The terms of immoderate plus is ever impacted by a operation of factors. Unlike accepted fiscal assets, bitcoin has historically had its ain acceptable of factors affecting its price. Do things look immoderate antithetic now? Let's find out.

Basic Factors: Supply And Demand

Bitcoin’s terms is heavy babelike connected proviso and request fluctuations, conscionable similar different assets. However, contrary to measures of fiat money, bitcoin’s proviso is ever known and its hard headdress is acceptable astatine 21 cardinal coins.

The request for bitcoin ever sits astatine the apical of the cryptocurrency world’s docket — that’s wherefore adoption of BTC is truthful talked about. Higher request volition pb to an summation successful its price, particularly erstwhile organization investors get involved.

For example, erstwhile companies and institutions began buying and holding bitcoin successful aboriginal 2021, its terms roseate importantly arsenic request outpaced the complaint astatine which caller coins were being placed connected the marketplace for sale, resulting successful a alteration successful the full disposable proviso of the cryptocurrency.

Its terms volition drop, however, if determination are much radical who privation to merchantability it.

Institutional Adoption

News influences capitalist cognition astir Bitcoin successful a large way.

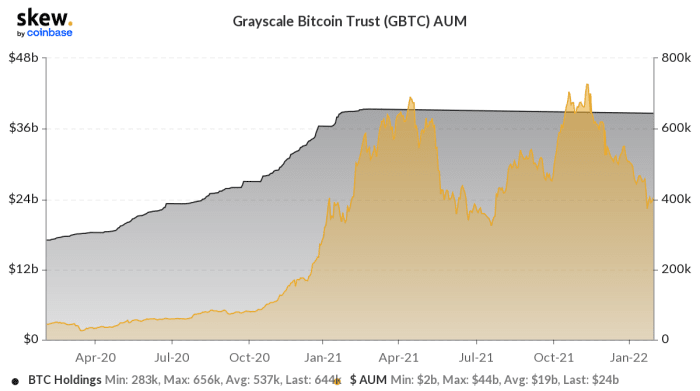

In spite of utmost volatility successful bitcoin’s price, the twelvemonth 2021 stands retired for its unprecedented adoption by some institutions and corporations.

For example, Grayscale Bitcoin Trust had an mean AUM of $31 cardinal and an mean Bitcoin holding of 650K successful 2021.

Crypto Regulation

Bitcoin’s terms is besides affected by regulatory developments. Changes successful regularisation tin promote oregon discourage concern successful BTC oregon successful its use, which successful crook leads to an summation oregon alteration successful its price.

Here's however the bitcoin terms overlaid with regulatory events successful 2021 looks:

News Indirectly Related To Bitcoin

Let’s see an illustration of however indirect quality events, specified arsenic reports astir a governmental concern successful a state determination successful the world, tin substantially interaction the terms of BTC.

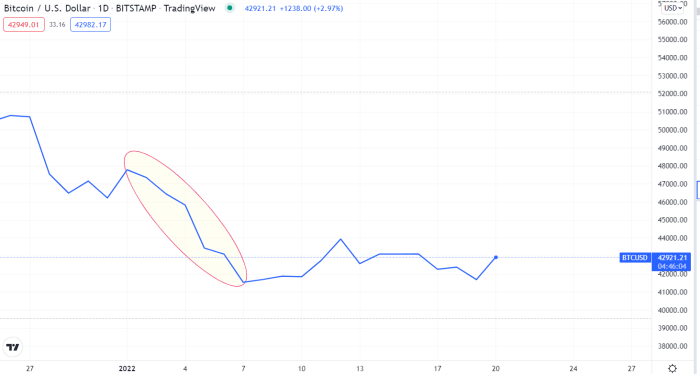

On 2 January, 2022, a week-long uprising started successful Kazakhstan. Most radical hadn’t realized the value of this lawsuit for the crypto market. In caller years, Kazakhstan became the world’s number two bitcoin miner based connected hash rate. It accounts for astir 18% of the planetary hash rate, and is lone outdone by the United States.

So, with the quality of an uprising, it took astir 24 hours for the crypto marketplace to react, and the BTC terms plunged a combined 13.1% from January 2 to January 8.

Image source: TradingView

BTC Increasingly Resembles Traditional Assets

In theory, accepted market-related quality specified arsenic reports connected the macroeconomic situation oregon monetary argumentation decisions of cardinal banks should not impact cryptocurrencies owing to their decentralized nature. However, the existent inclination suggests otherwise.

Global quality sentiment has a large interaction connected equity returns astir the world, according to World Bank research. This effect is not reversible successful the abbreviated run, suggesting an underlying root of sentiment-driven plus terms fluctuations.

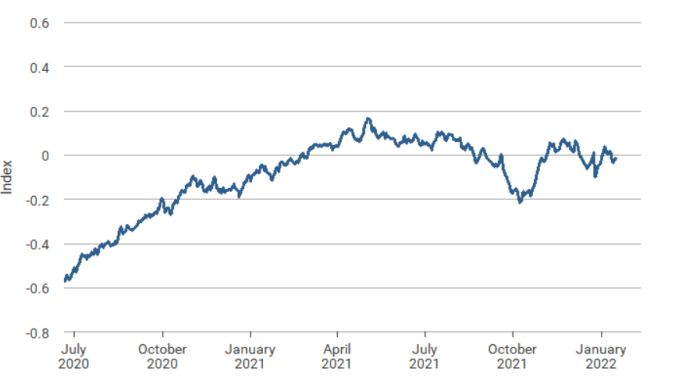

Below is the Daily News Sentiment Index by the Federal Reserve Bank of San Francisco, which gives an wide measurement of economical sentiment by analyzing quality articles:

Image source: Federal Reserve Bank of San Francisco

Although Bitcoin is not a accepted asset, it appears that the wide quality sentiment influences its value.

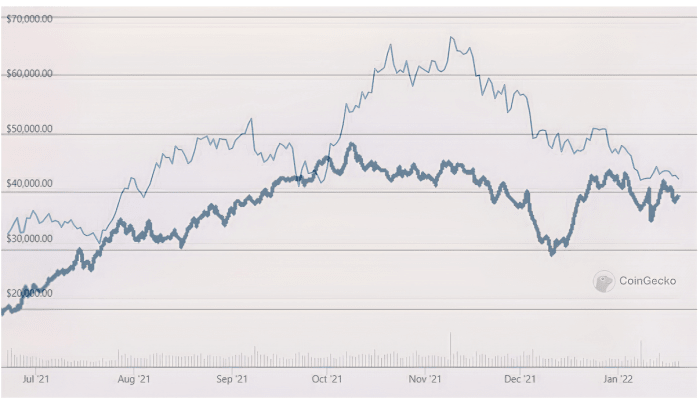

Here’s what bitcoin’s terms illustration looks similar erstwhile combined with the quality sentiment scale for the aforesaid period:

Image source: Author, information from CoinGecko

Recent information connected Bitcoin and large banal indices correlation besides suggests this.

Historically, crypto assets didn’t amusement a beardown correlation with large banal indices. In the latest Coinmetrics data, however, the regular correlation betwixt bitcoin and the S&P 500 jumped to 0.47 connected January 28, 2022, indicating a adjacent correlation.

Image source: Coinmetrics.io

Bottom Line

As the crypto marketplace matures, caller trends are emerging that we haven’t observed before. Initially a fringe asset, bitcoin is present progressively acting similar a accepted asset, delicate to the aforesaid marketplace forces that impact those markets. In summation to quality connected crypto regulations and organization adoption, bitcoin’s terms is affected by changes successful wide economical conditions and satellite events that interaction accepted markets.

This is simply a impermanent station by Mike Ermolaev. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)