Here’s however the existent Bitcoin rally stacks up against the erstwhile ones successful presumption of the drawdowns it has experienced truthful far.

The Current Bitcoin Rally Has Seen A Peak Drawdown Of -18.6% So Far

In a caller tweet, the on-chain analytics steadfast Glassnode compared the latest Bitcoin rally with the ones seen passim the full past of the cryptocurrency.

Generally, rallies are compared utilizing metrics similar the percent terms uplifts recorded during them oregon the magnitude of clip that they lasted (which whitethorn beryllium measured successful presumption of the blocks produced, arsenic is done erstwhile looking astatine cycles successful presumption of halvings). Here, however, Glassnode has taken a antithetic attack that provides a caller position connected these rallies.

The examination ground betwixt the terms surges present is the drawdowns that each of them experienced crossed their spans. Note that these drawdowns aren’t to beryllium confused with the cyclical drawdowns that are utilized to measurement however the terms has declined since the bull tally top.

The drawdowns successful question are the obstacles that the cryptocurrency encountered portion the rallies were inactive ongoing, and are hence, those that the coin yet managed to overcome.

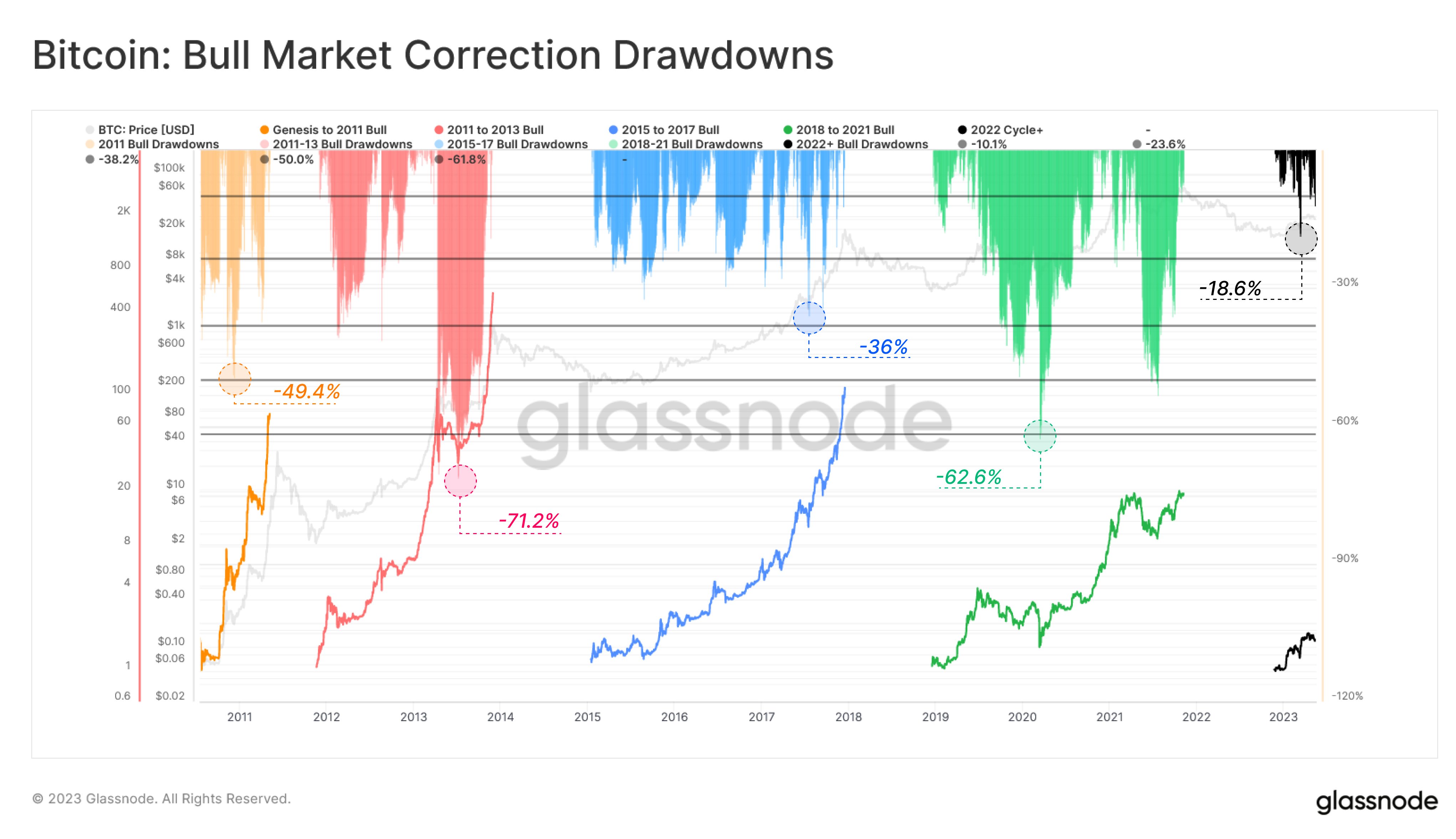

Here is simply a illustration that shows the grade of drawdowns that each of the humanities bull markets experienced, and besides wherever the existent rally stands successful examination to them:

The 5 bull rallies present are arsenic follows: genesis to 2011 (the precise archetypal rally), 2011-2013, 2015-2017, 2018-2021 (the past rally), and 2022 cycle+ (the ongoing one).

The analytics steadfast present has taken the bottommost of each of the carnivore markets arsenic the commencement of the adjacent bull rallies. This means that parts of the rhythm that immoderate whitethorn not see arsenic portion of the due bull tally are besides included.

The main illustration of this would beryllium the April 2019 rally, which is often considered its ain happening but is clubbed with the past Bitcoin bull marketplace successful the supra chart.

From the graph, it’s disposable that the deepest drawdown that occurred during the archetypal bull marketplace measured astir -49.4%. The adjacent run, the 2011 to 2013 bull, experienced an adjacent larger obstacle of a -71.2% plunge midway done it.

The adjacent 1 (2015-2017) past lone saw a drawdown of -36%, but the drawdown was again up astatine -62.6% for the tally that followed it (that is, the latest bull market).

So acold successful the 2022+ Bitcoin bull marketplace (which would lone beryllium considered a bull marketplace astatine each if the November 2022 debased was genuinely the cyclical bottom), the deepest drawdown observed truthful acold is the March 2023 plunge of -18.6%.

Clearly, the drawdown seen successful the existent rally truthful acold is importantly lesser than what the humanities bull markets face. If the signifier of the past runs holds immoderate value astatine all, past this would mean that the existent bull marketplace should inactive person much imaginable to grow.

BTC Price

At the clip of writing, Bitcoin is trading astir $26,900, down 2% successful the past week.

Featured representation from iStock.com, charts from TradingView.com, Glassnode.com

2 years ago

2 years ago

English (US)

English (US)