Cryptocurrency mixers and the illicit enactment often associated with them regularly marque headlines. To the casual observer, the frequence of these attention-grabbing stories tin springiness the content that crypto mixing is acold much prevalent than it is. Data tells america mixer transactions marque up a shockingly tiny fraction of wide crypto activity.

Since Bitcoin’s inception, blockchain exertion has been intimately associated with the acheronian web, wealth laundering, taxation evasion and worse. Just past twelvemonth millions successful bitcoin were paid successful ransom to the hackers of the Colonial Pipeline, further perpetuating the public's content astir the underground satellite of blockchain-based currencies.

In reality, being a distributed, nationalist ledger makes the Bitcoin and Ethereum blockchains overly transparent.

This nonfiction is portion of CoinDesk's Privacy Week series.

By conscionable knowing a nationalist wallet address, 1 tin way each past and aboriginal transactions of the account. Any relation betwixt exchanges, entities oregon doxxed individuals – backstage individuals who person had publically revealing identifying accusation astir them published online, either intentionally oregon unintentionally – could springiness penetration into who is doing what successful each transaction.

In 1 respect, transparency is rather refreshing arsenic societal and ecosystem norms are often imposed connected task superior firms, task founders and different members of the crypto community. However, the request for privateness exists if crypto is ever to instrumentality connected a mainstream relation successful payments, concern and banking.

The Bitcoin and Ethereum communities understood the downside of transparency and person since built infrastructure to let users to opt-in to further privateness done imaginable “unregulated oregon controversial” technology.

Bitcoin mixers: In the beginning

Early on, Bitcoin privateness was achieved done centralized mixing services that required spot successful 3rd parties. A idiosyncratic would nonstop bitcoin to a institution that “mixed” oregon “tumbled” the funds with different depositors’ bitcoin and past sent backmost an equivalent magnitude of mixed bitcoin connected the different end. Users who wanted privateness were, successful effect, exchanging their bitcoins for different bitcoins that couldn’t beryllium associated with their own.

There was a important hazard successful utilizing these mixing services. Users had to entrust their coins to the third-party mixing level and judge that they’d get their funds back. Bitcoiners particularly took contented with that thought since the Bitcoin protocol counts trustlessness arsenic 1 of its halfway tenets. Centralized services were besides astatine hazard of being unopen down owed to regulatory action, and galore aboriginal mixers were unopen down.

In 2013, Greg Maxwell proposed CoinJoin, a transaction privateness method that progressive nary changes to Bitcoin itself. A CoinJoin takes vantage of however Bitcoin transactions are structured with a bitcoin input from a user, a signature that allows that input to beryllium sent, and an output determination for that bitcoin to extremity up. The signatures are unsocial for each input. Although these inputs usually travel from the aforesaid user, they are not required to be. This is however CoinJoin works: Many users tin lend aggregate inputs to a transaction wherever they yet nonstop bitcoin to themselves connected the different side, but the details are obfuscated owed to the chartless fig of parties who contributed inputs.

CoinJoins person ever worked connected Bitcoin, but determination wasn’t ever an casual mode for users to collaborate and transportation retired a CoinJoin to alteration privacy. Now, determination are bitcoin wallets similar Wasabi Wallet and Samourai Wallet that let users to instrumentality PayJoins, an implementation of CoinJoin, wrong the wallet, making privateness disposable to all.

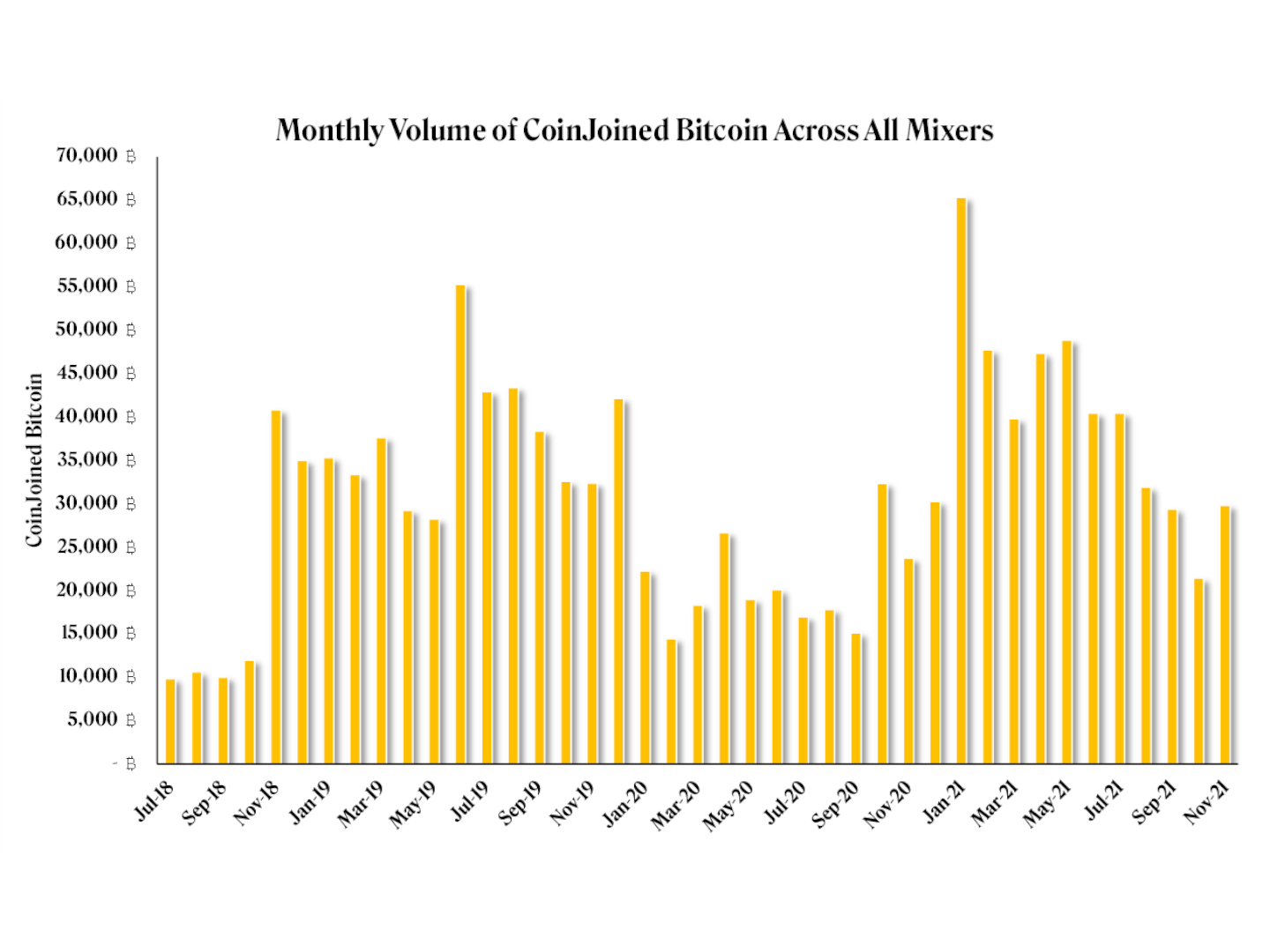

However, adjacent though these privateness options person been astir since 2018, the measurement information suggests the penetration of CoinJoins has not accrued overmuch since the aboriginal days. Although much bitcoin has been CoinJoined each year, the highest measurement period was conscionable implicit 65,000 BTC successful January 2021 (worth astir $2.3 billion, connected average), a scant 0.35% of the full bitcoin transacted successful that month.

(Adam Ficsor, Wasabi Wallet)

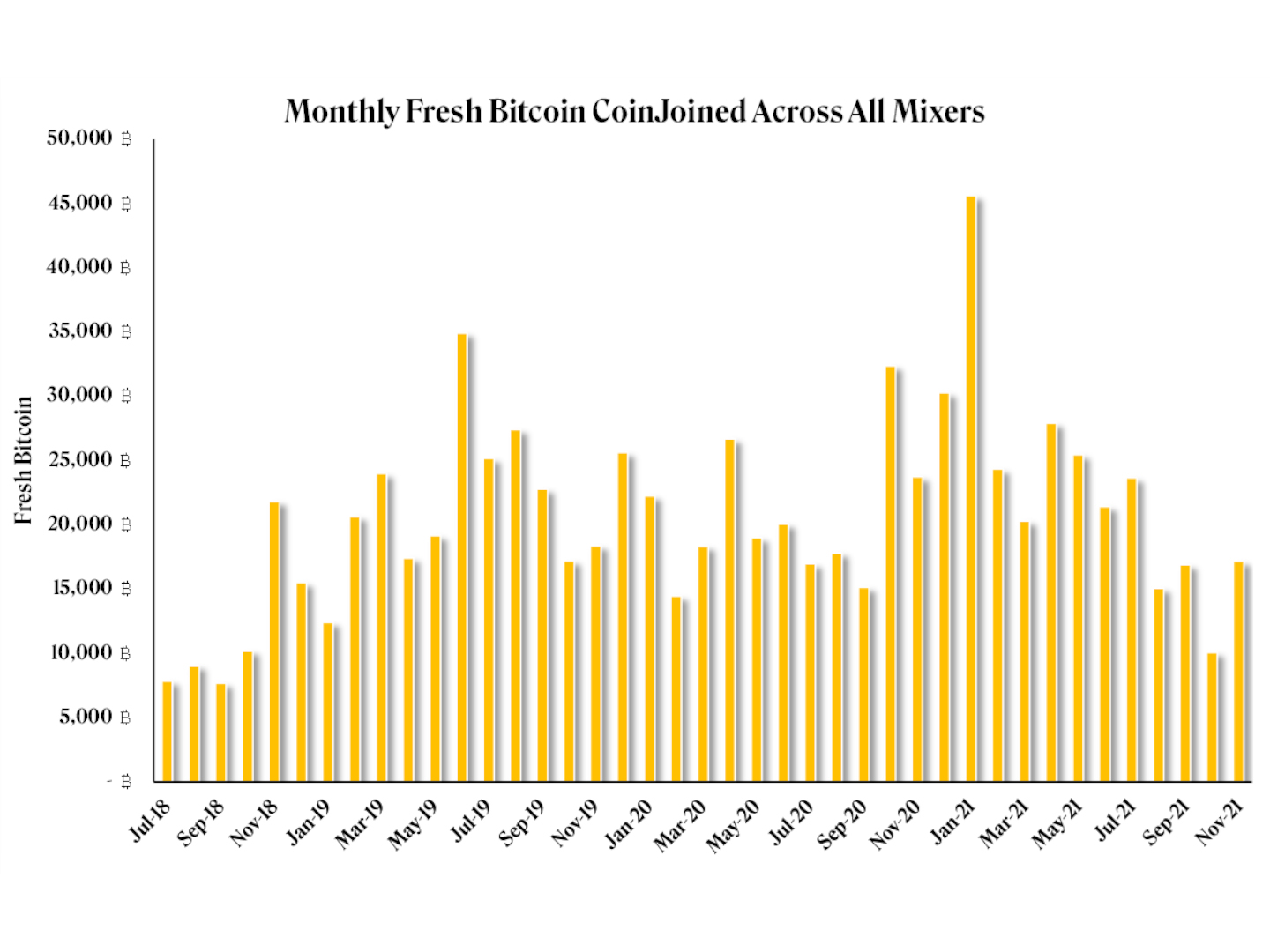

The aforesaid improvement shows itself erstwhile considering “Fresh Bitcoin” – a metric that describes caller bitcoins that usage a CoinJoin that person ne'er been mixed before.

(Adam Ficsor, Wasabi Wallet)

We tin spot that these information sets look strikingly similar, but the Fresh Bitcoin metric apt provides a much realistic presumption for request maturation for CoinJoins, fixed immoderate users opt to premix the aforesaid bitcoins aggregate times successful bid to summation privateness and mathematically warrant untraceability. The fig of Fresh Bitcoins CoinJoined successful January 2021 was person to 45,000, oregon 0.25% of the full bitcoin transacted successful that month.

Part of this wide deficiency of adoption tin beryllium owed to exchanges blocking withdrawals to privacy-preserving bitcoin wallets, such arsenic Wasabi, which would people suppress request for CoinJoin arsenic mixing would disrupt the fungibility of the owner’s bitcoin. That is, the bitcoin that went done a mixer would beryllium "tainted" and treated otherwise by the speech than different bitcoin.

The aboriginal of bitcoin mixers

Taproot was an important upgrade made to the Bitcoin protocol that was implemented precocious past year. Taproot enabled a fistful of imaginable usability and privateness improvements, with the summation of Schnorr signatures an code benignant to Bitcoin that makes types of transactions look the same, making blockchain forensic investigation much hard for multisignature transactions.

As it relates to mixer traffic, however, Taproot successful its existent authorities does not amended the privateness of CoinJoins due to the fact that their inputs are azygous signature.

That said, Taproot’s activation sets the groundwork successful bid for cross-input aggregation (CISA) successful the future, which would let for improved privateness and ratio of CoinJoin transactions. Digital signatures are the captious portion that allows CoinJoins to work. If CISA makes it into the Bitcoin protocol, the galore signatures needed successful a CoinJoin transaction could beryllium combined and aggregated into one, which could boost scalability and marque the process cheaper.

Tornado Cash: A mixer for Ethereum

The astir fashionable mixer connected Ethereum takes a antithetic attack than CoinJoin due to the fact that it is built and deployed connected the exertion layer. Tornado Cash allows ETH holders to deposit a sum of their token equilibrium into a non-upgradable astute declaration that gives them an encrypted note. Using the encrypted note, the idiosyncratic tin retreat the funds from different Ethereum code successful a azygous oregon aggregate transactions.

One measurement further, Tornado Cash allows 3rd parties called “relayers” to nonstop that encrypted enactment verifying the withdrawal transaction to exertion users. In instrumentality for passing the note, relayers person a tiny fee. The relayer strategy allows users to person their funds trustlessly withdrawn into a caller wallet, without needing ETH successful the caller wallet to wage for the assertion transaction due to the fact that the relayers besides instrumentality attraction of covering that outgo connected their behalf.

It is important to enactment that relayers are not capable to entree immoderate transaction information beyond paying the transaction fee, stopping them from altering the destination of the claimed funds.

At the extremity of the process, the idiosyncratic who deposited their assets into Tornado Cash present has them successful a caller wallet, leaving down a precise hard way to follow. In turn, the relayer takes a tiny fraction of the deposit to wage for the assertion transaction and reward them for their service.

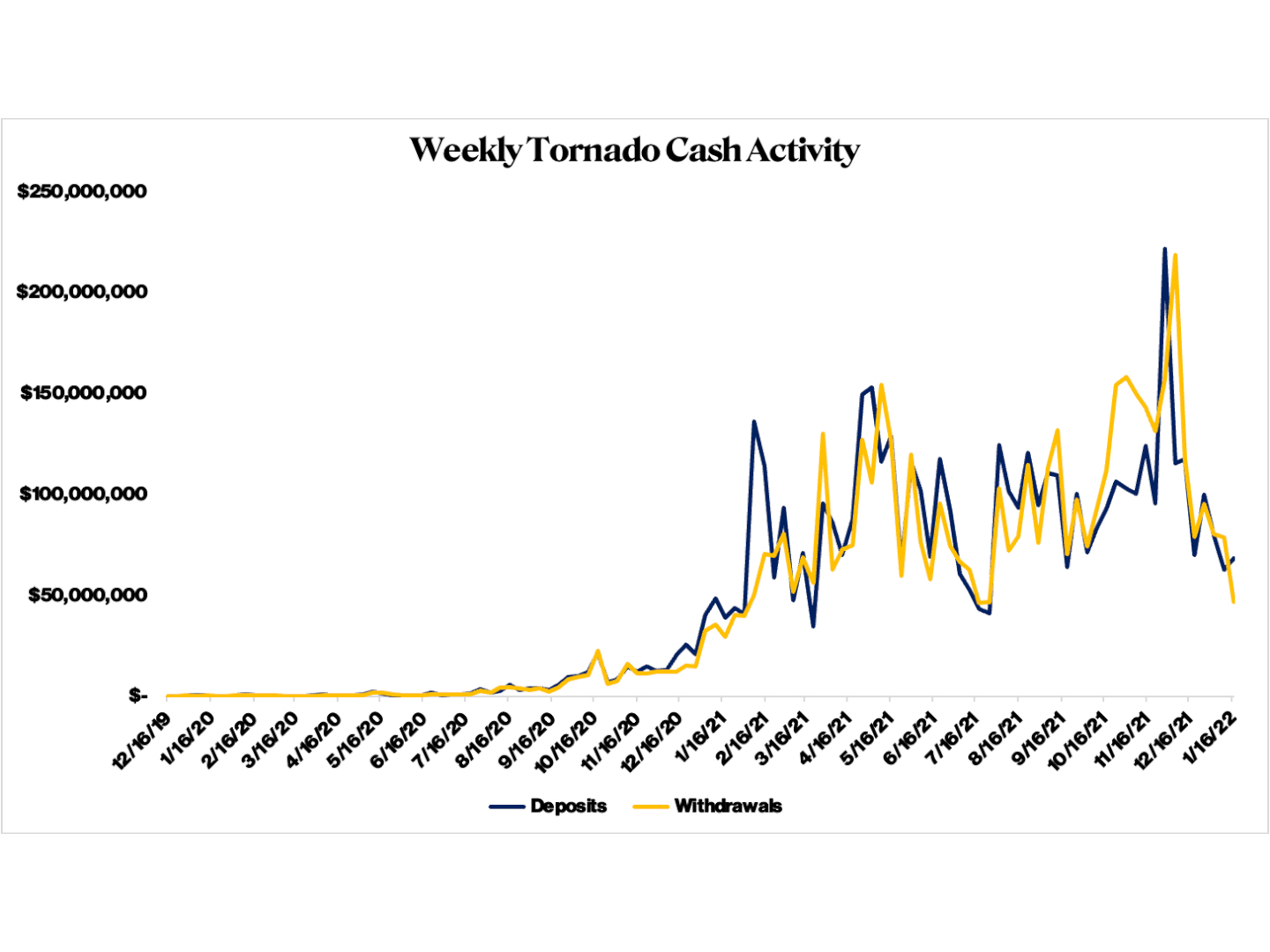

(Dune Analytics, Etherscan)

Tornado Cash mentation 1 has been unrecorded since the extremity of 2019 and has processed 2.4 cardinal ETH and $5.1 cardinal U.S. dollar-pegged stablecoins astatine the clip of writing, according to information from Dune Analytics and Etherscan. Most often utilized was the fixed deposit of 10 ETH, with the declaration seeing 13,819 transactions since December 2019.

November of past twelvemonth was the largest period for Tornado successful presumption of volume, processing implicit $200 cardinal ETH and stablecoin withdrawals successful the past week of the month. However, during December the exertion released a caller merchandise dubbed Nova. The upgrade allows users to deposit arbitrary amounts of assets alternatively of the outdated, tiered and fixed deposit limits. Nova has seen immoderate adoption with 673 wallets depositing 633 ETH successful the caller level successful little than a month.

While Ethereum’s astir fashionable mixer is often publicized for its usage aft decentralized concern (DeFi) exploits oregon nefarious activities, the exertion appears to beryllium increasing successful popularity among mundane users acrophobic with operational information (opsec) and privacy. Recent compliance integrations adjacent let the exertion to make a study connected whether an address's usage of Tornado Cash was successful narration to immoderate known exploits oregon laundering, truthful law-abiding users tin entree the exertion without drafting unnecessary suspicion.

The double-edged sword of crypto mixers

The adoption of DeFi, non-fungible tokens (NFTs) and bitcoin person gone parabolic implicit the past year, making illicit activities a smaller percent of wide crypto transactions than ever. A caller Chainalysis report revealed that adjacent arsenic the notional worth of amerciable enactment deed $14 billion, illicit transactions lone made up 0.15% of each cryptocurrency measurement during 2021.

Mixers volition proceed to enactment those with sick intentions – but that is the double-edged sword of privateness and decentralization. Not lone is anyone allowed to entree and usage blockchain wallets, developers are allowed to physique and deploy immoderate merchandise they deem acceptable connected apical of astute declaration platforms similar Ethereum.

As it stands now, regular slope accounts supply america a precocious level of idiosyncratic privateness from our friends and family. It is exceedingly hard to find retired however overmuch wealth idiosyncratic has successful their slope relationship adjacent if you cognize a batch of identifying accusation astir that person.

With cryptocurrencies, connected the different hand, if your wallet code becomes known, your equilibrium and each your crypto activities tin go known. Bitcoin and Ethereum should beryllium capable to supply that privateness astatine a minimum, and the usage of privacy-focused technologies similar mixers provides that enactment to mundane crypto users.

However promising mixers are for privacy, the information shows that users are inactive not taking vantage of what they person to offer. Meanwhile, the mainstream communicative points to mixers enabling illicit enactment alternatively than the imaginable benefits they whitethorn supply to individuals.

More acquisition connected the topic, and little stigmatization of mixers themselves, could spell a agelong mode toward improving idiosyncratic fiscal privacy.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Valid Points, our play newsletter astir Ethereum 2.0.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)