In fiscal markets, liquidity refers to the easiness with which an plus tin beryllium bought oregon sold without affecting its terms significantly. The higher the liquidity, the much unchangeable the marketplace is, arsenic galore transactions tin hap smoothly and with minimal slippage.

Bitcoin’s conflict to enactment supra $52,000 this week has reignited discussions astir the market’s liquidity. With on-chain information suggesting a imaginable supply crunch, insufficient liquidity could beryllium the spark that ignites important volatility successful the market.

To find conscionable however liquid the Bitcoin marketplace is and wherever that liquidity lies, CryptoSlate analyzed information from Kaiko. Kaiko’s aggregated 2% marketplace extent is simply a important metric for determining liquidity and imaginable terms stableness astir the existent terms level.

A 2% scope is commonly utilized arsenic a benchmark for assessing liquidity due to the fact that it balances betwixt excessively constrictive and excessively wide a measure. A 2% terms scope is simply a compromise that acknowledges this volatility portion inactive providing a snapshot of marketplace depth. It’s choky capable to beryllium applicable successful fast-moving markets but wide capable to seizure a meaningful array of bargain and merchantability orders.

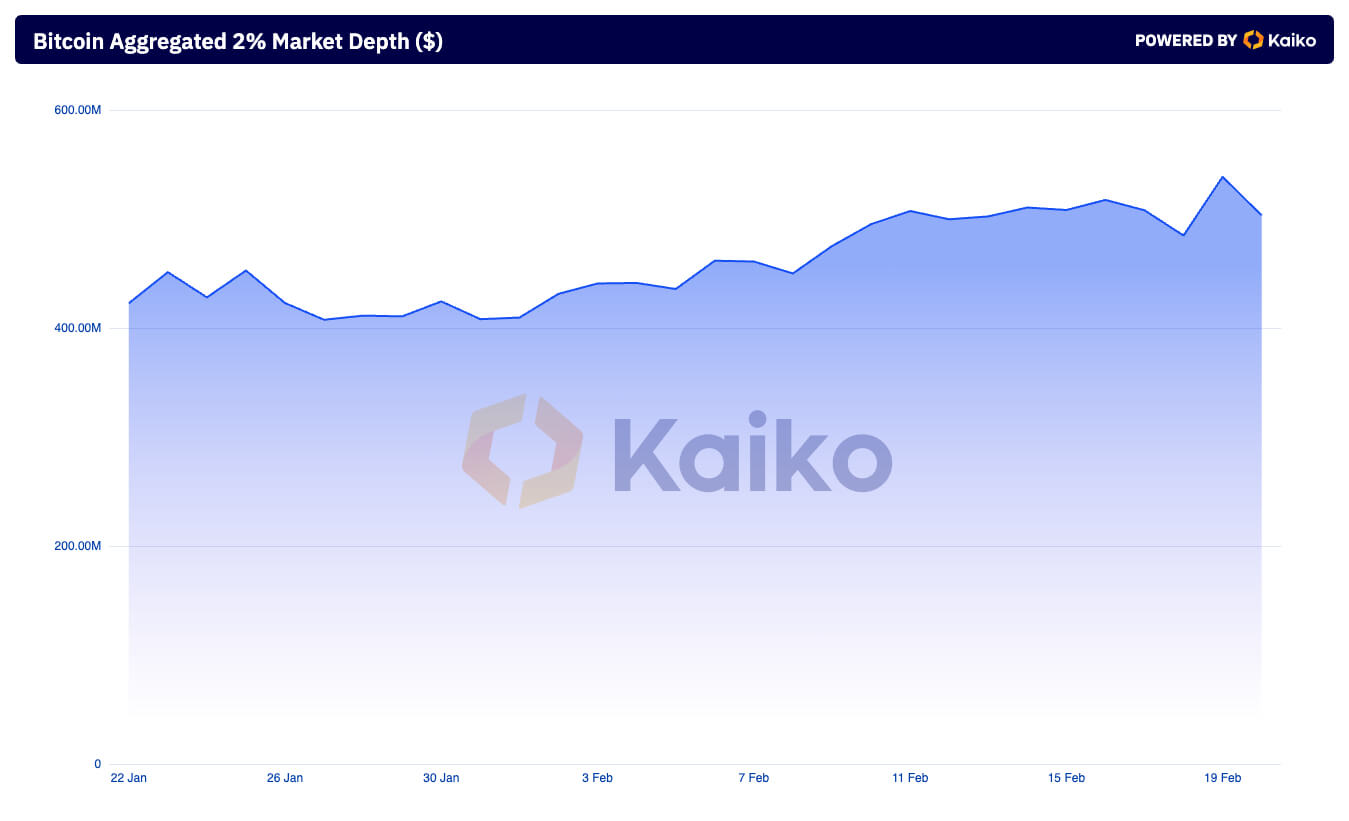

There has been a important emergence successful marketplace liquidity this week, with the aggregated 2% marketplace extent expanding from $485.05 cardinal connected Feb. 18 to $538.92 cardinal connected Feb. 19. This summation shows that much bargain and merchantability orders were placed wrong 2% of the marketplace price, suggesting much traders are acceptable to execute trades adjacent the existent price. The consequent driblet to $503.45 cardinal connected Feb. 20 inactive represents an wide summation from February levels but suggests a flimsy cooling disconnected from the erstwhile day’s activity.

Graph showing the aggregated 2% marketplace extent for Bitcoin from Jan. 22 to Feb. 20, 2024 (Source: Kaiko)

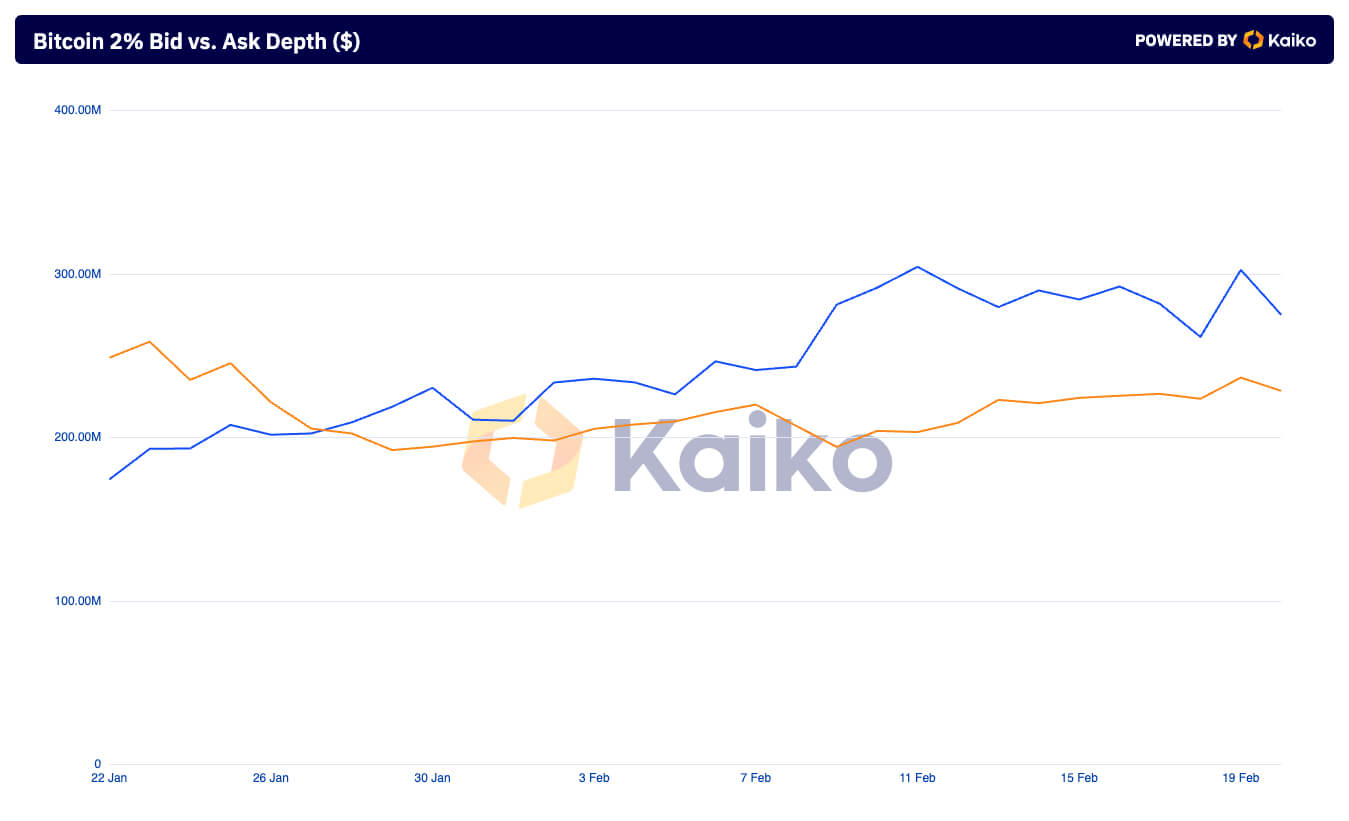

Graph showing the aggregated 2% marketplace extent for Bitcoin from Jan. 22 to Feb. 20, 2024 (Source: Kaiko)Kaiko’s bid vs. inquire extent metric provides further penetration into marketplace sentiment. On Feb. 18, the inquire (sell orders) extent was greater than the bid (buy orders) depth, with $261.42 cardinal successful asks versus $223.63 cardinal successful bids. This disparity widened connected Feb. 19, with asks increasing to $302.41 cardinal against bids of $236.54 million. The accrued inquire extent comparative to bid extent shows sellers were much progressive oregon assertive successful placing orders adjacent to the marketplace price, perchance expecting higher aboriginal prices oregon looking to capitalize connected existent prices.

Graph showing the 2% bid vs. inquire extent for Bitcoin from Jan. 22 to Feb. 20, 2024 (Source: Kaiko)

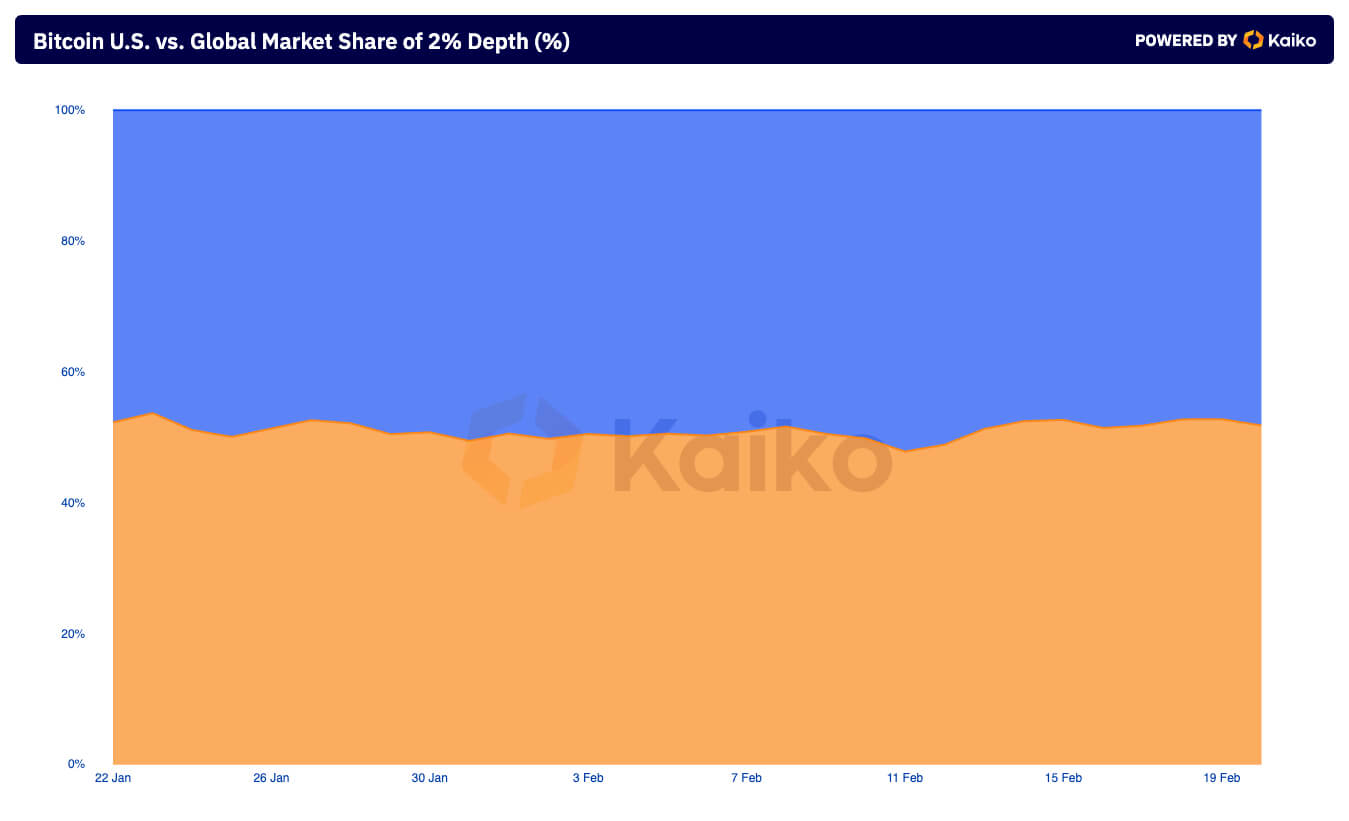

Graph showing the 2% bid vs. inquire extent for Bitcoin from Jan. 22 to Feb. 20, 2024 (Source: Kaiko)The organisation of marketplace extent betwixt the US and planetary markets shows 51.84% of the extent coming from the planetary market. This organisation implies that implicit fractional of the liquidity wrong 2% of the marketplace terms is being contributed by planetary markets extracurricular the US.

Graph showing the US vs. planetary marketplace stock of 2% extent for Bitcoin from Jan. 22 to Feb. 20, 2024 (Source: Kaiko)

Graph showing the US vs. planetary marketplace stock of 2% extent for Bitcoin from Jan. 22 to Feb. 20, 2024 (Source: Kaiko)The favoritism betwixt the proportionality of commercialized measurement and liquidity attributed to US exchanges compared to planetary exchanges helps america spot the comparative power of that liquidity. According to Kaiko, US centralized exchanges comprise 13.66% of the planetary Bitcoin trading volume.

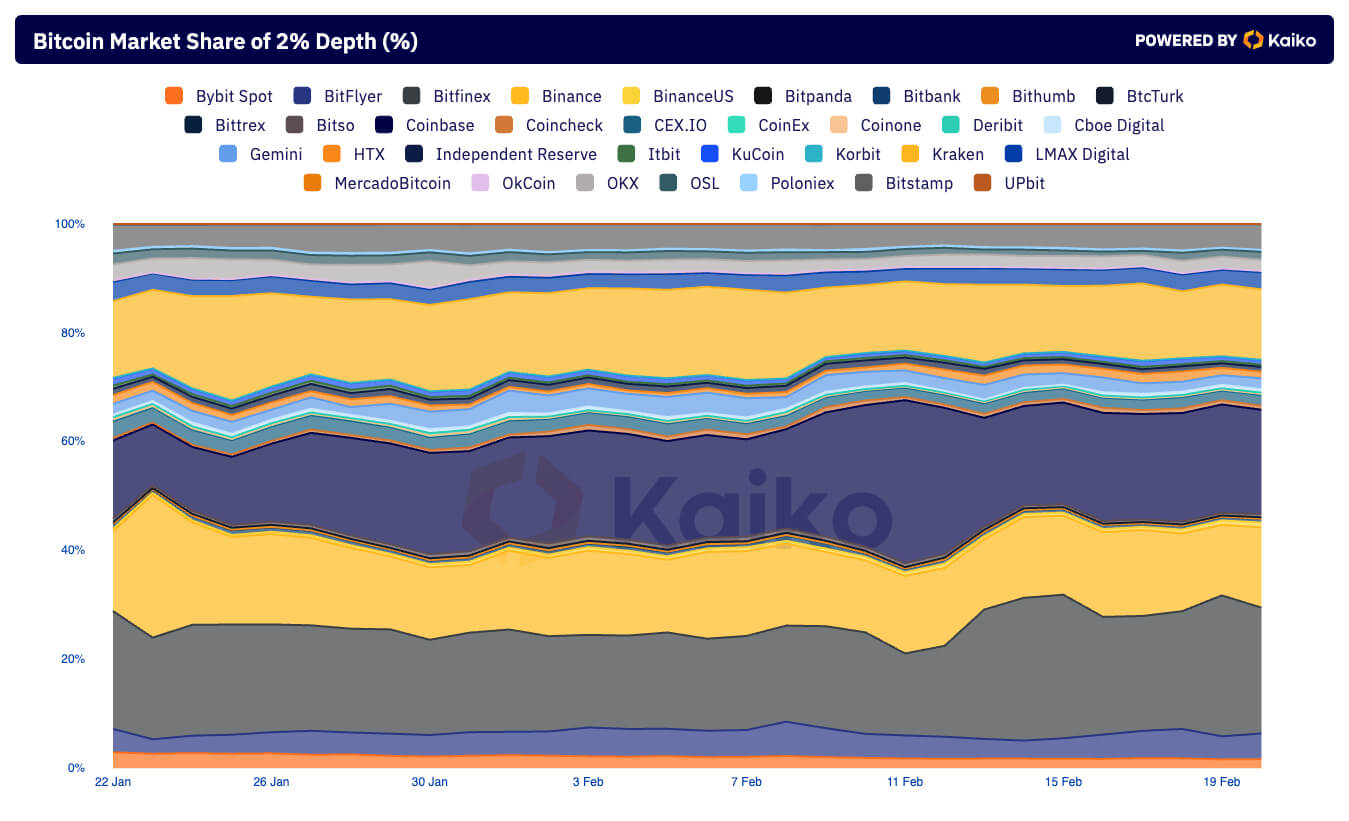

Graph showing the marketplace stock of 2% extent by exchanges from Jan. 22 to Feb. 20, 2024 (Source: Kaiko)

Graph showing the marketplace stock of 2% extent by exchanges from Jan. 22 to Feb. 20, 2024 (Source: Kaiko)The information that US exchanges relationship for a important stock of planetary liquidity (49%) yet lend a comparatively tiny information to planetary commercialized measurement (13.66%) suggests that they are highly liquid. This liquidity implies that US markets tin grip ample trades efficiently, with minimal terms impact. However, the little measurement stock indicates that less transactions are liable for this liquidity, perchance reflecting larger mean transaction sizes oregon a attraction of organization participants.

This proposal is further confirmed by looking astatine the exchanges’ marketplace stock of 2% depth. Bitfinex accounts for the largest share, with 23.12%. Coinbase comes 2nd with a 19.18% share, portion Binance ranks 3rd with a 14.75% stock and Kraken 4th with a 12.96% share.

Coinbase’s presumption peculiarly reinforces the relation US exchanges person successful planetary liquidity. Given Coinbase’s presumption arsenic a regulated speech wrong the US and a important subordinate successful the spot Bitcoin ETF market, its important publication to liquidity indicates the US market’s capableness to connection heavy and unchangeable trading environments, apt attracting galore organization and blase investors.

The beingness of some U.S.-based exchanges (Coinbase and Kraken) and planetary platforms (Bitfinex and Binance) among the apical contributors to 2% extent liquidity aligns with the erstwhile analysis. It demonstrates the captious relation the US plays successful providing liquidity done regulated exchanges portion highlighting the planetary market’s stock successful trading enactment and liquidity provision.

The station How bash US exchanges lend to Bitcoin’s marketplace liquidity? appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)