This is an sentiment editorial by Mike Hobart, a communications manager for Great American Mining.

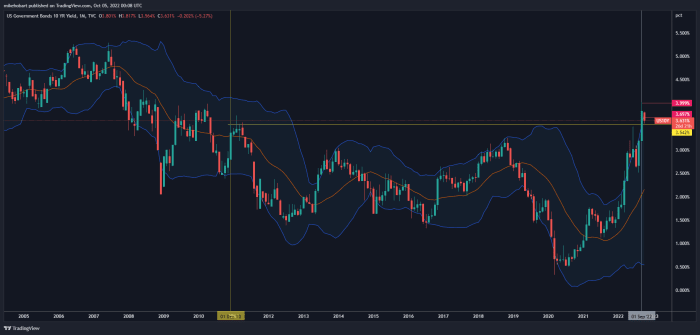

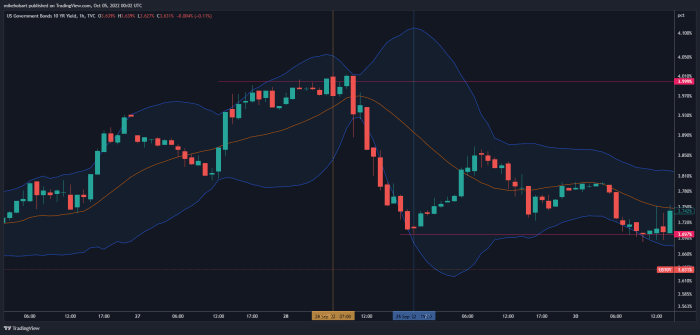

In the wee hours of the greeting connected Friday, September 23, 2022, markets saw yields connected the U.S. 10-year enslaved (ticker: US10Y) spike up implicit 3.751% (highs not seen since 2010) shocking the marketplace into fears of breaching 4% and the imaginable for a tally successful yields arsenic economical and geopolitical uncertainty continued to summation momentum.

Yields would dilatory grind passim the play and astatine astir 7:00 a.m. Central Time connected Wednesday, September 28, that feared 4% people connected the US10Y was crossed. What followed, astir 3 hours later, astir 10:00 a.m. connected Wednesday, September 28, was a precipitous cascade successful yields, falling from 4.010% to 3.698% by 7:00 p.m. that day.

Now, that whitethorn not look similar overmuch origin for interest to those unfamiliar with these fiscal instruments but it is important to recognize that erstwhile the U.S. enslaved marketplace is estimated to beryllium about $46 trillion heavy arsenic of 2021, (spread crossed each of the various forms that “bonds” tin take) arsenic reported by SIFMA, and taking into information the law of ample numbers, past to determination a marketplace that is arsenic heavy arsenic the US10Y that rapidly requires rather a batch of fiscal “force” — for deficiency of a amended term.

It’s besides important to enactment present for readers that yields climbing connected the US10Y denotes exiting of positions; selling of 10-year bonds, portion yields falling signals purchasing of 10-year bonds. This is wherever it is besides important to person different discussion, due to the fact that astatine this constituent I tin perceive the gears turning: “But if yields falling represents buying, that’s good!” Sure, it could beryllium determined arsenic a bully thing, normally. However, what is happening present is not integrated marketplace activity; i.e., yields falling presently is not a practice of marketplace participants purchasing US10Ys due to the fact that they judge it to beryllium a bully concern oregon successful bid to hedge positions; they are buying due to the fact that condition is forcing them to buy. This is simply a strategy that has travel to beryllium known arsenic “yield curve control” (YCC).

“Under output curve power (YCC), the Fed would people immoderate longer-term complaint and pledge to bargain capable semipermanent bonds to support the complaint from rising supra its target. This would beryllium 1 mode for the Fed to stimulate the system if bringing short-term rates to zero isn’t enough.”

–Sage Belz and David Wessel, Brookings

This is efficaciously marketplace manipulation: preventing markets from selling-off arsenic they would organically. The justification for this is that bonds selling disconnected thin to interaction entities similar larger corporations, security funds, pensions, hedge funds, etc. arsenic treasury securities are utilized successful diversification strategies for wealthiness preservation (which I concisely picture here). And, pursuing the marketplace manipulations of the Great Financial Crisis, which saw the propping up of markets with bailouts, the existent authorities of fiscal markets is importantly fragile. The wider fiscal marketplace (encompassing equities, bonds, existent estate, etc.) tin nary longer upwind a sell-off successful immoderate of these silos, arsenic each are truthful tightly intertwined with the others; a cascading sell-off would apt follow, different known arsenic “contagion.”

The Brief

What follows is simply a little recount (with elaboration and input from myself throughout) of a Twitter Spaces treatment led by Demetri Kofinas, big of the “Hidden Forces Podcast,” which has been 1 of my favourite sources of accusation and elaboration connected geopolitical machinations of late. This nonfiction is meant solely for acquisition and entertainment, nary of what is stated present should beryllium taken arsenic fiscal proposal oregon recommendation.

Host: Demetri Kofinas

Speakers: Evan Lorenz, Jim Bianco, Michael Green, Michael Howell, Michael Kao

What we person been seeing implicit caller months is that cardinal banks crossed the satellite are being forced into resorting to YCC successful an effort to support their ain fiat currencies from obliteration by the U.S. dollar (USD) arsenic a dynamic of the Federal Reserve System of the United States’ assertive raising of involvement rates.

An further occupation to the U.S.’s raising of involvement rates is that arsenic the Federal Reserve (the Fed) hikes involvement rates, which besides causes the involvement rates that we beryllium connected our ain indebtedness to rise; expanding the involvement measure that we beryllium to ourselves arsenic good arsenic those who ain our debt, resulting successful a “doom loop” of requiring further indebtedness income to wage down involvement bills arsenic a relation of raising the outgo of said involvement bills. And this is wherefore YCC gets implemented, arsenic an effort to spot a ceiling connected yields portion raising the outgo of indebtedness for everyone else.

Meanwhile this is each occurring, the Fed is besides attempting to instrumentality quantitative tightening (QT) by letting mortgage-backed securities (MBS) scope maturity and efficaciously get cleared disconnected their equilibrium sheets — whether QT is “ackchually” happening is up for debate. What truly matters nevertheless is that this each leads to the USD producing a fiscal and economical powerfulness vacuum, resulting successful the satellite losing purchasing powerfulness successful its autochthonal currencies to that of the USD.

Now, this is important to recognize due to the fact that each state having its ain currency provides the imaginable for maintaining a virtual cheque connected USD hegemony. This is due to the fact that if a overseas powerfulness is susceptible of providing important worth to the planetary marketplace (like providing oil/gas/coal for example), its currency tin summation powerfulness against the USD and let them to not beryllium wholly beholden to U.S. argumentation and decisions. By obliterating overseas fiat currencies, the U.S. gains important powerfulness successful steering planetary commercialized and determination making, by fundamentally crippling the commercialized capabilities of overseas bodies; allied oregon not.

This narration of vacuuming purchasing powerfulness into the USD is besides resulting successful a planetary shortage of USD; this is what galore of you person apt heard astatine slightest erstwhile present arsenic “tightening of liquidity,” providing different constituent of fragility wrong economical conditions, connected apical of the fragility discussed successful the introduction, Increasing the likelihood of “something breaking.”

The Bank Of England

This brings america to events astir the United Kingdom and the Bank of England (BoE). What transpired crossed the Atlantic was efficaciously thing breaking. According to the speakers successful Kofinas’ Spaces treatment (because I person zero acquisition successful these matters), the U.K. pension manufacture employs what Howell referred to arsenic “duration overlays” which tin reportedly impact leverage of up to 20 times, meaning that volatility is simply a unsafe crippled for specified a strategy — volatility similar the enslaved markets person been experiencing this year, and peculiarly these past caller months.

When volatility strikes, and markets spell against the trades progressive successful these types of hedging strategies, erstwhile borderline is involved, past calls volition spell retired to those whose trades are losing wealth to enactment down currency oregon collateral successful bid to conscionable borderline requirements if the commercialized is inactive desired to beryllium held; different known arsenic “margin calls.” When borderline calls spell out, and if collateral oregon currency is not posted, past we get what is known arsenic a “forced liquidation”; wherever the commercialized has gone truthful acold against the holder of the presumption that the exchange/brokerage forces an exit of the presumption successful bid to support the speech (and the presumption holder) from going into a antagonistic relationship equilibrium — which tin person the imaginable of going very, precise profoundly negative.

This is thing readers whitethorn retrieve from the Gamestop/Robinhood lawsuit during 2020 wherever a idiosyncratic committed suicide implicit specified a dynamic playing out.

What is rumored to person occurred is that a backstage entity was progressive successful 1 (or more) of these strategies, the marketplace went against them, placing them successful a losing position, and borderline calls were precise apt to beryllium sent out. With the imaginable of a unsafe cascade of liquidations, the BoE decided to measurement successful and deploy YCC successful bid to debar said liquidation cascade.

To further elaborate connected the extent of this issue, we look to strategies deployed successful the U.S. with pension management. Within the U.S., we person situations wherever pensions are (criminally) underfunded (which I concisely mentioned here). In bid to remedy the delta, pensions are either required to enactment up currency oregon collateral to screen the difference, oregon deploy leverage overlay strategies successful bid to conscionable the returns arsenic promised to pension constituents. Seeing however conscionable holding currency connected a firm equilibrium expanse is not a fashionable strategy (due to ostentation resulting successful accordant nonaccomplishment of purchasing power) galore similar to deploy the leverage overlay strategy; requiring allocating superior to borderline trading connected fiscal assets successful the purpose of producing returns to screen the delta provided by the underfunded presumption of the pension. Meaning that the pensions are being forced by condition to task further and further retired onto the hazard curve successful bid to conscionable their obligations.

As Bianco accurately described successful the Spaces, the determination by the BoE was not a solution to the problem. This was a band-aid, a impermanent alleviation strategy. The hazard to fiscal markets is inactive the menace of a stronger dollar connected the backmost of expanding involvement rates coming from the Fed.

Howell brought up an absorbing constituent of treatment astir governments, and by hold cardinal banks, successful that they bash not typically foretell (or prepare) for recessions, they usually respond to recessions, giving recognition to Bianco’s information that determination is imaginable for the BoE to person acted excessively aboriginal successful this environment.

One precise large dynamic, arsenic positioned by Kao, is that portion truthful galore countries are resorting to involution crossed the globe, everybody seems to beryllium expecting this to use unit connected the Fed providing that fabled pivot. There’s the likelihood that this situation really incentivizes individualist strategies for participants to enactment successful their ain interests, alluding to the Fed throwing the remainder of the world’s purchasing powerfulness nether the autobus successful bid to sphere USD hegemony.

Oil

Going further, Kao besides brought up his presumption that terms ostentation successful lipid is simply a large elephant successful the room. The price per tube has been falling arsenic expectations for request proceed to descent on with continual income of the U.S.’s strategical petroleum reserve washing markets with oil, erstwhile proviso outpaces request (or, successful this case, the forecast of demand). Then basal economics dictate that prices volition diminish. It is important to recognize present that erstwhile the terms of a tube of lipid falls, incentives to nutrient much diminish, starring to dilatory downs successful concern successful lipid accumulation infrastructure. And what Kao goes connected to suggest is that if the Fed were to pivot, this would effect successful request returning to markets, and the inevitability for lipid to resume its ascent successful terms volition spot america close backmost to wherever this occupation began.

I hold with Kao’s positions here.

Kao continued to elaborate connected however these interventions by cardinal banks are yet futile because, arsenic the Fed continues to hike involvement rates, overseas cardinal banks simply lone win successful burning done reserves portion besides debasing their section currencies. Kao besides concisely touched connected a interest with important levels of firm indebtedness astir the world.

China

Lorenz chimed successful with the summation that the U.S. and Denmark are truly the lone jurisdictions that person entree to 30-year fixed complaint mortgages, with the remainder of the satellite tending to employment floating-rate mortgages oregon instruments that institute fixed rates for a little period, aboriginal resetting to a marketplace rate.

Lorenz went on, “…with rising rates we’re really going to beryllium crimping spending a batch astir the world.”

And Lorenz followed up to authorities that, “The lodging marketplace is besides a large occupation successful China close now… but that’s benignant of the extremity of the iceberg for the problems…”

He went on, referring to a study from Anne Stevenson-Yang of J Capital, wherever helium said that she details that the 65 largest existent property developers successful China beryllium astir 6.3 trillion Chinese Yuan (CNY) successful indebtedness (about $885.5 billion). However, it gets worse erstwhile looking astatine the section governments; they beryllium 34.8 trillion CNY (about $4.779 trillion) with a hard close hook coming, amounting to an further 40 trillion CNY ($5.622 trillion) oregon much successful debt, wrapped up successful “local financing vehicles.” This is supposedly starring to section governments getting squeezed by China’s illness successful its existent property markets, portion seeing reductions successful accumulation rates acknowledgment to President Xi’s “Zero Covid” policy, yet suggesting that the Chinese person abandoned trying to enactment the CNY against USD, contributing to the powerfulness vacuum successful USD.

Bank Reserves

Contributing to this precise analyzable relationship, Lorenz re-entered the speech by bringing up the contented of slope reserves. Following the events of the 2008 Global Financial Crisis, U.S. banks person been required to support higher reserves successful the purpose of protecting slope solvency, but besides preventing those funds from being circulated wrong the existent economy, including investments. One statement could beryllium made that this could beryllium helping to support ostentation muted. According to Bianco, slope deposits person seen reallocations to wealth marketplace funds to seizure a output with the reverse repurchase agreement (RRP) installation that is 0.55% higher than the output connected treasury bills. This yet results successful a drain connected slope reserves, and suggested to Lorenz that a furthering of the dollar liquidity situation is likely, meaning that the USD continues to suck up purchasing powerfulness — retrieve that shortages successful proviso effect successful increases successful price.

Conclusion

All of this fundamentally adds up to the USD gaining accelerated and potent spot against astir each different nationalist currencies (except possibly the Russian ruble), and resulting successful implicit demolition of overseas markets, portion besides disincentivizing concern successful astir immoderate different fiscal conveyance oregon asset.

Now, For What I Did Not Hear

I precise overmuch fishy that I americium incorrect here, and that I americium misremembering (or misinterpreting) what I person witnessed implicit the past 2 years.

But I was personally amazed to perceive zero treatment astir the crippled mentation that has been occurring betwixt the Fed and the European Central Bank (ECB), successful league with the World Economic Forum (WEF), astir what I person perceived arsenic connection during interviews attempting to suggest that the Fed needs to people much wealth successful bid to enactment the economies of the world. This enactment would suggest an effort to support the equilibrium of powerfulness betwixt the opposing fiat currencies by printing USD successful bid to offset the different currencies being debased.

Now, we cognize what has played retired since, but the crippled mentation inactive remains; the ECB’s decisions person resulted successful important weakening of the European Union, starring to the weakness successful the euro, arsenic good arsenic weakening relations betwixt the European nations. In my opinion, the ECB and WEF person signaled assertive enactment and tendency for developments of cardinal slope integer currencies (CBDCs) arsenic good arsenic for much authoritarian argumentation measures of power for their constituents (what I spot arsenic vaccine passports and attempts astatine seizing lands held by their farmers, for starters). Over these past 2 years, I judge that Jerome Powell of the Federal Reserve had been providing assertive absorption to the U.S.’s improvement of a CBDC, portion the White House and Janet Yellen person ramped up pressures connected the Fed to enactment connected producing one, with Powell’s aversion to improvement of a CBDC seeming to wane successful caller months against pressures from the Biden medication (I’m including Yellen successful this arsenic she has, successful my opinion, been a wide hold of the White House).

It makes consciousness to maine that the Fed would beryllium hesitant to make a CBDC, speech from being hesitant to employment immoderate exertion that is not understood, with the reasoning being that the U.S.’s large commercialized banks stock successful ownership of the Federal Reserve System; a CBDC would wholly destruct the relation that commercialized banks service successful providing a buffer betwixt fiscal and monetary argumentation and the economical enactment of mean citizens and businesses. Which is precisely why, successful my humble opinion, Yellen wants accumulation of a CBDC; successful bid to summation power implicit economical enactment from apical to bottom, arsenic good arsenic to summation the quality to interruption each citizens’ rights to privateness from the prying eyes of the government. Obviously, authorities entities tin get this accusation contiguous anyway, however, the bureaucracy we person presently tin inactive service arsenic points of friction to acquiring said information, providing a veil of extortion for the American national (although a perchance anemic veil).

What this yet amounts to is; one, a furthering of the currency warfare that has been ensuing since the commencement of the pandemic, mostly going underappreciated arsenic the satellite has been distracted with the blistery warfare occurring wrong Ukraine, and two, an effort astatine further demolition of idiosyncratic rights and freedoms some within, and extracurricular of, the United States. China seems to be the furthest on successful the satellite with regards to improvement of a sovereign power’s CBDC, and its implementation is overmuch easier for it; it has had its social recognition people strategy (SCS) progressive for aggregate years now, making integration of specified an authoritarian bedewed imagination overmuch easier, arsenic the penetration of privateness and manipulation of the populace via the SCS is providing a ft successful the door.

The crushed I’m amazed that I did not perceive this marque it into treatment is that this adds a very, precise important dynamic to the crippled mentation of the determination making down the Fed and Powell. If Powell understands the value of maintaining the separation of cardinal and commercialized banks (which I judge helium does), and if understands the value of maintaining USD hegemony with regards to the U.S.’s powerfulness implicit overseas power (which I judge helium does), and helium understands the desires for atrocious actors to person specified perverse power implicit a population’s choices and economical enactment via a CBDC (which I judge helium might), helium would truthful recognize however important it is for the Fed to not lone defy the implementation of a CBDC but helium would besides recognize that, successful bid to support state (both domestically and abroad), that this ideology of proliferation of state would necessitate some an aversion to CBDC implementation and a consequent demolition of contention against the USD.

It’s besides important to recognize that the U.S. is not needfully acrophobic with the USD gaining excessively overmuch powerfulness due to the fact that we mostly import the bulk of our goods — we export USD. In my opinion, what follows is that the U.S. utilizes the crescendo of this powerfulness vacuum successful an effort to gobble up and consolidate the globe’s resources and physique retired the indispensable infrastructure to grow our capabilities, returning the U.S. arsenic a shaper of precocious prime goods.

This Is Where I May Lose You

This truthful opens up a existent accidental for the U.S. to further its power… with the authoritative adoption of bitcoin. Very fewer sermon this, and adjacent less whitethorn recall, but the FDIC went astir probing for accusation and remark successful its exploration of however banks could clasp “crypto” assets connected their equilibrium sheets. When these entities accidental “crypto,” they much often than not mean bitcoin — the occupation is that the wide populace’s ignorance of Bitcoin’s operations origin them to spot bitcoin arsenic “risky” erstwhile aligning with the asset, arsenic acold arsenic nationalist relations are concerned. What’s adjacent much absorbing is that we person not heard a peep retired of them since… starring maine to judge that my thesis whitethorn beryllium much apt to beryllium close than not.

If my speechmaking of Powell’s concern were correct, and this each were to play out, the U.S. would beryllium placed successful a precise almighty position. The U.S. is besides incentivized to travel this strategy arsenic our golden reserves person been dramatically depleted since World War II, with China and Russia some holding signficant coffers of the precious metal. Then there’s the information that bitcoin is inactive precise aboriginal successful its adoption with regards to utilization crossed the globe and organization involvement lone conscionable beginning.

If the U.S. wants to debar going down successful past books arsenic conscionable different Roman Empire, it would behoove it to instrumentality these things very, precise seriously. But, and this is the astir important facet to consider,I guarantee you that I person apt misread the environment.

Additional Resources

- “Introduction To Treasury Securities,” Investopedia

- “Bond Traders Relish Idea Of Fed Rates Above 4%,” Yahoo! Finance

- “10-Year Treasury Note And How It Works,” The Balance

- “Bond Market,” Wikipedia

- “Fixed Income — Insurance And Trading, First Quarter 2021,” SIFMA

- “How Much Liquidity Is In The US Treasury Market,” Zero Hedge

- “What Is Yield Curve Control?” Brookings

- “Using Derivative Overlays To Hedge Pension Duration,” ResearchGate

This is simply a impermanent station by Mike Hobart. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

2 years ago

2 years ago

![Top Crypto Exchanges [September 2025] – Best Platforms for Trading Bitcoin, Altcoins & Derivatives](https://static.news.bitcoin.com/wp-content/uploads/2025/09/best-crypto-exchanges-sept-2025-768x432.png)

English (US)

English (US)