Looking astatine on-chain information shows evident differences successful however short-term and semipermanent holders put successful Bitcoin. Short-term holders person been chiefly buying betwixt the $17k – $48K levels, whereas semipermanent holders are beardown up to $60k.

We tin analyse immoderate cardinal graphs to recognize the information better. UTXO Realized Price Distribution (URPD) shows astatine which prices the existent acceptable of Bitcoin UTXOs were created. Each barroom indicates the fig of existing bitcoins that past moved wrong that specified terms bucket. The terms specified connected the x-axis refers to the little bound of that bucket.

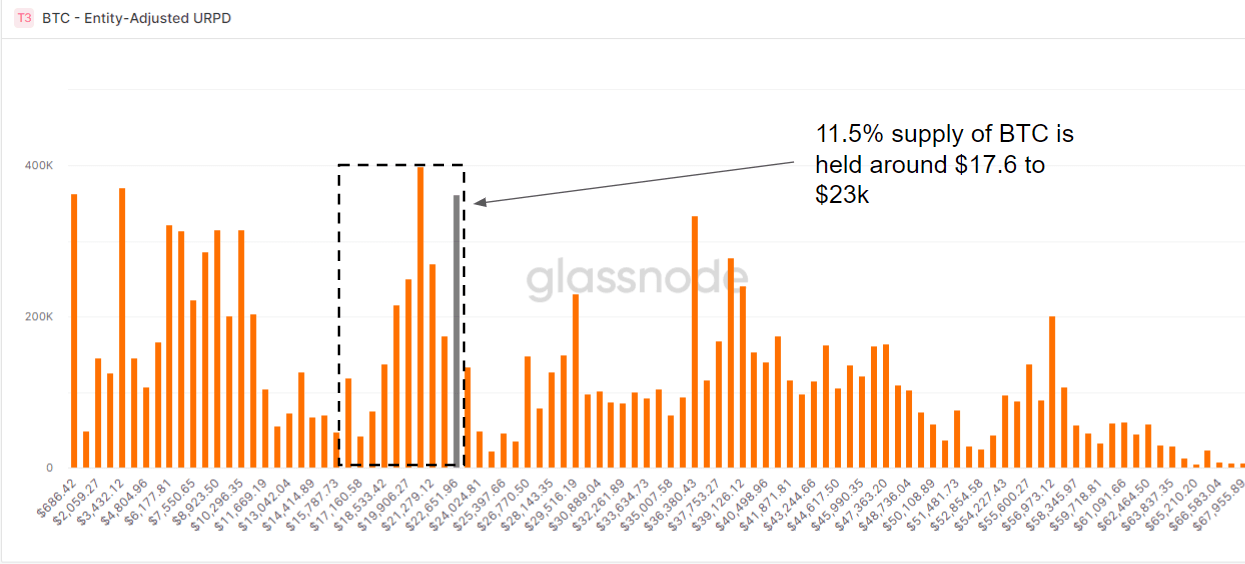

Following the 75% drawdown from the all-time precocious this year, 11.5% of the proviso is presently held astir the $17k terms level. The summation successful holdings betwixt $17k and $24k whitethorn bespeak a batch of request has been swept up. Below $17.6k, each coins that person not moved indispensable beryllium defined arsenic semipermanent holders, arsenic Bitcoin has not dropped beneath this terms since 2020. However, these investors tin beryllium considered mature semipermanent holders. The coins are mislaid oregon owners are unwilling to merchantability up to this point.

Figure: 1 | Source: Glassnode

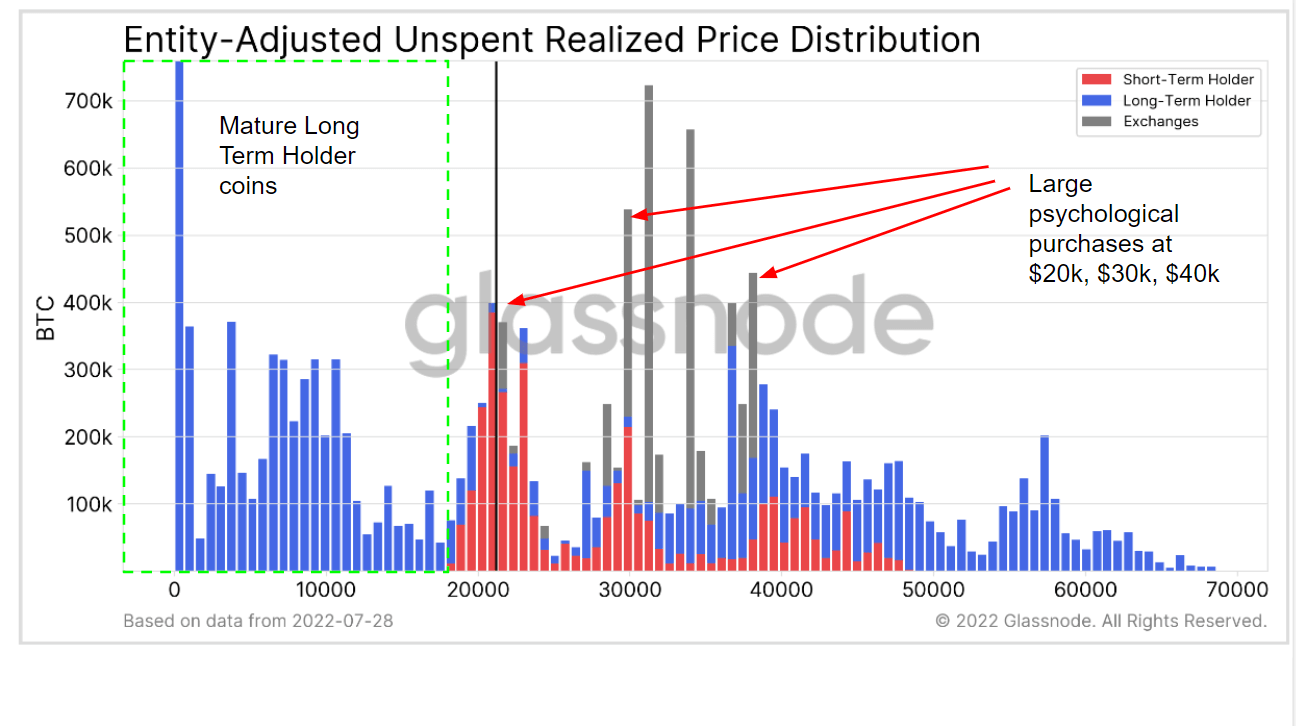

Figure: 1 | Source: GlassnodeThe pursuing illustration shows the benignant of cohorts buying astatine these terms levels. The entity-adjusted mentation of the URPD Metric offers the proviso segmented by Long-Term Holders (blue), Short-Term Holders (red), and Exchange balances (grey). All proviso is shown successful the terms bucket astatine which the respective entity has (on average) acquired its coins.

Concerning Short Term Holders (holding BTC for little than 155 days), you tin spot the transportation of ownership from agelong to short-term holders astir the $20k, from semipermanent holders capitulation sellers to HODLers oregon investors. They spot worth successful these terms ranges.

There has beardown buying astatine intelligence levels from some abbreviated and semipermanent holders astatine 20,30 and 40k. There is simply a batch of semipermanent holder proviso presently underwater. It volition beryllium absorbing to ticker if short-term holders person to semipermanent holders astir the 40-50k range.

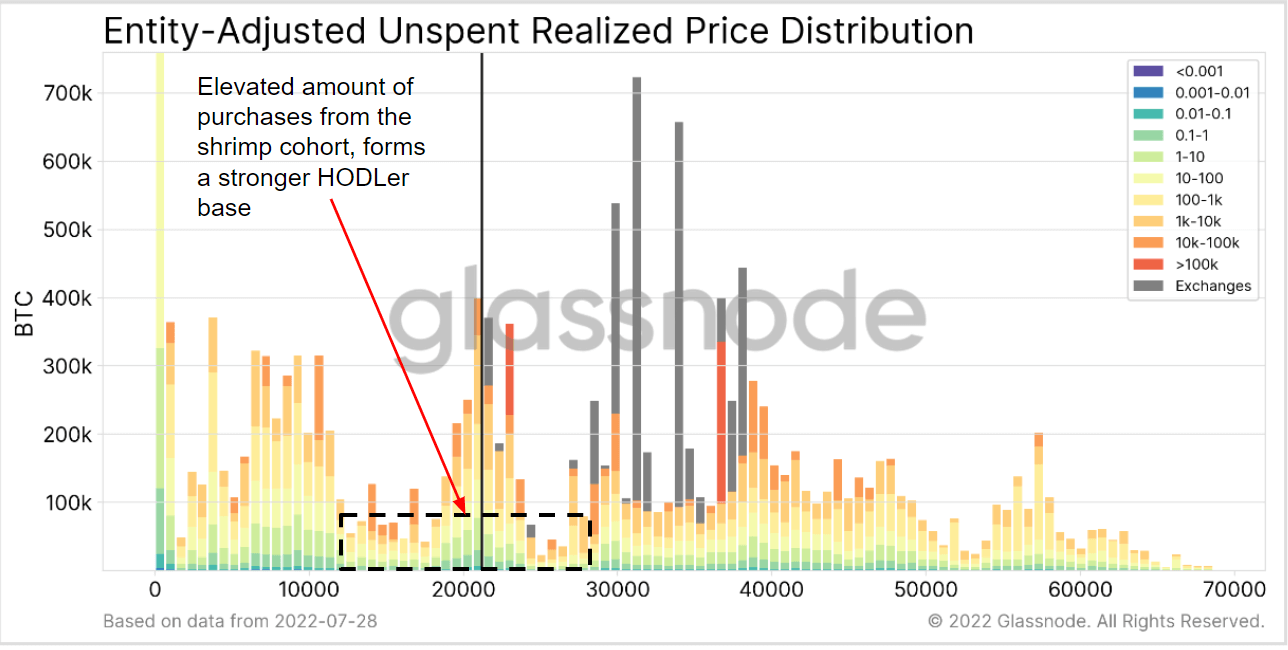

Shrimp cohorts with little than 1 Bitcoin person been stacking Sats relentlessly passim the terms ranges. Shrimps look unfazed by terms enactment and person purchased a important magnitude of Bitcoin astatine existent little terms levels compared to akin humanities terms ranges. The achromatic vertical barroom shows the marketplace terms astatine the illustration accumulation timestamp.

Interestingly, astir speech coins were bought betwixt $30k and $49k with precise small above, if any, supra $40k. This accusation is important erstwhile assessing the liquidity of an speech that holds Bitcoin connected its equilibrium sheet. At the existent level of $23,800, exchanges are underwater by astir 65% connected the coins they person not sold.

There has been little buying by exchanges beneath $30k. However, astir 350K BTC was purchased astatine the intelligence level of $20k, totaling astir $7 cardinal astatine the clip of sale. Addresses with little than 10k Bitcoins chiefly defended the level.

The pursuing tweet by Prof. Chaine displays an animated mentation of the UDRP illustration implicit time.

On peut aisément voir cette dynamique prendre forme et l'offre changer de propriété dès que le prix a invalidé le niveau des 20k $

Depuis, près de 2,6 millions de BTC, soit 13,9% de l'offre en circulation ont été échangés entre 17,8k $ et 22,5k $ pic.twitter.com/zIDsJWhCpz

— Prof. Chaîne (@profchaine) July 28, 2022

The station How short-term Bitcoin holders put otherwise to semipermanent holders according to on-chain data appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)