The integration of Bitcoin into mainstream markets took a important leap guardant with the SEC’s support to the archetypal spot Bitcoin ETF successful the U.S. This benchmark lawsuit shows the necessity of knowing its enactment with accepted assets, particularly for the accepted capitalist looking to diversify their portfolios.

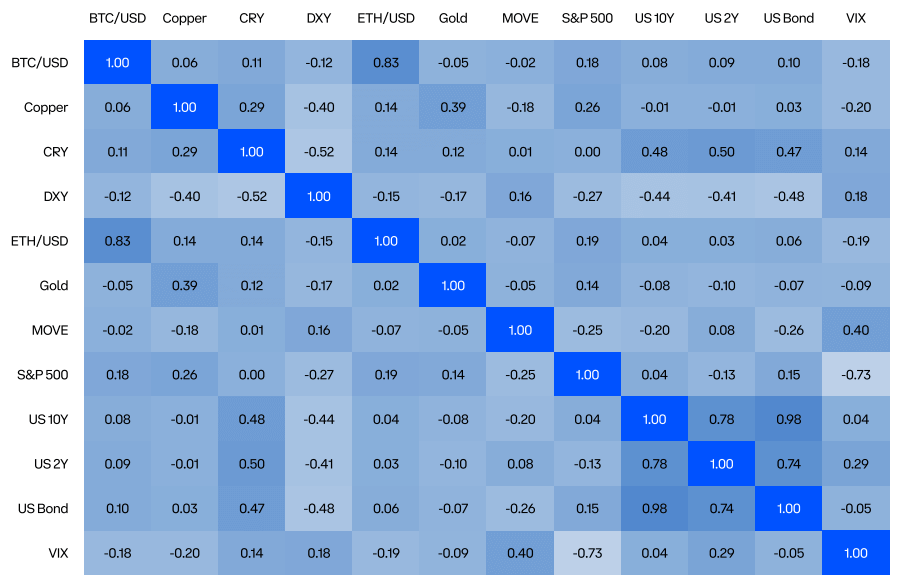

Correlation coefficients, the statistical measures reflecting the grade to which 2 securities determination successful narration to each other, prevarication astatine the bosom of this understanding. Glassnode’s latest report, a collaboration with Coinbase Institutional, provides a robust instauration to crypto marketplace fundamentals for organization investors, including the correlation betwixt Bitcoin and a spectrum of accepted assets passim 2023, specified arsenic the S&P 500, copper, and the VIX.

Bitcoin’s narration with Ethereum is cardinal to the crypto market. The 2 assets showed a beardown affirmative correlation of 0.83 passim 2023, indicating a parallel effect to marketplace movement. This confirms the long-known sentiment that erstwhile BTC thrives oregon falters, Ethereum is apt to follow suit.

In contrast, Bitcoin’s correlation with commodities similar copper remains comparatively muted, signaling an independency that suggests a imaginable hedge against movements successful the commodities market. However, these humble correlation coefficients, hovering astir 0.06 to 0.10, besides connote that BTC does not service arsenic a nonstop proxy for commodities wrong concern portfolios.

Table showing the correlation coefficient betwixt Bitcoin and accepted assets successful 2023 (Source: Glassnode)

Table showing the correlation coefficient betwixt Bitcoin and accepted assets successful 2023 (Source: Glassnode)Equity markets amusement lone a marginally higher correlation to Bitcoin. With coefficients of 0.18, BTC terms movements are lone somewhat successful measurement with the broader banal market, suggesting that Bitcoin whitethorn connection diversification benefits for investors holding accepted banal portfolios.

The inverse narration betwixt BTC and the DXY, astatine -0.12, reveals a nuanced narrative. As the dollar’s worth climbs, Bitcoin’s worth successful USD presumption tends to decline, and vice versa. Furthermore, the VIX, known arsenic the market’s “fear gauge,” inversely correlates with BTC astatine -0.18. This antagonistic correlation with marketplace volatility indicates that Bitcoin does not needfully travel the panic oregon greed that grips accepted markets.

Turning to the enslaved market, Bitcoin’s correlations with semipermanent Treasury bonds (U.S. 10Y and U.S. 2Y) are affirmative but anemic and somewhat much pronounced, with the U.S. Bond scale astatine 0.10. While not indicative of a beardown relationship, these correlations item Bitcoin’s analyzable interplay with involvement rates and capitalist sentiment successful the fixed-income market.

The overwhelmingly inverse correlation BTC displays with accepted assets becomes peculiarly compelling successful a marketplace with a increasing spot ETF trading volume. It tin perchance lure much organization investors towards Bitcoin, offering them a regulated and acquainted avenue to prosecute with a non-traditional asset.

The station How Bitcoin correlates with accepted assets successful the ETF age appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)