Over the past month, Bitcoin’s terms has fluctuated with each large macro lawsuit and regulatory announcement, specified arsenic the SEC’s caller lawsuits against Coinbase and Binance, which allege aggregate securities violations and incorporate connection that could reshape the industry.

These events person lone introduced much volatility, and adjacent though Bitcoin’s terms swings person not been arsenic assertive arsenic they could be, they person led to a chaotic and uncertain marketplace atmosphere.

Nevertheless, this has not deterred semipermanent holders from accumulating.

Diamond hands forever

Long-term holders are addresses that person held onto their coins for astatine slightest 155 days without moving them, showing a much diligent and semipermanent concern attack to Bitcoin. As such, they service arsenic a captious indicator of marketplace sentiment, arsenic short-term marketplace fluctuations are little apt to impact them.

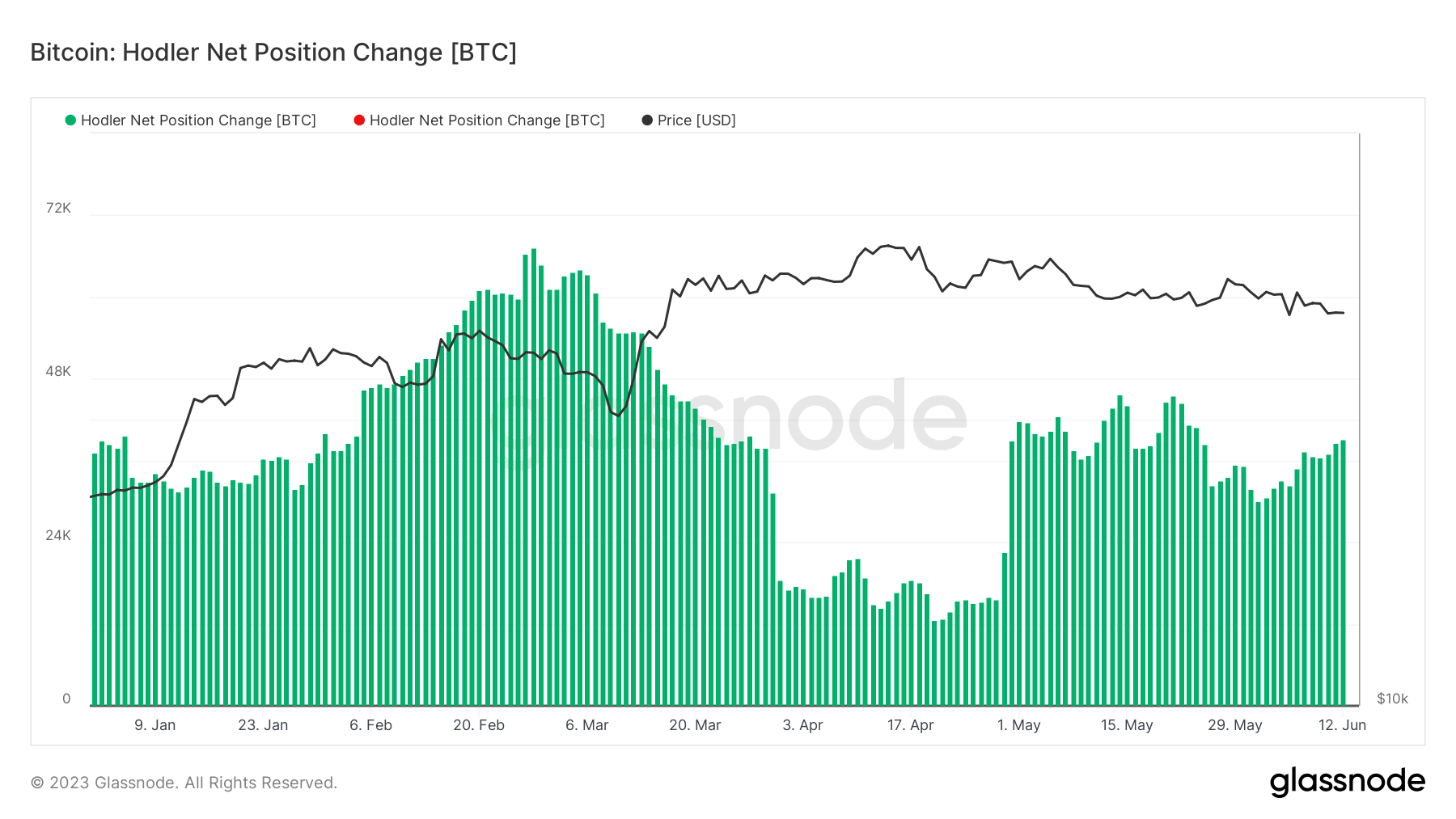

Despite the ongoing marketplace uncertainty, holders person continued their Bitcoin accumulation. Data from Glassnode showed that holders person been expanding their BTC presumption since the opening of the year, with each azygous time showing a affirmative alteration successful their position.

A notable accumulation spike was observed successful aboriginal May, sparking a caller question of accumulation. As of June 12, hodlers were expanding their positions astatine a complaint of 39,233 BTC per month.

Graph showing the hodler nett presumption alteration YTD (Source: Glassnode)

Graph showing the hodler nett presumption alteration YTD (Source: Glassnode)Historically, nett changes successful hodler positions person been inversely correlated with Bitcoin’s terms fluctuations — erstwhile Bitcoin’s terms peaks, semipermanent hodlers alteration their positions. This indicates experienced marketplace participants thin to bargain much Bitcoin erstwhile its terms is debased and merchantability erstwhile the terms increases.

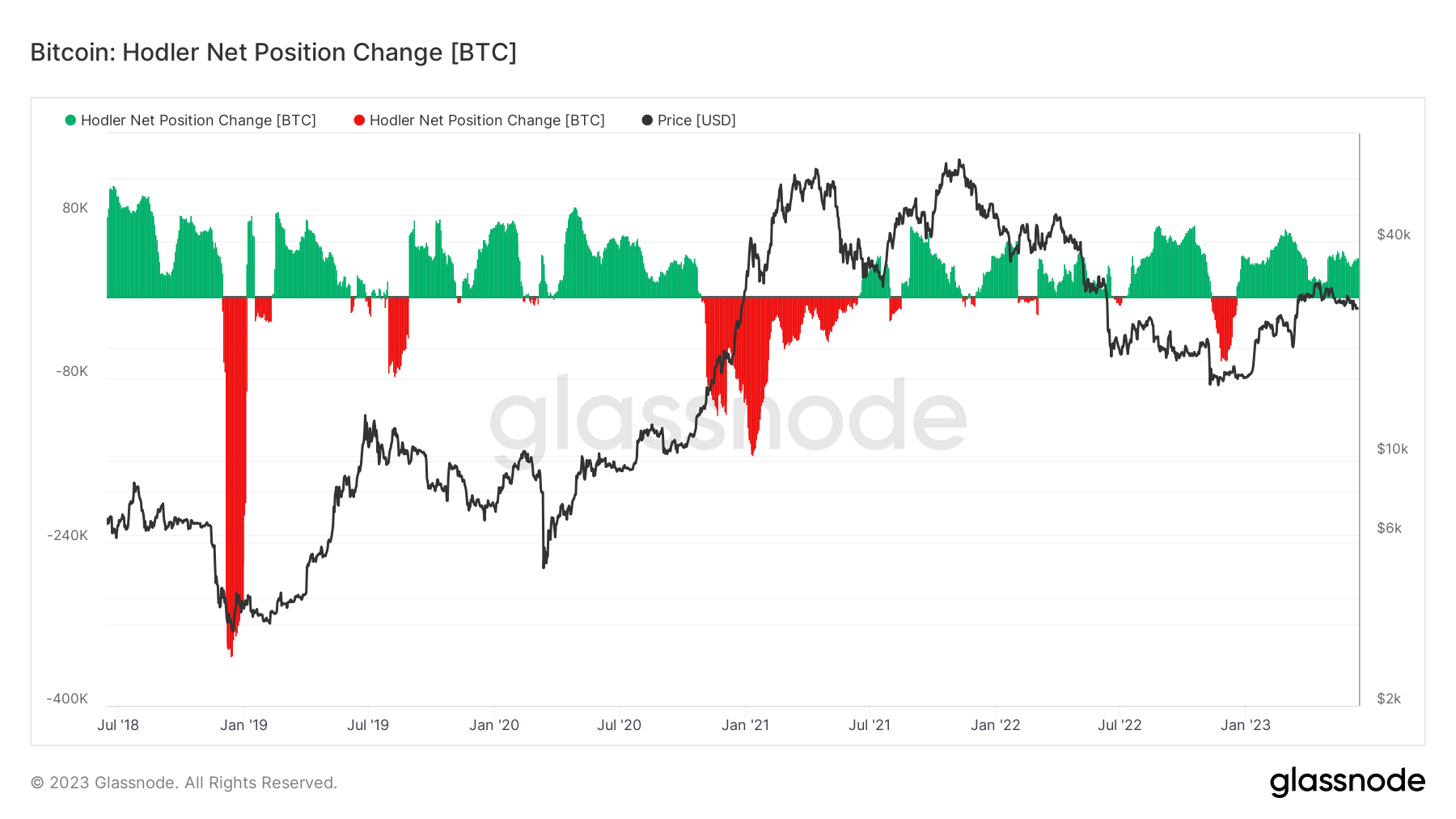

Graph showing the holder nett presumption alteration and Bitcoin’s terms from July 2018 to July 2023 (Source: Glassnode)

Graph showing the holder nett presumption alteration and Bitcoin’s terms from July 2018 to July 2023 (Source: Glassnode)Another on-chain metric, Coin Days Destroyed 90 (CDD-90), further supports this accumulation trend.

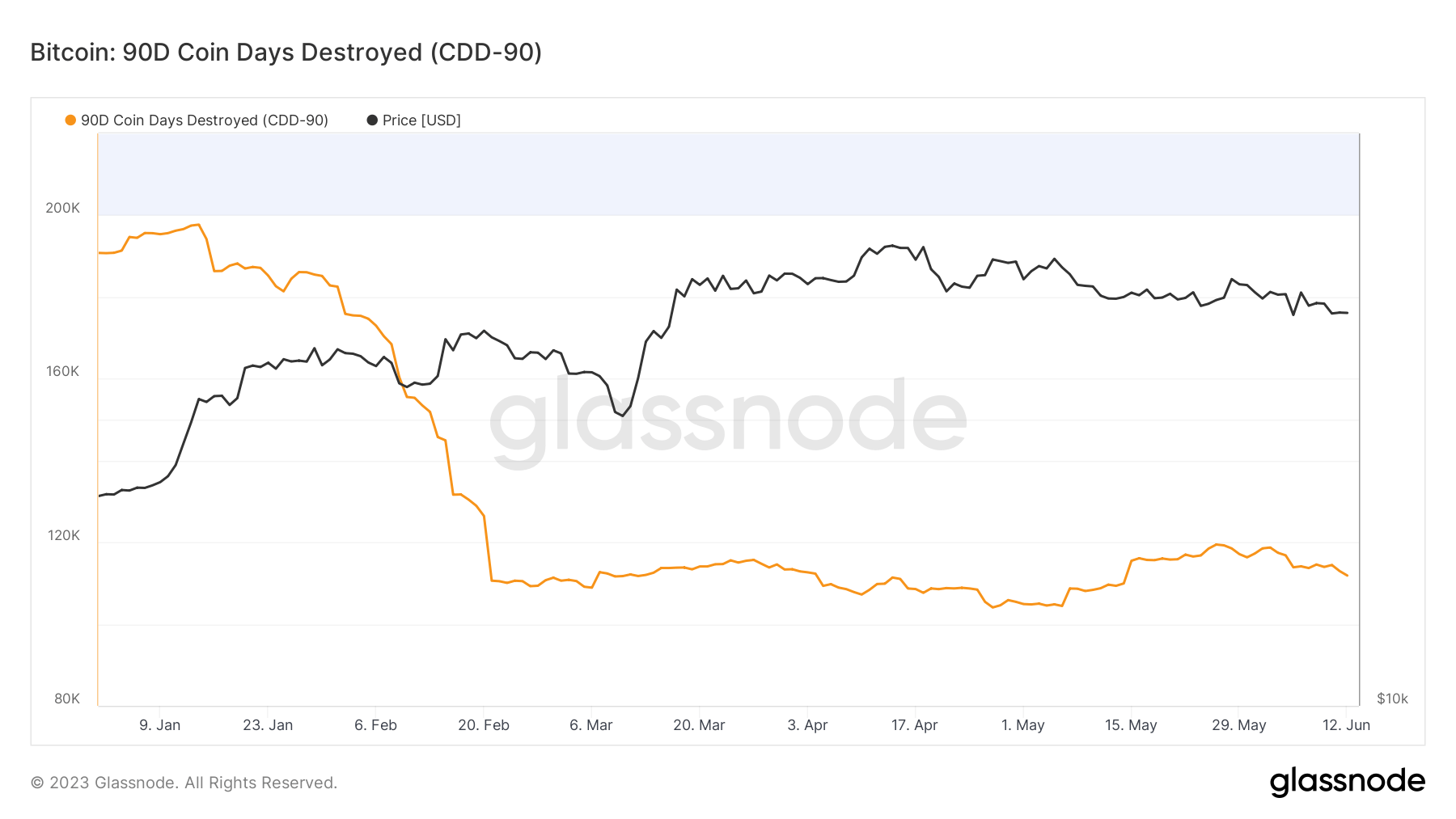

Coin Days Destroyed is simply a mode of measuring the question of aged coins. Holding a azygous Bitcoin for a time creates 1 coin day, portion moving the Bitcoin destroys the coin day. CDD tracks the full property of each Bitcoins moved connected a fixed day, providing penetration into however galore older coins held by semipermanent holders are connected the move.

And portion CDD provides a coagulated overview of the authorities of aged coins, CDD-90 is simply a overmuch much applicable measure. The metric adds up each the CDD from the past 90 days, providing a amended penetration into Bitcoin’s economical enactment implicit a much extended period. An uptrend successful CDD indicates holders who ain coins with agelong lifespans are selling, portion a downtrend shows a alteration successful interest.

Since February 21, the CDD-90 has been moving sideways. This suggests that hodlers person slowed their spending and are expanding their Bitcoin positions. This accumulation reduces the magnitude of Bitcoin disposable successful the market, tightening the supply.

Graph showing Coin Days Destroyed 90 (CDD-90) YTD (Source: Glassnode)

Graph showing Coin Days Destroyed 90 (CDD-90) YTD (Source: Glassnode)The accumulation from semipermanent hodlers and the sideways inclination of the CDD-90 suggest a continuous involvement successful Bitcoin that defies the uncertain conditions successful the market. While the contiguous aboriginal of Bitcoin remains uncertain fixed the complexity of the macro and intra-industry factors astatine play, these metrics bespeak a soundless but steadfast assurance successful the asset.

The station Hodlers support accumulating Bitcoin successful aftermath of US regularisation onslaught appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)