The information that Bitcoin is opening to behave similar existent assets is simply a affirmative development.

Bitcoin has truthful acold been precise delicate to immoderate decisions coming from the Federal Reserve, experiencing monolithic sell-offs successful an assertive absorption to inflation.

This has prompted galore to interest astir however Bitcoin volition execute successful a rate-rising environment, fixed the information that the Federal Reserve is considering 4 involvement complaint hikes successful 2022.

While Bitcoin’s show successful the past 2 months doesn’t look excessively promising, a caller study showed that its caller sensitivity to ostentation is really an highly bullish sign.

Rising involvement rates unit Bitcoin to behave much similar different inflationary assets

What volition hap to Bitcoin successful a marketplace with expanding involvement rates?

This is the question the latest CoinShares Digital Asset Outlook study tries to answer.

After astir a decennary of unprecedented levels of quantitative easing (QE), the marketplace is opening to travel to presumption with the anticipation of ostentation hitting the U.S. market. This has disquieted the Federal Reserve arsenic well, forcing it to see enting the tapering of QE earlier than the marketplace expected.

To curb the ostentation they judge volition inevitably come, the Federal Reserve is considering 4 involvement complaint hikes this year, alternatively than the 2 it primitively projected successful 2021.

The past clip the Federal Reserve accrued involvement rates was successful 2015, Bitcoin roseate by implicit 51% implicit a play of six months. With borrowing becoming progressively much expensive, much radical flocked to Bitcoin seeing it arsenic a hedge against unstable markets.

However, CoinShares analysts judge that this clip astir Bitcoin won’t repetition this pattern.

“We judge Bitcoin has matured importantly since past and is truthful apt to behave differently, and apt successful enactment with different existent (inflationary) assets,” the study said.

Therefore, to recognize however Bitcoin volition enactment we request to look backmost astatine however different inflationary assets behaved successful erstwhile complaint hiking periods.

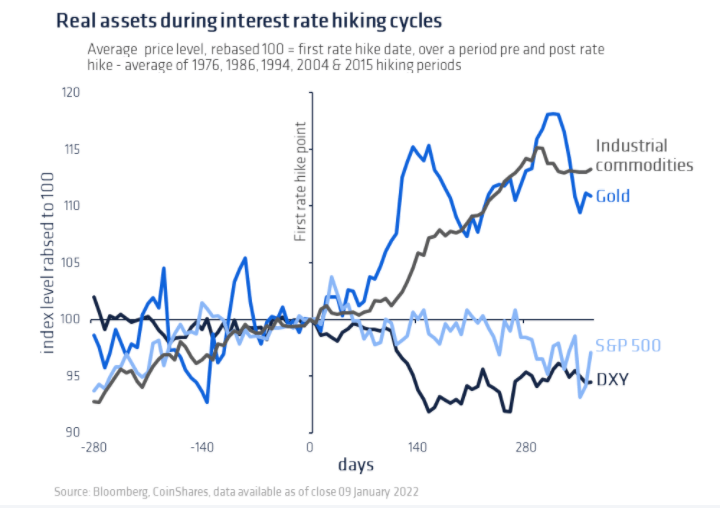

CoinShares identified 5 periods that are closest to today—they each saw hikes that followed periods of falling oregon comparatively low-interest rates for a agelong period. During December 1976, December 1986, February 1993, and June 2004 golden and different concern commodities each showed astonishing consistency successful performance.

Graph showing the show of existent assets during involvement complaint hiking cycles (Source: CoinShares)

Graph showing the show of existent assets during involvement complaint hiking cycles (Source: CoinShares)Being of fixed proviso and priced successful U.S. dollars, Bitcoin volition astir apt behave successful a akin mode to golden and different inflationary assets.

In December 2021 and January this year, Bitcoin experienced a beardown absorption to ostentation and the expanding probability of much complaint hikes, dropping much than 30% from its highs. This means that immoderate upcoming involvement complaint hike volition besides origin its terms to drop, with each consequent hike causing a little aggravated downturn.

However, pursuing a play of downward terms swings, Bitcoin volition astir apt spot a important summation successful price. This is successful enactment with however astir existent assets behaved successful akin involvement complaint cycles, arsenic good arsenic Bitcoin’s inverse narration with the spot of the U.S. dollar.

Namely, pursuing periods of involvement complaint hikes, the U.S. dollar has been experiencing periods of utmost volatility and has fallen, connected average, by 7% wrong a year.

As there’s a precocious accidental that the Federal Reserve volition rise involvement rates excessively aggressively, CoinShares expects the U.S. dollar to acquisition a akin selloff this year.

With the dollar losing its power, a large portion of the marketplace volition flock to alternate assets, with Bitcoin being the wide prime among each cryptocurrencies. Its absorption to censorship and quality to get distant from the agelong limb of the Federal Reserve marque it an charismatic hedge against inflation. If this was to happen, CoinShares believes that different existent assets specified arsenic golden volition travel suit and spot periods of unbridled maturation contempt raising ostentation and the dollar’s downturn.

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)