Yes, it’s that clip of twelvemonth again. The caller twelvemonth is upon america and we each request to commencement gathering taxation documents. Fun stuff, right? And if you’ve invested successful bitcoin oregon sold bitcoin, past things get truly fun.

The beneath database of items is meant to assistance you recognize the astir captious aspects for taxation filing erstwhile it comes to bitcoin. And it should beryllium noted that this specifically covers U.S. taxes (though U.K. regulations are precise similar).

Here’s what you request to know:

1. Bitcoin Is Taxed As Property

That’s right, conscionable similar stocks, bonds oregon existent estate. Although often utilized arsenic currency, it is not treated similar a currency for taxation purposes. Every azygous clip you sell, walk oregon speech bitcoin, you person executed a taxable transaction. You person a superior summation oregon little each clip you dispose of your bitcoin, unless it is by gifting it to someone.

I cognize what you’re thinking. Well, I cognize what I’m thinking, anyway: This necessitates a batch of elaborate grounds keeping. In bid to compute superior gains and losses, you request to cognize your archetypal outgo basis. Now, crypto exchanges volition support a past of each of your transactions, but they won’t beryllium reporting your outgo ground to you connected immoderate regular basis. In addition, if you’ve moved coins oregon taken self-custody, you truly request to support way of each your coins and their archetypal costs. I’m reasoning a bully Excel spreadsheet. And enactment up connected it regularly. Your taxation accountant volition beryllium pleased.

2. Bitcoin Received From Mining Are Taxable

If you’re mining bitcoin, each coin you excavation is taxable arsenic ordinary income. Don’t fto the connection “ordinary” fool you. Ordinary income, successful IRS parlance, is taxed astatine higher rates than semipermanent superior gains are. (“Long term” successful the U.S. means you’ve held the plus for 1 twelvemonth oregon longer.)

Not lone is mining taxed arsenic mean income, but besides arsenic self-employment income, truthful you’ll beryllium societal information and medicare taxes arsenic well.

Now, you get to constitute disconnected each of your expenses associated with the mining operation, specified arsenic electricity, which is simply a large one. You tin besides constitute disconnected the outgo of the mining rigs implicit respective years, and successful immoderate cases instrumentality a deduction for the full outgo successful twelvemonth one. That’s a bully benefit.

How bash you tally up and study however overmuch income you’ve generated, successful U.S.-dollar terms? The IRS regulations accidental your income is the just marketplace worth of the bitcoin you excavation connected the time you person it. Thus, each time you person much income. Again, present comes a large Excel spreadsheet opportunity.

Now, if you excavation bitcoin arsenic a hobby, you tin simply study the income connected your taxation instrumentality arsenic “other income,” and arsenic such, won’t wage self-employment taxes similar societal information and medicare. The downside, however, is that you won’t beryllium capable to constitute disconnected immoderate expenses against the income. If you bash privation to instrumentality the deductions, study the income and expenses connected U.S. Schedule C.

Note: If you study income from mining, you present person a outgo ground for the coins to usage against aboriginal superior gains — much grounds keeping.

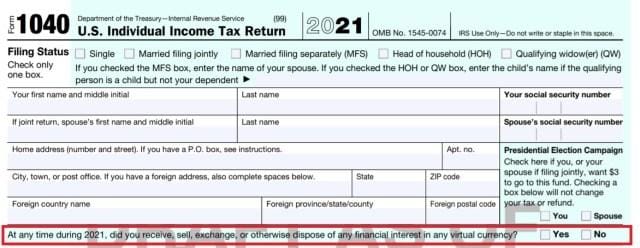

3. How To Answer “That Question” On Top Of Form 1040

Above is what the draught mentation of the 2021 Form 1040 “crypto question” looks like. Note that this is simply a flimsy alteration from 2020, erstwhile the question besides included “sending” immoderate cryptocurrency. If you lone purchased bitcoin during 2021, you tin reply “No.”

"At immoderate clip during 2021, did you receive, sell, exchange, oregon different dispose of immoderate fiscal involvement successful immoderate virtual currency?”

So, bash you person to reply this? Yep, and you should reply it honestly. Will it get you audited? Probably not, since lone .45% of taxpayers with incomes betwixt $75,000 and $200,000 were audited successful caller years. If you reply the question “Yes,” the IRS whitethorn look astatine your instrumentality and spot that immoderate bitcoin transactions are reported, superior gains and mining income, mainly.

4. Being Paid In Bitcoin, Or Paying In Bitcoin, Are Taxable Events

If idiosyncratic pays you for your services successful bitcoin, that is taxable arsenic self-employment income. Your income is the U.S. dollar worth of the coins you received connected that time of payment. Like with mining, you past person a outgo ground for those coins.

Likewise, if you wage idiosyncratic other for their services with bitcoin, you person conscionable disposed of immoderate coins. As such, you person either a superior summation oregon superior nonaccomplishment connected the transaction.

5. Paying For Starbucks With Bitcoin Is A Taxable Transaction

Though Starbucks makes immoderate astonishing drinks, you truly shouldn’t wage for them successful bitcoin because, yes, it is simply a taxable transaction, each clip you walk your bitcoin. Your adjacent question: “Is determination a de minimis objection for specified a tiny transaction?” No, not astatine this time.

And that, successful a nutshell, is the occupation of having a spot that acts similar a currency, and a currency that acts similar a property. There is not yet a user-friendly strategy of taxation to grip each Bitcoin transactions fluidly.

6. You Can Deduct Losses From Trading Bitcoin, But…

Capital losses from trading immoderate plus tin beryllium utilized to offset superior gains, whether the gains were from bitcoin, stocks, existent property oregon immoderate property. That’s the bully news. If you’ve suffered immoderate losses successful bitcoin, but had gains successful stocks, oregon vice versa, you tin offset.

If you didn’t person immoderate gains to offset, oregon your losses are greater, you tin inactive deduct immoderate this year. Taxpayers tin deduct up to $3,000 per twelvemonth successful superior losses that transcend your gains. That’s not much, I know. However, you tin transportation these losses guardant to deduct against profits successful aboriginal years.

7. Exchanging Bitcoin For Other Cryptocurrencies Is Taxable

A like-kind speech is wherever 1 plus is exchanged for different akin one, typically 2 parcels of existent estate. But determination is nary proviso for “like-kind” exchanges for cryptocurrencies. This taxation proviso enables the seller to defer paying superior gains taxes connected the nett until a clip erstwhile the 2nd plus is sold.

8. Do Bitcoin Exchanges Report Transactions To The IRS?

Cryptocurrency exchanges bash not study income of assets successful the aforesaid mode arsenic bash banal brokerages. Every merchantability of banal oregon communal funds is reported, truthful you indispensable amusement each merchantability connected your taxation return, adjacent if the merchantability doesn’t effect successful a gain. Tax reporting by cryptocurrency exchanges is, astatine this time, a mixed bag. And that is thing that the U.S. authorities wants to wrapper its arms around.

For example, Coinbase, the largest U.S.-based exchange, volition not beryllium issuing Form 1099-K oregon Form 1099-B to study income of cryptocurrency. Thus, nary of your income proceeds are being shared with the IRS. You person the sole work of reporting each of your income proceeds and outgo basis. The lone transactions that Coinbase reports are rewards oregon fees that you whitethorn person earned during the year, and lone if they transcend $600. Those are reported connected signifier 1099-MISC.

Gemini takes a wholly antithetic approach. The institution views itself arsenic a third-party colony enactment (TPSO) and arsenic specified files Form 1099-K for definite transactions. (A 1099-K is usually filed by merchant services companies to study funds sent to retailers.) Gemini volition lone study if your income of integer assets exceeded 200 transactions successful a twelvemonth and exceeded $20,000 successful proceeds.

Binance, a Malta-based company, does not study to the IRS, and is really nary longer serving U.S.-based traders. Binance had antecedently issued Form 1099-K to definite traders.

9. Generally, You Don’t Have To Pay Taxes On Bitcoin Donations To Charity

Though by giving your bitcoin to a foundation you’ve really disposed of it, you volition mostly not wage taxes connected the transaction, adjacent if the coins person gone up successful value. Even better, you whitethorn beryllium capable to instrumentality a deduction arsenic a charitable publication successful the magnitude of the just marketplace worth connected the day of the donation — win-win. You can’t accidental that precise often with regards to taxes.

If idiosyncratic gifts you immoderate bitcoin, bully for you. Best of all, it’s not a taxable transaction to you — a win-win, again. When you dispose of the coins successful the future, your outgo ground volition beryllium the aforesaid arsenic the person’s who talented it to you. So, successful that case, a small connection volition beryllium necessary.

10. Key Points To Remember

Taxes tin get beauteous analyzable with bitcoin. Key points to remember:

- Every clip you dispose of bitcoin, it triggers a taxable event

- Keep accurate, thorough records of each buys and sells

- Don’t expect your bitcoin speech to springiness you a nice, neat yearly summary

- Seek nonrecreational assistance (tax assistance that is) successful an accountant who knows the bitcoin landscape

This is simply a impermanent station by Rick Mulvey. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)