The launch of the spot Bitcoin ETFs successful the U.S. marked a watershed infinitesimal successful the crypto industry. While the interaction it could person connected the planetary Bitcoin market, similar legitimizing it arsenic an plus people oregon creating much demand, has been analyzed astatine length, fewer person focused connected its effects connected different regulated concern products similar futures.

As a spot Bitcoin ETF offers a much nonstop concern roadworthy to cryptocurrencies, it’s important to analyse however it influences the Bitcoin futures market. The narration betwixt these 2 concern vehicles shows capitalist sentiment and marketplace trends, and the interaction regularisation has connected crypto trading.

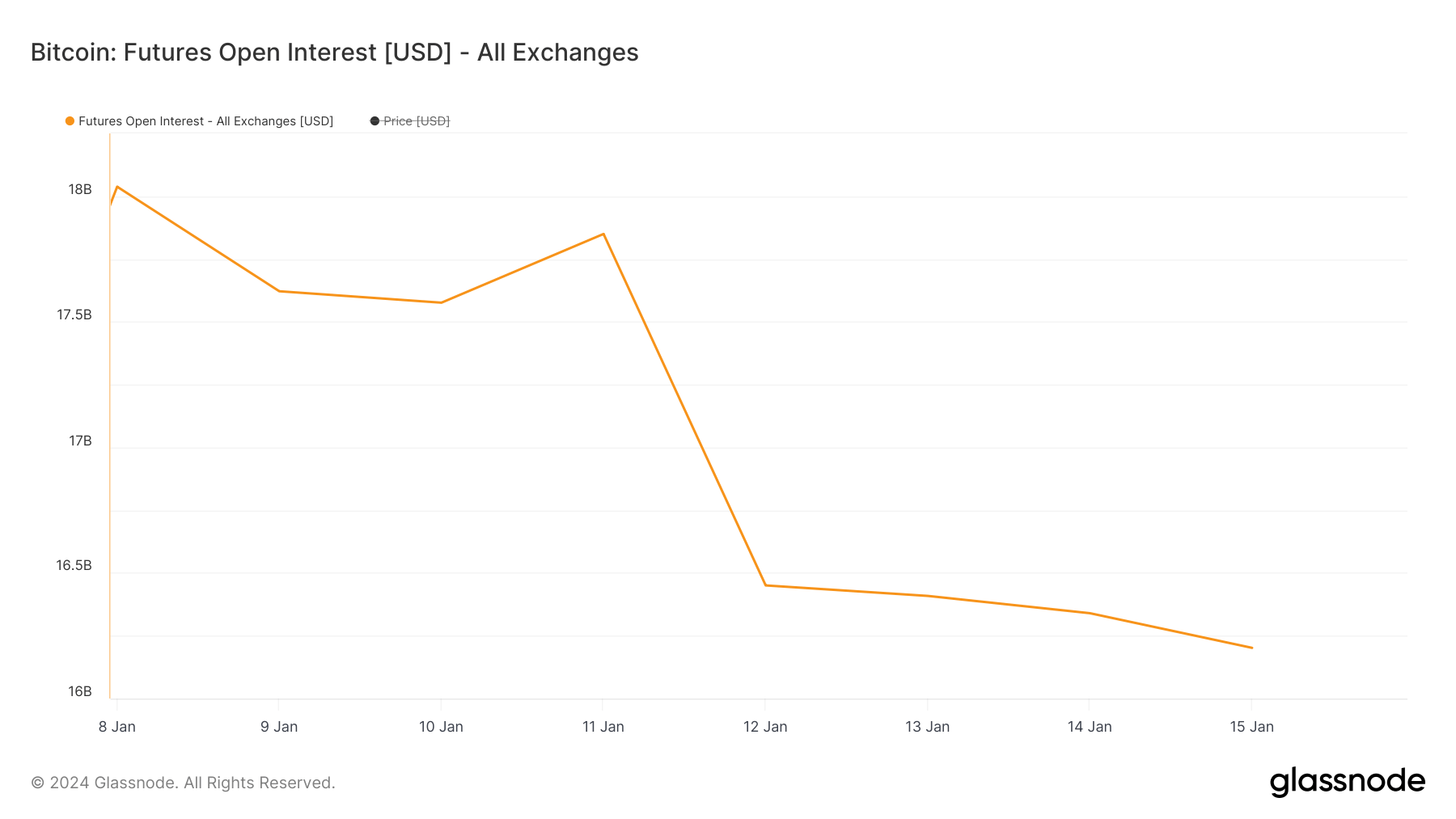

From Jan. 9 to Jan. 15, determination was a noticeable diminution successful the full unfastened involvement crossed each exchanges, decreasing from $17.621 cardinal to $16.201 billion. This 8.05% driblet suggests a simplification successful the fig of unfastened futures contracts, hinting astatine either a diminished involvement successful futures trading oregon a imaginable reallocation of investments to different vehicles, specified arsenic the spot ETFs, which began trading connected Jan. 11.

Graph showing the full unfastened involvement connected Bitcoin futures crossed exchanges from Jan. 8 to Jan. 15, 2024 (Source: Glassnode)

Graph showing the full unfastened involvement connected Bitcoin futures crossed exchanges from Jan. 8 to Jan. 15, 2024 (Source: Glassnode)Most exchanges offering futures and different derivatives saw akin drops successful unfastened interest. However, CME stands arsenic an outlier, the speech that suffered the astir important alteration successful unfastened involvement and trading volume.

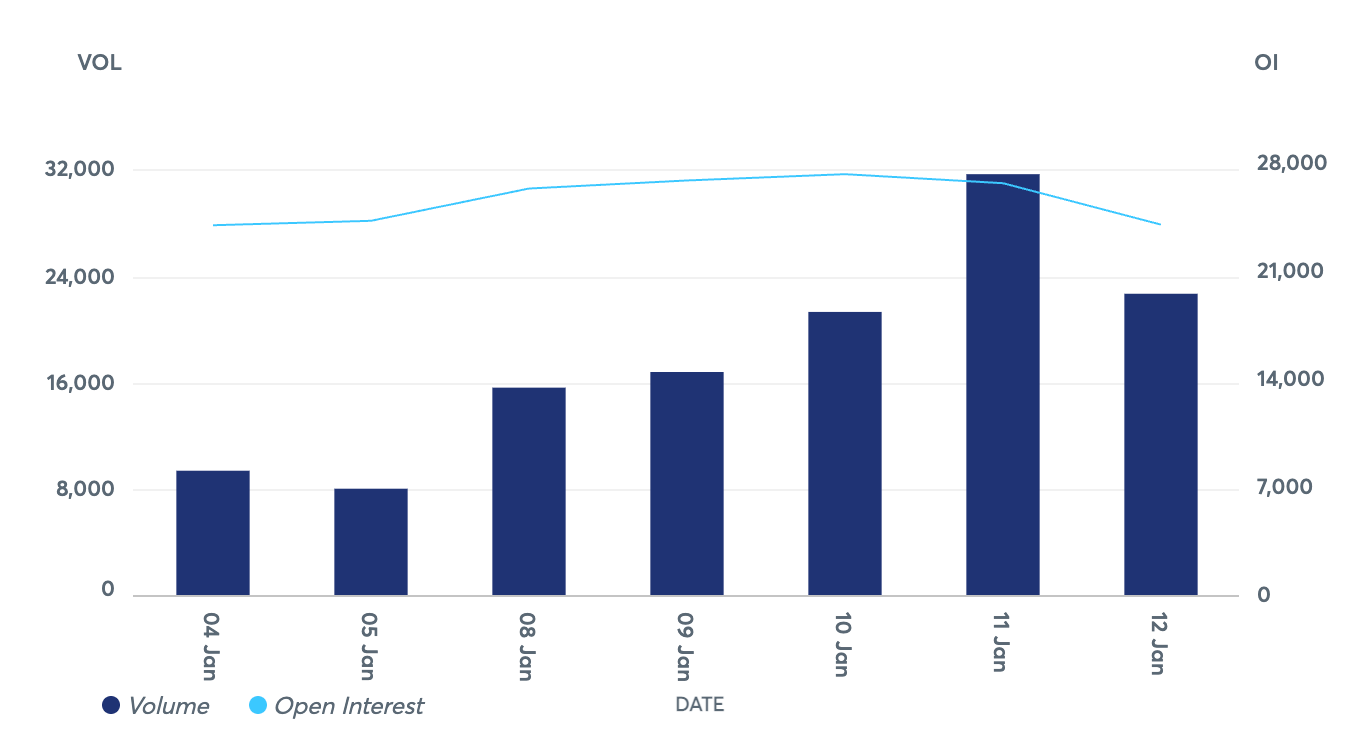

Beginning astatine 26,846 BTC connected Jan. 9, unfastened involvement connected CME Bitcoin futures accrued somewhat to 27,252 BTC connected Jan. 10, a humble summation of 1.51%, earlier entering a decline. By Jan. 12, the unfastened involvement had fallen to 23,992 BTC, marking a important simplification of 10.64% from its highest constituent connected Jan. 10.

This alteration successful unfastened interest, peculiarly notable betwixt Jan. 11 and Jan. 12, coincides with a sizeable driblet successful Bitcoin’s terms during the archetypal time of spot Bitcoin ETF trading. This suggests a correlation betwixt the declining marketplace assurance successful Bitcoin’s aboriginal terms and the reduced involvement successful futures contracts.

The trading measurement of CME Bitcoin futures showed adjacent much volatility. After an archetypal measurement of 16,821 BTC connected Jan. 9, it peaked connected Jan. 11 with 31,681 BTC, a important summation of 88.33%. However, this highest was short-lived; pursuing the crisp diminution successful Bitcoin’s price, the futures trading measurement fell to 22,699 BTC by Jan. 12, a alteration of 28.34% from the erstwhile day’s peak.

Graph showing the trading measurement and unfastened involvement connected CME Bitcoin futures from Jan. 4 to Jan. 12, 2024 (Source: CME Group)

Graph showing the trading measurement and unfastened involvement connected CME Bitcoin futures from Jan. 4 to Jan. 12, 2024 (Source: CME Group)Bitcoin besides exhibited important volatility past week. Starting astatine $46,088 connected Jan.9, the terms fluctuated somewhat earlier experiencing its astir important driblet betwixt Jan. 11 and Jan. 12, falling from $46,393 to $42,897, a decrease of 7.54%.

The notable driblet successful unfastened involvement and measurement connected CME shows the imaginable the spot Bitcoin ETF has to power established markets similar Bitcoin futures oregon GBTC.

Within the archetypal 2 days of trading, spot Bitcoin ETFs saw $1.4 cardinal successful inflows. These 2 days saw highly precocious trading activity, totaling astir 500,000 traders and amassing astir $3.6 cardinal successful volume. Amidst this influx, the Grayscale Bitcoin Trust (GBTC) encountered notable outflows, amounting to $579 million. When these outflows are factored in, the nett inflows for each spot Bitcoin ETFs are $819 million. However, these figures mightiness not bespeak the existent measurement and inflows connected Jan. 11 and Jan. 12, arsenic immoderate transactions are inactive pending last accounting settlement.

Some analysts speculate that the outflows from GBTC could respond to the support of the spot Bitcoin ETF, arsenic Grayscale’s 1.50% interest is being weighed against much cost-effective alternatives similar BlackRock’s ETF, which charges a 0.25% fee. In specified a abbreviated time, the magnitude of outflows could bespeak a increasing sensitivity among investors to ETF interest structures.

This sensitivity to outgo could besides beryllium 1 of the astir important factors influencing Bitcoin futures. Spot ETFs whitethorn connection a much cost-effective mode of investing successful Bitcoin, arsenic futures contracts often impact premium costs and rollover expenses. For larger organization investors, these costs tin beryllium important implicit time, particularly fixed the highly competitory fees among the 11 listed ETFs.

For accepted investors oregon institutions, an ETF represents a acquainted operation akin to investing successful stocks oregon different commodities, making it a much charismatic enactment than futures contracts. If the displacement toward the spot Bitcoin ETF continues, it volition amusement a increasing penchant for simpler, much nonstop concern methods successful Bitcoin. It would bespeak that investors are seeking ways to incorporated Bitcoin into their portfolios successful a mode that aligns much intimately with traditional concern practices.

The station How ETFs affected BTC futures trading successful the U.S. appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)