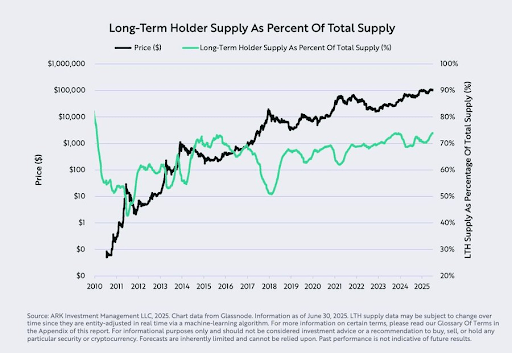

The percent of Bitcoin’s semipermanent holders’ proviso has reached a 15-year high, providing a bullish outlook for the flagship crypto. Asset manager Ark Invest highlighted this improvement successful a caller study and explained what this could mean for BTC going forward.

Bitcoin Long-Term Holders Supply Hit 74%

According to the Ark Invest report, the semipermanent holders’ proviso has reached 74% of Bitcoin’s full supply, marking a 15-year precocious for this metric. The plus manager noted that this inclination indicates increasing marketplace condemnation successful BTC’s relation arsenic a store of worth oregon “digital gold.” These long-term holders notation to addresses that person held for 155 days oregon longer.

This improvement comes astatine a clip erstwhile Bitcoin is witnessing massive request from organization investors done the ETFs and treasury companies. These investors are considered amended ‘diamond-hands’ than retail investors, which means that this metric could support rising, with semipermanent holders gaining much power of BTC’s full supply.

This organization buying has besides driven the Bitcoin terms to respective all-time highs (ATHs) this year, with BTC reaching arsenic precocious arsenic $123,000 past week. The flagship crypto appears to inactive beryllium successful terms discovery, arsenic ETFs led by BlackRock and treasury companies, led by Saylor’s Strategy, proceed to accumulate astatine an unprecedented pace.

Source: Chart from Ark Invest

Source: Chart from Ark InvestCathie Wood’s Ark Invest is ultra bullish connected the Bitcoin price, predicting that it could scope $1.5 cardinal by 2030. They expect BTC to scope this people owed to the rising organization concern and planetary designation of Bitcoin’s quality to service arsenic a store of value. In a CNBC interview, Cathie Wood besides doubled down connected this prediction.

She explained that they expect BTC to instrumentality a important stock from golden oregon turn the store of worth market. Wood added that institutions are inactive conscionable investigating the waters contempt the monolithic accumulation truthful far. As such, she inactive expects a emergence successful adoption for these companies. Meanwhile, lone astir 1 cardinal unmined Bitcoins are remaining.

Other Bullish Metrics For BTC

The Ark Invest study besides revealed that planetary liquidity per bitcoin reached a 12-year high. This metric reached this precocious with $5.7 cardinal successful global M2 supply per BTC successful circulation. The plus manager remarked that this ratio could proceed to emergence fixed Bitcoin’s diminishing aboriginal proviso maturation and the continued enlargement of planetary liquidity.

Meanwhile, successful June, Bitcoin managed to clasp supra the enactment betwixt $96,000 and $99,000 and is present good supra these levels. $98,888, $96,278, and $71,393 are BTC’s short-term holder outgo basis, 200-day moving average, and on-chain mean, respectively, which is wherefore this improvement is bullish for the flagship crypto.

At the clip of writing, the Bitcoin terms is trading astatine astir $19,100, up successful the past 24 hours, according to data from CoinMarketCap.

Featured representation from Pixabay, illustration from Tradingview.com

4 months ago

4 months ago

English (US)

English (US)