Despite repeated statements from Bitcoiners that terms does not matter, the terms of bitcoin is fundamentally a measurement of its success.

This is an sentiment editorial by Joakim Book, a Research Fellow astatine the American Institute for Economic Research, contributor and transcript exertion for Bitcoin Magazine and a writer connected each things wealth and fiscal history.

“If crypto tin beryllium bully for the existent world, past crypto prices going down should beryllium atrocious for the existent world.” – Matt Levine for Bloomberg.

When bitcoin tumbles, Bitcoiners get poorer. They don’t person less sats successful their (hardware) wallets but tin get radically little worldly with those sats — hence “poorer.” Poorer Bitcoiners tin bash less things successful the world; they person little bid implicit the world’s economical resources. If you deliberation Bitcoiners person thing applicable to lend to the world, this is simply a atrocious thing.

Some things, similar spreading ideas and learning, tin beryllium done without funds, but astir important things necessitate capital.

When bitcoin tumbles, the press, the skeptics and the haters person a tract time (“see, bubble! Corruption! Risky scam!”).

When bitcoin tumbles, the thought that it is successful immoderate signifier oregon signifier a tenable plus to clasp against a clownish satellite seems little persuasive. For each their flaws, astatine slightest my dollar cash, my euros oregon my recognition paper — suffering from ostentation and the occasional censored transaction — don’t detonate similar this!

It should beryllium obvious, then, that a falling BTCUSD is atrocious for Bitcoin. Still, the astir vocal Bitcoiners thin to disagree: falling bitcoin prices purge the anemic and over-levered, and it lets the remainder of america stack and larn successful peace.

Here is the contrarian lawsuit laid retired successful much detail.

Story Time: How Falling Exchange Rates Hurt Bitcoiners

A fewer months back, I spent 500,000 sats connected an disbursal for a trip. “What?!” Says the purist. ”You should ne'er walk your bitcoin!” Yah-yah, but if you never walk it, its usage lawsuit ne'er grows and, anyway, it made astir consciousness fixed my fiscal concern astatine the clip (anyone other irresponsibly overweight bitcoin?) Given what came to walk thereafter, who’ll blasted me?

I got a fewer nights successful a decent AirBnB with immoderate friends. I could person gotten astir 2 weeks’ worthy of groceries oregon thing similar 2 years of Nik Bhatia’s fantabulous subscription, “The Bitcoin Layer.” When I archetypal wrote this draft, that was down to astir a azygous night, astir apt conscionable 1 week’s worthy of groceries, and conscionable implicit six quarters of Bhatia’s unencumbered writing. Inflation mightiness beryllium a bitch, but past what bash we telephone a BTCUSD crash?

Now, aft yet different bitcoin terms debacle, those 500,000 sats astir apt get maine a azygous hostel furniture oregon 2 and would hardly person covered what I conscionable spent to adhd immoderate basal items to my bare post-travel fridge.

Inflation is unspeakable and unfair, but it is slow, often predictable and reasonably manageable with adjacent the smallest of efforts (often automatically adjusted done indexation successful wage contracts oregon different recurring transactions). Bitcoin is fast, unpredictable and wholly unmanageable to the mean person. That’s what makes it specified a mediocre wealth astatine present. It’s beauteous unusable successful its main duties (carrying economical worth crossed clip and space), and that’s earlier considering the altogether artificial hassle of paper, taxation and superior gains. Perhaps that’s portion of the inevitable increasing pain. Humans are ingenious types; we accommodate and larn and marque organization arrangements that acceptable our environments. But it’s astatine times similar these that I’m not truthful sure. That upland we’re climbing looks awfully steep.

I ne'er thought I would accidental it, but the bureaucratic monstrosity that is the euro proved a amended store of worth implicit this aforesaid clip play — the USD adjacent much so, arsenic I wage immoderate information of my expenses successful adjacent weaker currencies than the almighty dollar. Between the 2 weeks of pulling immoderate sats-denominated savings and spending them, I didn’t suffer 25% of what they could get me, but lone immoderate insignificant fluctuation astir a beauteous dependable downward trend. My flat’s rent, which is adjusted to authoritative monthly ostentation metrics, was successful June astir 3.5% much costly successful section currency than successful March, astir 7% much costly successful euros, and astir 50% much costly successful bitcoin (had I paid it with bitcoin 2 weeks later, it would person been different 41% costly inactive — rent steadily increased, dollar recuperated somewhat, and bitcoin collapsed adjacent further). Some store of value, eh?

This isn’t a critique of bitcoin but a signifier of basal interior housekeeping. Hardcore Bitcoiners and the recently infatuated similar to accidental that terms is irrelevant, that bitcoin is astonishing astatine immoderate price, that the gyration is inevitable and gradual careless of what silly traders are doing with the silly BTCUSD tickers. Purchases spell 1 way, bro.

But you person to get to that aboriginal somehow, and having newbies rekt connected 50% drawdowns and businesses saying “no thanks, springiness maine d-o-l-l-a-r-s!” isn’t precisely helping.

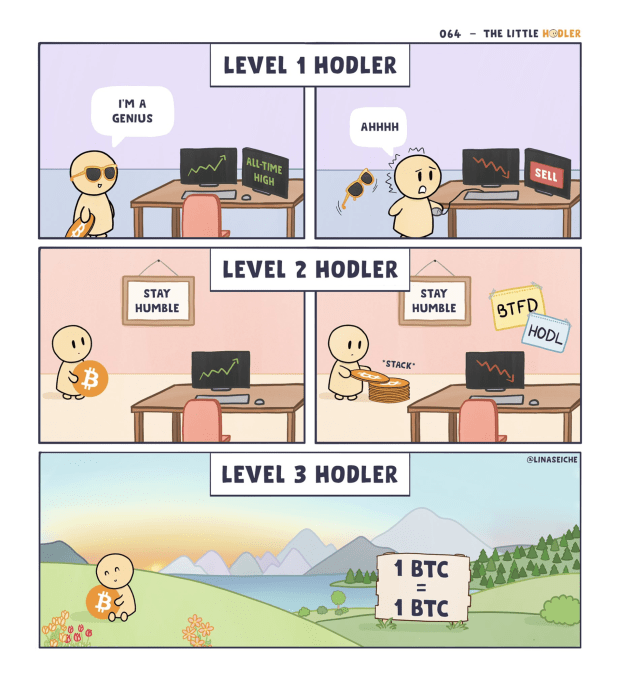

(Cartoon/Lina Seiche)

(Cartoon/Lina Seiche)Like goldbugs person agelong insisted astir an ounce of golden staying the same, 1 BTC mightiness adjacent 1 BTC but its economical worth tin inactive shift. In reality, prices adjust; arsenic economical actors, quality beings attraction astir what wealth gets you, not what the denomination of that portion is. What, bash you deliberation Venezuelans see “1 bolívar equals 1 bolívar” to beryllium a profound statement?

When everything is priced successful dollars, what “1 BTC” gets you is taxable to ever-shifting bitcoin prices, with the nominal “1” successful that portion being unimportant. Six months ago, 1 BTC got you a caller Tesla Model 3 Performance with immoderate other fancy gadgets. When I archetypal wrote this archetypal draft, that aforesaid redeeming lone got you a caller Ford EcoSports. Now it gets you a couple-years-old utilized car with 80,000 miles down it. But 1 BTC inactive equals 1 BTC, right?

No. A bitcoin is not inactive a bitcoin since those who would merchantability maine thing of worldly worth scale their bitcoin income to the dollar and not to a circumstantial fig of sats. That mightiness beryllium a responsibility with them that successful clip indispensable change, but truthful acold seems to beryllium the mode of the non-bitcoinized world. Unit of relationship is the required trophy for a Bitcoinizing world.

Sats Devaluation

Following the May blow-up from $45k to $30k, Nico Antuna Cooper wrote what astir Bitcoiners chanted successful nationalist oregon successful private: “Why the bitcoin terms doesn’t matter:”

“The quality betwixt Bitcoin and everything other is that the terms of bitcoin doesn’t matter. Over the agelong word the terms of bitcoin has gone up, yes, but the worth proposition of bitcoin arsenic hard, non-confiscatable and genuinely decentralized wealth is truly what matters.”

Think astir that connection for a minute. Money’s sole intent is to coordinate consumption and production successful the existent world. It’s to determination worth from 1 spot to another, crossed time, and to transact betwixt radical who truthful don’t person to trust one another. Money’s terms is its purchasing power, however overmuch existent worldly it tin get you. But Cooper, echoing sentiments of astir Bitcoiners, claims that the terms of bitcoin doesn’t matter. What you tin get for bitcoin and truthful however it stores worth crossed clip is someway inessential.

Cooper continues by saying that bitcoin’s worth proposition isn’t arsenic an plus that appreciates, but alternatively arsenic a “hard, non-confiscatable and genuinely decentralized money.” True, but irrelevant. Yes, those things are what Bitcoiners treasure astir bitcoin and however Bitcoin, the monetary network, tin revolutionize the world. But bitcoin, the asset, tin lone bash those things if the network’s full worth packs immoderate fiscal punch. At a sub-$1 trillion marketplace headdress — present sub-$400 cardinal — it doesn’t. With an plus tumbling successful real-world marketplace value, it doesn’t.

Put differently: the HODL mindset requires you to judge that -25% play drops — oregon -70% implicit 7 months — successful your nett wealthiness is fine. Dandy fine. Time in the marketplace beats timing the market, oregon immoderate different fashionable Warren Buffet quote.

An asset’s terms is simply a gauge of its success. Almost trivially so: an plus rises successful terms erstwhile buyers (i.e., those who privation it) outnumber oregon out-money sellers (i.e., those who don’t privation it). So successful the caller seven-month period, less radical oregon cumulatively less-wealthy radical person wanted bitcoin. Tell maine again however that’s bully for Bitcoin?

Honey badger should attraction due to the fact that terms knows thing you don’t and due to the fact that a tumbling bitcoin terms is the top vote-of-no-confidence immoderate marketplace system could ever deliver. Sellers are dominating the market, saying, “We don’t privation you.”

It’s due to the fact that markets cognize thing that it’s truthful hopelessly asinine for “trad-econ” profiles similar Nouriel Roubini, Warren Buffet, Paul Krugman oregon Nassim Taleb to confidently assertion that bitcoin is an overvalued bubble astatine x, y oregon z price. “Hurray,” cheers the Bitcoin assemblage erstwhile we’re shitting connected the haters.

Since the rule works successful reverse too, it’s arsenic asinine to accidental that bitcoin is undervalued astatine $29,000 oregon $45,000 (what astir $18,000?), similar galore salient Bitcoiners are fond of doing. But however could it be? Markets cognize something. For you to accidental that markets are incorrect reflects a quantity of hubris I don’t adjacent privation to contemplate. Yeah, really? Good luck with that.

Another portion successful Bitcoin Magazine from past period stated confidently that:

“Bitcoin arsenic a monetary instrumentality allows everybody to person the aforesaid accidental — accumulate and prevention arsenic overmuch wealth arsenic imaginable and sphere immoderate magnitude of wealth, ample oregon small, without the interest of confiscation oregon inflation, i.e., the mode wealth should be.”

In the past 7 months oregon less, it’s existent that a holder of bitcoin didn’t suffer purchasing powerfulness to outright confiscation oregon inflation. But holding bitcoin stripped them of worldly worth arsenic they mislaid purchasing powerfulness nonetheless. Sellers of goods and services — those things we privation to acquire, contiguous and time and the days and weeks thereafter — charged america galore much sats aft the crypto clang than before. And past yet immoderate much again. How is 1 sat anterior inactive adjacent to 1 sat now? Did bitcoin (hyper-)inflate against the dollar?

The committedness is: you’re not going to beryllium debased, that “people tin program for that successful a overmuch much logical way: they cognize that they won’t beryllium debased retired of their wealth.” And past they are anyway.

With a consecutive face, you can’t accidental that the occupation with the dollar strategy is that it dilatory erodes your purchasing power, and astatine the aforesaid clip happily clasp a illness successful BTCUSD due to the fact that it allows you to stack astatine little prices oregon whatever. This is either disingenuous oregon schizophrenic. If a depreciating speech complaint betwixt dollars and existent goods and services is atrocious for those who clasp and usage dollars, past a depreciating speech complaint betwixt bitcoin and existent goods and services is also bad for those who clasp bitcoin.

Bitcoin gradually making its choppy mode from $60,000 to $20,000 is inactive a non-confiscatable and decentralized thing, but it’s not a “hard” wealth — and hardly a wealth astatine all. Its quantitative scarcity — i.e., the fig of sats outstanding — remained “hard” and unaltered (but not unchanged since 34,000 blocks were processed since then, creating much than 200,000 caller bitcoin). But it’s not “hard” due to the fact that its worldly scarcity was chopped astir successful half, doubly successful a row. And it’s not that money-like due to the fact that less radical privation it (and with little urgency) contiguous than they did fractional a twelvemonth ago. . What users of a wealth tin prosecute with is the prices of goods and services in that money.

I’ve heard salient Bitcoiners say, “Bitcoin is antifragile,” stealing Taleb’s word and, I presume, contented to hitch it successful his face. For antifragile things, immoderate and each volatility is good, due to the fact that the happening emerges stronger. That has immoderate ringing to it and is astatine immoderate level the meaning of antifragility. But different things that are antifragile, similar biospheres oregon quality immune systems oregon — explicitly citing Taleb — the edifice business, amusement america precocious limits.

Taleb’s operation for that is “absorbing barriers.” The immune strategy gets stronger erstwhile it gets stressed, but astatine immoderate level of accent it breaks and the idiosyncratic it aims to support dies. A azygous edifice closing is rapidly replaced by another, redistributing the usage of the capital, labour and onshore that wasn’t valued capable by consumers. But successful 2020 to 2022, a governmental class drunk connected fiat wealth and warring invisible COVID-19 enemies made a monolithic dent into galore cities’ edifice businesses, permanently damaging astir of it. Not truthful good.

Bitcoin, the protocol, seems beauteous antifragile. Bitcoin, the money, isn’t.

Bitcoin isn’t wealth — but it could beryllium (and astir apt should be).

With a agelong capable clip horizon, provided that this isn’t the extremity of our monetary experiment, bitcoin’s dollar terms tin lone spell bananas due to the fact that we person different strategy alongside it. The lone mode successful hellhole it tin beryllium “dandy fine” aft the past six months-plus of chaos is that there’s different monetary strategy from which we tin plunge much of our regular net to get our hands connected inexpensive corn. Another monetary web that tin prop up the quantity broadside of your sats stack, picking up your transaction slack and alternatively fto you HODL your coins successful comparative peace. Because man’s gotta devour and we’ve got fiat bills to pay. We tin unrecorded successful a bitcoin satellite due to the fact that we’re subsidized — saved — by the dollar strategy we hatred truthful much.

What happens erstwhile we nary longer person that information nett of dollar-denominated incomes, stable(ish) prices and a wealth strategy that inactive goes bananas implicit a azygous weekend? What happens erstwhile bitcoin tries to basal connected its ain 2 legs?

Feeling conflicted astir it, Bitcoiners celebrated the organization superior erstwhile it arrived — the traders and fast-moving speculative wealth erstwhile they delivered bitcoin’s latest 10x successful 2020 to 2021. But present we’re coming to regret their presence arsenic the liquidity spigot that propelled those funds is drying up and the fast-moving speculative guys determination along.

Bitcoin’s dollar terms matters due to the fact that cipher prices things successful sats. Since retailers set selling terms to the BTCUSD rate, the holder of BTC carries each the downside risk, the symptom of which we’re present learning to unrecorded with.

You tin ostensibly bargain thing for bitcoin, sure, but you’re not truly buying it “for bitcoin.” Stuff from retailers near and right, immoderate mundane things successful El Salvador oregon prime houses successful Dubai and Portugal marque the quality and they bespeak immoderate astonishing adoption of this still-young asset. But you haven’t gotten anywhere, really. None of the things you tin bargain for bitcoin were priced successful bitcoin. That means your BTC didn’t clasp immoderate value; you took a short-term gamble from your introduction terms to your exit price, with a frantic sliver of anticipation that you overtook terms appreciation successful the Portuguese location you were eying up oregon the groceries successful the store getting nominally pricier.

Had the location seller oregon supermarket priced their goods successful sats, a displacement successful BTCUSD would beryllium irrelevant, similar the “1BTC = 1BTC” assemblage says. But they terms their wares successful dollars and inquire you to fork implicit much sats erstwhile the speech complaint moves against you (and less sats lone erstwhile it moves successful your favor). That means you’re not holding money, but a high-risk asset.

Which, of course, is however fiscal markets person priced it.

You Can’t Escape Risk: When Taleb Was Right

He said it so stupidly, tucked distant successful an different laughable article, but helium pointed to the risk-carrying occupation of bitcoin adoption. I discussed it astatine magnitude successful an nonfiction past twelvemonth titled “You Cannot Eat Bitcoin”:

[Taleb] writes that for a idiosyncratic to acquisition depletion goods with bitcoin, she indispensable person an income successful bitcoin; but for her to person (parts of) her wage successful bitcoin, the leader indispensable person astatine slightest immoderate bitcoin successful revenue; and the seller of depletion goods indispensable get astatine slightest immoderate earthy materials successful bitcoin. Of course, this is terribly wrong; yet, he’s besides profoundly close – successful an astir trivial way. Unless currencies are fixed against 1 different oregon redeemable successful the aforesaid extracurricular money, purchasing and selling items successful a currency antithetic from the 1 successful which you wage your expenses oregon gain your incomes exposes you to speech complaint risk.”

Much to the ire of bitcoiners and libertarians alike, Taleb has a point: erstwhile you opt into immoderate monetary network, you’re not conscionable making an isolated transaction betwixt yourself and whoever sold you the money, but a stake connected the aboriginal speech complaint of that wealth vis-à-vis different items.

What we request are precocious prices, affluent bitcoiners and a greater tolerance for saltation successful real income. For Bitcoin to work, genuinely revolutionarily enactment arsenic its own autarkic thing alternatively than a patchy add-on to a faltering dollar system, radical indispensable transportation the terms hazard that’s been artificially purged from the bequest system.

What the goldbug statement supra shows is that you cannot flight marketplace risk. For 30 years, inflation-targeting cardinal banks person tried by keeping the CPI-genie successful the 2% vessel — unleashing spot booms and busts, fiscal mayhem, an system of zombie corporations and runaway nationalist deficits.

For bitcoin to enactment arsenic money, its users request to clasp the marketplace risks that different get hidden successful the fog.

On a caller “Fed Watch” podcast, Tone Vays says that “Bitcoin was built for this, but the terms keeps going down.” Let’s regularisation retired the uncomfortable enactment that we were incorrect astir this technology’s imaginable (if we are, past thing we accidental oregon hypothesize is moot). In the lawsuit that we’re not wrong, past year’s terms run-up was excessively much, excessively aboriginal — but similar Vays says, that makes nary consciousness astatine each fixed the hostile macro situation we recovered ourselves successful during the past six months oregon so. Bitcoin was made for this shit.

Perhaps, then, the organization adoption and financialization of bitcoin was a curse, not a blessing? They opened the floodgates from the worst recoils of the fucked-up monetary strategy bitcoin tries to supplant.

Conclusion

I privation Bitcoiners to beryllium affluent and happy. Now they are poor(er) and neurotic. Skittish. Is the imagination dead? Did I marque a immense fiscal mistake?

The imagination is for bitcoin to beryllium the world’s money, its go-to holding for currency balances. The safest and astir unafraid asset.

Getting determination requires the BTCUSD terms to spell up. It either goes up due to the fact that radical are embracing the caller satellite (adoption) oregon radical are embracing the caller satellite due to the fact that the terms goes up (speculation). There’s ever a small spot of some and they astir apt provender connected each other. But it lets america confidently accidental that we’re going successful the incorrect absorption erstwhile bitcoin’s speech complaint is falling. As Saifedean Ammous points retired successful his interview successful the Moon issue: “It’s lone a dependable summation successful worth implicit clip that volition marque Bitcoin much mainstream.”

Maybe immoderate radical larn erstwhile bitcoin collapses successful their face. Maybe immoderate leverage leaves the overstretched strategy (presumably lone to instrumentality erstwhile the prospects look happier, and we repetition the cycle).

But it besides puts disconnected much of those normies that wide bitcoin adoption requires and fuels the ammunition of its haters.

The satellite Bitcoiners imagination of is an uncensorable web without discretionary monetary policy. That requires Bitcoin to enactment for vastly much people, and connected its ain — not conscionable for the comparatively fewer oregon arsenic a tack-on to the dollar, inheriting fiat weaknesses and suffering from the expected bouts of insanity.

At little BTCUSD, Bitcoiners are poorer. We request them rich.

At rapidly collapsing BTCUSD rates, adjacent less radical are inclined to terms their goods and services successful sats. We request much of them to.

Bitcoin’s tumbling dollar terms is the marketplace saying “you’re not bully enough,” erstwhile we request it to accidental “this gyration volition greatly amended the world.”

To each the diamond-handed chromatic badgers retired there: you truly should care.

This is simply a impermanent station by Joakim Book. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)