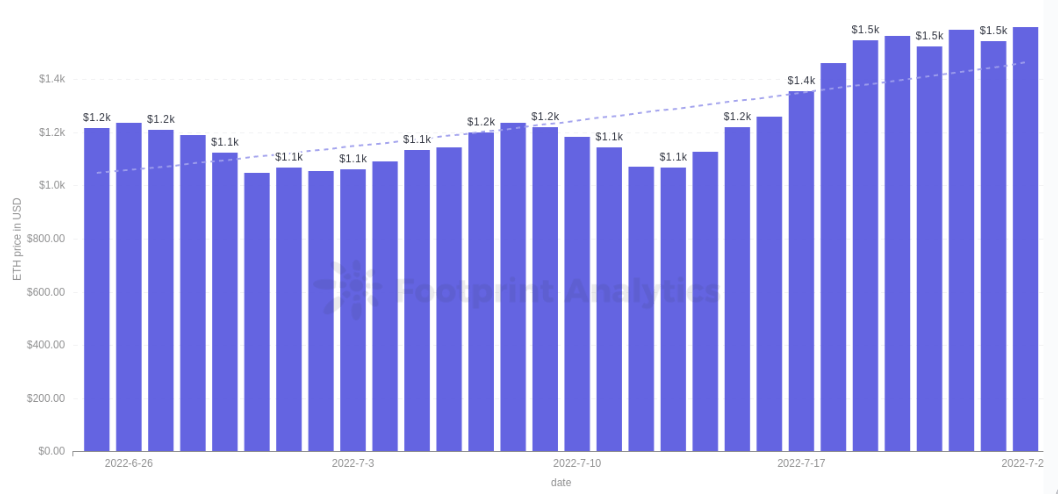

Last week, ETH saw a important uptick successful its price, pursuing the merchandise of the notes from the past dev’s gathering that hinted astatine the timeline for its upcoming upgrade, known arsenic The Merge.

ETH terms action, erstwhile 30 days – source: Footprint Analytics

ETH terms action, erstwhile 30 days – source: Footprint AnalyticsThis upgrade volition alteration however the web is secured, its vigor consumption, and tokenomics. Staking volition play an indispensable portion successful it. So however should the capitalist hole for the upcoming events?

What is The Merge?

A bid of upgrades are happening connected the Ethereum blockchain to alteration it from a Proof of Work (PoW) to a Proof of Stake (PoS) statement mechanism. For this to beryllium completed, the milestones are:

- The instauration and motorboat of the Beacon Chain happened connected Dec. 1, 2020. The Beacon Chain is what introduces the PoS connected Ethereum. Because of this, it is called the “consensus layer.”

- Replace the statement mechanics of the existent concatenation from PoW to PoS (current estimate: happening successful September.) The existing chain, Mainnet, volition past enactment arsenic the “execution layer”, arsenic the existent PoW moving it volition beryllium replaced by the Beacon Chain.

The statement furniture volition instrumentality attraction of the information of the network. The execution furniture is wherever the astute contracts tally and the transactions are created.

As the upgrade volition link these 2 chains to enactment arsenic one, the sanction of this lawsuit was updated from ETH 2.0 to “The Merge.”

Why The Merge Matters

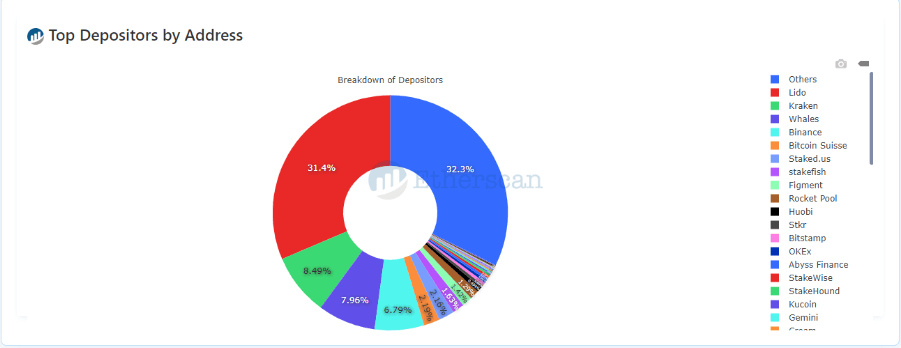

Top Depositors by Address

Top Depositors by AddressAs the Beacon Chain is already moving since December 2020, a bully portion of the ETH proviso is already being staked connected it, receiving rewards for moving the network. Currently, determination is implicit 12 cardinal ETH staked connected the Beacon Chain astute contract:

That fig is astir 10% of the existent ETH supply. Furthermore, this ETH is locked long-term, arsenic determination is nary day for deploying the unstaking capableness nether the PoS ETH chain.

How it affects the ETH emissions

After the alteration for PoS, determination volition beryllium nary much mining rewards. Therefore, the ETH emissions volition driblet significantly, connected apical of that 10% proviso already locked connected the staking contract.

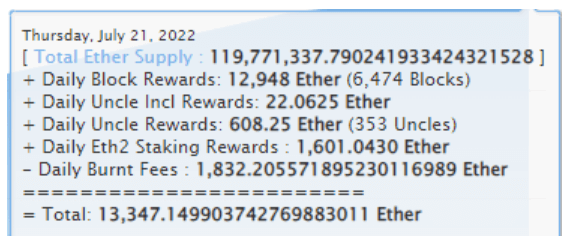

Total ETH Supply

Total ETH SupplyAs per Etherscan, a full of 13,347 ETH was added to the existent proviso connected July 21. If we region the Block Rewards (mining) and permission lone the Staking Rewards (staking), the regular nett effect would beryllium negative. That means that much ETH would beryllium burnt arsenic fees than rewarded, lowering the ETH full supply.

How to Capitalize connected This Shift

None of the pursuing is meant to beryllium fiscal advice, and investors should ever proceed with utmost caution erstwhile trading cryptocurrencies. Analyzing the information presented, determination are immoderate concern strategies that an capitalist could take:

Buy ETH

With the merchandise of a somewhat steadfast day for “The Merge,” determination is simply a abbreviated play wherever ETH proviso volition proceed to grow. After that, it volition go “deflationary.” If the capitalist believes that ETH volition person a applicable spot successful the crypto markets and its request volition increase, the ETH terms volition rise. We saw immoderate terms enactment already happening, but determination is inactive country for much upside, arsenic the inducement to summation the magnitude of ETH staked (and retired of circulation) volition rise.

Buy liquid staked ETH

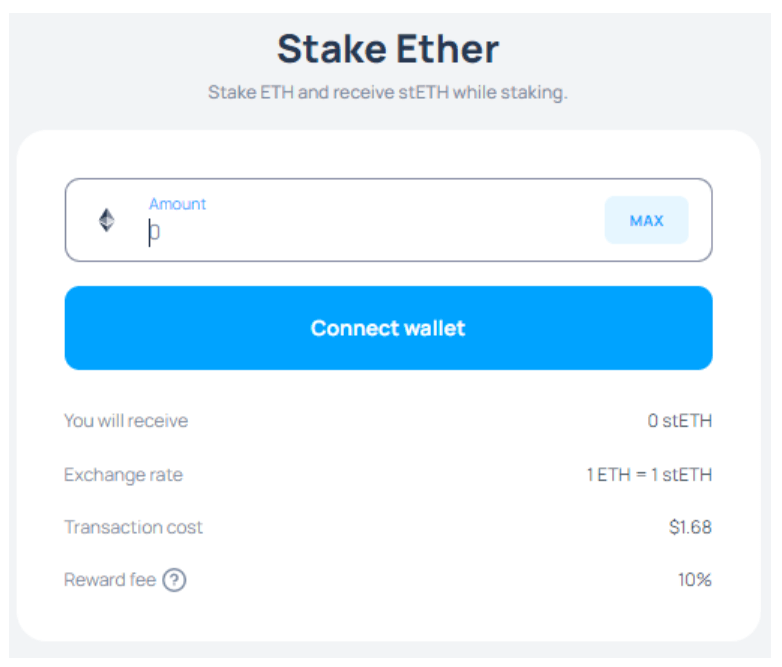

As the ETH sent to the Beacon Chain staking declaration is locked for an chartless period, and the minimal magnitude needed to beryllium sent is comparatively precocious (at slightest 32 ETH), pools were created to assistance users to involvement their ETH. Some of these pools past created an ERC-721 token arsenic a tradeable receipt of that staked ETH.

Examples are the Lido’s stETH token and the Rocket Pool rETH. When the idiosyncratic accesses their level to involvement ETH, their token is minted 1:1 to ETH.

Source: Lido Finance

Source: Lido FinanceHowever, arsenic it is simply a receipt for aboriginal redemption, it is traded with a discount compared to the ETH price. This discount is not fixed; the marketplace determines its value, arsenic we tin spot in the Footprint illustration below:

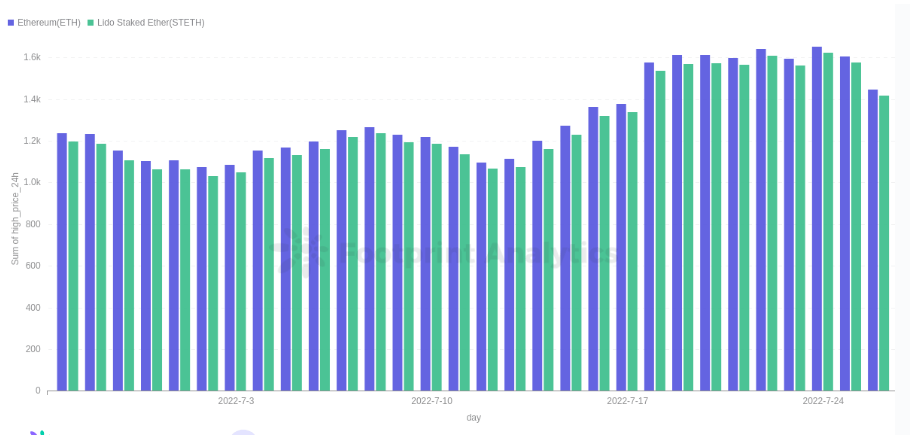

ETH and stETH terms action, erstwhile 30 days – source: Footprint Analytics

ETH and stETH terms action, erstwhile 30 days – source: Footprint AnalyticsBuying the staked mentation would springiness the capitalist an other 2-3% instrumentality and the accruing involvement that comes with it if helium is consenting to hold for the merchandise of the unstaking diagnostic aft the implementation of the PoS connected the Ethereum Blockchain. There is nary owed day for the deployment of this diagnostic (the unstaking), but the unsmooth timeline is 6-12 months aft “The Merge”

Key Takeaways

In the agelong term, the ETH terms volition emergence with The Merge—if Ethereum retains its applicable and ascendant spot successful blockchain and the blockchain manufacture continues to grow—as the token volition displacement from an inflationary emanation to a deflationary one. With the proviso shrinking and the request staying the aforesaid (and astir apt increasing), this is the logical terms action.

For other opportunities to summation the gains, buying a liquid-staked mentation of ETH tin bring further profits if the capitalist tin hold much time, arsenic the staked mentation often has a discount implicit the spot ETH price.

The Footprint Analytics assemblage contributes this portion successful July 2022 by Thiago Freitas.

Data Source: The Merge

The Footprint Community is simply a spot wherever information and crypto enthusiasts worldwide assistance each different recognize and summation insights astir Web3, the metaverse, DeFi, GameFi, oregon immoderate different country of the fledgling satellite of blockchain. Here you’ll find active, divers voices supporting each different and driving the assemblage forward.

Connect with Footprint

The station How should investors hole for The Merge? appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)