As anticipation and mainstream media sum statesman to ramp up up of “the Merge”, a fashionable communicative astir staked ether (ETH) and its derivatives is opening to instrumentality shape: namely, that staked ETH could beryllium an perfect concern conveyance for large institutions looking to dip their toes into crypto holdings.

Currently, staked ETH is already a wildly fashionable concern among crypto traders and investors, adjacent though those deposits are illiquid and intolerable to commercialized until sometime aft the Merge takes place. Liquid staking solutions – services that connection users a tradable token representing those deposits successful the ETH 2.0 staking contract– presently relationship for astir $20 cardinal successful deposits, per DeFiLlama, astir 10% of each of DeFi’s full worth locked (TVL).

This nonfiction primitively appeared successful Valid Points, CoinDesk’s play newsletter breaking down Ethereum 2.0 and its sweeping interaction connected crypto markets. Subscribe to Valid Points here.

The crushed for this unthinkable occurrence is attributable to however staked ETH derivatives connection yield farmers lucrative opportunities arsenic portion of analyzable farming strategies. For instance, users tin leverage stETH, Lido’s staked ETH derivative, arsenic collateral for galore DeFi protocols.

Curve’s azygous largest excavation is “steth,” with $4.91 cardinal successful full worth locked.Aave is different main destination for stETH, with $1.63 cardinal full stETH supplied. One fashionable strategy is erstwhile a idiosyncratic deposits their ETH into the Ethereum staking declaration done Lido and receives stETH, past supplies their stETH arsenic collateral to get much ETH against it, and re-stakes that borrowed ETH for stETH. The idiosyncratic tin repetition this process aggregate times over, successful ample portion due to the fact that the involvement gained by staking is overmuch higher than the borrowing rates crossed DeFi lending platforms. For instance, the APR for staking ETH is astir 4%, portion ETH’s adaptable involvement complaint for borrowing is 2.33% connected AAVE’s lending platform, allowing them to make a leveraged output position.

While the strategies institutions and idiosyncratic farmers utilize with the assets volition beryllium different, staked ether’s halfway properties entreaty to some for akin reasons.

A fashionable talking constituent among Ethereum maximalists is the “triple halvening” – aft the Merge, ETH’s yearly ostentation complaint volition driblet from 4.3% to 0.43%, with caller emissions falling from 12,000 ETH a time to 1,280 ETH a day. Combined with EIP 1559, which introduced an Ethereum pain mechanism, the power to proof-of-stake volition beryllium the equivalent of 3 Bitcoin “halvenings” astatine once, the statement goes.

While traders person been excited astatine the forthcoming ETH proviso daze for years (not to notation the beefier staking returns, which by immoderate estimates mightiness transcend 10%), institutions are starting to get the connection arsenic well.

The crypto marketplace tin beryllium intimidating for organization investors due to the fact that it truthful seldom seems tethered to immoderate fundamentals – the messiness of dogcoins, memecoins and outright scams would enactment disconnected immoderate self-respecting suit. But trackable returns, provable scarcity and technological infrastructure – these are qualities an concern table tin appreciate.

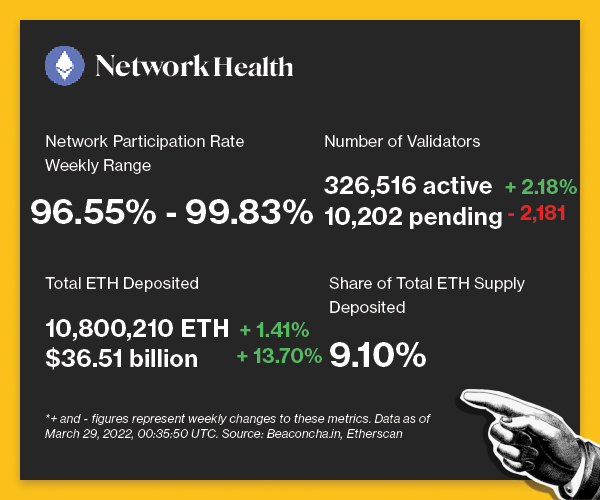

Over 10 cardinal ETH worthy $34 cardinal is presently staked successful the ETH 2.0 contract. As the buzz approaching the Merge grows louder, we expect to spot much headlines astir large fiscal entities getting progressive arsenic well.

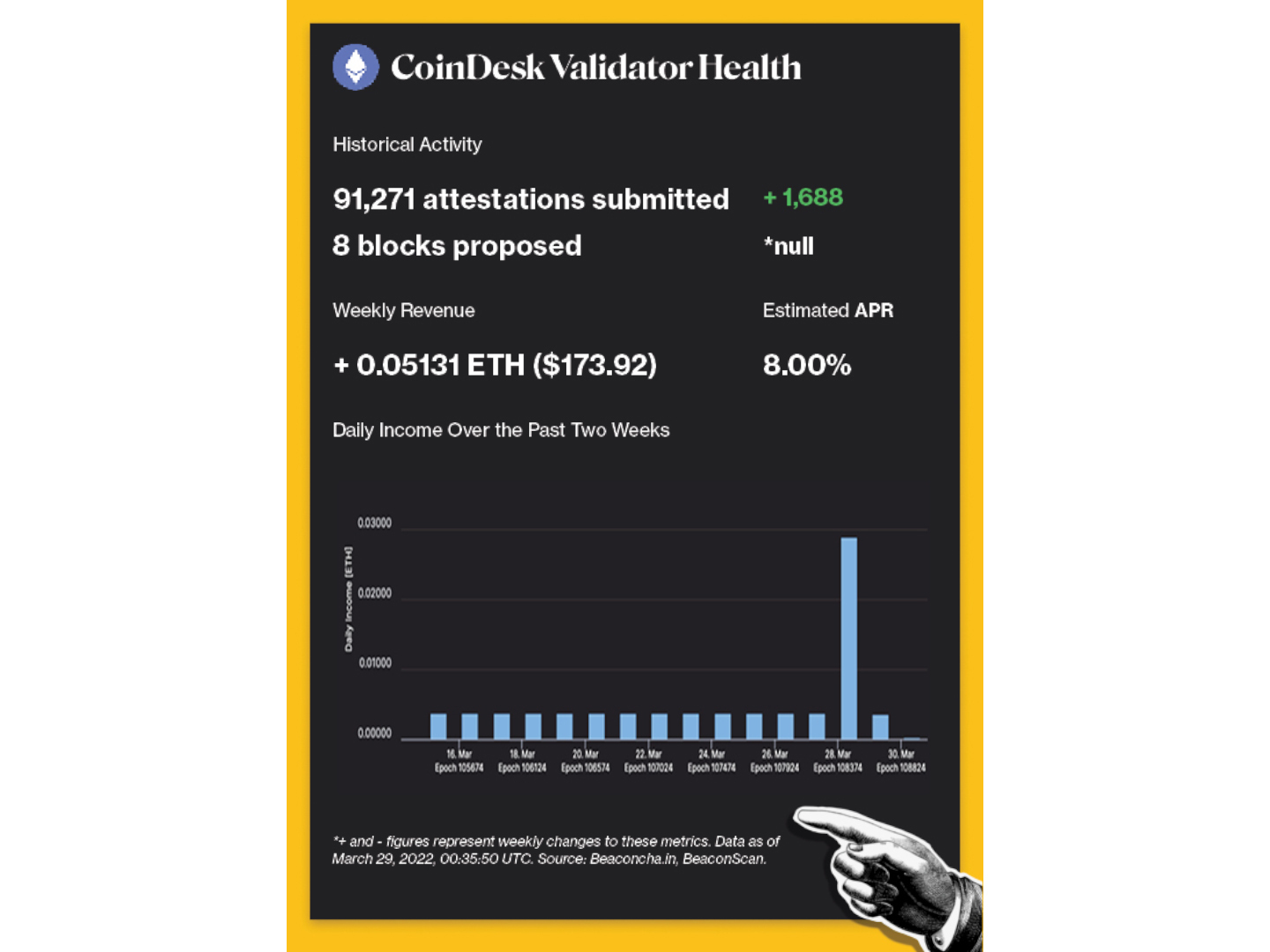

This has been an breathtaking week astatine Valid Points, arsenic CoinDesk’s precise ain Beacon Chain validator, dubbed “Zelda,” successfully projected a artifact yesterday. Zelda has been progressive since February 2021, and with Zelda’s caller artifact connection our full artifact proposals has accrued to eight!

Zelda was awarded 0.0289 ETH oregon $98.23 for the palmy artifact proposal. As shown successful the graph successful the Validator Health Data Visualization, determination was a ample summation successful regular income yesterday, arsenic artifact proposals are greater than attestations successful one-time rewards. Zelda, implicit its full lifetime, has earned 2.2177 ETH oregon $7,537.96.

Zelda’s past artifact connection occurred successful November 2021, 5 months ago. According to information sourced from etherscan.io, the mean fig of blocks produced regular successful 2022 connected the Ethereum web is astir 6,455 blocks, and with 326,516 progressive validators an idiosyncratic validator specified arsenic Zelda has a slim accidental of receiving a artifact connection each day.

The pursuing is an overview of web enactment connected the Ethereum Beacon Chain implicit the past week. For much accusation astir the metrics featured successful this section, cheque retired our 101 explainer connected Eth 2.0 metrics.

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking task volition beryllium donated to a foundation of the company’s choosing erstwhile transfers are enabled connected the network.

The dominance of Prysm, the starring lawsuit for the Ethereum proof-of-stake protocol, has waned to 62%.

WHY IT MATTERS: Ethereum’s halfway developers person been informing astir the deficiency of lawsuit diverseness connected the Beacon Chain due to the fact that of the hazard stemming from having much than two-thirds of each validators concentrated connected a azygous client. While determination is inactive an urgent request for improved diversity, the alteration successful Prysm’s dominance to little than two-thirds bulk demonstrates however the Ethereum assemblage is making strides to code the deficiency of lawsuit diversity.

WHY IT MATTERS: The SEC’s proposal expands what it means to beryllium a “dealer” to see traders and liquidity providers that utilize automated and algorithmic trading technology. A footnote successful the 200-page papers said the connection would see immoderate integer assets deemed arsenic securities, which has been interpreted by immoderate ineligible experts arsenic a shadow onslaught connected DeFi.

WHY IT MATTERS: The Electronic Currency And Secure Hardware Act would enactment the U.S. Treasury Department successful complaint of piloting integer dollar technologies that replicate the privacy-respecting characteristics of carnal dollar bills. This integer dollar would beryllium deemed ineligible tender and identical to a carnal greenback.

WHY IT MATTERS: The attacker compromised Ronin validators by utilizing hacked backstage keys to forge fake withdrawals, making this 1 of the largest exploits successful DeFi history. This onslaught highlights however the crypto abstraction tin beryllium a susceptible manufacture arsenic the open-source quality of crypto creates a cleanable situation for attackers to exploit.

Google Searches for “Ethereum Merge” deed an all-time high.

WHY IT MATTERS: CoinDesk’s Omkar Godbole wrote, “Google Trends, a wide utilized instrumentality to gauge wide oregon retail involvement successful trending topics, precocious showed a highest worth of 100 for the worldwide hunt query ‘Ethereum Merge’ for the past 12 months.” Peak fashionable involvement successful the “Ethereum Merge” highlights the ongoing discussions and conversations astir Ethereum post-Merge, which includes ETH’s proviso decreasing and the interaction proof-of-stake volition person connected the environment.

Valid Points incorporates accusation and information astir CoinDesk’s ain Eth 2.0 validator successful play analysis. All profits made from this staking task volition beryllium donated to a foundation of our choosing erstwhile transfers are enabled connected the network. For a afloat overview of the project, cheque retired our announcement post.

You tin verify the enactment of the CoinDesk Eth 2.0 validator successful existent clip done our nationalist validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it connected immoderate Eth 2.0 artifact explorer site,

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Shows, amusement newsletter promo.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)