The beneath is from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Today, we’ll beryllium taking a look astatine the evolving relation that the Chicago Mercantile Exchange (CME) has played successful the bitcoin futures market. In particular, we volition analyse immoderate of the trends since the ProShares Bitcoin Strategy Futures ETF (BITO) began trading successful October 2021.

We covered the imaginable interaction of a bitcoin futures ETF successful The Daily Dive #080 - Bitcoin Futures ETF Impact.

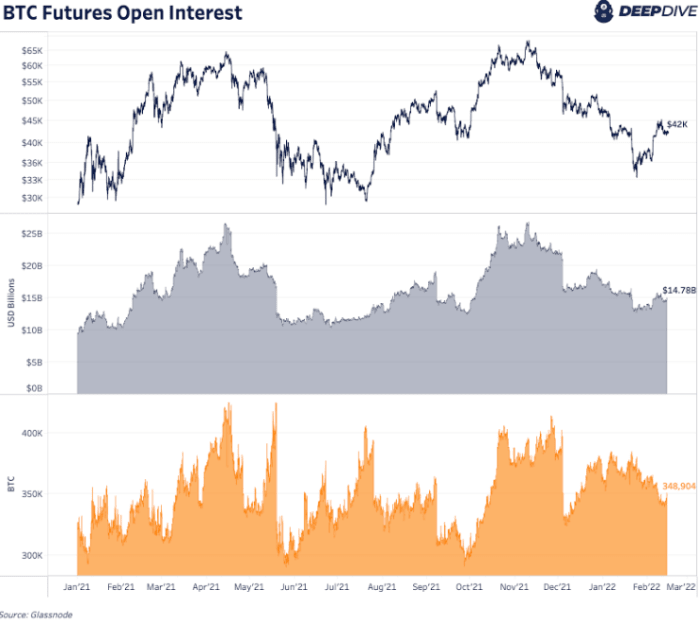

There is presently $14.7 cardinal of bitcoin futures unfastened involvement contracts crossed assorted exchanges and declaration types, a fig equivalent to 348,000 bitcoin.

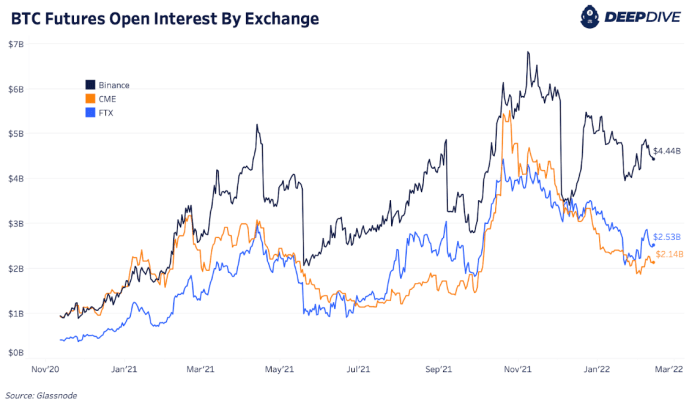

An investigation of unfastened involvement by speech shows Binance ($4.44 billion) arsenic the marketplace person with FTX ($2.53 billion) and CME ($2.14 billion) pursuing behind. These 3 exchanges marque up the bulk of unfastened involvement contracts accounting for implicit 60% of the market.

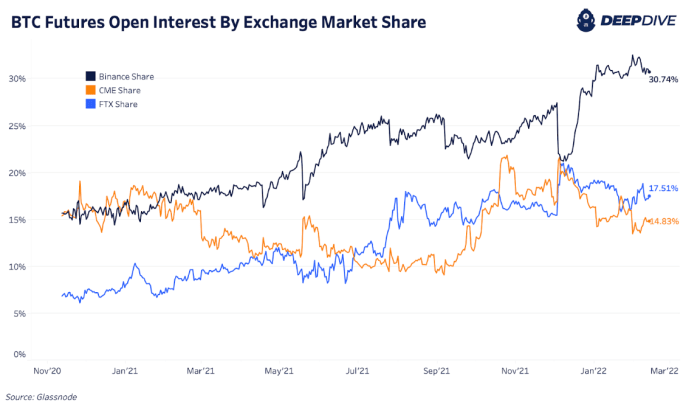

In presumption of the percent of aggregate unfastened involvement by exchange, 30.74% is presently held connected Binance portion FTX and CME clasp 17.51% and 14.83% of unfastened involvement each, respectively.

Among the astir absorbing dynamics, successful regards to analyzing the unfastened involvement of circumstantial exchanges successful the futures market, is the emergence of unfastened involvement successful the CME starring up to the support of the bitcoin futures ETF.

In aboriginal October, rumors began to circulate that a futures ETF was imminent and bitcoin futures unfastened involvement connected the CME (where the prospective futures ETF would commercialized its holdings) much than doubled to a highest of $5.5 cardinal successful little than a month, concisely becoming the marketplace person successful unfastened interest.

3 years ago

3 years ago

English (US)

English (US)