From the outside, Japanese speech Liquid looks similar a crypto occurrence story. Trading powerhouse FTX precocious acquired it for an undisclosed terms estimated to beryllium determination betwixt $140 cardinal and $200 million.

But erstwhile Liquid employees picture a chaotic workplace (even by crypto standards) with questionable information and compliance.

For example, sources accidental that executives downplayed immoderate accusation information breaches, did not disclose others, failed to adequately code low-level insider theft and prematurely stopped investigations into past year’s $90 cardinal hack.

Liquid bought its ain QASH token to support the terms done portion of the 2018 carnivore marketplace and double-counted trades erstwhile reporting its volumes, erstwhile employees said.

Senior absorption offered IOUs for Telegram’s never-issued GRAM tokens and, according to sources, ignored interior compliance squad concerns. Liquid mislaid millions connected the offering.

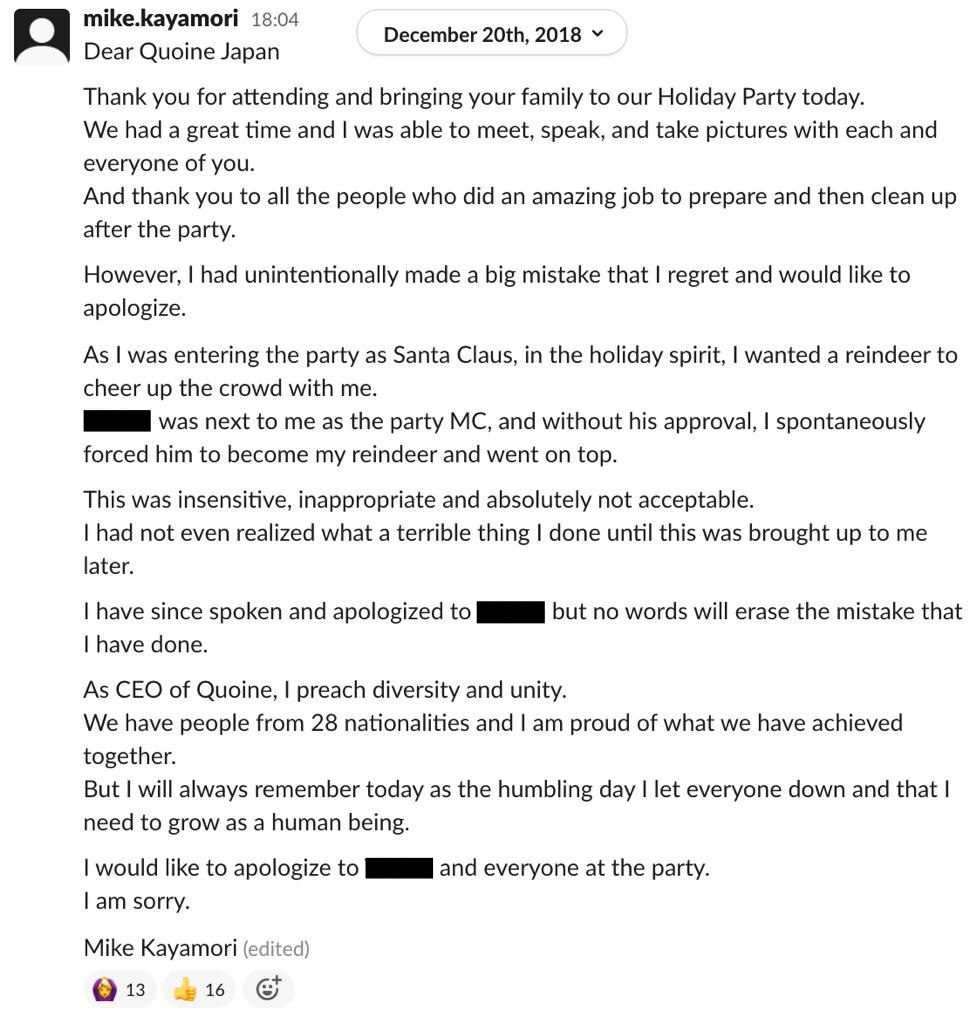

The December 2018 institution Christmas enactment was awkward, to accidental the least, for employees of the Japanese cryptocurrency speech known arsenic Liquid.

Mike Kayamori, co-founder and CEO, wore a Santa Claus suit to the party, held astatine Liquid’s office, astir 5 minutes from Tokyo Station. About 50 employees were astatine the party, immoderate of them with their children. A Black worker dressed up arsenic a reindeer.

Kayamori asked the employee, whose woman was successful attendance, to get connected his hands and knees. The CEO past mounted him similar a horse.

People stood with their drinks and watched. Holiday euphony played successful the background.

“He evidently didn’t look happy. He was trying to bash his best,” an eyewitness said of the employee.

Shortly afterward, Kayamori apologized to colleagues.

“I wanted a reindeer to cheer up the assemblage with me,” helium wrote successful a connection posted connected the company’s Slack connected Dec. 20, 2018, reviewed by CoinDesk. “I had not adjacent realized what a unspeakable happening I [had] done until this was brought up to maine later.” Kayamori added that helium had apologized straight to the worker (who soon near the company).

“I preach diverseness and unity,” Kayamori continued. “I volition ever retrieve contiguous arsenic the humbling time I fto everyone down and that I request to turn arsenic a quality being.”

The incidental speaks to absorption problems that agelong bubbled nether the aboveground astatine Liquid.

“Of each the things Mike did, I don’t deliberation that was the worst thing,” the eyewitness said. “This was minor.”

Mike Kayamori apologizes for mounting employee

From the outside, Liquid looks similar a crypto occurrence story, albeit with immoderate bumps on the road. It was 1 of the archetypal exchanges to beryllium licensed successful Japan, which boasts immoderate of the world’s toughest regulations for crypto.

Like galore exchanges, Liquid weathered hacks, including a $90 cardinal theft past August that forced it to get an exigency indebtedness from crypto derivatives speech powerhouse FTX. Led by billionaire Sam Bankman-Fried, FTX aboriginal agreed to bargain Liquid, legally known arsenic Quoine (pronounced “coin”), for an undisclosed terms successful a woody that closed connected April 4 of this year.

Over the past 5 weeks, CoinDesk interviewed much than a twelve erstwhile Liquid employees and different individuals acquainted with the exchange’s interior workings. Nearly each of them asked for anonymity for fearfulness of reprisal.

Taken together, the interviews and interior documents reviewed by CoinDesk overgarment a representation of a chaotic workplace, adjacent by the standards of a planetary crypto manufacture known for its hard-charging personalities and loosey-goosey firm cultures.

Kayamori's absorption decisions and casual cognition toward accusation information whitethorn person led to information breaches, much than 1 of which were not adequately disclosed to customers, 4 erstwhile employees said. Employees were berated and cursed at, and their concerns astir regulatory, cybersecurity and concern risks were ignored.

While immoderate employees tried to bash close by users, absorption was known to disregard their efforts.

“There are forces of bid and bully trying to marque things happen, but the existing civilization has an immune strategy seeking retired and destroying them,” a erstwhile worker said.

CoinDesk emailed Kayamori for remark connected whether Liquid complied with regulatory expectations, and whether helium had thing to accidental to erstwhile employees who expressed their unhappiness with the company’s enactment civilization and his leadership. He did not respond.

In 2017, Japan was one of the astir progressive places successful the world for crypto. It was 1 of the archetypal countries to regulate cryptocurrency exchanges, requiring them to registry with the Japanese Financial Services Agency (JFSA). Japan besides introduced a ineligible explanation of “virtual currency” successful its Payment Services Act.

“There was immense retail interest, progressive regulators and immense imaginable for the state to go a existent person successful the space,” said Steve Lee, an concern manager and caput of the Asia-Pacific portion astatine BlockTower Capital.

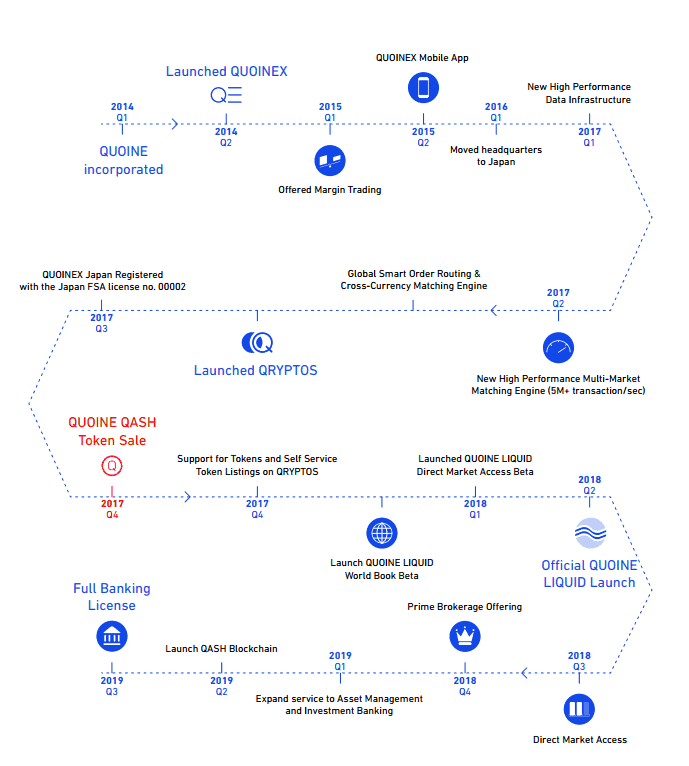

Liquid was successful the rod position. Founded arsenic Quoine successful 2014, the speech pitched itself arsenic a institution that did things by the book. It was among the first batch of companies to person a licence and ran 1 of the country’s largest exchanges. Besides Japan, it had a beingness successful Singapore and teams based successful the Philippines and Vietnam.

The institution initially operated 2 exchanges: Quoinex, which facilitated trading betwixt fiat currency and bitcoin (BTC), and Qryptos, which handled lone crypto-to-crypto trades. It aboriginal merged the two, rebranding nether the sanction Liquid.

Kayamori had a prestigious resume, having studied astatine Harvard Business School and the University of Tokyo and worked astatine SoftBank, the Japanese concern conglomerate. Co-founder Mario Gomez Lozada had worked astatine fiscal giants Merrill Lynch and Credit Suisse (CS). Kayamori dealt with the concern portion Lozada handled the exertion and improvement of fiscal products.

An aboriginal worker remembers moving retired of a tiny bureau consisting of 1 ample country that could acceptable 10 radical comfortably and 3 gathering rooms, 1 of which became an hold of the bureau owed to the deficiency of space.

“Mike was a tenable person erstwhile times were good,” different erstwhile worker said.

Kayamori talked a batch astir high-level concepts specified arsenic “financial inclusion” and “democratizing finance,” the aforesaid erstwhile worker said. “He had a vague vision, but it was mostly detached from reality.”

Then, arsenic now, crypto was an illiquid marketplace compared with accepted stocks oregon bonds, meaning a ample bid to bargain oregon merchantability a coin could beryllium hard to capable and could mightily sway marketplace prices. Kayamori claimed Liquid could lick this occupation done a pooling strategy helium called the “World Book.”

There are hundreds of crypto exchanges astir the world, each with its ain bid book, oregon database of offers to bargain oregon merchantability a fixed coin astatine a circumstantial price. Kayamori wanted to aggregate orders from planetary exchanges into 1 bid book. An connection to merchantability a token connected the U.S. speech Coinbase (COIN), for example, could beryllium matched with a bargain connection connected Liquid if some listed the asset.

World Book roadmap

Investors believed successful the vision. The institution raised astir $105 million worthy of the cryptocurrency ether (ETH) by distributing its autochthonal QASH token successful an archetypal coin offering (ICO) successful November 2017.

At its peak, Liquid’s assemblage of followers, crossed the main radical successful the Telegram messaging app, the subreddit forum connected Reddit and societal channels ran into the tens of thousands. Many of these were QASH holders.

As an speech token, QASH could beryllium utilized to wage trading fees connected the issuer’s platform. In a video from the time, Lozada said that different crypto exchanges were consenting to follow QASH and that banks and fiscal institutions would payment from doing so. But lone a fistful of different crypto exchanges listed it.

QASH was created arsenic an ERC-20 standard token moving connected the Ethereum network, but the project’s white paper (something betwixt a prospectus and a manifesto) called for the instauration of a brand-new blockchain by the 2nd 4th of 2019. Migrating to its ain blockchain would boost QASH’s value, Lozada said successful the video.

Even successful Liquid’s glory days, things weren’t rather arsenic they seemed. Kayamori claimed publically successful March 2018 that the institution was connected with much than 17 different exchanges. However, successful interior Slack messages reviewed by CoinDesk, an worker wrote that “none of the 17 exchanges ever agreed to beryllium portion of the external” World Book and that Liquid could entree Coinbase’s liquidity lone by paying the U.S. institution a fee. “We person nary authoritative statement from them,” this worker said.

That year, the U.S. Securities and Exchange Commission (SEC) went aft galore token issuers for selling unregistered securities to American buyers, but Liquid appears to person not been connected its radar. Internal records reviewed by CoinDesk amusement that 217 individuals from the U.S. bought QASH tokens successful the ICO. Those U.S. citizens who took portion successful the merchantability bought 10,294,721 tokens astatine a terms of 24 cents each, for a full of $2 million.

The ICO’s occurrence meant that Liquid had a autochthonal token and a roadworthy map. The token didn’t vessel close aft its debut, arsenic galore others did. The institution had currency to spend.

“It meant that Mike was promising each these things,” said a erstwhile employee, who called the ICO “a blessing and a curse.” QASH reached an all-time precocious of $2.45 connected Jan. 14, 2018.

“It frightened disconnected organization investors arsenic good arsenic retail investors, slowed down crypto improvement and brought tougher regulation,” Lee said. “The crypto marketplace successful Japan is inactive struggling to retrieve from that hack.”

Liquid recovered itself operating successful 1 of the world’s astir tightly regulated jurisdictions for crypto. The JFSA launched a circular of inspections and stiffened the rules.

To unafraid idiosyncratic funds, the regulator stipulated that astir customers’ assets beryllium held successful cold wallets – with the backstage keys, oregon passwords, stored successful a hardware instrumentality disconnected from the net oregon written connected a portion of insubstantial locked successful a safe.

The past large crypto carnivore marketplace began successful aboriginal 2018. Liquid’s fiscal wellness was “dented by the crypto marketplace but solvent to the constituent wherever they could tally for different twelvemonth and a fractional astatine that pain rate,” a erstwhile worker said. The institution had “at slightest tens of millions of dollars,” this idiosyncratic said.

The speech was growing, with unit numbers crossed offices ballooning from astir 50 successful 2017 to implicit 300 successful 2018. Senior absorption decided it was clip to determination to an bureau that reflected the company’s future.

In June 2018, Japan employees moved to Kyobashi Edogrand, a glass-and-steel gathering successful 1 of Tokyo’s astir costly districts. The institution occupied a abstraction of implicit 6,500 quadrate feet, paying astir $200,000 per period successful rent, 2 erstwhile employees said. The complaint was treble the city’s average.

During this period, Liquid followed champion information practices, 2 erstwhile employees recalled. The bureau featured a heavy secured “signing room” for crypto transfers. Fingerprints were needed to participate the air-gapped country (where the web was isolated from unsecured ones) and cameras watched from wrong and outside. Large withdrawals required sign-off from 1 worker successful Japan and different successful the Vietnam office, and these were processed each fewer hours.

On June 22, 2018, Japanese regulators handed retired business betterment orders to the Liquid exchange and 5 different crypto companies, requiring them to amended their hazard absorption practices. Liquid’s betterment bid hindered efforts to bash caller concern successful Japan, wherever fractional of its lawsuit basal resided.

Kayamori didn’t code the compliance issues, and alternatively blamed employees for not generating much gross successful Japan, 4 erstwhile employees said.

The co-founders started feuding. Liquid informally divided into 2 teams arsenic each laminitis tried to propulsion the different out, six erstwhile employees said.

“Their flaws astir balanced each different retired successful the beginning,” a root adjacent to Liquid said. “It got to the constituent wherever they couldn’t adjacent beryllium successful the aforesaid room.”

“Mario had grown frustrated by the dilatory gait of improvement and the repeated failures,” 1 erstwhile worker explained. Lozada believed that Kayamori had enactment the incorrect radical successful cardinal positions, different said.

Lozada wanted to make Qryptos, a crypto-to-crypto exchange, to supplement the exchange’s superior offering of facilitating trades betwixt crypto and fiat currencies, the erstwhile worker explained. Kayamori decided to enactment a young and inexperienced unit subordinate successful complaint of the project, who took a week-long abrogation 2 weeks earlier the launch.

It was the “right time, incorrect person,” the erstwhile worker said, noting that Binance launched astir the aforesaid clip and became a wildly successful crypto-to-crypto exchange.

While Lozada understood method matters amended than Kayamori, helium was not peculiarly beardown astatine execution, different erstwhile worker said. Lozada often yelled astatine inferior unit and ridiculed radical for making mistakes, helium said.

Kayamori did the same, erstwhile employees said. “He was bully and humble erstwhile helium talked to me,” said 1 source, but helium besides shouted astatine employees successful squad calls, rhetorically asking wherefore everyone was anserine and didn’t bash their occupation well.

People broke into unfastened infighting successful nationalist Slack channels. “They would conscionable spell nuts connected Slack,” a root adjacent to Liquid recalled. Abusive connection was pervasive. Team leads referred to employees arsenic “f**king idiots,” “childish,” and to their enactment arsenic “garbage.”

Liquid was highly unmeritocratic, 2 erstwhile employees said. There were standards but it didn’t look to substance if you met them. Managers awarded discretionary bonuses to those adjacent to them.

Kayamori showed “bizarre favoritism,” different erstwhile worker said, citing arsenic an illustration the assignment of chap SoftBank alumnus Katsuya Konno to Chief Financial Officer.

This idiosyncratic recounted an incidental successful outpouring 2018 erstwhile Konno was moving connected the motorboat of the Japan-focused Liquid mobile app. According to this erstwhile employee, Konno spent freely connected banner ads, yet determination was scant monitoring of advertisement show oregon advertisement targeting.

At 1 point, Liquid was notified that its Google advertizing accounts were astatine hazard of being unopen down for nonaccomplishment to wage astir $300,000 successful bills. A ligament transportation from a slope would instrumentality excessively agelong to prevention the account. So a selling section worker spent astir of her time astatine a convenience store, making 1 tiny outgo aft different until the full magnitude owed was sent to Google.

Given that the convenience store transportation bounds is usually astir 250,000 yen (about $2,000), the selling worker apt spent 5 hours making 150 transfers, this idiosyncratic estimated.

That aforesaid year, Liquid sold a ample proportionality of ether raised successful the ICO astatine what turned retired to beryllium the bottommost of the market, 2 erstwhile employees said.

“They held onto it, hedged nary of it,” 1 said, “then panic sold.”

Konno did not respond to a petition for comment.

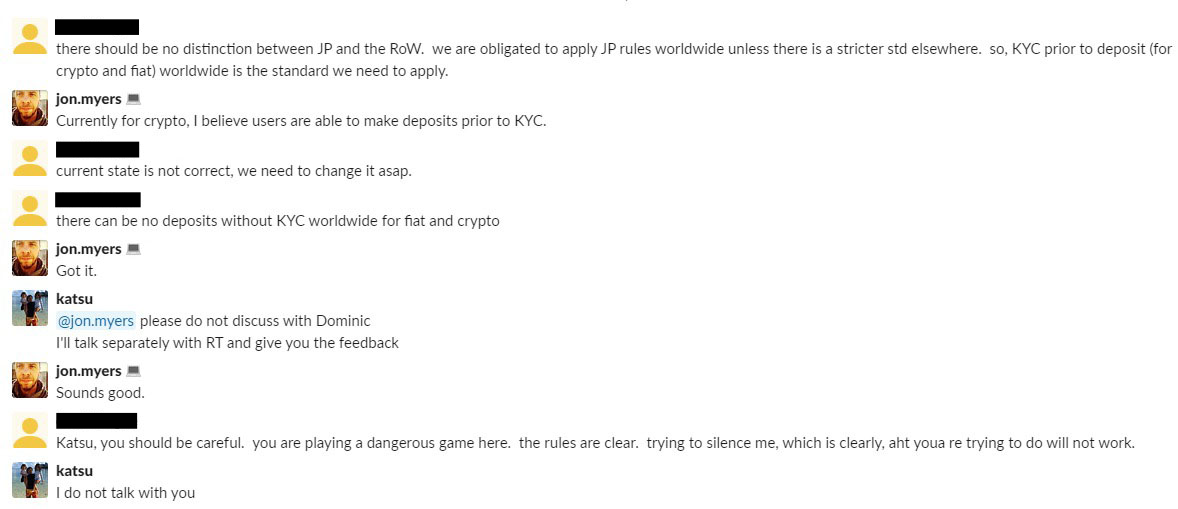

CFO Katsuya Konno responds to compliance concerns

The feud betwixt the co-founders not lone divided the company, but it meant that unit worked connected a immense scope of initiatives and products.

“When Mike and Mario were feuding implicit the company, determination were various, brainsick ‘hail Mary’ projects that they attempted,” a erstwhile worker said.

Among Lozada’s favored projects was a 100x leveraged contract-for-difference (CFD) derivative merchandise called Liquid Infinity, introduced successful April 2019 for non-Japanese customers. Such highly leveraged contracts are mostly a risky investment, and Liquid’s ain limitations made it moreso.

“The exchange’s bladed liquidity meant that immoderate medium-large bargain oregon merchantability could spike oregon clang the market,” 1 erstwhile worker explained. As a effect of those melodramatic swings, traders’ highly leveraged positions were much apt to beryllium liquidated, 2 erstwhile employees said.

Also successful April 2019, Liquid announced a U.S. task called Liquid USA. A idiosyncratic with cognition of the task said that Liquid absorption insisted Liquid USA let “basic” accounts, which did not necessitate know-your-customer (KYC) screening, adjacent though specified accounts generated small gross and were apt to beryllium frowned upon by U.S. regulators.

The venture relied connected Liquid’s technology, which this idiosyncratic described arsenic a “huge albatross.” The flagship Japanese speech sometimes crashed, the idiosyncratic said, and absorption seemed to prioritize fancy layers of tech implicit getting the fundamentals right. In precocious 2020, the U.S. task was called off.

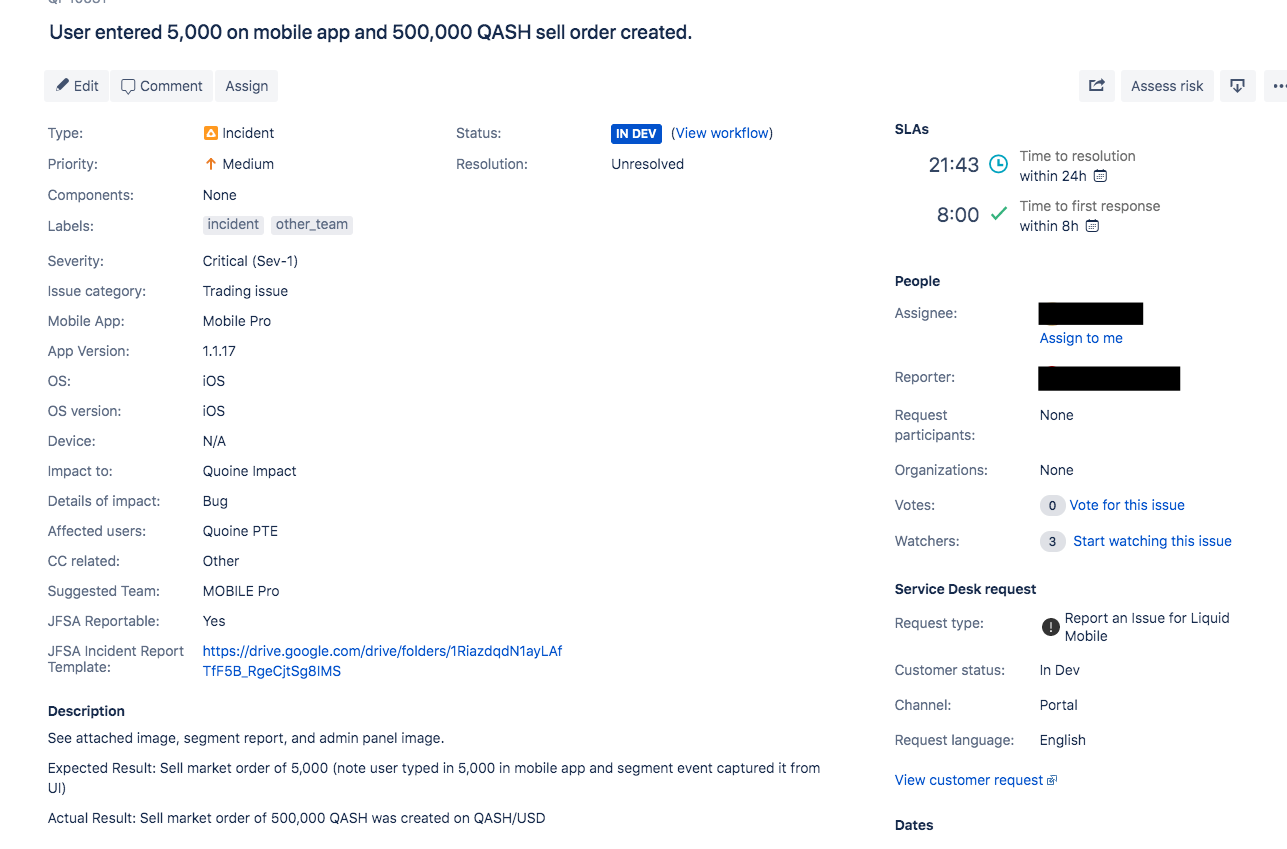

An worker flags bugs successful Liquid's system.

Throughout its history, Liquid hemorrhaged talented radical liable for halfway products, 5 erstwhile employees said.

“The bully radical near and you person radical successful roles that astir apt consciousness a spot excessively ample for them,” said Norbert Gehrke, laminitis of Tokyo FinTech, a non-profit enactment of Japan fintech enthusiasts. Gehrke invited Kayamori to talk to Tokyo FinTech members successful 2017 and is acquainted with different Liquid staff.

Liquid kept up appearances. QASH held its worth successful November and aboriginal December 2018 adjacent arsenic bitcoin and ether, the crypto market’s bellwethers, tumbled.

It did truthful thanks, astatine slightest successful part, to the institution buying its ain token to prolong the terms astatine 21 cents, Slack messages reviewed by CoinDesk show. It does not look that Liquid disclosed these purchases publicly.

QASH held dependable done November and aboriginal December 2018 adjacent arsenic crypto bellwethers BTC and ETH tanked. (TradingView)

In different messages, employees discussed the company’s signifier of double-counting trades. While the manufacture norm is to number a commercialized lone once, Liquid’s strategy recorded each commercialized twice, erstwhile for the bargain bid and again for the merchantability order. So, for instance, a commercialized of 1 BTC was recorded arsenic 2 BTC. This reporting signifier inflated the exchange’s commercialized volume, making it look much palmy than it was.

Liquid continued to marque itself “the world’s astir unafraid exchange” done 2019, though 4 erstwhile employees said that by this clip information had deteriorated.

Two of those employees described an incidental successful which a lawsuit work worker took vantage of a loophole connected the backmost extremity to make bogus accounts, utilizing head privileges to retreat tiny amounts of BTC and XRP from institution wallets. The worker made disconnected with astir $30,000 worthy of crypto.

Liquid’s now-porous information frustrated immoderate of its employees. One of them ran a “pentest,” oregon penetration test, which attained speech funds connected a thumb drive, and delivered the thrust to elder absorption to show however casual it was to breach security, 2 erstwhile employees said. Pentests are a signifier of white-hat, oregon benevolent, hacking, akin to investigating your beforehand doorway aft locking it.

During this period, Kayamori’s precedence was dressing up Liquid for sale. In April 2019, announcing a Series C backing circular of undisclosed size, he declared Liquid a unicorn, 1 of lone 2 billion-dollar companies connected Japan's startup scene.

“The rise was structured solely to get that cardinal fig retired there,” a root adjacent to Liquid said. The circular was done successful 2 parts; Liquid raised a larger magnitude of wealth astatine a little valuation, and past a tiny magnitude of wealth astatine the unicorn valuation, the root said, calling this determination “a motion of the hubris of Mike Kayamori.”

Kayamori and Konno spent astir $5 cardinal worthy of Liquid’s ICO funds buying allocations of GRAM tokens, which were meant to beryllium the autochthonal tokens for messaging app supplier Telegram’s ambitious blockchain project, the TON network.

CEO Mike Kayamori stresses the value of the GRAM IEO.

“Please enactment connected this arsenic if our endurance depends connected the occurrence of the Gram IEO due to the fact that it truly does,” Kayamori told employees connected Slack. (IEO stands for initial speech offering, a token merchantability managed by an exchange, which was a fashionable mode to administer caller crypto assets astatine the time.)

Traders successful backstage markets were buying and selling IOUs for GRAM adjacent though Telegram’s token statement prohibited buyers from selling their allocations until the web went live.

Liquid purchased the allocations not from Telegram itself but from an entity known arsenic Gram Asia, 2 erstwhile employees said. Gram Asia, successful turn, had bought allocations from different party, and truthful on.

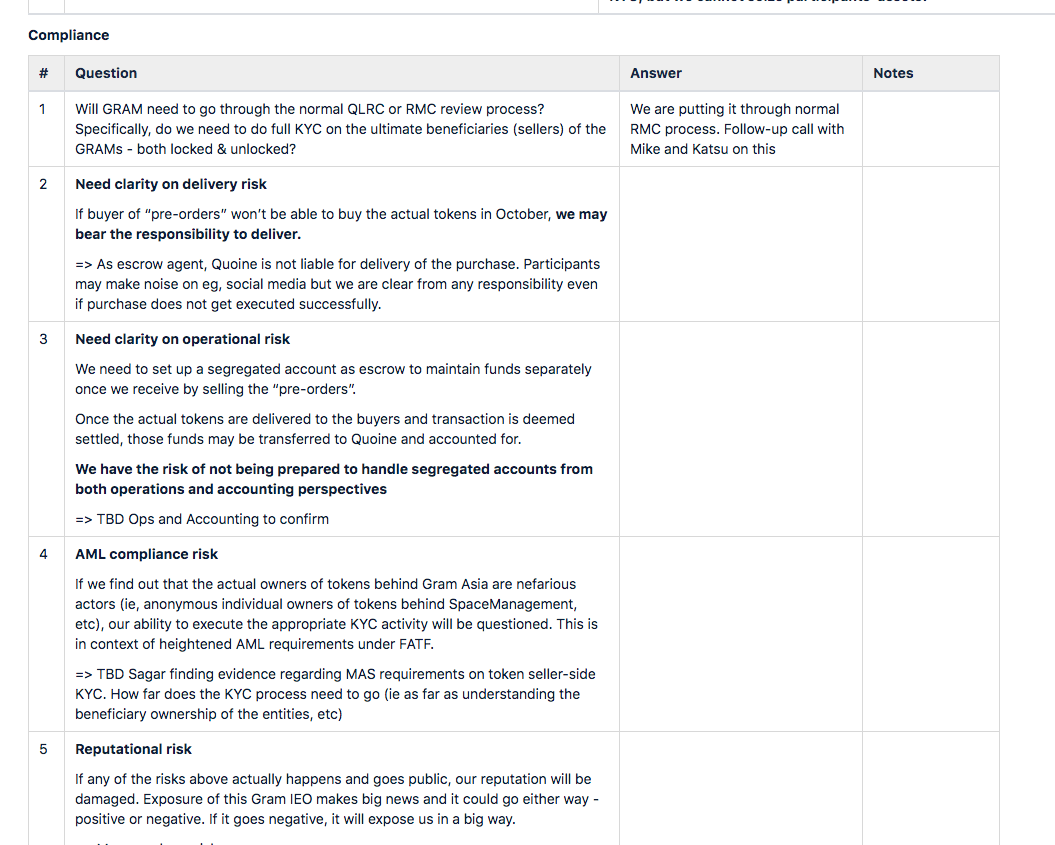

Compliance unit raised questions astir delivery risk, operational hazard and reputation risk, according to an interior document. On balance, elder absorption wanted to make speedy revenue.

Internal compliance concerns implicit GRAM IEO

In October 2019, the SEC sued Telegram, citing usurpation of U.S. securities law, and the tokens never got minted. Liquid didn’t merchantability anyplace adjacent to the magnitude of GRAM tokens it bought, nor did it recoup the funds sent to Gram Asia, 3 erstwhile employees said.

Liquid canceled the GRAM merchantability successful January 2020 and refunded the wealth to investors. The speech mislaid wealth connected the IEO, astatine slightest $5 million, 3 erstwhile employees said.

In 2020, Liquid chopped costs by moving its Tokyo office into a fourth-floor office, which is usually the cheapest, owed to the fig four’s inauspicious similarity to the Japanese connection for death.

The caller office, wherever the institution remains, was little than a 4th of the size of the erstwhile office. Unlike the erstwhile headquarters, the caller digs had nary beds, nary cafe and nary backstage rooms; employees worked successful an open-plan office.

The signing country was present a happening of the past. By this time, Liquid had started utilizing the services of a cryptographic cardinal absorption company called Unbound, which relies connected a method called multi-party computation (MPC), oregon “warm wallet” technology.

Crypto exchanges equilibrium concern interests against information risks. Users privation accelerated withdrawals, and besides expect their funds to beryllium secure. Cold, oregon offline, wallets are harmless from hackers but dilatory down withdrawals. Hot wallets, connected to the internet, are riskier yet marque withdrawals easy. In 2019, MPC exertion was a fashionable mediate option, a erstwhile Liquid worker recalled.

Spending by the C-suite continued contempt the bureau downgrade.

“They were conscionable blowing done each the wealth successful the ICO connected anserine things,” a erstwhile worker said, citing executives taking first-class flights betwixt Vietnam and Japan.

There was unit to marque Liquid rapidly profitable, which whitethorn person driven Kayamori to leap from shiny happening to shiny thing, 4 erstwhile employees said.

Liquid took five- and six-figure token listing fees arsenic precocious arsenic $250,000 from projects, an interior papers reviewed by CoinDesk shows. Their tokens were usually listed connected the planetary portion of the exchange, unavailable to Japanese customers. (The papers shows 1 pending woody with a U.S.-based task that would wage an other $100,000 for a “Japan listing” connected apical of its $150,000 fee.)

Liquid came adjacent to listing the SHOPIN token earlier the SEC charged the project’s CEO, Eran Eyal, with fraud. The institution besides onboarded the ARE token, lone to delist it little than a twelvemonth later.

Yet, astatine the aforesaid time, Liquid declined to database projects that absorption acknowledged were of precocious prime if they refused to wage listing fees, according to Slack messages reviewed by CoinDesk. (The lack of listing fees would not needfully marque listing a token unprofitable for the exchange, if it could marque wealth implicit clip connected trading fees.)

Slack speech connected token listing standards

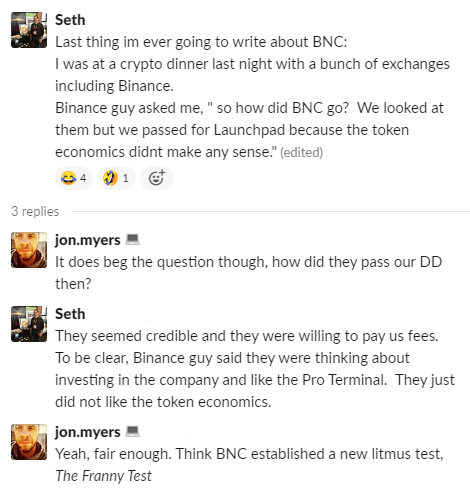

When asked by CoinDesk whether helium refused to database high-quality tokens favoring much dubious tokens instead, Seth Melamed, who headed concern improvement astatine Liquid up to November 2019, earlier becoming main operating officer, described listing integer assets arsenic a “multi-faceted process.” Considerations included owed diligence, timing and costs of exertion implementation, among different factors, helium said.

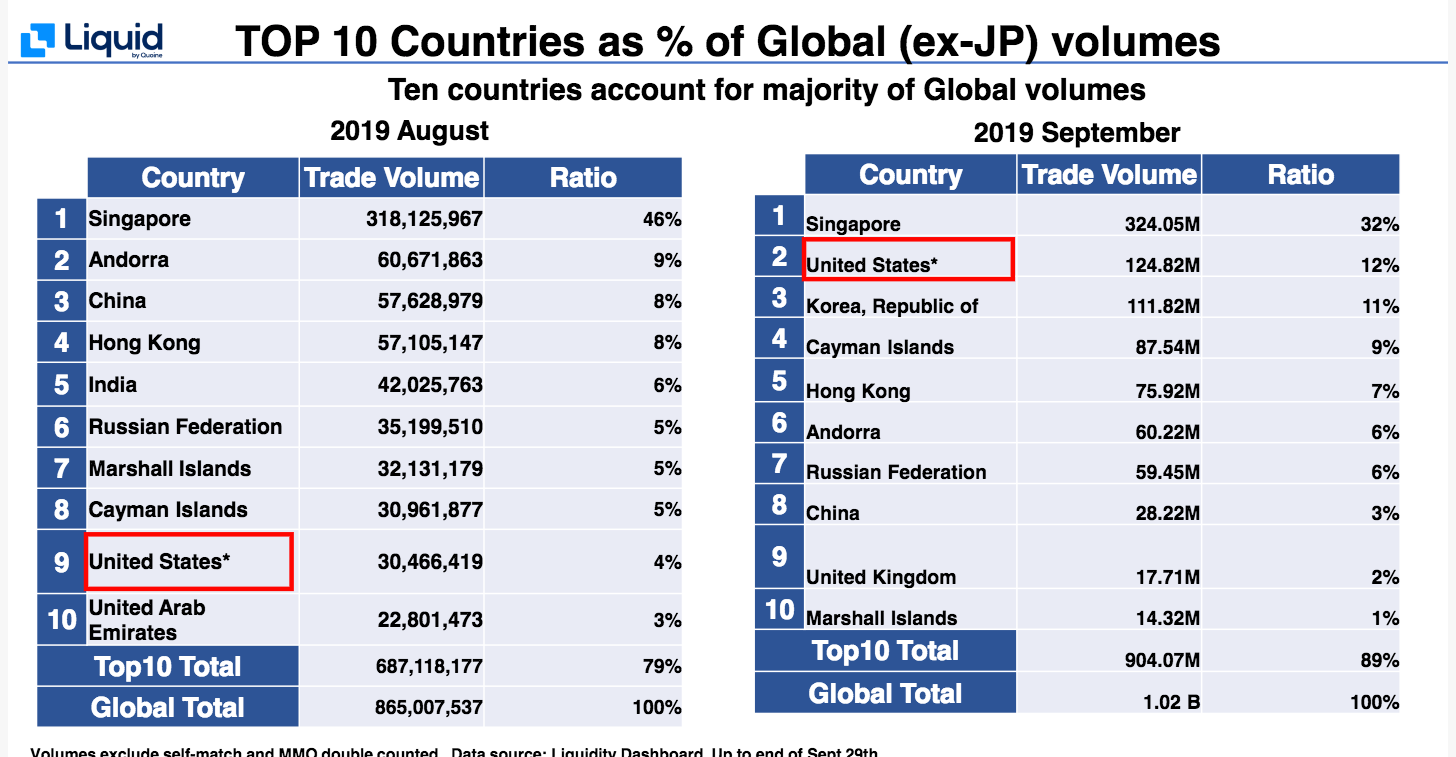

Liquid besides allowed U.S. citizens to instrumentality portion successful dozens of ICOs and IEOs, adjacent though these were not registered arsenic securities and frankincense risked putting the institution successful the SEC’s crosshairs, said a erstwhile employee.

Liquid's U.S. users

“There's inactive the question of whether the connection and merchantability of the tokens successful question suffice arsenic securities transactions, but it's decidedly going to enactment the speech connected the SEC's radar if it wasn't determination already,” said Grant Gulovsen, an lawyer successful backstage signifier who represents clients progressive successful crypto.

All the while, gathering the company’s ain QASH blockchain continued astatine a snail’s pace.

“It didn’t get capable attraction oregon manpower,” a erstwhile worker said, recalling that six to 7 developers spent a week each period gathering the QASH blockchain.

To go a palmy layer 1, oregon base, blockchain, this idiosyncratic said, QASH needed astatine slightest treble the fig of developers arsenic good arsenic to enactment unneurotic a selling run and a program to transportation radical to usage the chain.

According to interior Slack messages from the 2nd fractional of 2019, absorption realized Liquid was not going to present connected ICO capitalist expectations, specified arsenic the proprietary blockchain for QASH and the World Book.

Also during this period, Liquid took steps to capitalize connected different company’s mistake.

In November 2019, Bitmex, a high-flying crypto derivatives speech known for its leveraged futures contracts, disclosed that it had accidentally revealed tens of thousands of lawsuit email addresses successful the “cc” tract of a wide mailing.

Liquid got a clasp of these addresses and cross-referenced them with those of its ain users, according to a erstwhile worker and Slack messages reviewed by CoinDesk.

A Liquid selling manager wrote a program to tribunal existing customers who had accounts astatine Bitmex, the erstwhile worker said, due to the fact that these traders were apt to beryllium users of leverage. Liquid aimed to go their preferred spot for leveraged trading.

Targeting Bitmex customers who didn’t already person Liquid accounts would person been excessively risky, the erstwhile worker explained.

It is unclear whether Liquid ever followed done connected the plan.

Personal laptops for work

In aboriginal 2020 employees began moving remotely owed to the coronavirus pandemic. Kayamori was known not to crook connected his camera for online meetings; employees lone heard his voice. He appeared to immoderate to permission day-to-day absorption to Chief Operating Officer Melamed.

From April to June 2020, immoderate employees had to usage their idiosyncratic laptops for work.

“It was a reddish emblem due to the fact that this is simply a fiscal company” that should person provided unit with unafraid devices, a erstwhile worker said. Liquid yet solved the occupation by reallocating laptops from departing employees to those who remained, this idiosyncratic said.

“Instead of taking calculated risks, executives chopped the institution to pieces astatine the disbursal of idiosyncratic employees,” different erstwhile worker said. The institution didn’t walk wealth to capitalize connected bull runs oregon the alleged DeFi summer of 2020, erstwhile decentralized finance protocols rewarded users with generous yields for lending their tokens, this idiosyncratic said.

Kayamori persuaded the committee to ballot Lozada retired successful the mediate of 2020.

When asked astir his departure by CoinDesk, Lozada said that it was “amicable.” He did not respond to questions astir his show arsenic co-founder, nor the products and practices helium introduced.

A higher-than-usual proportionality of lawsuit work employees had entree to the idiosyncratic accounts astatine a level that meant they could alteration idiosyncratic details, presumption wallet addresses and presumption funds, a erstwhile worker said.

Chief Operating Officer Seth Melamed connected Liquid’s security

On Nov. 13, 2020, Liquid was hacked. The speech blamed information lapses astatine domain registrar and web hosting institution GoDaddy (GDDY).

The vendor “incorrectly transferred power of the relationship and domain to a malicious actor,” Kayamori wrote astatine the time. GoDaddy did not respond to CoinDesk’s petition for comment.

Kayamori claimed that lawsuit funds were accounted for, and remained harmless and secure. But 2 erstwhile employees said the afloat grade of the November 2020 hack was ne'er disclosed. Customer assets and a trove of idiosyncratic information were stolen, they said.

“Insofar arsenic Mike ever considered information astatine all, helium thought of it arsenic a merchandise that helium could buy,” a erstwhile worker said sardonically. “Yep, we bought ourselves a security. Got one, don't request to discarded immoderate much currency connected different ‘security.’”

Rival Japanese exchanges Coincheck and bitFlyer were beating Liquid domestically. JFSA lifted the concern betterment bid successful 2021, enabling Liquid to bash caller concern successful Japan, but the institution needed capital.

Two stories astir Liquid’s fiscal wellness circulated. Earnings posted successful nationalist channels and announced successful play calls made Liquid look similar it was doing well, 2 erstwhile ground-level employees said. The institution earned astir of its wealth from listing caller tokens, making $200,000 to $600,000 successful bully months, they said.

But 2 erstwhile elder staffers with cognition of the company’s finances said that Liquid was lone profitable for a fewer months successful its lifetime, adjacent with the bull runs of 2020 and 2021.

A root adjacent to Liquid said that absorption stopped reporting metrics conscionable months aft caller merchandise launches if the numbers didn’t look good.

“This isn’t lone for committee decks, this is their ain interior data,” the root said. “Mike could not basal failing.”

On Aug. 19 2021, Liquid suspended withdrawals and deposits. It claimed that it had been hacked again. The size of the hack was aboriginal reported to beryllium $90 million.

The hack brought down Liquid’s valuation, 3 erstwhile employees said. It was nary longer a unicorn. A week aft the hack, FTX extended a $120 cardinal indebtedness to the Japanese exchange.

Liquid said the wealth would spell toward “accelerating caller superior procreation projects and providing captious liquidity.” (FTX has built its estimation connected its derivatives offering and leverage products.)

Within 2 months, the JFSA awarded Liquid a Type 1 license, which allowed it to connection derivatives successful the Japan market. Without a Type 1 license, exchanges tin lone connection spot trading. Without the indebtedness from FTX, Liquid apt would not person obtained the Type 1 license, a erstwhile worker said.

There is inactive nary authoritative mentation for what happened successful the hack. Liquid called successful information teams, including situation absorption steadfast Blackpanda, to investigate.

“Blackpanda has noted that to respect the confidentiality of each clients (past and prospective) successful the crypto industry, it has declined to remark connected the substance astatine hand,” CEO Gene Yu said.

Forensic investigations into the August 2021 hack person stopped, 2 erstwhile employees said.

“Pausing a information reappraisal earlier a afloat study is made is efficaciously the aforesaid arsenic not getting one,” said Josh Smith, laminitis of Blockwell, which has been a vendor and external token auditor for Liquid for 5 years.

Liquid held non-Japanese users’ assets successful “warm” MPC wallets managed by Unbound due to the fact that Singapore, which regulated that portion of the business, does not necessitate exchanges to clasp assets successful acold wallets.

A erstwhile worker said that earlier the hack, and without her knowledge, her entree had been changed truthful that she could determination funds retired of wallets, a task good extracurricular her occupation description. When she learned this had happened, the worker said, she disquieted she would beryllium made a scapegoat for the hack.

A antithetic worker would aboriginal assertion successful tribunal papers that’s precisely what happened to her.

Wrongful-termination suit

On March 28, 2022, Liquid’s erstwhile caput of merchandise and selling successful Japan, Marisa McKnight, filed a wrongful termination suit against Quoine, the authoritative ineligible entity, claiming that she was “scapegoated” for the hack.

According to documents McKnight filed successful Singapore’s High Court, she initially enjoyed a affirmative and adjacent moving narration with Liquid’s elder absorption but aboriginal became “increasingly excluded and isolated.”

The documents assertion that aft McKnight resigned successful September 2021 (the period aft the hack), elder absorption astatine Liquid told her she was a fishy successful the breach and requested she alert to Japan.

McKnight claims she refused to question determination due to the fact that of the superior quality of management’s allegations, the two-week quarantine for travelers during COVID-19 and the information the institution did not publication her a edifice oregon instrumentality flight. She besides said successful her assertion that Kayamori threatened her. Even though she had resigned, Liquid terminated her with origin successful October 2021.

She is suing the institution for the nonaccomplishment of 60 shares, worthy $210,000, positive nonaccomplishment of estimation and nonaccomplishment of aboriginal employment opportunities. On April 19, Quoine issued its defence against McKnight’s claim, denying astir of the allegations. She filed a reply connected May 4 and the lawsuit is pending.

Five different erstwhile employees said they thought it highly improbable McKnight was progressive successful the hack.

According to Smith, the Liquid vendor, it was “nigh impossible” that McKnight hacked the speech fixed her occupation title, the level of entree it provides and the information that she worked remotely astatine the time. Smith's archetypal occupation successful crypto was shutting down an ICO hack mid-sale without a dollar lost, and helium has consulted connected implicit a twelve hacks professionally.

Were Unbound’s keys circumvented? Or did Liquid undermine Unbound’s enactment with wallets whose full backstage keys could beryllium compromised?

“Nothing successful Unbound’s MPC extortion mechanics was compromised, and the theft was not owed successful immoderate way, signifier oregon signifier by a weakness successful Unbound’s system,” Unbound CEO Yehuda Lindell told CoinDesk. Lindell added that helium was “unable to disclose what the origin of the theft was.”

A seasoned Liquid vendor said details of erstwhile hacks bespeak Liquid astatine slightest partially disregarded a cardinal facet of a unafraid system, which is having chiseled identities for antithetic unit members truthful the institution knows precisely who is accessing interior systems and when.

If that sounds excessively abstract, see the slope paper successful your wallet. Even if you person a associated relationship with a household member, each of you has a unsocial paper and PIN truthful your monthly connection shows precisely who made each ATM withdrawal oregon purchase. But if you shared your paper and your PIN with a clump of people, you’d person nary mode of knowing which 1 of them made which transaction.

“It doesn't substance however unafraid Unbound is if a azygous acceptable of credentials into the Unbound relationship is shared around,” the Liquid vendor said.

A root adjacent to Liquid astatine the clip of the hack said that, successful his opinion, it couldn't person been carried retired by idiosyncratic who wasn't straight progressive successful the implementation of the platform.

This root explained that a squad called “DevOps” ran and maintained Liquid’s systems and servers. The DevOps unit had built a strategy lone they knew however to operate. They were unafraid of managers who asked them to marque changes.

Whoever did the hack “had to beryllium idiosyncratic who built it oregon worked with it frequently, due to the fact that they had 1 accidental to get this close ... and they got it right,” the root opined.

When asked to picture what happened successful the signifier of a slope robbery analogy, this root said:

“Two slope information guards determine that they privation to rob the place. In the mediate of the night, they unfastened up a seldom-used broadside doorway that leads to the outside. They flip galore bundles of currency retired that broadside door, past 1 ties up the different and beats him up. They are trying to marque it look similar an intruder came successful that broadside door, caught the defender unawares, took his keys, grabbed the currency and fled to Neptune.”

Asked what Liquid should bash to support the assets of existent users, this root said: “Suspend operations for 90 days, instantly occurrence anyone adjacent tangentially progressive with the design, operation oregon cognition of the existing trading platform, and rebuild from scratch with untainted servers and engineers.”

Five months aft the hack, FTX announced it was acquiring Liquid Group. It intended to bargain each shares, banal options and warrants from shareholders, according to contracts reviewed by CoinDesk. The dates connected the contracts are blacked out.

A Liquid competitor, Japan crypto speech bitFlyer, was precocious valued astatine up to $370 million. Gehrke said that Liquid was apt sold astatine a discount to bitFlyer's worth arsenic a effect of the hack, truthful perchance astir $200 million. “From an FTX perspective, it's a bargain, right?” helium said.

Another root adjacent to Liquid said the institution had astir 40,000 shares. McKnight's suit and a shareholder papers reviewed by CoinDesk bespeak the per-share terms was $3510.41, truthful connected the ground of that stock count, the institution would person sold for astir $140 million.

FTX declined to remark connected Liquid’s compliance and information issues and did not reply questions astir its ain owed diligence connected the acquisition.

By acquiring Liquid, FTX gained the quality to connection derivatives successful the Japan marketplace and picked up licenses connected the cheap. Japan has been much cautious astir approving caller licenses for crypto exchanges implicit the past fewer years. Even Nasdaq-listed Coinbase, 1 of the world’s astir palmy exchanges, did not get a Japanese licence until June 2021, 3 years aft it announced plans to bash concern there.

On May 1, Kayamori emailed shareholders from FTX’s bureau successful the Bahamas, confirming that the acquisition had closed and that Liquid would present run nether the sanction FTX Japan. FTX plans to migrate its Japanese customers to Liquid's platform. Investors can swap Liquid’s QASH token for FTX’s FTT.

In his email, Kayamori said his imaginativeness for Liquid had been to supply fiscal services for all.

“We knew it was not going to beryllium casual but, to beryllium honest, I ne'er thought it would beryllium this hard either,” helium wrote. “But arsenic the 19th period German philosopher Friedrich Nietzsche erstwhile said, what doesn’t termination you lone makes you stronger. And we were capable to withstand each challenges to go portion of the FTX family.”

3 years ago

3 years ago

English (US)

English (US)