sponsored

The 2022 U.S. taxation play is upon america and cryptocurrency traders request each the assistance they tin get. Here are 5 communal crypto taxation misconceptions you should look retired for, courtesy of crypto taxation bundle provider, Cointelli.

“You don’t person to wage taxes connected crypto”

One precise communal mistake that radical marque is reasoning they don’t person to wage taxation connected cryptocurrency transactions. However, crypto transactions are taxable, and the IRS is precise susceptible of coming aft you and your assets if you don’t comply. The IRS refers to cryptocurrency arsenic virtual currency, and immoderate transactions connected exchanges, income from mining oregon staking, crypto received from hard forks and airdrops, and adjacent DeFi transactions – fundamentally the bulk of profits and losses resulting from crypto enactment – are taxable to tax.

According to the IRS’s guidelines from 2014, cryptocurrency is treated arsenic spot for taxation purposes. This means that immoderate superior summation oregon nonaccomplishment generated from selling your assets is taxable, portion assets that you simply clasp oregon person are not taxable until you merchantability them. The IRS hasn’t yet provided wide guidelines for areas that see staking, NFTs, and DeFi transactions.

So, what happens if you don’t study crypto transactions to the IRS? The crypto marketplace has grown rapidly successful caller years, and the IRS’s enforcement efforts person grown with it. If you don’t study your crypto transactions connected your taxation returns, you could onshore yourself successful large trouble. As you whitethorn person already seen, the IRS has been asking the pursuing question connected the archetypal leafage of Form 1040:

“At immoderate clip during [the taxation year], did you receive, sell, send, exchange, oregon different get immoderate fiscal involvement successful immoderate virtual currency?”

Trying to debar paying taxes connected your crypto is nary longer a feasible option. Thankfully, Cointelli is present to prevention you from accent and vexation this taxation play and assistance you enactment compliant with the astir caller taxation laws.

“Reporting my crypto transactions volition conscionable pb to maine paying much successful taxes”

Another communal misconception is that reporting your crypto transactions tin lone pb to you paying much successful taxes. This is not needfully true, however. In fact, determination is really a mode to trim your taxes by utilizing a strategy called tax-loss harvesting. But however precisely does this work?

Basically, harvesting is an investing strategy wherever you merchantability assets astatine a nonaccomplishment to offset your different superior gains. For instance, if your crypto was tanking, your earthy instinct mightiness beryllium to clasp onto it until it recovers its value. But if you determine to merchantability your crypto and judge the loss, you could alternatively “harvest” it. Because the nonaccomplishment you instrumentality tin beryllium utilized to offset your superior gains from different investments, you could frankincense extremity up reducing oregon adjacent eliminating your superior gains tax.

You indispensable support 4 things successful caput earlier harvesting losses though:

- Be wary of the wash merchantability rule: A connection to use the lavation merchantability regularisation to cryptocurrency whitethorn instrumentality effect successful 2022. If this regularisation takes effect you volition not beryllium capable to deduct a nonaccomplishment from the merchantability of crypto if you acquisition the aforesaid crypto 30 days earlier oregon aft the sale.

- It is advisable to harvest your losses year-round.

- Remember that offsetting your short-term gains comes first.

- Don’t hide astir speech fees.

In bid to assertion your losses for the taxation year, you indispensable study your losses connected crypto to the IRS and decorativeness your tax-loss harvesting earlier the extremity of the year. Capital losses from crypto are reported connected Form 8949. After entering the details, you indispensable cipher the full sum of proceeds, take the champion outgo ground for you, and input your nett superior gains and losses astatine the bottommost of Form 8949. For more, cheque retired this guide.

As whitethorn beryllium wide from the above, calculating your superior gains and losses manually tin beryllium complicated. This is wherefore galore crypto traders are already utilizing crypto taxation bundle similar Cointelli to rapidly and accurately cipher their nett crypto gains and losses from short-term and semipermanent crypto transactions.

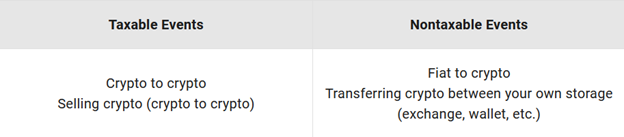

“You lone request to wage taxes erstwhile converting crypto into fiat currency”

A 3rd communal misconception is that you lone request to wage taxes erstwhile converting crypto into fiat currency. However, this is likewise not the case. Many antithetic scenarios and situations are taxable. For example, did you excavation immoderate cryptocurrencies? You whitethorn beryllium amazed to larn that traders request to wage taxes connected crypto mining. The IRS classifies gaining income from generating blocks successful a blockchain arsenic earned income, which means you beryllium income taxation connected immoderate cryptocurrency you whitethorn person mined

Another script to see is if you person received “free” crypto from an airdrop. This is considered income arsenic well, which means you beryllium taxes connected it! The IRS’s cryptocurrency taxation guidelines from 2019 authorities that each crypto received from airdrops is taxable to income tax. Regardless of whether you intended to person it oregon not, “free” crypto that enters your wallet oregon speech relationship is considered mean income.

To find if a crypto lawsuit is taxable, you should archetypal recognize that the IRS classifies cryptocurrency arsenic property, not currency. Therefore, galore forms of crypto-related income are classified arsenic superior gains and are taxable to superior gains oregon income tax.

It is besides important to recognize the taxation implications of a crypto hard fork. But what precisely is simply a hard fork? After a cryptocurrency has been retired for a while, it is precise communal for developers to contented updates oregon to upgrade its programming. When a cryptocurrency programme oregon “protocol” gets a important upgrade oregon coding modification, we telephone this a “hard fork.”

If your cryptocurrency went done a hard fork but determination was not a caller cryptocurrency issued to you, whether done an airdrop oregon immoderate different benignant of distribution, you bash not person taxable income. However, if your cryptocurrency went done a hard fork upgrade and the developers issued caller cryptocurrency to you, this is a taxable transaction.

“Crypto profits are ever taxed astatine the aforesaid rate”

A 4th misapprehension that galore radical person is that crypto profits are ever taxed astatine the aforesaid rate. Don’t beryllium fooled; the rate astatine which crypto profits are taxed varies, which tin marque calculating however overmuch you beryllium precise complicated. Three factors impact the complaint astatine which crypto gains are taxed.

The archetypal is the holding period, oregon however agelong a idiosyncratic held their crypto earlier selling it. Crypto gains are categorized into short-term and semipermanent gains and are taxed according to their holding period. Short-term superior gains tin beryllium taxed astatine up to 37%, portion semipermanent superior gains tin beryllium taxed astatine up to 20%.

The 2nd is your income bracket. High income taxpayers indispensable wage a 3.8% nett concern income taxation (NIIT) connected investments specified arsenic crypto, which volition impact their taxation rate.

The 3rd origin is your location. You whitethorn person to wage authorities and/or section taxes depending connected wherever you live. If you are preparing to sell, marque definite you recognize your section taxation laws earlier calculating your profits and losses.

Cointelli understands that this tin each get confusing, and that not everyone is simply a tax-expert. That’s wherefore it takes attraction of the hardest parts of preparing crypto taxation reports for you.

“Doing my crypto taxes is excessively complicated”

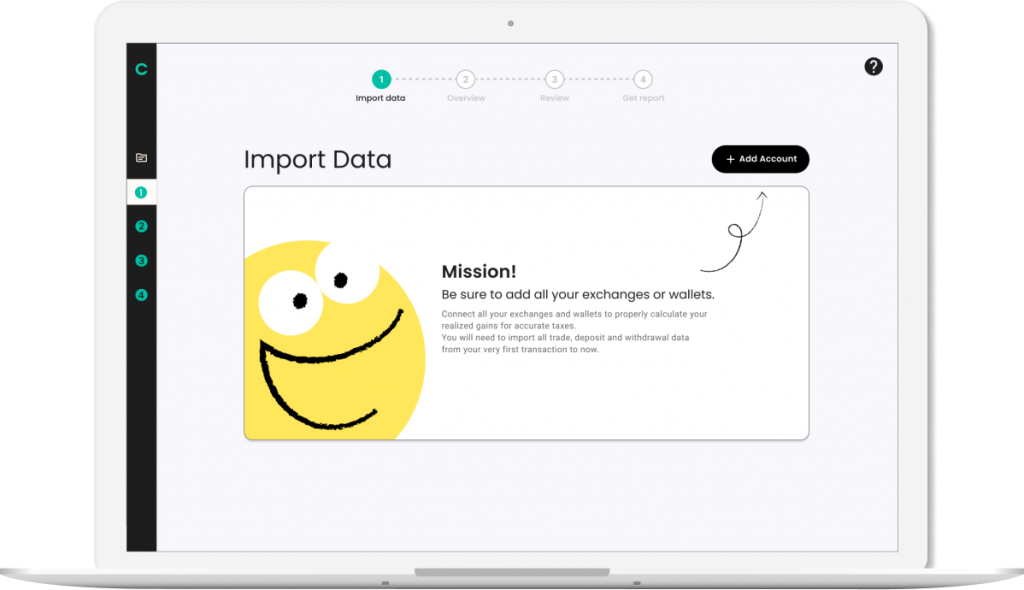

Filling retired your crypto taxation study doesn’t person to beryllium hard! Cointelli boils it down to the beneath 3 steps:

- Figure retired your crypto gains and losses

- Complete Form 8948 and Schedule D

- Add your different crypto income to the taxation report

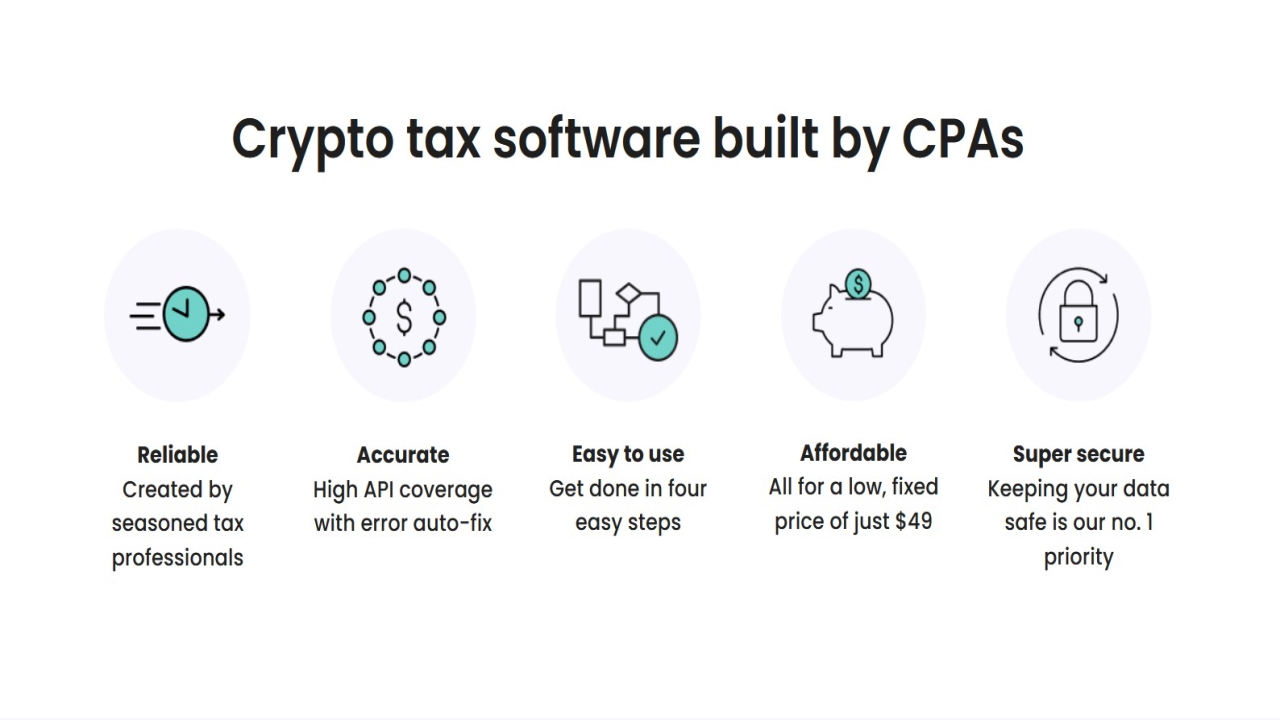

Cointelli is bundle created by a squad of CPAs who specialize successful cryptocurrency and privation to assistance you study your crypto taxes accurately. The magnitude you wage successful taxation tin alteration broadly depending connected however you cipher your superior gains, which makes it captious that you usage reliable crypto taxation software. Featuring wide compatibility with exchanges, wallets, and blockchains and functions similar mistake auto-fix, Cointelli is crypto taxation bundle that you tin number on. What’s more, it besides makes the full process speedy and easy!

Simply import your crypto transactions from your exchanges into the software, and Cointelli volition automatically signifier your acquisition costs, acquisition dates, selling costs, selling dates, holding periods, transaction fees, and more.

Struggling with crypto taxes this taxation season? Click here to fto Cointelli grip it each for you, truthful you tin beryllium backmost and relax!

- This nonfiction is intended to supply wide fiscal accusation designed to amended a wide conception of the public; it does not springiness personalized tax, investment, legal, oregon different concern and nonrecreational advice. Before taking immoderate action, you should ever consult with your ain nonrecreational taxation advisor for proposal connected taxes, your investments, the law, oregon immoderate different concern and nonrecreational matters that impact yourself oregon your business.

- Cointelli is presently lone disposable successful the US. The supra fiscal and taxation accusation pertains to the US market.

This is simply a sponsored post. Learn however to scope our assemblage here. Read disclaimer below.

Bitcoin.com Media

Bitcoin.com is the premier root for everything crypto-related.

Contact [email protected] to speech astir property releases, sponsored posts, podcasts and different options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

English (US)

English (US)