Key takeaways

A elemental data-entry mistake allowed 620,000 nonexistent BTC to look successful idiosyncratic accounts for 20 minutes due to the fact that trades update a backstage database first, with onchain colony happening later.

Around 1,788 BTC worthy of trades were executed earlier the speech locked everything down. What could person been dismissed arsenic a harmless mistake turned into a superior operational and regulatory event.

Regulatory filings showed Bithumb held lone 175 BTC of its ain successful Q3 2025, portion it held custody of implicit 42,000 BTC for customers. This highlights however heavy the strategy depends connected close interior accounting.

South Korea’s Financial Supervisory Service focused connected wherefore faulty interior information could effect successful executable trades. It raised cardinal questions astir safeguards and tradability controls.

Bithumb, 1 of South Korea’s largest cryptocurrency exchanges, ran a regular promotional run successful aboriginal February 2026. However, it turned into a large regulatory concern. What started arsenic a elemental interior data-entry mistake concisely displayed hundreds of thousands of “ghost Bitcoin” connected idiosyncratic dashboards. Some relationship holders really traded those balances, prompting regulators to analyse the interior mechanisms of centralized crypto platforms much closely.

This nonfiction explores however the shade Bitcoin incidental became a cardinal illustration of vulnerabilities successful speech accounting. It besides discusses the reasons down South Korea’s accelerated determination toward much rigorous, bank-like supervision of virtual plus services.

From a humble promotion to a superior error

Bithumb intended to connection a tiny reward program, crediting users with a humble magnitude of Korean won, typically 2,000 won ($1.37) per person. Reward programs are a modular maneuver to boost idiosyncratic activity.

Instead, an input mistake caused the strategy to recognition Bitcoin (BTC) alternatively than fiat. For astir 20 minutes, the exchange’s interior ledger reflected astir 620,000 BTC crossed hundreds of accounts. The worth of the shade BTC was successful billions of dollars, vastly exceeding the exchange’s ain holdings and full lawsuit reserves.

Staff rapidly detected the problem, froze the affected accounts and reversed the credits. But during that little period, immoderate users sold the shade Bitcoin successful their accounts, executing trades worthy astir 1,788 BTC earlier a afloat lockdown.

Although payouts were processed, it appears that nary tokens really near the exchange. Later, the level successfully recovered 93% of the mislaid worth successful a premix of Korean won and different cryptocurrencies.

How “ghost Bitcoin” tin exist

Centralized exchanges run otherwise from decentralized ones. They bash not settee each commercialized onchain successful existent time. Instead, they update idiosyncratic balances connected an interior ledger, a backstage database, allowing accelerated execution. Onchain movements are batched and processed later, often during deposits oregon withdrawals.

This architecture facilitates speedy trading, precocious liquidity and competitory fees, but it relies wholly connected the accuracy of the exchange’s interior records. Users fundamentally spot that these records lucifer existent plus holdings.

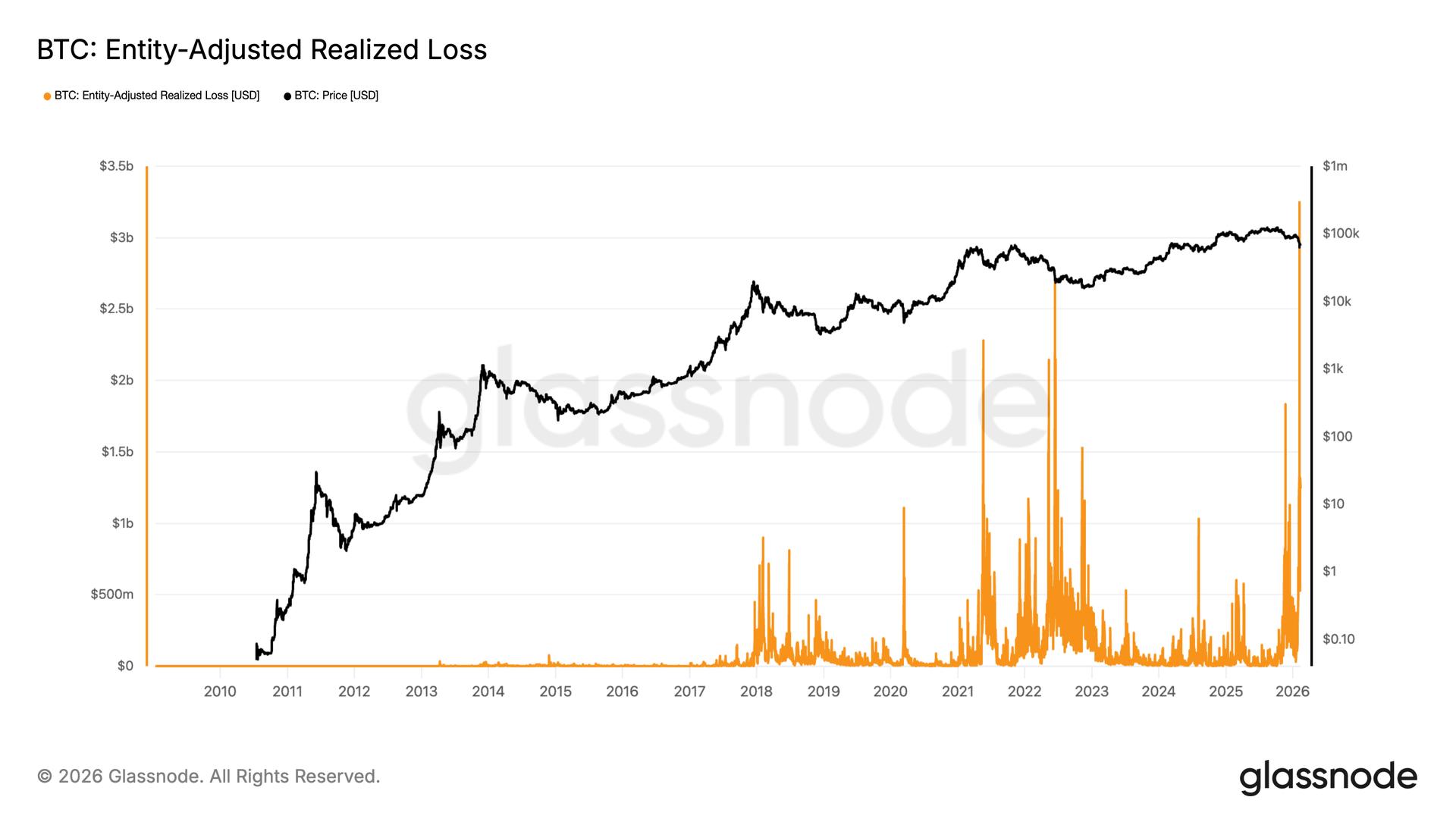

In this case, the ledger temporarily showed unbacked Bitcoin balances. According to a regulatory filing, Bithumb’s ain Bitcoin reserves were amazingly thin successful Q3 2025, holding lone 175 BTC compared to the 42,619 BTC it manages for its customers.

Did you know? South Korea was among the archetypal countries to mandate real-name slope accounts for crypto trading, a regularisation introduced successful 2018 to curb anonymous speculation and trim wealth laundering risks successful integer plus markets.

Why regulators viewed it arsenic a systematic failure

South Korea’s Financial Supervisory Service (FSS) acted promptly, concluding that the occupation was not simply a typing mistake but that trades proceeded based connected faulty interior data.

This raised halfway questions: How tin an speech alteration trading of assets it does not hold? What safeguards could forestall erroneous balances from becoming tradable? And who is accountable erstwhile users payment from specified mistakes?

The FSS conducted on-site inspections astatine Bithumb and indicated that a ceremonial probe could beryllium launched to analyse whether immoderate laws were breached. They cited the lawsuit arsenic grounds that existing crypto rules whitethorn not sufficiently code interior strategy oversight.

Ripple effects of the Bitcoin promotion mistake successful the industry

The incident’s interaction extended good beyond Bithumb, triggering a question of industry-wide scrutiny. Digital Asset eXchange Alliance, South Korea’s large crypto alliance, responded by launching a thorough audit of interior controls crossed each subordinate platforms.

Meanwhile, legislators pointed to the lawsuit arsenic grounds of systemic vulnerabilities successful centralized exchanges. They noted that operational information had failed to support gait with the market’s accelerated growth.

Ultimately, the situation highlighted a harsh reality: A azygous exchange’s nonaccomplishment could endanger the stableness of the full ecosystem.

Did you know? In accepted finance, akin “fat-finger” errors person triggered billion-dollar equity marketplace disruptions, including impermanent trading halts connected large banal exchanges, showing that operational hazard is not unsocial to crypto.

Liability and user extortion concerns

A cardinal statement arose implicit the liability of trades executed connected erroneous credits. Some users sold BTC rapidly earlier relationship freezes took effect. Bithumb reported recovering astir of the worth and absorbing shortfalls with its ain funds. Regulators noted that, nether applicable laws, users who profited from erroneous credits could perchance beryllium taxable to clawback oregon restitution claims.

This incidental exposed ambiguities successful centralized crypto platforms. Displayed balances look definitive to users, yet they stay reversible if systems marque an error. The lawsuit compelled regulators to code however protections use erstwhile method failures nutrient existent fiscal outcomes.

Advancing to “Phase Two” regulation

Regulators stated that the incidental exposed regulatory unsighted spots successful earlier integer plus laws. As they pointed out, regulations emphasized custody, Anti-Money Laundering (AML) and the prevention of manipulation but mostly overlooked interior ledger management.

The lawsuit is present driving discussions regarding enhanced oversight of the crypto ecosystem, including:

Required multi-level approvals for promotions and credits

Stricter, much predominant checks betwixt ledgers and existent reserves

Defined procedures for erroneous trades and reversals

Audit and disclosure standards comparable to accepted finance.

This displacement moves beyond token listings oregon promotions to scrutinize the underlying operational infrastructure.

Did you know? South Korea’s crypto trading volumes often spike during overnight US marketplace hours, reflecting however planetary clip zones tin amplify the interaction of speech incidents beyond home users.

A trial of spot successful centralized exchanges

Although Bithumb took steps rapidly to bounds the damage, the interaction connected its estimation is apt to linger. The incidental taught users that a equilibrium displayed connected a centralized speech indicates a assertion connected the platform’s interior systems. It does not bespeak nonstop ownership of onchain assets.

For regulators, the Bitcoin promotion mistake pointed to a broader concern. As integer plus markets expand, nationalist spot rests connected interior mechanisms that relation wholly down closed doors. Should these protocols falter adjacent briefly, the interaction could beryllium severe. South Korea’s effect has made it evident that regulators present presumption ledger integrity successful crypto exchanges arsenic a systemic hazard alternatively than conscionable an operational detail.

The “ghost Bitcoin” occurrence volition stay successful nationalist representation not chiefly for its magnitude but for the captious vulnerability it exposed. In crypto transactions, the invisible accounting systems moving down the scenes are arsenic important arsenic the blockchains functioning underneath.

Cointelegraph maintains afloat editorial independence. The selection, commissioning and work of Features and Magazine contented are not influenced by advertisers, partners oregon commercialized relationships.

2 hours ago

2 hours ago

English (US)

English (US)