The beneath is from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

In today’s Daily Dive, we’re covering the authorities of realized losses and nett successful the marketplace and an update to derivatives markets. With bitcoin’s terms falling, however overmuch much nonaccomplishment tin the marketplace prolong and is determination much short-term downside?

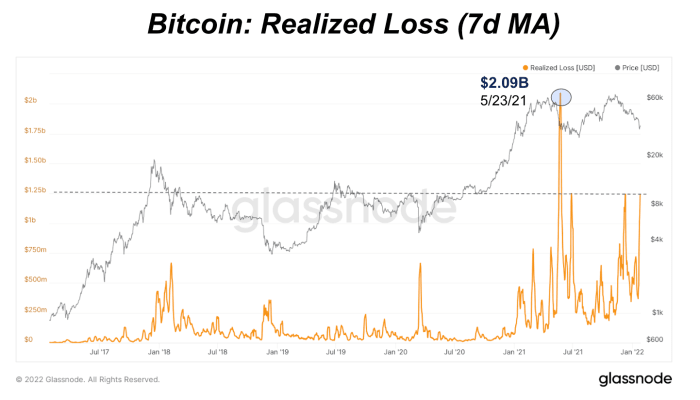

Over the past week, we’ve seen a rising level of realized losses on-chain during the latest terms drawdown. During bitcoin’s drawdowns implicit the past six months, realized losses implicit $1 cardinal connected a 7-day moving mean has been a accordant ceiling for each caller sell-off.

Back successful May, realized losses deed implicit $2 billion, the highest level successful the past 5 years, which was driven by superior derivatives liquidations.

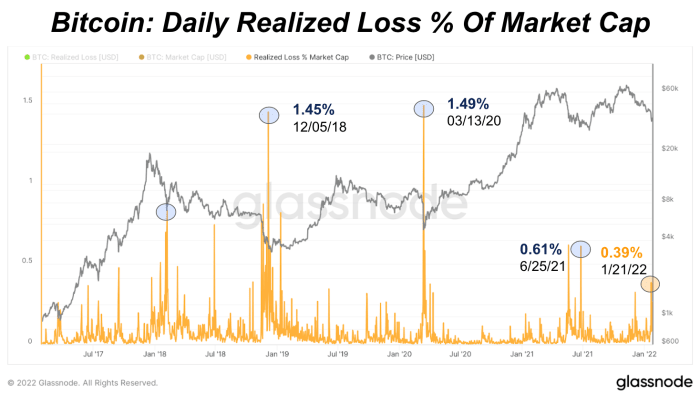

Yet arsenic a percent of bitcoin’s marketplace cap, the latest circular of realized losses and selling are comparatively tiny to marketplace capitulation we’ve seen before.

Historically, the Net Unrealized Profit/Loss Ratio (NUPL) has been a utile indicator to amusement erstwhile the marketplace is successful afloat capitulation and has bottomed. As a refresher, NUPL is calculated arsenic (Market Cap - Realized Cap) / Market Cap. Currently the full marketplace looks to beryllium successful a neutral state, but historically we’ve seen each emergence successful NUPL followed by a large capitulation period. These periods bring the marketplace backmost to (and adjacent below) the market’s outgo basis.

3 years ago

3 years ago

English (US)

English (US)