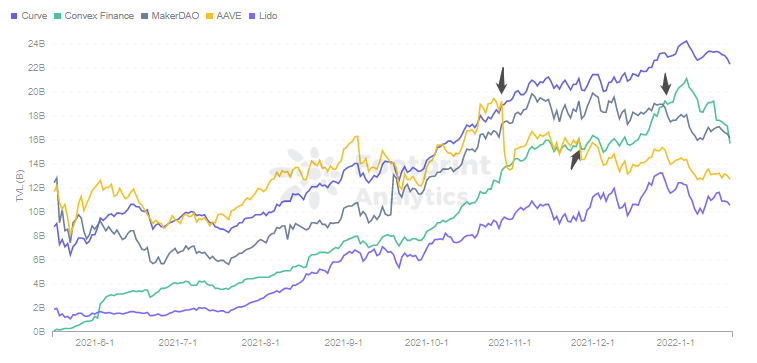

Convex surpassed MakerDAO astatine the extremity of December, becoming the No. 2 task down Curve.

According to information from Footprint Analytics, the TVLs of some Curve and Convex surpassed Aave, formerly the No. 1 DeFi protocol, successful November and December. Continuing its beardown momentum, Convex besides overtook MakerDAO successful precocious December to go the second-ranked task down Curve.

Footprint Analytics – TVL of Top 5 Projects

Footprint Analytics – TVL of Top 5 ProjectsThe maturation of Convex TVL is highly correlated with Curve, arsenic Convex was primitively launched to assistance LPs who connection liquidity connected Curve to easy gain trading fees and assertion boosted returns without locking CRV. Convex wants to alteration LPs to summation returns without losing liquidity.

In this article, we volition comparison Convex with Curve and Yearn, which it besides overtook, to analyse however Convex climbed to 2nd spot successful DeFi from the position of data. Why Yearn? As the person among output aggregators, Yearn is often compared to Convex.

Making Curve Accessible for Everyone

Before looking astatine Convex, it’s indispensable to recognize Curve, which is presently the apical task successful the DEX class by TVL and focuses connected swaps betwixt stablecoins. Many investors similar Curve for its debased slippage, debased fees and impermanent loss. Both traders and LPs get the champion fees connected Curve.

Curve provides incentives to LPs done the issuance of token CRV. Users tin get non-circulating veCRV by irreversibly staking CRV. The magnitude obtained is tied to the magnitude of clip staked, with a 4-year lockup to get veCRV astatine a 1:1 ratio.

Users volition sacrifice liquidity for veCRV due to the fact that of the stock of assemblage governance fees and mostly the quality to boost LPs’ returns by up to 2.5x. However, the minimum 1-year lock-up play is simply a barrier, and Convex tin lick this gap.

Users who deposit LP tokens from Curve into Convex volition person basal Curve APR, boosted CRV APY, and Convex’ token CVX.

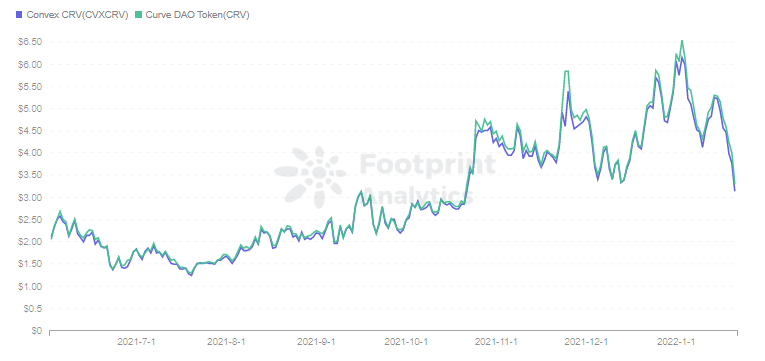

Users tin besides involvement CRVs connected Convex and volition person CVX arsenic a reward. The involvement present is besides irreversible. The cvxCRV obtained from the involvement is similar a mapping of the veCRV connected Convex, but it tin beryllium traded successful the marketplace. The prices of CRV and cvxCRV stay astir identical and tin beryllium swapped astatine a adjacent 1:1 ratio connected some Uniswap and SushiSwap.

Footprint Analytics – Token Price CRV vsS cvxCRV

Footprint Analytics – Token Price CRV vsS cvxCRVUsers get a boost successful gross portion retaining liquidity. For Convex, which collects a ample fig of CRV, it volition summation capable votes connected Curve for inducement allocation crossed pools.

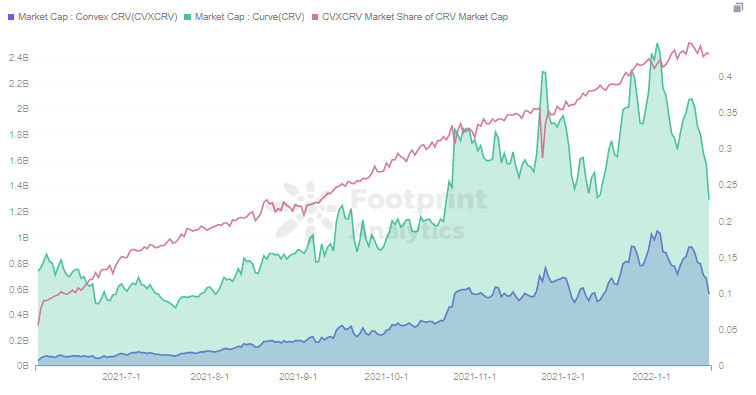

As seen done Footprint Analytics, cvxCRV’s marketplace headdress is present rising astatine a faster complaint compared to CRV’s, rising to 43% of CRV’s. This means that with astir fractional of each users staking their CRV holdings connected Convex, Convex volition person a important interaction connected the organisation of incentives to Curve.

Footprint Analytics – Market Cap of CRV & CVXCRV

Footprint Analytics – Market Cap of CRV & CVXCRVIn summation to solving the occupation of liquidity, Convex simplifies the analyzable cognition process of Curve to springiness users a convenient experience. A much in-depth investigation of the Curve tin beryllium recovered successful Footprint Analytics’ associated presumption with the Blockchain NYC community, “Intro to Defi & Analysis of Curve Finance“.

The Battle for the Top of the Yield Aggregator with Yearn

As the DeFi ecosystem develops, much tokens are added to Curve’s pool. Curve has much than 100 pools currently, including mill pools (permissionless pools allowing anyone to deploy connected Curve without vetting requests)

It is precise important for projects to vie for the ballot of veCRV successful bid to basal retired among the pools. This led to the conflict of the output aggregator platforms led by Yearn.

For task parties, having capable veCRV allows them to ballot successful the assemblage to measurement the organisation of CRV. Therefore Yearn has besides acceptable up yeCRV pools to sorb CRV. Similar to Convex, users volition person a precocious APY aft depositing arsenic good arsenic veCRV that tin beryllium circulated successful the market.

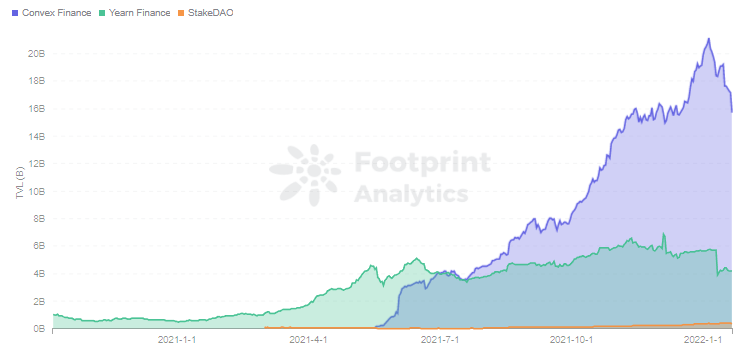

But Yearn, the pioneer of Yield, was overtaken by Convex little than 2 months. While the mechanisms are mostly the same, the usage cases for their tokens are somewhat different.

Footprint Analytics – Yearn vs Convex successful TVL

Footprint Analytics – Yearn vs Convex successful TVLYFI and CVX are the governance tokens for Yearn and Convex respectively, but locking CVX besides allows users to ballot connected Convex’s governance decisions connected Curve. It is equivalent to influencing the inducement allocation of the Curve excavation done CVX, moving the determination connected Curve with CRV to CVX. CVX’s terms has besides climbed, rising to $39 arsenic of Jan. 20.

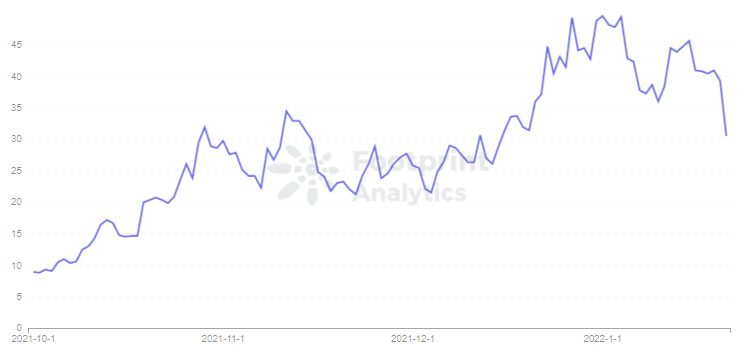

Footprint Analytics – CVX Price

Footprint Analytics – CVX PriceWhile YFI’s proviso of lone 33,000 led to a overmuch higher terms than CRV, CVX surpassed YFI successful presumption of marketplace headdress successful December.

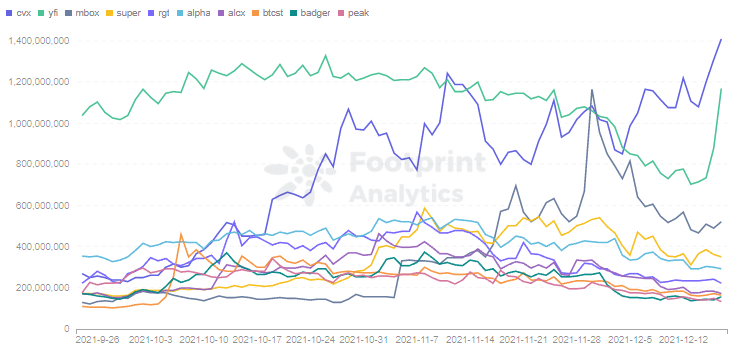

Footprint Analytics – Yield Token Market Cap

Footprint Analytics – Yield Token Market CapAs of the extremity of January, it looks similar Yearn has mislaid retired to Convex. However, we tin besides spot that a ample fig of Yearn’s pooling strategies marque usage of Convex. In bid to amended the gross of its ain mill pool, Yearn besides entrusted its veCRV to Convex.

Summary

Convex became DeFi’s 2nd largest task by:

- Solving the gross and liquidity problems of Curve staked CRVs.

- Simplifying Curve’s analyzable operational process.

- Moving Curve-focused voting rights to Convex by influencing the inducement allocation of the Curve excavation done CVX. Even Yearn has included Convex successful its strategy.

The heavy ties to Curve besides tied its hazard with Curve. A protocol that is wholly babelike connected different projects is tantamount to putting its full aboriginal successful the hands of others.

At this point, Yearn is increasing sluggishly, but is inactive leveraging the Lego properties of the DeFi satellite to support gathering outwards. In summation to offering a excavation of much tokens, it is besides gathering Iron Bank with Cream connected the lending and partnering with Cover connected the security side.

For Curve, Convex seems to person go a subsidiary of Curve. As Convex holds much veCRV with much votes, it seems to reverse the positions of the big and the guest.

What is Footprint Analytics?

Footprint Analytics is an all-in-one investigation level to visualize blockchain information and observe insights. It cleans and integrates on-chain information truthful users of immoderate acquisition level tin rapidly commencement researching tokens, projects and protocols. With implicit a 1000 dashboard templates positive a drag-and-drop interface, anyone tin physique their ain customized charts successful minutes. Uncover blockchain information and put smarter with Footprint.

Date & Author: Friday 4th February 2022, [email protected]

Data Source: Footprint Analytics Convex Dashboard

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)