In precocious November, a pseudonymous crypto trader down the Twitter grip @GiganticRebirth issued a warning to his legion of implicit 85,000 followers.

“High assurance interval that we're precise precocious successful the rhythm [and that cycles inactive exist],” helium wrote. “Secure your state if you've won it.”

@GiganticRebirth, who besides goes by GCR (an acronym for Gigantic-Cassocked-Rebirth), said helium was feeling progressively bearish astir the cryptocurrency market, which had conscionable enjoyed a 20-month-long bull tally that showed nary signs of stopping.

As others shilled predictions of “a caller crypto supercycle” oregon “bitcoin to $100K,” GCR was readying a different, contrarian trade: a large short, oregon a large stake against overvalued altcoins that would make monolithic profits if his bearish views played out.

To propulsion disconnected the trade, helium says helium assembled a smattering of part-time crypto researchers, ranging from a nonrecreational poker champion to a aesculapian student. They shared their findings with each different successful a Discord transmission and traded connected their own.

GCR says helium shorted astir 30 antithetic tokens crossed aggregate exchanges astatine the tallness of crypto fervor past November. In January, helium tweeted retired a screenshot of a trading dashboard from the FTX crypto exchange, purportedly showing large profits from the gambit.

And without rather wanting to uncover his existent identity, helium present wants to archer his story.

“The marketplace statement is that nary 1 saw this coming,” GCR told CoinDesk successful a telephone call. “I saw it coming, I took action."

Over the past 13 years, the crypto manufacture has minted billionaires who were aboriginal to bitcoin and held onto the plus arsenic its terms mounted a seemingly inexorable climb.

But successful the notoriously volatile satellite of cryptocurrencies, timing these accelerated marketplace cycles has proved acold trickier. In fact, there's nary telling whether profitable trades tin beryllium replicated successful the future.

The clang that started successful precocious 2021 and extended done January sent the full crypto marketplace capitalization plummeting from a precocious of $3.1 trillion successful November to $1.7 trillion successful precocious January, astir wiping retired fractional of its value. Breaking adjacent during a marketplace downturn is difficult; profiting is adjacent harder.

GCR's communicative offers besides a model into the quirky satellite of crypto markets, wherever idiosyncratic traders sometimes squad up to speculate connected volatile plus prices, hoping their corporate appraisal proves right.

To corroborate the cardinal elements of GCR’s story, a CoinDesk newsman talked to him and respective of his collaborators via telephone calls, Telegram messages and Discord chats. Nearly each of them declined to supply their existent names, asking to beryllium identified lone by their pseudonymous Twitter and Discord handles. However, GCR has a reputation, arsenic evidenced by the precocious five-figure pursuing helium has built connected Twitter successful the past year. He besides regularly appears – nether the moniker Gigantic-Cassocked-Rebirth – connected the FTX exchange’s Top 100 Traders leaderboard, which ranks users by nett and loss. (Currently he’s No. 12).

With faint echoes of “The Big Short,” Michael Lewis’ publication (adapted into a deed movie) astir Wall Street misfits who stake against the frothy U.S. lodging market, present is the communicative of however 1 autarkic crypto trader appears to person predicted past year's marketplace top, collaborating with a ragtag squad of alpha hunters.

It each started successful October, erstwhile a radical of crypto traders assembled successful a Discord chat to absorption connected 1 of the biggest marketplace catalysts of the year: whether the U.S. Securities and Exchange Commission (SEC) would assistance support for a hotly anticipated bitcoin futures exchange-traded money (ETF).

If the radical could spot and digest the determination minutes, adjacent seconds, earlier the remainder of the market, they mightiness beryllium capable to nett disconnected a determination successful bitcoin’s price.

To prepare, the squad of pseudonymous collaborators – they didn't stock their existent names with each different connected Discord – spent days researching arcane regulatory filings and coding web-scraping bots.

On Oct. 15, 2021, astatine 4:15 p.m. ET, a web-scraping bot pinged the Discord radical arsenic soon arsenic an announcement went up: A caller SEC filing had conscionable been posted regarding the Proshares Bitcoin ETF.

The news: approved (or technically, not opposed). The bot notification gave the radical capable clip to bargain bitcoin earlier overmuch of the satellite had clip to process the bullish news. The terms of bitcoin instantly popped to astir $59,000 from $57,100.

The terms of bitcoin instantly popped to $59,000 from $57,100 upon quality of the ETF approval. (Messari)

A ‘decentralized’ hedge fund

The squad down the ETF experimentation called itself RebirthDAO, a "decentralized autonomous organization" founded by GCR.

In astir blockchain-related conversations, a DAO is simply a decentralized enactment powered by a token that confers voting rights; this was truly conscionable an informal radical that met successful a Discord channel.

“The thought was to signifier a decentralized hedge fund,” GCR told CoinDesk successful 1 of a bid of telephone calls and Telegram exchanges. “A abstraction wherever radical could get unneurotic and look for alpha.”

Alpha refers to the excess returns that immoderate investors question to pouch supra and beyond emblematic marketplace returns, known arsenic beta. The pursuit often relies connected bespoke strategies; successful some crypto and accepted fiscal markets, alpha is hard to execute and trading secrets are intimately guarded.

“GCR had told maine aboriginal connected that DAOs were going to alteration the industry,” Discord idiosyncratic fungible0x, a subordinate of the radical who acts arsenic liaison betwixt GCR and the moderators, told CoinDesk successful a Discord call. “From the beginning, helium knew determination were galore astute minds to collaborate with successful crypto. He saw a vacuum for that benignant of space.”

GCR, the driving person down RebirthDAO, regularly ranks precocious connected a intimately watched database known arsenic the FTX Top 100 Traders by PNL oregon “FTX Leaderboard.”

The moniker, helium says, was a randomly generated username from FTX that helium has stuck with passim the years.

To beryllium helium was the aforesaid trader arsenic shown connected the FTX Leaderboard, GCR concisely changed his show sanction determination to a Gmail address, and past communicated with CoinDesk via email with that account.

The leaderboard is not lone a scorekeeper for the FTX exchange’s 100 astir profitable trading accounts, but besides doubles arsenic a who’s who of the crypto industry’s apical traders; making the chopped is considered an awesome feat. Other highly ranked traders see Three Arrows Capital, seen arsenic an manufacture heavyweight.

FTX Leaderboard for Feb. 15, 2022. (FTX)

Since mid-2020, GCR has amassed a cultish legion of implicit 85,000 Twitter followers. The relationship has attracted speculative retail “copy-traders” who commercialized according to his recommendations.

In summation to his marketplace calls, his governmental tweets person ranged from correctly predicting the retirement of Supreme Court Justice Stephen Breyer to betting connected the underdog run of French Presidential campaigner Valérie Pécresse.

Since switching implicit to crypto, GCR’s contrarian marketplace calls person earned him recognition from Three Arrows Capital's Su Zhu.

“For 3 1/2 years, I did not instrumentality a azygous time off,” said GCR erstwhile asked astir his trading background. “You person to sacrifice virtually everything.”

“He’s a benevolent assassin,” RebirthDAO subordinate and Discord idiosyncratic Pxeo said of GCR successful a telephone telephone with CoinDesk. “He’s precise bully astatine cutting done things to get to the information of the situation. There are nary amended marketplace sentiment accounts connected Twitter.”

On Nov. 22 - conscionable 12 days aft bitcoin peaked astir $69,000 but astatine a clip erstwhile immoderate commentators were inactive calling for a $100,000 price by year-end - GCR tweeted retired his astir arguable prediction yet.

He was “back and shorting” the market, conscionable arsenic bitcoin and Ethereum's ether notched caller all-time highs and immoderate crypto traders crowed that a "supercycle" mightiness transportation prices adjacent higher.

“You conscionable had each froth indicator. The full marketplace headdress of each crypto successful November was astatine its peak, implicit $3 trillion,” said GCR. “There was highest euphoria and content successful eternal cycles. It was truly contrarian astatine the time.”

In summation to perceiving a gloomy macro climate, GCR besides had beardown condemnation successful seasonality. In 2017, conscionable earlier the past prolonged carnivore market, bitcoin and different cryptocurrencies had begun falling successful December; by aboriginal 2018, it was a full-blown meltdown.

To GCR, the signs pointed to an evident caller trade: abbreviated the market.

He believed the champion mode to nett disconnected of the inevitable sell-off would beryllium to stake against overbought altcoins, which stood to suffer up to 90% of their worth successful a carnivore market.

“We knew that the Fed was going to awesome a much hawkish stance,” said GCR. (A much assertive attack by the Fed to tame ostentation would undermine the “digital gold” lawsuit for bitcoin and/or spur selling by investors who viewed the cryptocurrency arsenic a hazard asset. And wherever bitcoin goes, the remainder of crypto follows.)

“Everyone had been saying for each of 2021 that they would merchantability everything, fastener successful gains,” GCR went on. “Once the sell-off started to really happen, radical recovered progressively convoluted excuses for wherefore the rhythm would support connected going.”

After the occurrence of the ETF project, RebirthDAO acceptable its sights connected a caller trade: a large short.

“Everyone dropped what they were doing and started probe connected what helium presented arsenic the champion opportunity,” said fungible0x.

Discussion and probe for ‘the large short’ commercialized occurred successful a backstage chat successful RebirthDAO’s Discord. (CoinDesk screenshot)

On Nov. 26, GCR enactment retired an unfastened telephone to his legion of Twitter followers: He was hiring researchers to look into the distribution, unlocking and vesting schedules for dozens of tokens.

“The immense bulk of the marketplace had a portion of these tokens erstwhile they went up,” said Pxeo. “Some radical adjacent had them since they were a mates of cents. They thought, ‘How tin you abbreviated it?’ It’s unnatural.”

Upon an archetypal coin offering (ICO) oregon archetypal speech offering (IEOs) – somewhat akin to archetypal nationalist banal offerings, but for cryptocurrencies – projects typically merchantability a information of their liquid tokens to the public, portion different illiquid portions are allocated among squad members, the project's treasury and task superior investors.

These locked tokens travel a years-long vesting docket that sets retired what percent of the token proviso volition beryllium unlocked and eligible to beryllium sold astatine circumstantial clip intervals.

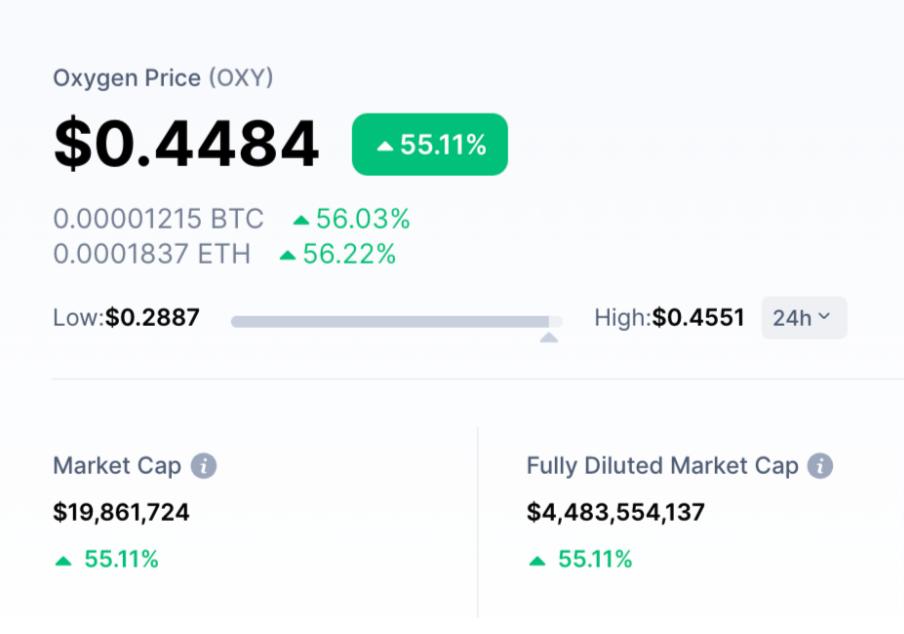

The tokens are typically characterized by a large quality betwixt their afloat diluted marketplace capitalization and circulating marketplace capitalization. A precocious ratio is associated with a ample proportionality of "locked" tokens – those that can't beryllium transacted oregon traded.

“It creates a level of ostentation that volition necessitate an unthinkable magnitude of caller wealth to prolong the baseline price,” GCR explained to CoinDesk.

Eventually, the reasoning went, immoderate unlocks – predetermined schedules astatine which locked tokens are deemed disposable for trading – would flood the marketplace with a monolithic proviso of further tokens, depressing prices.

Example: OXY's circulating marketplace headdress of astir $20 cardinal is dwarfed by its afloat diluted marketplace headdress of astir $5.5 billion. (CoinMarketCap)

Although determination are astir 3,000 members successful RebirthDAO, lone 50 to 60 members person earned an exclusive "Alpha" designation, which allows those members to entree restricted chat rooms and discussions wherever profit-generating trading ideas are exchanged.

To summation admission, a prospective subordinate indispensable "audition" by sharing immoderate of their winning trading strategies with a fistful of DAO administrators, who measure candidates based connected the prime of their alpha. (No outgo is required.)

“It became truly wide during the ETF task that determination were immoderate superstars,” said fungible0x, who said the DAO closed to caller members owed to capableness constraints. “We had to truly absorption the effort. The champion mode to bash that was to make an ‘alpha’ group.”

CoinDesk was granted entree by GCR to the group's Alpha chats (without an audition). Conversations successful the Discord channels focused connected respective trading themes, including "The Big Short," "Macro Task Force" and "News Trading," arsenic good arsenic aggregate web-scraping bots.

According to the group’s "Introductions" channel, members’ backgrounds span from erstwhile poker champions to aesculapian students, with galore having had trading acquisition successful crypto oregon accepted fiscal markets.

“The tone is conscionable sharing and pushing the radical to spot if we tin virtually foretell what volition hap to the marketplace done our quality to research,” said an Alpha subordinate of the group, Pxeo. “Working together, we were decidedly getting much information.”

While GCR provided a targeted database of tokens and the cardinal trading thesis, the analysts would independently probe the unlocks and past reconvene to robust retired immoderate conflicting information.

“Token unlock schedules are amazingly public, but precise vague,” said Pxeo, who contributed to The Big Short project. “They’re usually conscionable a non-interface graph. You person to inquire the task devs to verify.”

Alpha members were encouraged to personally talk with the squad members assigned to the tokens successful question to pinpoint close figures, which often diverged from information connected sites similar CoinGecko oregon CoinMarketCap.

They besides relied connected blockchain analysis, specified arsenic pursuing task treasury wallets, liquidity supplier wallets and task squad wallets.

“You tin already cognize connected the task broadside that an unlock is coming, but you don’t cognize what dates oregon however galore tokens,” said fungible0x. “We looked astatine thing on-chain and not on-chain to enactment unneurotic the organisation of the circumstantial token successful question and verify the unlock schedule.”

After weeks of research, the researchers identified a database of astir 30 highest-conviction tokens to short.

“It’s a ample task due to the fact that determination were truthful galore coins,” said Pxeo. “But it became evident successful the archetypal 2 to 3 days that the champion mode to abbreviated was done the Solana ecosystem.”

Px

eo said immoderate of the identified Solana-based tokens included SERUM, STEP, SOLENS, OXY and FIDA.

“The metaverse coins were besides implicit garbage,” continued Pxeo. “They had nary infrastructure. It was truthful obvious.”

Other shorted tokens, according to GCR, included Gala’s GALA (-77% from November all-time high), IoTeX’s IOTX (-80%), The Sandbox’s SAND (-64%), Ethereum Name Service’s ENS (-80%), Gitcoin’s GTC (-76%), Livepeer’s LPT (-75%) and Axie Infinity’s AXS (-69%).

These tokens person each massively underperformed bitcoin (-45%) and ether (-49%), arsenic good arsenic the broader cryptocurrency marketplace (-45%).

“Most altcoins volition ne'er retrieve backmost to their all-time highs,” GCR told CoinDesk.

“The immense bulk volition inclination to zero and beryllium replaced with caller narratives and caller rotations. Things tin spell overmuch much little than radical realize.”

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)