The caller Bitcoin rally has led to speculation that the terms could emergence further with the instauration of spot ETFs. The accomplishment of ETFs, particularly from reputable companies specified arsenic BlackRock and Fidelity, could boost organization capitalist assurance and pb to a surge successful the Bitcoin price. The 1 cardinal dollar question, however, is: however high? Clues to answering this question tin travel from assorted metrics and data.

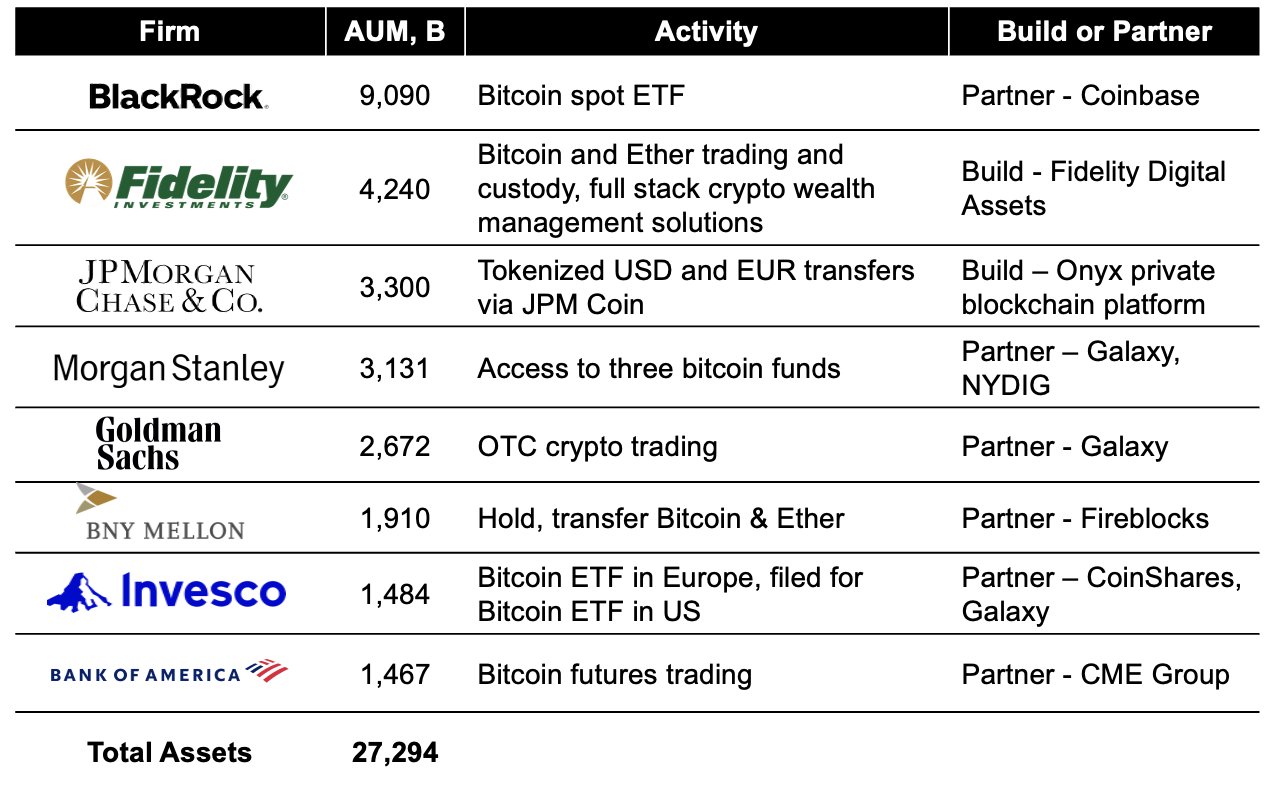

One specified information constituent was provided yesterday by CoinShares’ Chief Strategy Officer Meltem Demirors via Twitter. As she writes, the Bitcoin spot ETF quality is not the lone story. Many of the largest fiscal institutions successful the US are presently actively moving to supply entree to BTC and more. In total, determination are much than $27 trillion successful lawsuit assets waiting connected the sidelines.

Institutions gathering infrastructure for Bitcoin | Source: Twitter @Melt_Dem

Institutions gathering infrastructure for Bitcoin | Source: Twitter @Melt_DemWith BlackRock, the world’s largest plus manager has filed a Bitcoin ETF application. Rumour has it that the world’s fig three, Fidelity Investments, is besides flirting with a Bitcoin ETF. Bitcoin ETF applications from Invesco and WisdomTree (both apical 10 ETFs) are a fact.

How High Can Bitcoin Rise? All-Time High? Quadruple?

If conscionable a fraction of the $27 trillion successful lawsuit wealth managed by the largest plus managers were to spell into Bitcoin spot ETFs, the interaction connected terms would beryllium gigantic. Just 1% would magnitude to implicit $270 cardinal (rather much due to the fact that not each Bitcoin ETF applicants are included successful the chart). In comparison, the Bitcoin marketplace headdress is presently $590 billion.

As NewsBTC reported 2 weeks ago, the show of the golden terms aft the archetypal golden ETF successful November 2004 could besides beryllium a metric that provides a glimpse into the future. The motorboat of the archetypal golden ETFs led to a fabulous golden rally. While the terms of golden was inactive astatine $400 astatine the clip of approval, it reached $600 successful 2006 and $800 successful 2008. Seven years aft approval, successful 2011, golden reached its preliminary precocious of astir $2,000 (+359%).

Renowned adept Will Clemente commented via Twitter:

Shown beneath is erstwhile GLD launched, allowing casual entree to Gold vulnerability for investors. If/when Blackrock’s (who has a 99% ETF approval) Bitcoin ETF launches (very akin operation to GLD), expect akin terms enactment arsenic it unlocks entree to Bitcoin vulnerability for the masses.

Bitcoin vs golden terms | Source: Twitter @WClementeIII

Bitcoin vs golden terms | Source: Twitter @WClementeIIIAs Bitcoin is the integer golden of the 21st century, it is besides worthy looking astatine the marketplace capitalizations of some assets successful comparison. While BTC stands astatine $590 billion, the golden marketplace capitalization is astir $12 trillion.

If Bitcoin were to summation conscionable 10% of gold’s marketplace stock (around $1.2 trillion), this would beryllium a doubling of BTC’s existent marketplace capitalization and, to enactment it simply, a doubling of Bitcoin’s existent price. That this people is by nary means intolerable is shown by BTC’s all-time precocious of astir $67,000 astatine the extremity of 2021, erstwhile its marketplace capitalization was already astir $1.2 trillion.

Another benchmark is the full marketplace capitalization of the planetary banal marketplace of implicit $100 trillion. Apple accounts for astir 3% of this. The institution is frankincense 5 times arsenic capitalised arsenic Bitcoin.

One origin that besides needs to beryllium taken into relationship erstwhile determining the terms is the proviso side. As adept Alessandro Ottaviani writes, BlackRock and Fidelity would lone person to determination 0.3% of their managed superior into Bitcoin to bargain each existing BTC connected the exchanges astatine the existent price.

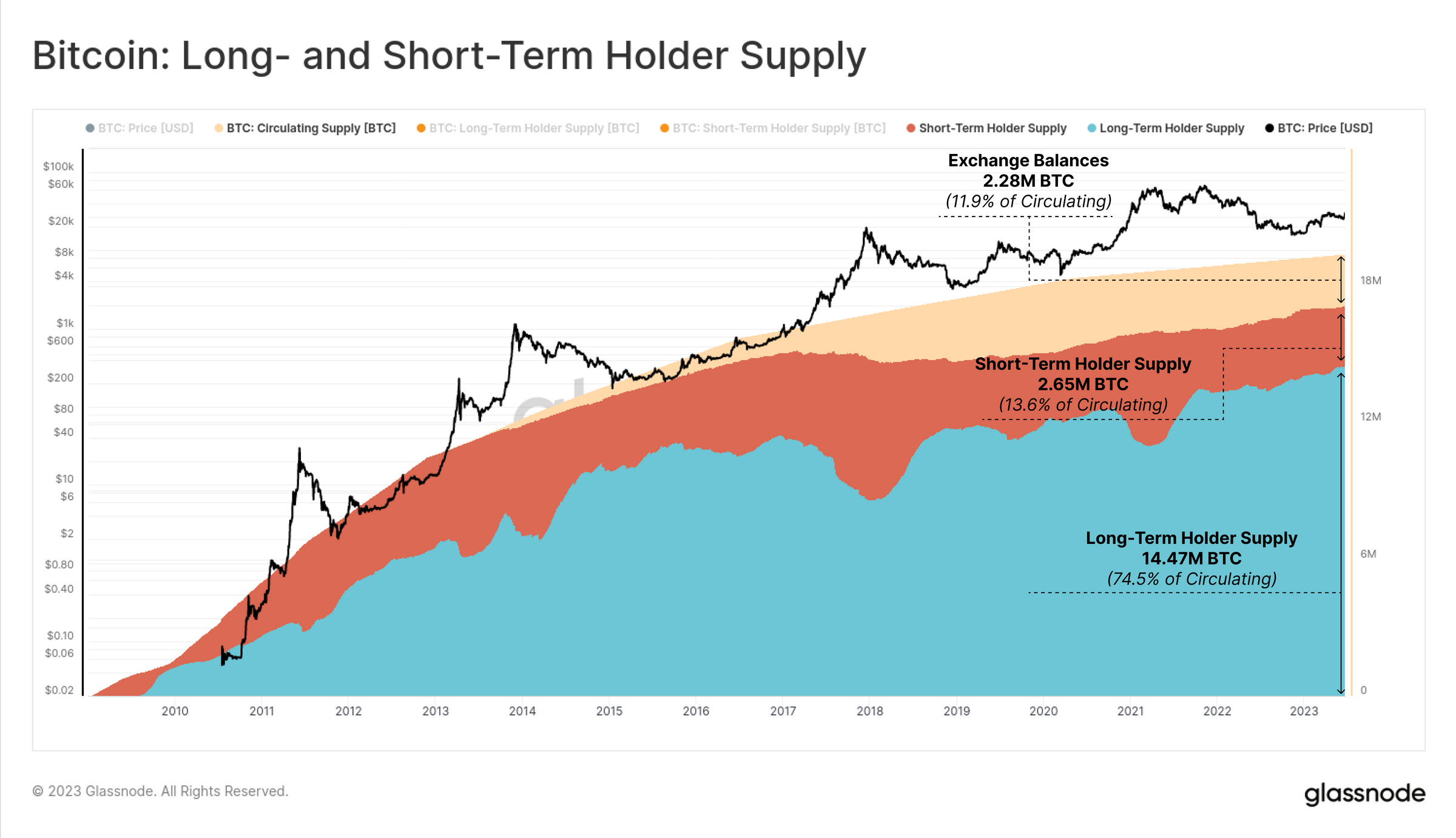

The on-chain investigation work Glassnode has published probe connected this. The analysts constitute that aft a play of weaker comparative US demand, determination is simply a revival successful 2023. This encounters a highly illiquid market.

Currently, determination is simply a continued transportation of wealthiness to HODLers, portion much and much coins are being withdrawn from exchanges. According to Glassnode, determination are presently lone 2.28 cardinal BTC near connected exchanges (11.9% of circulating supply), a abbreviated word holder proviso of 2.65 BTC (13.6% of circulating supply) portion 14.47 BTC are held by agelong word holders (74.5% of circulating supply).

Bitcoin’s proviso broadside | Source: Glassnode

Bitcoin’s proviso broadside | Source: GlassnodeAll the supra metrics and information suggest that Bitcoin is facing a immense bull tally led by institutions. However, determination is nary warrant for this. One happening to see is that the US Securities and Exchange Commission could cull the Bitcoin spot ETFs contempt BlackRock’s fantastic occurrence rate.

On the different hand, BlackRock and others request to bargain BTC connected the spot marketplace for it to person a nonstop interaction connected the price. But 1 anticipation is that BlackRock could bargain Bitcoin over-the-counter (OTC). For example, the plus manager could bargain the BTC seized by the US authorities (over 200,000) over-the-counter.

This could pb to a “buy the rumor merchantability the news” event. But adjacent if they bought over-the-counter from the US, this could beryllium beneficial successful the agelong run, arsenic it means that the US authorities volition nary longer merchantability its BTC connected the unfastened marketplace arsenic it did successful the past.

At property time, the BTC terms stood astatine $30,388.

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)