Bitcoin’s estimation arsenic a harmless haven plus has agelong been disputed by the satellite of accepted finance. Its deficiency of centralized control, utmost terms volatility, and novelty made it hard to categorize arsenic inflation-proof oregon recession-proof.

However, successful the past twelvemonth we’ve seen that successful times of uncertainty, investors support choosing Bitcoin implicit fiat.

Inflation leads to Bitcoin

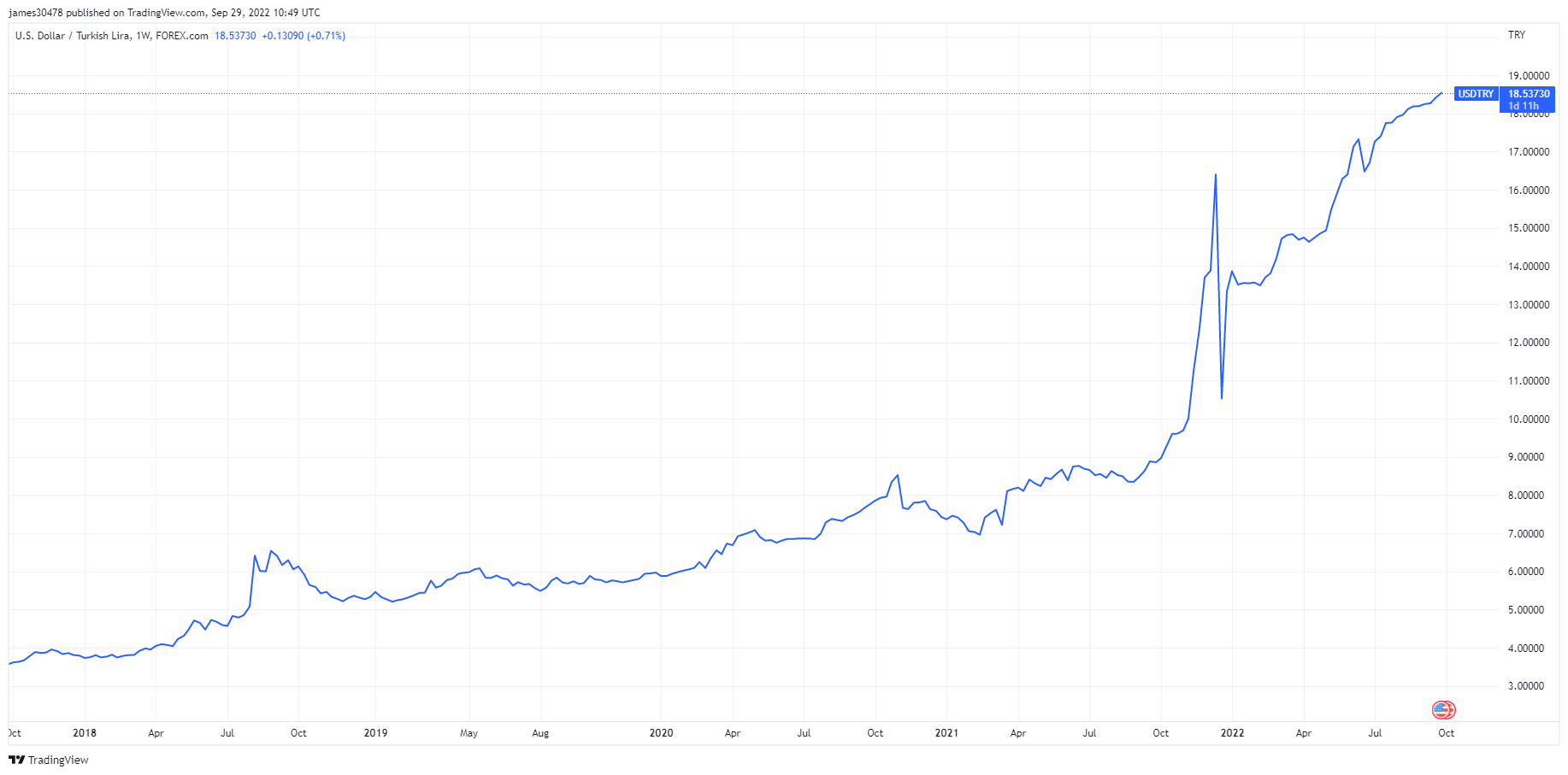

Take, for example, the Turkish lira (TRY). The currency has been connected a dependable diminution since 2018, with the cumulative ostentation implicit the past 3 years surpassing 100%. Since the opening of the year, the lira mislaid 26% of its worth against the U.S. dollar (USD). PwC categorized Turkey arsenic a hyperinflationary system successful its September report, saying that deteriorating conditions began successful 2021 and person worsened successful mid-summer 2022.

The 2017 speech complaint of 1 USD per 3.5 TRY present stands astatine 1 USD er 18 TRY. This has created immense amounts of USD/TRY trading volume, which has been connected a parabolic emergence since the opening of the year.

Graph showing the USD/TRY 24-hour trading measurement from 2018 to 2022 (Source: TradingView)

Graph showing the USD/TRY 24-hour trading measurement from 2018 to 2022 (Source: TradingView)The U.S. dollar isn’t the lone currency Turkish radical person flocked to.

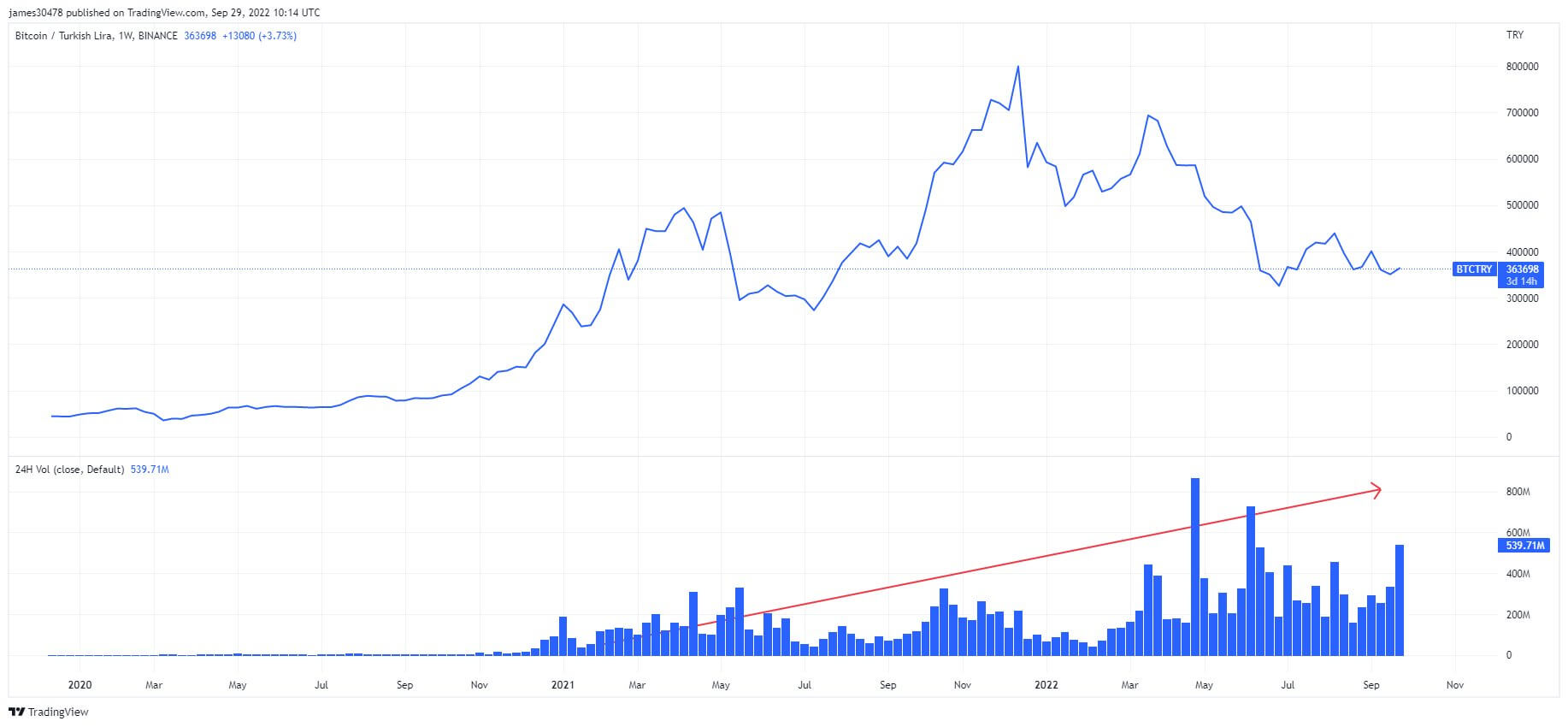

There has been a dependable summation successful BTC/TRY trading measurement connected centralized exchanges. Data from Binance has shown that the terms of Bitcoin successful TRY jumped to its ATH astatine the opening of 2022, portion the 24-hour trading measurement for the brace reached its highest successful May this year.

Graph showing the terms and trading measurement for BTC/TRY connected Binance, from 2020 to 2022 (Source: TradingView)

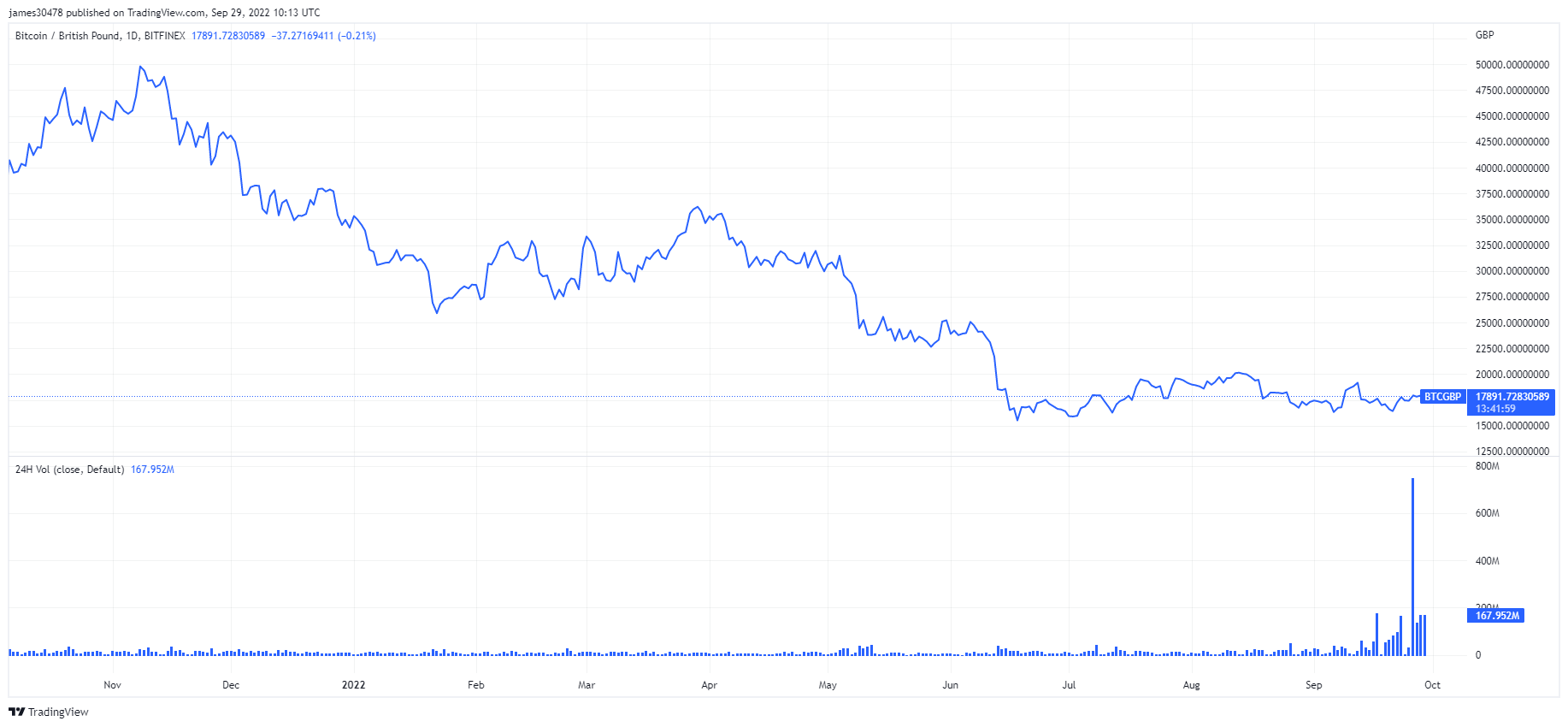

Graph showing the terms and trading measurement for BTC/TRY connected Binance, from 2020 to 2022 (Source: TradingView)On Sept. 26, 2022, the British lb experienced a flash clang arsenic ample arsenic the 1 recorded connected Black Wednesday 1992, losing 4.3% of its worth against the U.S. dollar successful a azygous day. As antecedently covered by CryptoSlate, the driblet was a effect of the Bank of England’s exigency involution successful the enslaved market.

The aforesaid time the lb experienced its worst driblet successful 30 years, the BTC/GBP trading measurement reached its ATH, soaring implicit 1,200% successful 24 hours.

Graph showing the terms and 24-hour trading measurement for BTC/GBP connected Bitfinex (Source: TradingVIew)

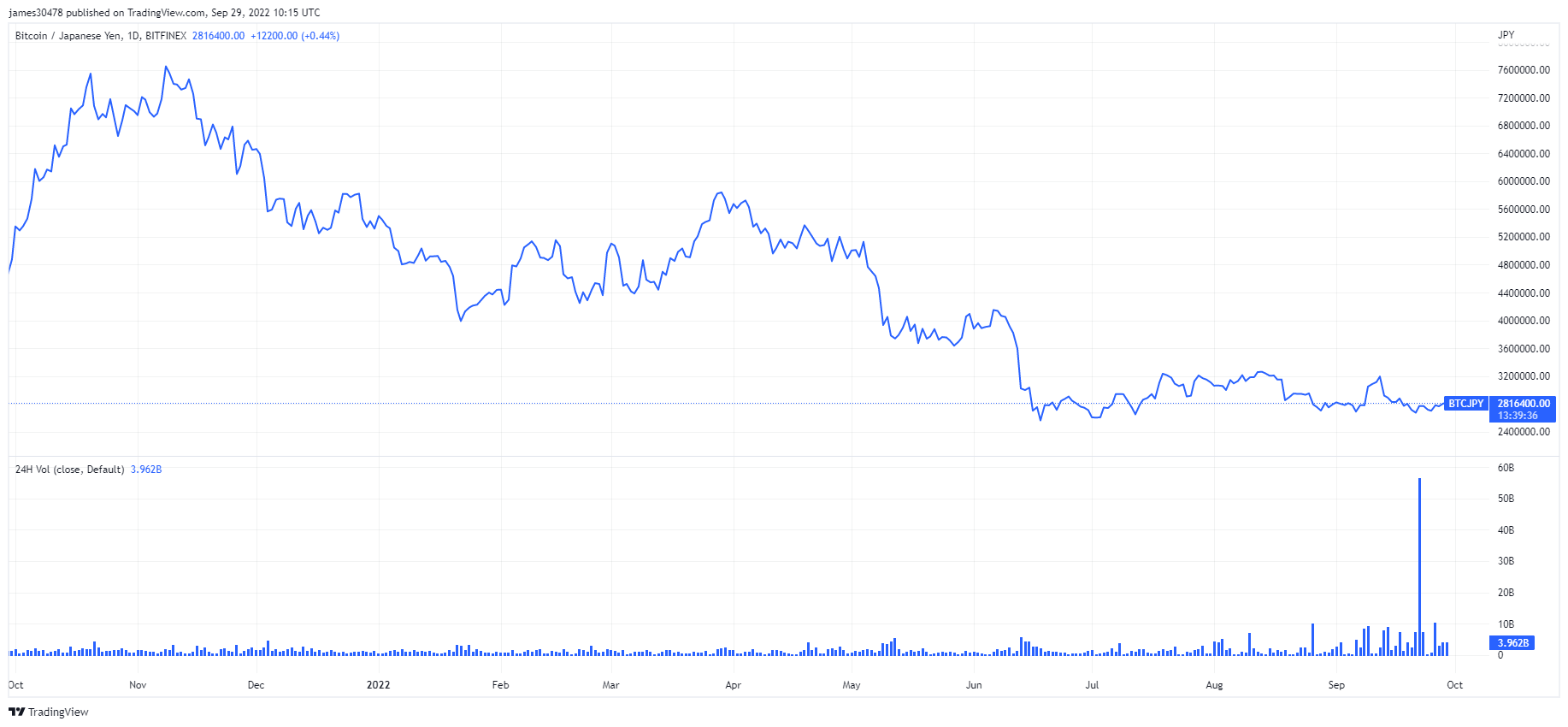

Graph showing the terms and 24-hour trading measurement for BTC/GBP connected Bitfinex (Source: TradingVIew)The concern was nary amended successful Japan, wherever the cardinal slope spent astir $20 billion, oregon 3.6 trillion yen, intervening successful the overseas speech marketplace to prop up the rapidly declining yen. While the fig indicates the government’s full spending connected currency involution successful the full period of September, it’s wide believed that each of the $20 cardinal person been utilized successful a azygous involution connected Sept. 22.

This is present the Bank of Japan’s largest and astir important dollar-selling, yen-buying intervention, surpassing the 2.6 trillion yen grounds it acceptable successful 1998. The involution was expected to heal the struggling yen, which mislaid a 5th of its worth against the U.S. dollar this year.

However, the remedy was short-lived — the yen traded astatine 144 against the dollar earlier the intervention, aft which it concisely reached 140. The pursuing time the yen dropped to 145 against the dollar the pursuing day, erasing the effects of the intervention.

As the yen tumbled, Japanese investors besides flocked to Bitcoin. The BTC/JPY trading measurement peaked close astatine the clip of the intervention.

Graph showing the terms and 24-hour trading measurement for BTC/JPY connected Bitfinex from 2021 to 2022 (Source: TradingView)

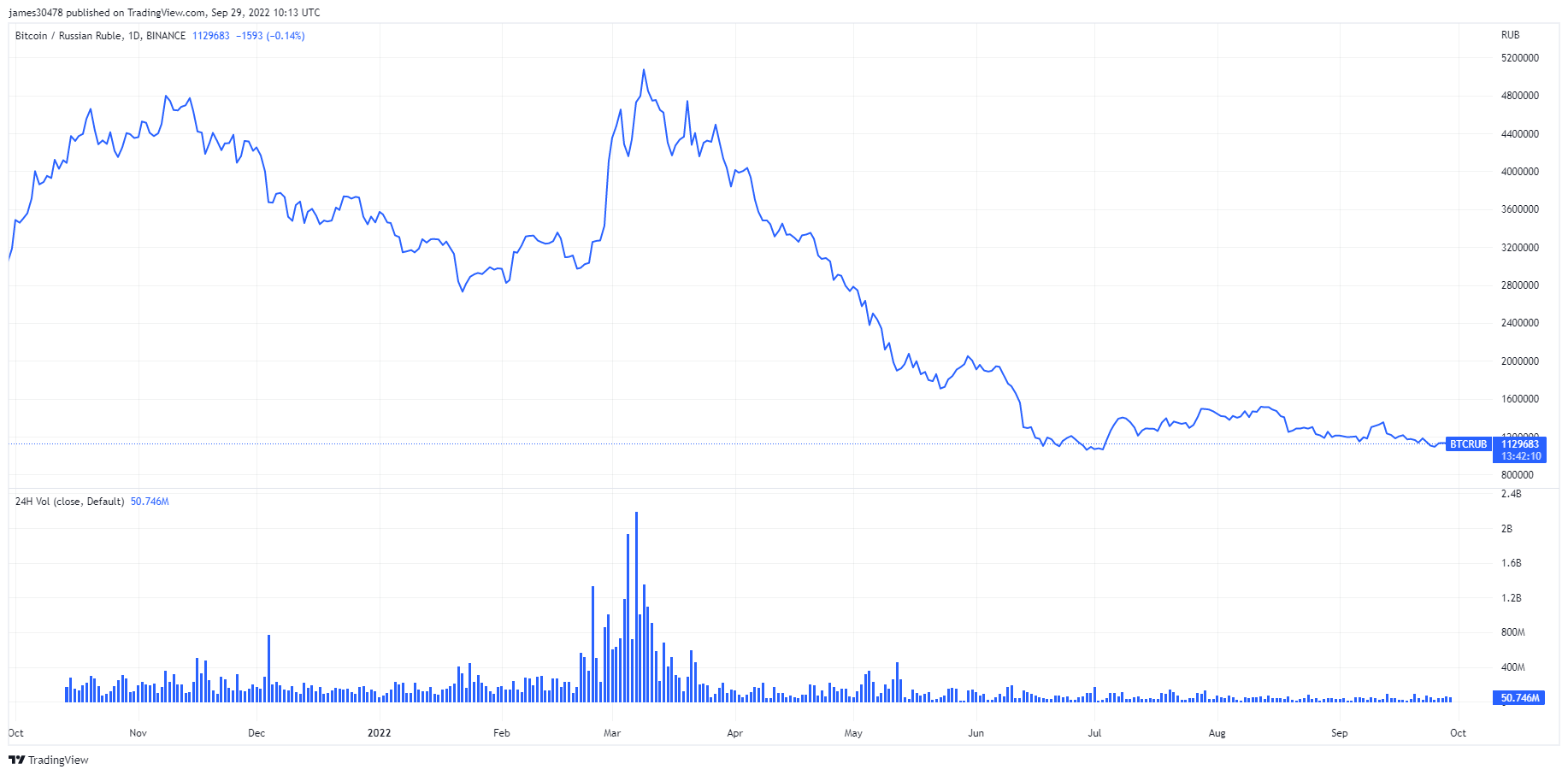

Graph showing the terms and 24-hour trading measurement for BTC/JPY connected Bitfinex from 2021 to 2022 (Source: TradingView)In Russia, arsenic the ruble fell to its historical lows, the BTC/RUB trading measurement soared. Investors successful the state turned to the hardest plus disposable arsenic Russia began its penetration of Ukraine, pouring their wealth into Bitcoin.

Graph showing the terms and 24-hour trading measurement for BTC/RUB connected Binance from 2021 to 2022 (Source: TradingView)

Graph showing the terms and 24-hour trading measurement for BTC/RUB connected Binance from 2021 to 2022 (Source: TradingView)While the spikes we’ve seen successful Bitcoin trading measurement mightiness not signify that wide adoption is near, they amusement that it’s opening to enactment arsenic a harmless haven asset. Faced with macro uncertainty, inflation, and debasing currencies, investors are flocking to Bitcoin en masse.

The station How ostentation and debased fiat currencies are pushing investors to Bitcoin appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)