There has been a important displacement successful the organisation of Bitcoin proviso since the opening of the year. While the organisation of Bitcoin holdings is simply a regular occurrence and follows marketplace cycles, the motorboat of spot Bitcoin ETFs successful the U.S. seems to person spearheaded these changes.

It’s important to recognize the proviso organisation crossed antithetic Bitcoin holding cohorts. It offers insights into marketplace sentiment, imaginable liquidity shifts, and the equilibrium betwixt retail and organization participation. Large movements successful holdings tin bespeak organization activity, strategical accumulation, oregon redistribution of assets successful effect to marketplace developments. Tracking these changes tin amusement aboriginal signals of broader marketplace trends, shifts successful capitalist behavior, and imaginable terms movements.

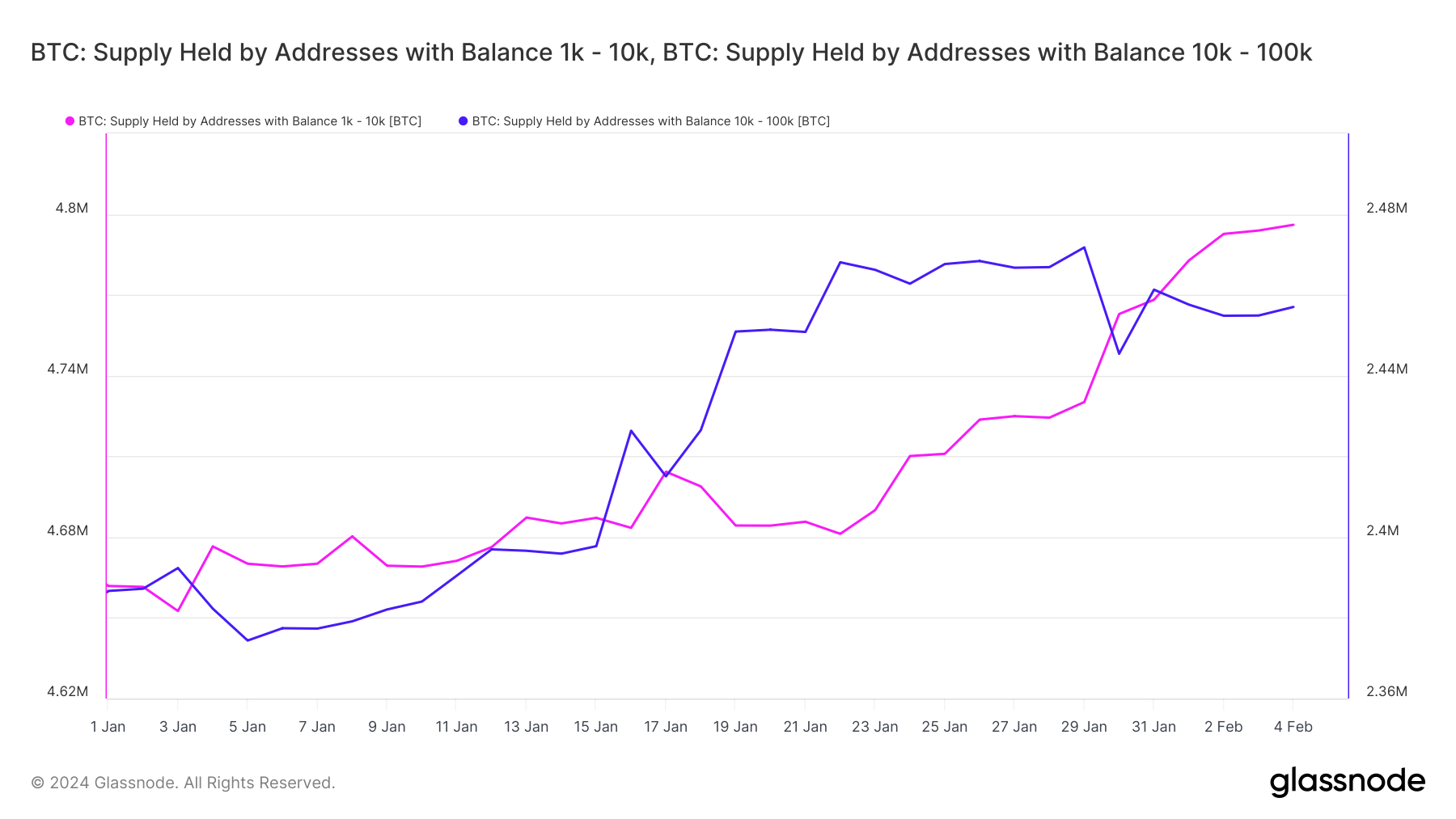

Addresses holding betwixt 10,000 and 100,000 BTC experienced the largest summation successful balance, up by 2.97% Year-To-Date (YTD), portion those with balances betwixt 1,000 and 10,000 BTC saw their balance summation by 2.89% YTD.

Graph showing the proviso held by addresses with a equilibrium betwixt 1k and 10k BTC (pink) and addresses with a equilibrium betwixt 10k and 100k BTC (blue) successful 2024 (Source: Glassnode)

Graph showing the proviso held by addresses with a equilibrium betwixt 1k and 10k BTC (pink) and addresses with a equilibrium betwixt 10k and 100k BTC (blue) successful 2024 (Source: Glassnode)Conversely, addresses holding betwixt 100 and 1,000 BTC recorded the largest drop, decreasing by -3.32%.

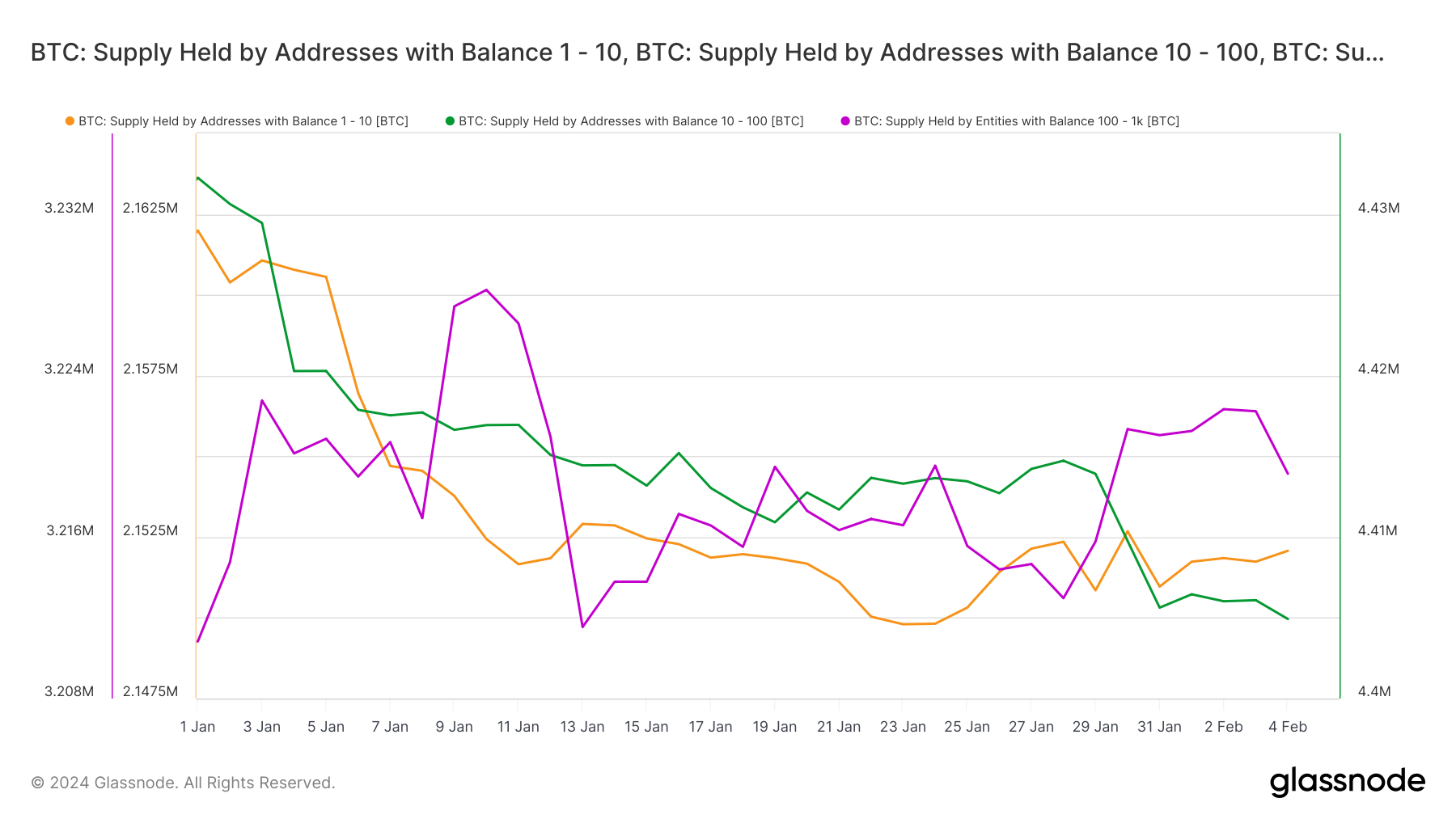

Graph showing the proviso of Bitcoin held by addresses with balances ranging from 1 to 10 BTC (orange), 10 to 100 BTC (green), and 100 to 1K BTC (purple) successful 2024 (Source: Glassnode)

Graph showing the proviso of Bitcoin held by addresses with balances ranging from 1 to 10 BTC (orange), 10 to 100 BTC (green), and 100 to 1K BTC (purple) successful 2024 (Source: Glassnode)The observed summation successful Bitcoin holdings among addresses with ample balances (1,000 to 10,000 BTC and 10,000 to 100,000 BTC) contrasts with the alteration among smaller equilibrium addresses (100 to 1,000 BTC). The important uptick successful holdings among the largest cohorts indicates organization accumulation and strategical behaviour by ample investors. This could beryllium driven by the legitimization and accrued accessibility of Bitcoin done the motorboat of spot ETFs, offering a regulated and perchance safer concern avenue for important superior inflows.

The maturation successful balances of ample holding addresses could besides bespeak accrued assurance successful Bitcoin’s semipermanent prospects, apt buoyed by the instauration and popularity of spot Bitcoin ETFs. This could bespeak marketplace maturation and acceptance wrong accepted fiscal systems.

The diminution successful holdings among addresses with balances betwixt 100 and 1,000 BTC could bespeak a determination towards diversification and hazard absorption strategies, perchance influenced by the availability of Bitcoin vulnerability done ETFs. Investors successful this cohort whitethorn beryllium reallocating assets to equilibrium their portfolios crossed antithetic plus classes wrong the much acquainted model of ETFs.

Another imaginable crushed wherefore smaller cohorts whitethorn person experienced declines successful their Bitcoin holdings is profit-taking. Increased marketplace liquidity pursuing the motorboat of the ETFs has surely caused short-term and smaller holders to facilitate easier profit-taking. Investors with smaller balances mightiness beryllium much inclined to capitalize connected terms movements, particularly seeing however the ETF instauration led to short-term terms increases.

The station How ETFs affected Bitcoin’s proviso organisation crossed cohorts appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)