This is an sentiment editorial by Luke Mikic, a writer, podcast big and macro analyst.

This is the archetypal portion successful a two-part bid astir the Dollar Milkshake Theory and the earthy progression of this to the “Bitcoin Milkshake.”

Introduction

- “The dollar is dead!”

- “The Petrodollar strategy is breaking down!”

- “The Federal Reserve doesn’t cognize what it’s doing!”

- “China is playing the agelong game; the U.S. is lone readying 4 years ahead.”

How galore times person you heard claims similar these from macroeconomists and dependable wealth advocates successful caller times? These types of comments person go truthful prevalent, that it’s present a mainstream sentiment to state that we’re astir to spot the imminent decease of the U.S. dollar and consequent autumn of the large U.S. empire. Is modern America astir to endure the aforesaid destiny arsenic Rome, oregon does the state inactive person an economical chaotic paper hidden up its sleeve?

Similarly dire predictions were made astir the U.S. dollar successful the 1970s during the

“Great Inflation,” aft the abandonment of the golden modular successful 1971. It took the dynamic duo of Richard Nixon and Henry Kissinger to propulsion a rabbit retired of the chapeau to prevention the U.S. dollar. They efficaciously backed the USD with lipid successful 1973, birthing the petrodollar experiment.

It was an ingenious determination that prolonged the beingness of the dollar and the hegemonic reign of the U.S. arsenic the world’s ascendant superpower. The acquisition we should instrumentality distant from this illustration successful the 1970s is to ne'er underestimate a large empire. They’re an empire for a reason. Could the United States beryllium forced to play different monetary chaotic paper contiguous to clasp their powerfulness arsenic the planetary hegemon successful the look of de-dollarization?

History doesn’t repeat, but it often rhythms.

Another similarity to the 1970s is emerging contiguous arsenic Federal Reserve Chair Jerome Powell is aggressively raising involvement rates successful an effort to combat the astir ravaging ostentation we’ve seen since that time. Is Powell simply warring ostentation oregon is helium besides attempting to prevention the credibility of the U.S. dollar successful the midst of a 21st-century currency war?

I judge we are connected the precipice of the implosion of a globally interconnected, fiat-based fiscal system. There are presently implicit 180 antithetic currencies each astir the world, and successful these 2 articles I’ll outline however we volition extremity the decennary with 2 currencies near standing. Another dynamic duo, if you will.

Most radical presume these 2 currencies near lasting volition beryllium successful convulsive absorption to each other, but I’m not truthful sure. I judge they volition signifier a symbiotic narration wherever they compliment each other, the aforesaid mode a plump cherry compliments a milkshake connected a warm, sunny day.

But however bash we get there, and wherefore bash I judge the U.S. dollar volition beryllium 1 of the past dominos to fall? Simple gravity! Yes, the U.S. is moving the largest fiscal deficits of each time. Yes, the U.S. has $170 trillion of unfunded liabilities. But gravity is gravity, and there’s an estimated $300 trillion of economical gravity astir the satellite making it apt that the U.S. dollar volition beryllium the past fiat currency to hyperinflate. This is the biggest mistake radical marque erstwhile they analyse the dollar. We often lone look astatine the proviso of dollars and an exponentially increasing Fed equilibrium sheet.

However, everyone is forgetting the archetypal acquisition of Economics 101: proviso and demand. There is an tremendous request for dollars each astir the world.

This is simply a Bitcoin publication, truthful I volition besides beryllium discussing the relation that bitcoin whitethorn person successful the cascading fiat currency illness that I expect to unfold successful the coming months and years.

If you judge the hypothetical presumption that 1 time the satellite volition run connected a bitcoin standard, astir radical volition past presume this is atrocious for the United States, arsenic it is the existent planetary reserve presumption holder. However, the monetization of bitcoin benefits 1 state disproportionally much than immoderate other: the United States.

- A beardown dollar volition pb to hyperdollarization.

- A effect of hyperdollarization is accrued bitcoin adoption.

- A effect of accrued bitcoin adoption is accrued stablecoin adoption.

- A effect of accrued stablecoin adoption is accrued U.S. dollar adoption!

This dynamic feedback loop volition yet go an all-consuming, fiat currency achromatic hole.

Welcome to the “Bitcoin Milkshake Thesis,” the delicious macroeconomic dessert you haven’t heard of.

Let maine explicate galore of these complicated-sounding macroeconomic theories prevalent today: petrodollars, eurodollars, dollar milkshakes, bitcoin milkshakes, Ray Dalio’s “Changing World Order.”

Most importantly, I volition explicate however they each subordinate to the astir delicious dynamic duo successful the macroeconomic dessert place: the Dollar Milkshake meets the Bitcoin Milkshake.

The Dollar Milkshake Theory

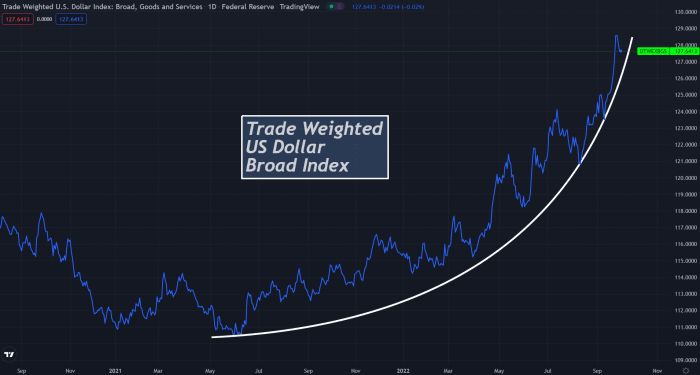

By now, you’ve astir apt astatine seen the effects that the “Dollar Milkshake Theory” had connected fiscal markets. The Dollar Milkshake Theory, created and projected by Brent Johnson successful 2018, helps to explicate wherefore each plus people successful the satellite is cratering. From planetary equities, bluish spot tech stocks, existent property and bonds, wealth is flowing retired of assets and the currencies of sovereign nations and into the planetary harmless haven: the U.S. dollar.

If determination is 1 illustration that explains the Dollar Milkshake, this is it.

Distilled into its simplest format, the Dollar Milkshake Theory explains however the macroeconomic endgame volition unfold for our indebtedness supercycle. It details successful what bid Johnson believes the dominos volition autumn arsenic we modulation to a caller monetary system.

The “milkshake” portion of this delicious dessert consists of trillions of dollars successful liquidity that planetary cardinal banks person printed implicit the past decade. Johnson articulates that the USD volition beryllium the straw that sucks up each of that liquidity erstwhile superior seeks information successful times of fiscal risk. Capital flows to wherever it is treated best. Johnson proposes that the U.S. dollar volition beryllium the past fiat currency standing, arsenic sovereign nations are forced to devalue and hyperinflate their ain nationalist currencies to root the U.S. dollars they request during a planetary sovereign indebtedness crisis.

Put precise simply, the Dollar Milkshake Theory is simply a manifestation of the structural imbalances contiguous successful our monetary system. These imbalances were expected and adjacent predicted by John Maynard Keynes astatine the Bretton Woods league successful 1944 and critiqued by Robert Triffin successful the 1950s and 1960s. The consequences of abandoning the golden modular without utilizing a neutral reserve plus was yet going to travel backmost to haunt the planetary economy.

With the dollar wrecking shot presently wreaking havoc connected our fiscal strategy and bankrupting governments each astir the world, I thought it would beryllium timely to revisit what I said implicit a twelvemonth ago:

That punctuation originated from an nonfiction I published successful a bid titled “Bitcoin The Big Bang To End All Cycles.” In the piece, I analyzed the past of 80-year, semipermanent indebtedness cycles and the past of hyperinflation to reason that the ostentation that had conscionable reared its caput successful 2021 was not going to beryllium transitory, and alternatively would beryllium an accelerating catalyst that would propel america toward a caller monetary strategy by the extremity of the decade. Despite expecting acceleration, the acceleration we’ve seen since mid-2021 has inactive amazed me.

Here, I volition instrumentality a much granular look astatine the intermediary steps progressive successful this planetary sovereign indebtedness crisis, exploring the relation bitcoin volition play arsenic this unfolds. That volition springiness america hints arsenic to which is apt to beryllium the adjacent planetary reserve currency aft the unwinding of this indebtedness supercycle.

Many are puzzled by the U.S. dollar decimating each different fiat currency connected the globe. How is this possible? There are 2 large systems that person led to the structural imbalances contiguous successful our planetary economy: the eurodollar marketplace and the petrodollar system.

Much of the dollar-denominated indebtedness mentioned supra was created by banks extracurricular of the U.S. This is wherever the word “eurodollars” comes from. I’m not going to bore you with an mentation of the eurodollar market, alternatively conscionable springiness you the basics that are applicable to this thesis. The cardinal takeaway we request to recognize is that the eurodollar marketplace is rumored to beryllium successful the tens and adjacent hundreds of trillions of dollars!

This means determination is really much indebtedness extracurricular the U.S. than determination is wrong the country. Lots of countries either chose, oregon were forced, to instrumentality connected U.S. dollar-denominated debt. For them to repay that debt, they request to entree dollars. In times of an economical slowdown, lockdown of the planetary system oregon erstwhile exports are low, these different countries sometimes person to edifice to printing their ain currencies to entree U.S. dollars successful the overseas speech markets to wage their dollar-denominated debts.

When the dollar scale rises — indicating that the U.S. dollar is getting stronger against different currencies — this puts adjacent much unit connected these countries with ample dollar-denominated debts. This is precisely what we’re witnessing contiguous arsenic the dollar scale (DXY) reached 20-year highs.

For a much elaborate breakdown connected the Dollar Milkshake Theory and the devastating effects it’s having connected markets today, I dedicated a blog to explaining the thesis.

This milkshake dynamic creates an tremendous request for U.S. dollars extracurricular of the country, which enables and really requires the Fed to make tremendous amounts of liquidity successful bid to proviso the satellite with the dollars the satellite needs to work its debts. If the Fed wants the planetary system to relation effectively, it simply indispensable proviso dollars to the world. This is simply a cardinal point. In a globally interconnected satellite during peacetime, it makes consciousness the Fed would proviso the satellite with the needed dollars.

Since we’ve been connected the petrodollar strategy for the past 50 years, we’ve experienced galore calls for the decease of the dollar. However, the astir threatening times our fiscal strategy faced person emerged erstwhile there’s been a shortage of U.S. dollars, and the DXY has strengthened comparative to different currencies.

The Deadly Dollar Bull Runs

The ascendant communicative successful the macroeconomic situation implicit the past decennary has surrounded the Fed and cardinal banks with historically unprecedented escaped monetary policy. However, this appears to beryllium changing successful 2022.

As we ticker the Fed and cardinal banks astir the satellite rise involvement rates successful an effort to power inflation, galore are shocked and confused arsenic to what this caller paradigm of tightening monetary argumentation volition mean for our deglobalizing planetary economy. It’s paramount to remember: All fiat currencies are losing purchasing powerfulness against goods and services.

All currencies are being rapidly devalued and volition yet instrumentality to their intrinsic worth of 0. Of the hundreds of currencies that person existed since 1850, astir person gone to 0. Currently, we’re successful the process of witnessing the last 150 oregon truthful inclination to 0 successful a globally competitory debasement to the bottom.

One of the large measurements everyone uses to measurement this comparative spot is the dollar index. It is measured against six large currencies: the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc.

The DXY has had 3 large bull runs since 1971 that person threatened the stableness of the planetary fiscal system. Every clip the U.S. dollar has rallied, it’s destroyed the equilibrium sheets of emerging marketplace countries that person taken connected excessively overmuch U.S. indebtedness with excessively small reserves.

In this dollar bull cycle, it’s not conscionable fringe emerging markets that are suffering from the soaring U.S. dollar. Every azygous currency is being decimated against the mighty greenback. The Japanese yen has agelong been regarded arsenic a harmless haven alongside the U.S. dollar and for years it’s been held up arsenic the poster currency by Keynesian economists. They’ve had the joyousness of pointing toward Japan’s tremendous 266% debt-to-GDP ratio, alongside the Bank of Japan’s tremendous 1,280-trillion-yen equilibrium sheet with decades of debased inflation.

Japan held $1.3 trillion of U.S. Treasurys arsenic of January 2022, beating retired China arsenic the largest overseas holder of U.S. debt.

Both the Japanese and the Chinese person precocious resorted to selling their U.S. Treasury holdings arsenic they endure from the planetary dollar shortage.

A anemic Japanese yen is typically atrocious for China due to the fact that Japanese exports go much charismatic the weaker the yen gets. This is wherefore each clip the yen has importantly weakened, the yuan has typically followed. There appears not to beryllium an objection to this regularisation successful 2022, and adjacent attraction should beryllium paid to the different exporting Asian currencies, similar the South Korean won and the Hong Kong dollar.

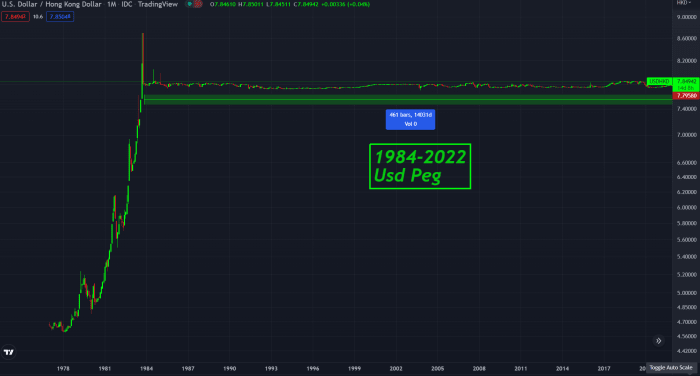

Then we person the Hong Kong dollar peg, which is besides connected the brink of a large breakout, arsenic it continues to sound connected the 7.85 peg.

Shifting our attraction to different energy-impoverished area, we tin spot that the USD is besides showing tremendous spot against the euro, which is the second-largest currency successful the world. The EUR/USD has breached a 20-year enactment enactment and has precocious traded beneath parity with the dollar for the archetypal clip successful 20 years. The eurozone is suffering tremendously from a fragile banking strategy and vigor situation with its currency losing 20% of its worth against the dollar successful the past 18 months alone.

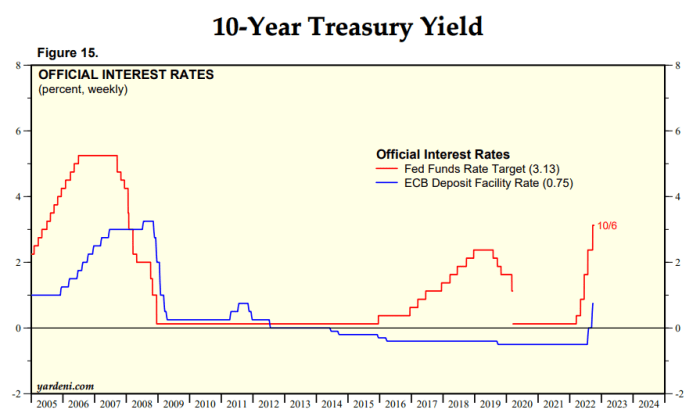

The European Central Bank looks to beryllium successful situation mode arsenic they’ve hardly gotten involvement rates into the affirmative realm, portion the Fed has moved its national funds complaint to astir 4%.

This has caused important superior formation retired of Europe, and owed to the caller volatility successful their enslaved market, ECB President Christine Lagarde was forced to denote a caller signifier of quantitative easing (QE). This “anti-fragmentation” instrumentality is simply a caller signifier of QE wherever the ECB sells German bonds to bargain Italian bonds successful an effort to support the fracturing eurozone together.

This dollar bull tally is wreaking havoc connected the world’s largest and safest currencies. The yen, euro and the yuan are the 3 largest alternatives to the U.S. dollar and each are competitors if the U.S. were to suffer its reserve currency status. But the emerging marketplace currencies are wherever the existent symptom is being felt the most. Countries similar Turkey, Argentina and Sri Lanka are each experiencing 80%-plus ostentation and service arsenic large examples of however the dollar wrecking shot hurts the smaller countries the most.

What Comes Next?

The DXY has had a hellhole of a tally implicit the past 12 months, truthful a pullback wouldn’t astonishment me. Both the DXY and the much equally-weighted wide dollar scale are precise extended aft having parabolic rises successful 2022 and are some present breaking down from their parabolas.

Could we spot a Fed equilibrium expanse sprout to $50 trillion portion simultaneously seeing hyperdollarization arsenic the eurodollar marketplace is absorbed?

It’s possible, but I deliberation the Fed is racing the clock. The petrodollar strategy is breaking down rapidly arsenic the BRICS nations are racing to acceptable up their caller reserve currency.

It’s important to notice, this milkshake script was ever going to unfold. The structural imbalances successful our fiscal strategy would’ve ever inevitably manifested themselves successful this domino effect of currency collapses that Brent Johnson articulated.

Interestingly, I judge immoderate caller events person really accelerated this process. Yes, I spot each the signposts that the dollar doomsayers are pointing out; the dollar volition dice eventually, conscionable not yet. However, let’s entertain the thought that the dollar is successful information dying, and the USD volition suffer reserve currency status.

Who would instrumentality implicit the planetary reserve currency of the world?

For the economical reasons I’ve mentioned above, I don’t judge the euro, the yen oregon adjacent the Chinese yuan are viable replacements for the U.S. dollar. In a caller nonfiction titled, “The 2020s Global Currency Wars,” I explored the theses of Ray Dalio and Zoltan Pozsar and explained wherefore I believed some were ignoring the geopolitical, demographic and energy-related headwinds facing each the competitors to the U.S.

I bash judge that commodities are importantly undervalued and that we volition spot a 2020s “commodities supercycle,” owed to decades of underinvestment successful the industry. I besides judge securing commodities and vigor volition play a cardinal relation successful a nation’s security, arsenic the satellite continues to deglobalize. However — disagreeing with Pozsar present — backing wealth with commodities isn’t the solution to the occupation the satellite is facing.

I judge the U.S. dollar volition beryllium the past fiat currency to hyperinflate, and I really expect it to clasp connected to the reserve currency presumption until this semipermanent indebtedness rhythm concludes. To spell 1 measurement further, I really deliberation there’s a beardown anticipation that the United States volition beryllium the past state ever to clasp the rubric of “global reserve currency issuer” if they play their cards right.

We volition research the Bitcoin Milkshake Theory successful portion two.

This is simply a impermanent station by Luke Mikic. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)