Key takeaways:

US determination slope accent hits markets arsenic car assemblage bankruptcies exposure risky loans, sending fiscal banal prices sinking.

Bitcoin fell beneath the 200-day SMA, dropping to $104,500 amid $1.2 cardinal crypto liquidations.

Analysts presumption $88,000 arsenic the adjacent important enactment level for BTC, unless $104,000 holds.

Bitcoin (BTC) dropped to $104,000 successful a 2nd achromatic Friday lawsuit arsenic signs of recognition accent among US determination banks triggered a caller question of hazard aversion crossed the crypto market.

Bitcoin extends losses arsenic equities slide

Bitcoin terms began dropping during the New York trading hours connected Thursday arsenic investors turned defensive, with equities slipping, bonds gaining, and gold reaching a caller all-time high.

This came aft concerns emerged implicit a looming fiscal turmoil successful the US, with determination banks nether unit owed to vulnerability to 2 bankruptcies successful the car sector.

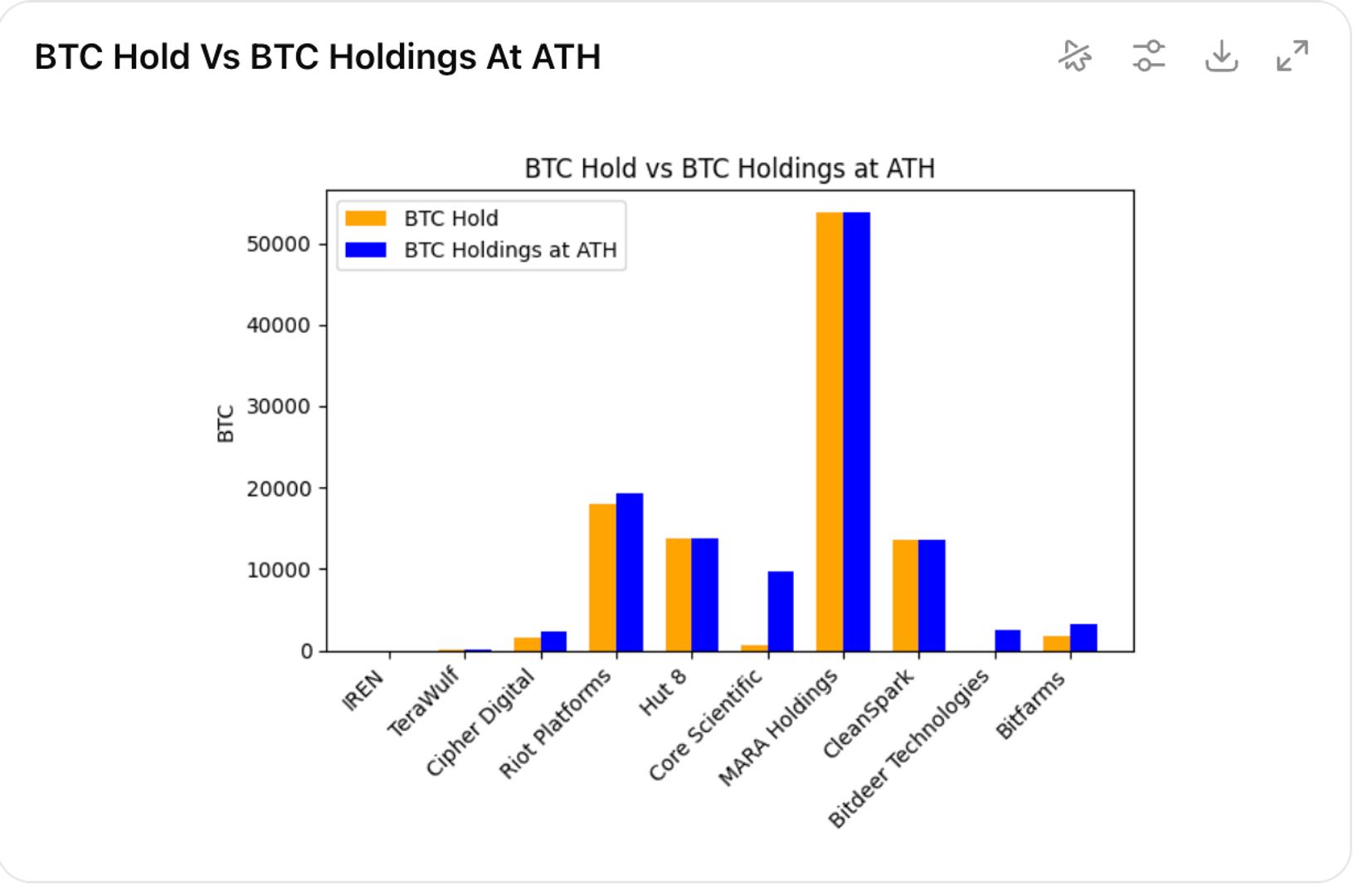

Related: Investors are getting amended astatine spotting atrocious Bitcoin treasuries: David Bailey

First Brands Group, an Ohio-based car parts supplier with $10 cardinal successful liabilities, and Tricolor Holdings, a subprime car lender with $1 cardinal successful debt, filed for bankruptcy successful precocious September.

These failures exposed risky lending practices, peculiarly successful backstage recognition markets, sparking fears of contagion.

Zions’ banal sank 13% aft disclosing it would instrumentality a $50 cardinal nonaccomplishment successful the 3rd 4th connected 2 loans from its California division. Western Alliance’s banal slumped 11% aft it initiated a suit alleging fraud by Cantor Group V, LLC.

As a result, the S&P 500 dropped by 0.63% to adjacent the time astatine 6,629.07 connected Thursday, portion the Nasdaq composite scale declined by 107 points (-0.47%). The Dow Jones scale mislaid 0.65% to adjacent the trading time connected Oct. 16 astatine 45,952.24.

This panic rippled into the crypto market, pushing Bitcoin to an intraday debased of $104,500, with the full crypto marketplace capitalization dropping by 5% to $3.58 trillion, according to information from Cointelegraph Markets Pro and TradingView.

Bitcoin wipes retired liquidity successful tumble beneath $105,000

Bitcoin’s sell-off connected Friday extended the deviation from its Oct. 6 all-time precocious of $126,000 to 16.5% and was accompanied by monolithic liquidations crossed the derivatives market.

Related: Bitcoin OG whales to blasted for BTC’s achy rise: Willy Woo

More than $935.2 cardinal successful agelong positions were liquidated, with Bitcoin accounting for $317.8 cardinal of that total. Ether (ETH) followed with $196.3 cardinal successful agelong liquidations.

Across the board, a full of $1.19 cardinal was wiped retired of the marketplace successful abbreviated and agelong positions, arsenic shown successful the fig below.

“Another time with a batch of liquidations crossed the board. It’s not adjacent conscionable longs portion the marketplace has been going down,” said trader Daan Crypto Trades connected Friday, adding:

“This is precisely what happens aft astir large flushes. Traders chop themselves up portion trying to marque backmost what’s lost.”Additional information from CoinGlass showed Bitcoin terms eating distant liquidity astir $105,000, with much orders inactive sitting astatine $103,500 arsenic shown successful the illustration below.

This suggests that Bitcoin’s terms mightiness driblet further to expanse the liquidity wrong this scope earlier staging a sustained recovery.

How debased tin Bitcoin terms go?

Bitcoin’s driblet beneath $105,000 contiguous saw it suffer cardinal enactment areas, including the 200-day SMA astatine $107,520.

This has near traders speculating however debased the BTC terms volition spell earlier it finds its footing.

“No reversal successful show astatine the infinitesimal for $BTC,” said expert Block_Diversity successful an X post.

An accompanying illustration highlighted cardinal levels to ticker connected the regular chart, including past Friday’s debased connected Binance astir $101,000, and the request zones astir $95,000 and $88,000.

“These are unfastened targets, unless $BTCstarts getting enactment astatine $107.4K.”“$104K is the HTF level that matters astir close here,” said chap expert Sykodelic, adding that they expect this country to clasp since the regular RSI is present astatine the lowest level since the $74,000 bottom.

“The play adjacent this week volition beryllium precise important.”As Cointelegraph reported, with the crypto Fear and Greed Index astatine yearly lows and astatine “extreme fear,” which suggests that BTC terms mightiness rebound successful the abbreviated word from existent levels.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

4 months ago

4 months ago

English (US)

English (US)