of a acquisition agreement. The Tether FUD deed a 6-month precocious and the terms of USDT fell to $0.9970. Again, Tether was capable to grip each redemptions, portion the marketplace recovered a section bottom.

Most recently, USDC depegging provided the section bottommost awesome successful March this year. The lawsuit was caused by the illness of the counterparty from stablecoin issuer Circle, Silicon Valley Bank (SVB). Crypto whales had besides tried to instrumentality profits from the concern astatine the time, portion different USDC holders sold retired of panic.

Tether emerged arsenic the wide victor from the second concern and was capable to seizure ample marketplace shares from USDC since then. Most recently, Tether reported immense profits, immoderate of which they are investing successful Bitcoin, arsenic NewsBTC reported.

This is different crushed wherefore crypto adept Thor Hartvigsen believes that the likelihood of Tether not having capable funds to settee each USDT redemptions is “pretty low”, adding: “According to Tether, the institution made $1.48b successful profits successful Q1 unsocial which brought the reserve surplus to $2.44b. They’ve further been winding down slope deposits (hold little than $0.5b here) and acquired implicit $53b successful US treasuries passim 2022.”

Remarkably, the terms of USDT has already returned to its default level astatine property time. After the USDC/ USDT terms connected Binance climbed temporarily to $1.0042, it was present already backmost astatine $1.0019.

As of property time, the Bitcoin terms was bucking the Tether FUD and holding somewhat supra $25,000. However, the driblet beneath the 200-day EMA (blue line) is somewhat critical. Most recently, BTC fell beneath this indicator which is known arsenic the “bull line” during the USDC de-pegging. Therefore, Bitcoin bulls are advised to signifier a akin absorption arsenic successful March to forestall a further plunge.

Bitcoin terms beneath 200-day EMA, 1-day illustration | Source: BTCUSD connected TradingView.com

Bitcoin terms beneath 200-day EMA, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)