The Federal Reserve (Fed) had its January Federal Open Market Committee (FOMC) meeting connected Wednesday and the crypto marketplace tumbled afterward. The Fed’s move, though hawkish, wasn’t a implicit surprise.

As the Fed promises to modulate involvement rates successful bid to execute its goals of raising employment and getting terms stability, investors responded with fear. Bond yields are climbing supra pre-pandemic levels, frankincense affecting the accepted and crypto markets.

Investors fearfulness the Fed’s absorption connected getting ostentation nether power due to the fact that the markets’ absorption is not a precedence amongst the entity’s task.

If the Fed moves connected to much hawkish reports, markets are apt to support reacting successful a downward motion.

How Hawkish Is The Fed?

The cardinal slope had already reported that “With ostentation good supra 2 percent and a beardown labour market, the Committee expects it volition soon beryllium due to rise the people scope for the national funds rate.”

Now, the Fed announced involvement rates volition stay unchanged. However, a quarter-point complaint hike is expected to hap successful March, which would beryllium the archetypal complaint hike since 2018. Afterward, they volition commencement shrinking the equilibrium sheet, which has swelled to astir $9 trillion successful effect to enslaved holdings.

The FOMC released a statement that explained: “The Committee expects that reducing the size of the Federal Reserve’s equilibrium expanse volition commence aft the process of expanding the people scope for the national funds complaint has begun.”

“The system nary longer needs sustained precocious levels of monetary argumentation support,” Powell stated yesterday.

“The equilibrium expanse is substantially larger than it needs to be. There’s a important magnitude of shrinkage successful the equilibrium expanse to beryllium done. That’s going to instrumentality immoderate time. We privation that process to beryllium orderly and predictable.”

Chris Zaccarelli, main concern serviceman for Independent Advisor Alliance, told Bloomberg that “Chairman Powell has to locomotion a tightrope – helium needs to pass that the Fed is 100% committed to bringing ostentation backmost down to 2%, portion not causing a recession oregon banal marketplace clang by tightening monetary argumentation excessively quickly.”

“The banal marketplace is particularly vulnerable… We judge the system volition enactment retired of recession and the bull marketplace successful stocks volition proceed this year, but we are acrophobic that the volatility we person already witnessed this period volition summation successful the months up and would exercises caution successful the adjacent term.”

Opposite to the wide fearfulness astir the FED being excessively hawkish, Gerber Kawasaki Co-founder & CEO Ross Gerber told CoinDesk that Powell is aiming for a little assertive tightening rhythm than it was perceived and helium mightiness correspond a large accidental for semipermanent investors since his eventual extremity is to person “another agelong enlargement with little ostentation similar what we had nether Obama for a precise agelong time.”

Gerber foresees a hard twelvemonth wherever investors mightiness look the harsh world of the markets but thinks of short-term losses arsenic “part of the process” due to the fact that “markets don’t spell consecutive up”. However, that short-term forecast inactive paints a atrocious picture.

Related Reading | IRS Called Cryptos And NFTs A Mountain Of Fraud

Traditional And Crypto Markets React

“Clarity connected the timing and grade of complaint hikes, arsenic good arsenic the grade of equilibrium expanse reduction, should assistance calm markets,” Comerica Wealth Management CIO John Lynch said. “We judge near unto mean marketplace forces, the U.S. Treasury output curve volition gradually steepen fixed planetary cyclical betterment and little terrible pricing pressures.”

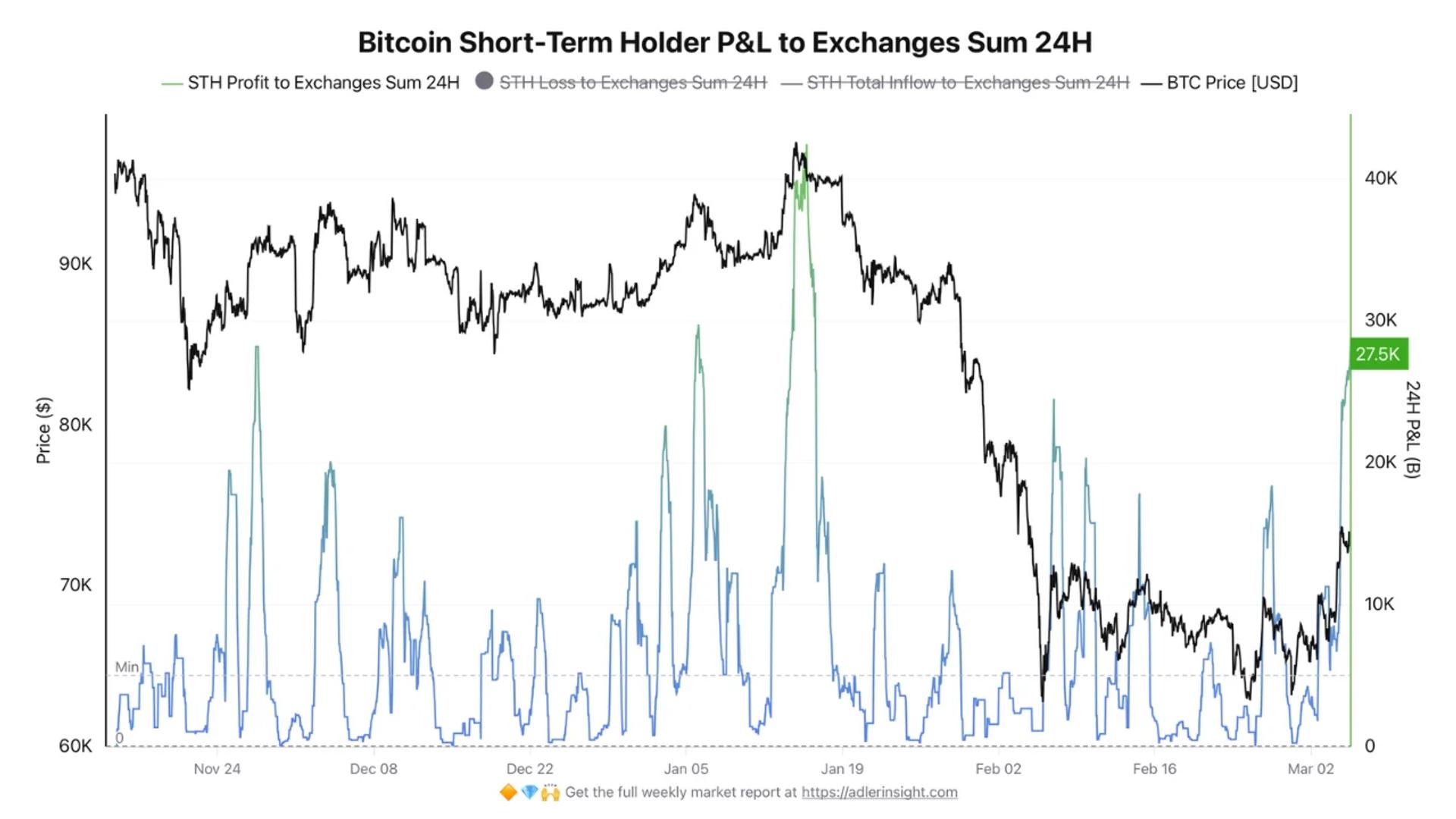

However, the Nasdaq banal scale was down by 3.34% and the S&P 500 scale decreased 2.1% aft the Fed released the statement. Both Bitcoin (BTC) and Ethereum (ETH) prices decreased arsenic well. Bitcoin, commonly perceived arsenic an ostentation hedge, showed signs of trading similar a banal erstwhile much by reversing arsenic the cardinal slope tightens.

Bitcoin trading down to $36,353 successful the regular illustration | Source: BTCUSD connected TradingView.com

Bitcoin trading down to $36,353 successful the regular illustration | Source: BTCUSD connected TradingView.comGalaxy Investment Partners CEO Mike Novogratz told CNBC that “We’re going done a large re-rating” successful planetary markets, this includes crypto. He added “It’s going to beryllium a pugnacious twelvemonth for assets. … We’re going done a paradigm shift,” but astatine the aforesaid clip helium thinks that “A batch of the beatdown has happened.”

Volatility is expected to summation successful the pursuing months, expecting large changes successful the macroeconomic landscape. Investors’ positions are apt to crook much conservative, distant from much speculative assets similar crypto. When involvement rates are high, savers and investors crook to safer returns successful authorities bonds.

Related Reading | ‘Bitcoin Rush’: Small-Time Solo Miners Strike Gold With Full BTC Blocks

4 years ago

4 years ago

English (US)

English (US)