Mainstream conversations astir integer assets mostly absorption connected the melodramatic terms show of bitcoin and ether. For years, retail and organization investors person targeted beta exposure, oregon returns that reflector the broader crypto market. However, the instauration of products like bitcoin exchange-traded funds (ETFs) and exchange-traded products (ETPs) person made achieving beta much accessible, with these products drafting implicit $100 billion successful organization capital.

But arsenic the plus people matures, the speech is shifting. More institutions are present pursuing alpha, or returns that exceed the market, done actively managed strategies.

The relation of uncorrelated returns successful diversification

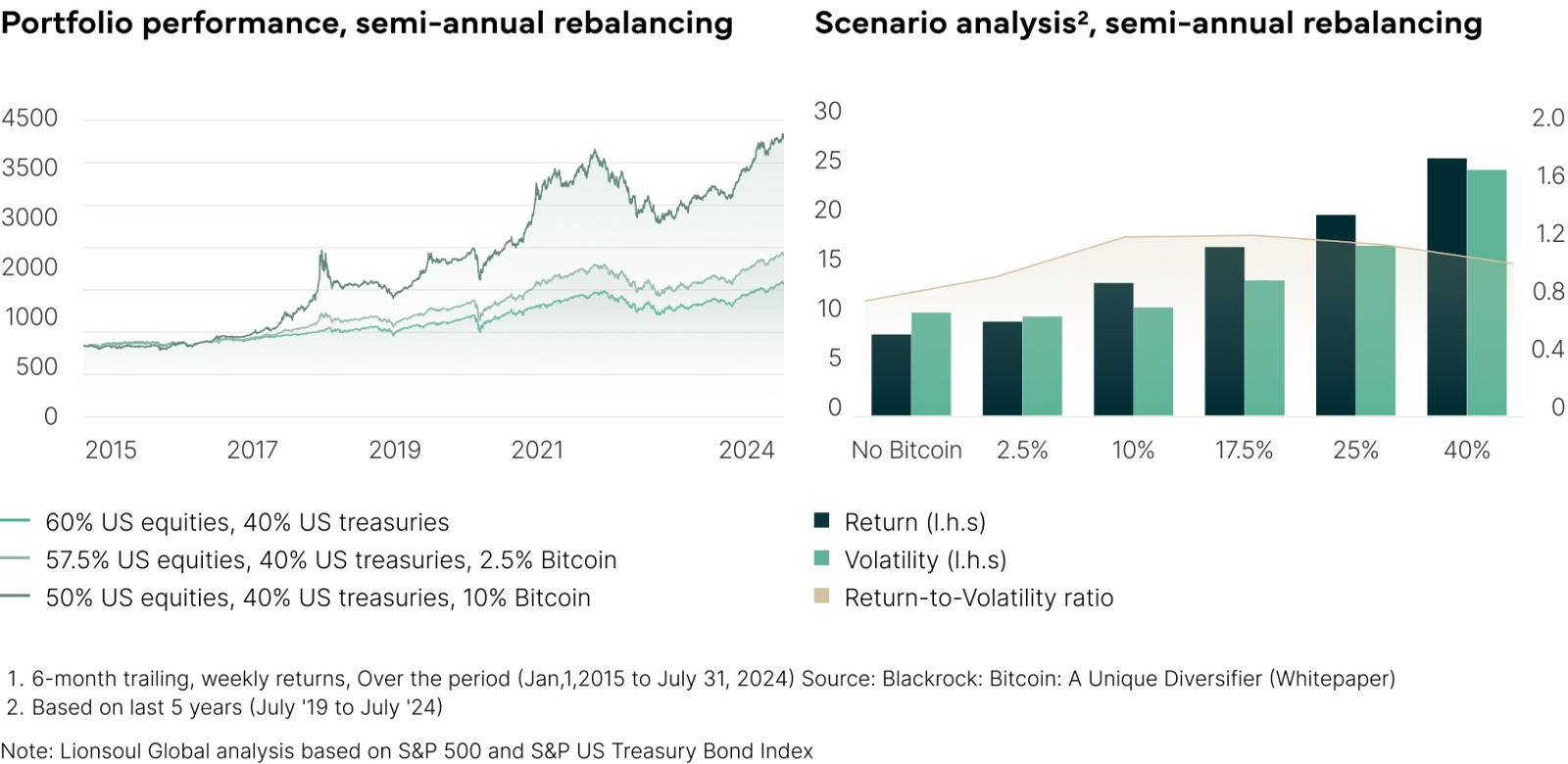

Low correlation to accepted assets enhances the relation of integer assets successful diversified portfolios. Since 2015, bitcoin’s regular correlation to the Russell 1000 Index has been conscionable 0.231, meaning that bitcoin's regular returns determination lone weakly successful the aforesaid absorption arsenic the Russell 1000 Index, with golden and emerging markets remaining similarly low. A humble 5% allocation to bitcoin successful a 60/40 portfolio, a portfolio containing 60% equities and 40% fixed income, has been shown to boost the Sharpe ratio (the measurement of risk-adjusted instrumentality connected a portfolio) from 1.03 to 1.43. Even wrong crypto itself, varying correlations let for intra-asset diversification. This makes integer assets a almighty instrumentality for risk-adjusted instrumentality enhancement [see grounds 1].

Digital assets participate the progressive era

Just arsenic hedge funds and backstage equity redefined accepted markets, integer assets are present evolving beyond index-style investing. In accepted finance, progressive absorption represents implicit 60% of planetary assets. With informational asymmetries, fragmented infrastructure and inconsistent pricing, integer assets contiguous a compelling scenery for alpha generation.

This modulation mirrors the aboriginal stages of the alternatives industry, erstwhile hedge funds and backstage equity capitalized connected inefficiencies agelong earlier these strategies were adopted by the mainstream.

Market inefficiencies

Crypto markets stay volatile and structurally inefficient. Though bitcoin’s annualized volatility fell below 40% successful 2024, it remains much than doubly that of the S&P 500. Pricing inconsistencies crossed exchanges, regulatory fragmentation and the dominance of retail behaviour make important opportunities for progressive managers.

These inefficiencies — combined with constricted contention successful institutional-grade alpha strategies — contiguous a compelling lawsuit for specialized concern approaches.

- Arbitrage strategies: Utilization of trading strategies specified arsenic currency and carry, which captures spreads betwixt spot and futures prices, oregon ground trading, which involves entering agelong positions successful discounted assets and shorts successful premium ones, enables alpha procreation by utilizing marketplace inefficiencies wrong the integer assets market.

- Market making strategies: Market makers gain returns by placing bid/ask quotes to seizure spread. Success relies connected managing risks similar inventory vulnerability and slippage, particularly successful fragmented oregon volatile markets.

- Yield farming: Yield farming taps into Layer 2 scaling solutions, decentralized concern (DeFi) platforms and cross-chain bridges. Investors tin gain yields done lending protocols oregon by providing liquidity connected decentralized exchanges (DEXs), often earning some trading fees and token incentives.

- Volatility arbitrage strategy: This strategy targets the spread betwixt implied and realized volatility successful crypto options markets, offering market-neutral alpha done precocious forecasting and hazard management.

High upside and an expanding universe

Meanwhile, caller opportunities proceed to emerge. Tokenized real-world assets (RWAs) are projected to transcend $10.9 trillion by 2030, portion DeFi protocols, which person amassed 17,000 unsocial tokens and concern models portion accumulating $108 billion+ successful assets, are expected to surpass $500 billion successful worth by 2027. All of this points towards an ever expanding, ever processing integer plus ecosystem that is perfect for investors to utilize arsenic a morganatic alpha generating medium.

Bitcoin's terms has surged implicit the years, portion its semipermanent realized volatility has steadily declined, signaling a maturing market.

5 months ago

5 months ago

English (US)

English (US)