The play starring up to the ETF motorboat was marked by an summation successful Bitcoin’s price. And portion the motorboat of the first spot ETFs successful the U.S. failed to make the bombastic bull rally galore were hoping for; it showed conscionable however important section markets are successful driving planetary prices.

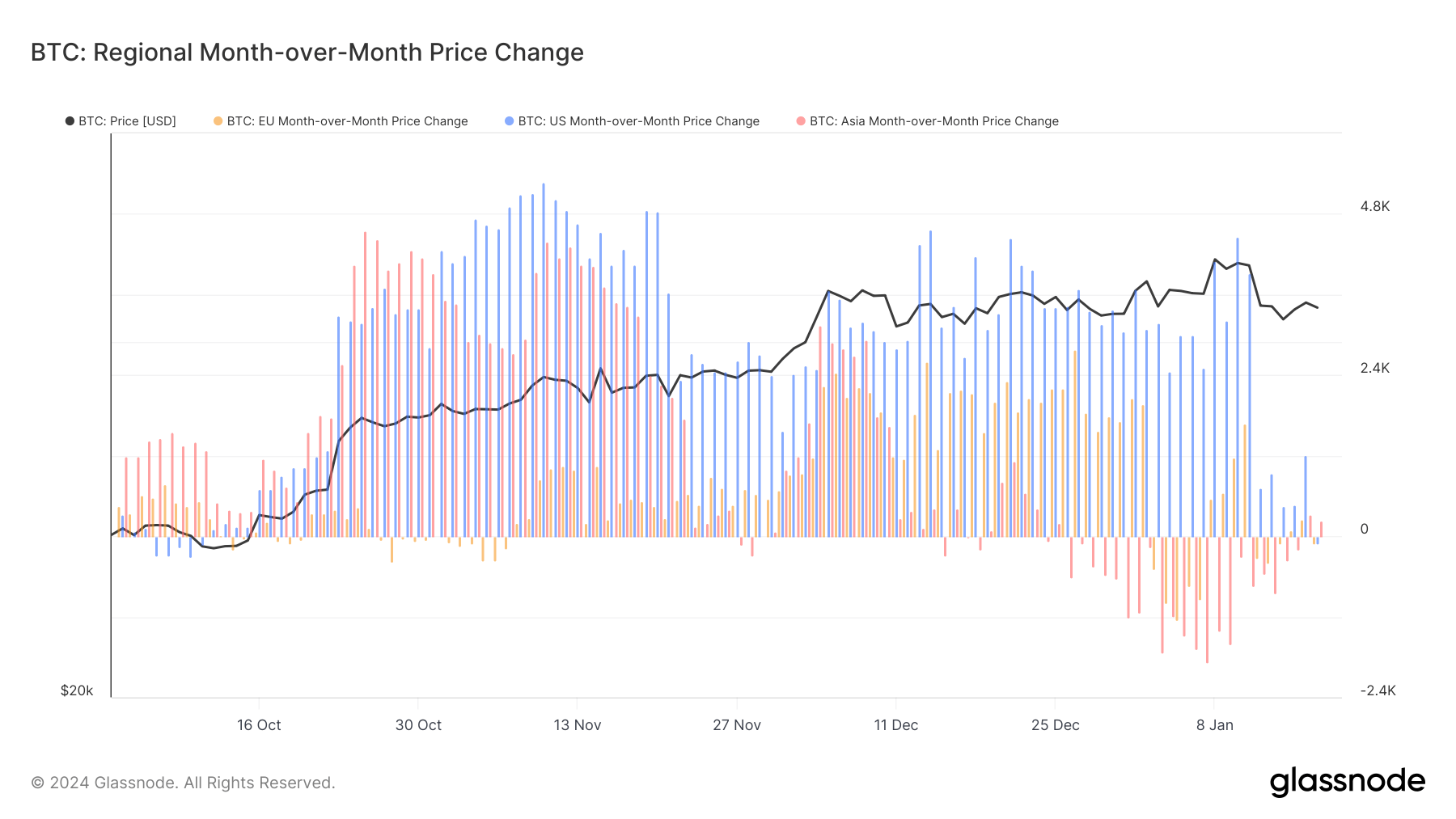

Specifically, Glassnode’s information connected determination month-over-month terms changes indicates that the U.S. marketplace experienced the highest complaint of terms summation compared to Asia and the E.U. This suggests a increasing involvement successful Bitcoin among U.S. investors, apt fueled by the anticipation of the ETFs’ introduction.

Such a determination surge successful involvement is significant, arsenic it highlights however localized factors, specified arsenic regulatory changes oregon the motorboat of caller fiscal products, tin importantly interaction the market.

Graph showing the determination month-over-month terms alteration successful the U.S. (blue), Asia (red), and E.U. (yellow) from Oct. 4, 2023, to Jan. 17, 2024 (Source: Glassnode)

Graph showing the determination month-over-month terms alteration successful the U.S. (blue), Asia (red), and E.U. (yellow) from Oct. 4, 2023, to Jan. 17, 2024 (Source: Glassnode)The U.S. marketplace importantly influences planetary Bitcoin prices owed to its cardinal relation successful the planetary fiscal system. As location to a ample fig of influential investors and a large hub for technological and fiscal innovation, trends successful the U.S. often signifier planetary marketplace sentiments. Additionally, the U.S. dollar’s presumption arsenic the superior planetary reserve currency means that fiscal movements successful the U.S., including successful the cryptocurrency sector, person wider planetary repercussions.

Historically, launching caller concern vehicles similar ETFs tin make bullish sentiment, particularly successful the portion wherever they are introduced, arsenic they supply a much regulated and perchance safer mode to put successful cryptocurrencies.

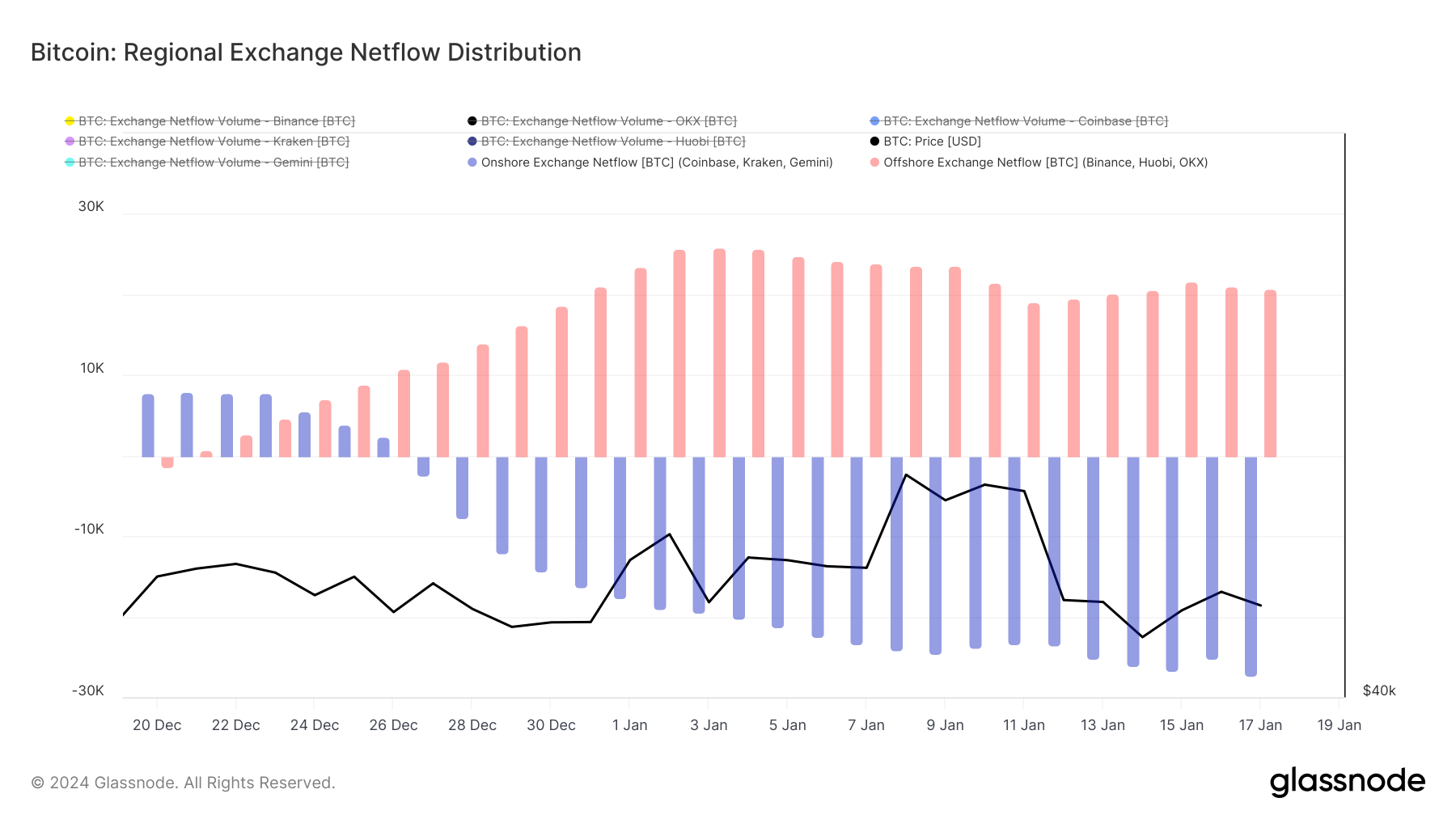

Further supporting this proposal is the investigation of speech netflow distribution, a measurement of however overmuch Bitcoin is entering oregon leaving exchanges, which shows a accordant signifier of Bitcoin outflows from U.S.-based exchanges similar Coinbase, Kraken, and Gemini. Starting from precocious December 2023, these outflows increased, culminating successful a highest connected Jan. 17, 2024.

This question of Bitcoin distant from exchanges and apt into backstage wallets oregon longer-term holdings suggests a strategical displacement by U.S. investors towards holding Bitcoin successful anticipation of the ETFs’ launch. Such a displacement would people alteration the liquid proviso connected exchanges, creating upward unit connected prices.

Graph showing the nett travel of Bitcoin successful and retired of U.S. exchanges (blue) and off-shore exchanges (red) from Dec. 20, 2023, to Jan. 17, 2024 (Source: Glassnode)

Graph showing the nett travel of Bitcoin successful and retired of U.S. exchanges (blue) and off-shore exchanges (red) from Dec. 20, 2023, to Jan. 17, 2024 (Source: Glassnode)The terms drop post-ETF launch, from $46,944 to $42,730, illustrates the market’s effect to the materialization of a much-anticipated event. This benignant of terms correction is not uncommon successful fiscal markets pursuing the build-up to large events, reflecting the adage “buy the rumor, merchantability the news.”

The information from Glassnode demonstrated the important influence of the U.S. marketplace connected Bitcoin’s terms summation successful the months starring up to the motorboat of the U.S. spot Bitcoin ETFs. Considering these findings, it volition beryllium absorbing to observe however the American marketplace continues to signifier planetary cryptocurrency trends successful the future. This further confirms that affirmative section marketplace sentiments, influenced either by favorable regulatory quality oregon broader fiscal marketplace trends, tin person a spillover effect connected the planetary markets.

The station How increasing U.S. involvement shaped Bitcoin’s terms up of the ETF appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)