Since April, the cryptocurrency marketplace has been successful a terrible downturn.

Bitcoin is down by 70% from all-time highs, portion Ethereum is down 80%. Whole ecosystems, similar Luna, person been obliterated, and dozens of altcoins and GameFi tokens person mislaid astir each their value.

Investors tin execute passive returns successful a bull marketplace by simply investing successful beta to travel the wide trend. But successful carnivore markets, it doesn’t work. Amid these conditions, we request to usage alpha investing to find concern opportunities.

How to put successful DeFi successful a carnivore market

Use macro information to find marketplace trends

DeFi copies astir each accepted concern models, from lending to fiscal derivatives. The main quality betwixt DeFi and accepted concern projects is the usage of astute contracts, much transparent accusation connected the concatenation and the minting of its token arsenic an incentive.

Therefore DeFi has galore of the characteristics of accepted finance, but it lacks beardown regularisation starring to precocious terms fluctuations. DeFi doesn’t person much real-world usage cases extracurricular of making much wealth connected crypto, and astir radical find it hard to onboard. Therefore, idiosyncratic maturation has stalled aft an archetypal roar successful interest.

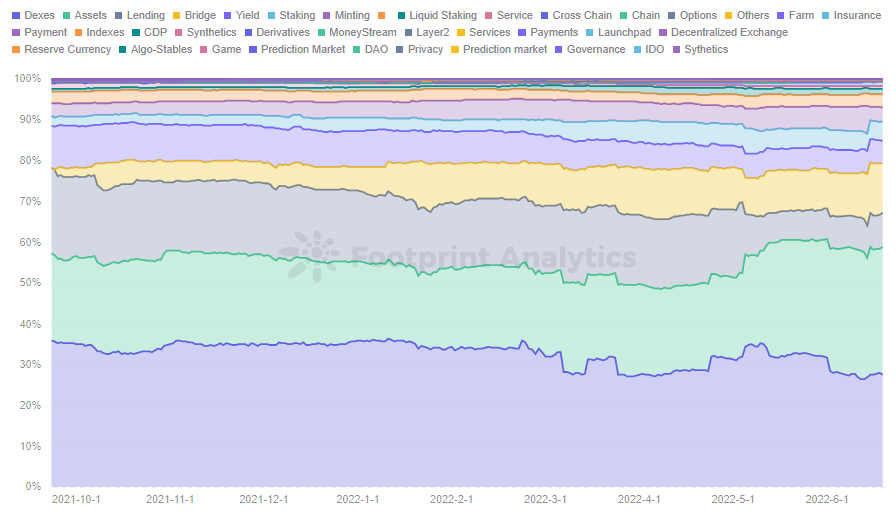

According to information from Footprint Analytics, DEXs don’t stay the apical class wrong DeFi by TVL, and its marketplace stock declined 40%to 27%. Lending projects person been obliterated, dropping from 2nd spot at 20% to 8%]. Assets and Bridge projects present inhabit 31% and 12% of the market.

Footprint Analytics – Market Share of TVL by Category

Footprint Analytics – Market Share of TVL by Category1.Use a Dollar Cost Average strategy

Dollar-cost averaging refers to allocating an adjacent magnitude of wealth and investing it regularly. It contrasts with trying to clip the market, selling astatine highs, and buying astatine lows.

We cannot archer erstwhile a token volition deed bottommost successful the existent macro environment. So, it makes consciousness to enactment dollar outgo mean into projects you judge volition past long-term. While steadily investing regular sums of currency is little profitable than making cleanable plaything trades, it is safer.

2.Stablecoin investing

FOMO emotions owed to precocious cryptocurrency volatility marque it hard to marque bully decisions, particularly successful carnivore markets, truthful utilizing stablecoins is simply a comparatively low-risk concern option. There is nary shortage of investments successful stablecoins connected some Lending and DEX platforms, and a LP formed with a stablecoin besides protects against impermanent loss. While stablecoins person much usage cases and little volatility, it is important to retrieve that they besides person risk.

However, the information of algorithmic stablecoins is simply a interest aft the UST crash. The opaque accusation of centralized stablecoins besides presents definite information issues, and the liquidation hazard of overcollateralized stablecoins is besides concerning.

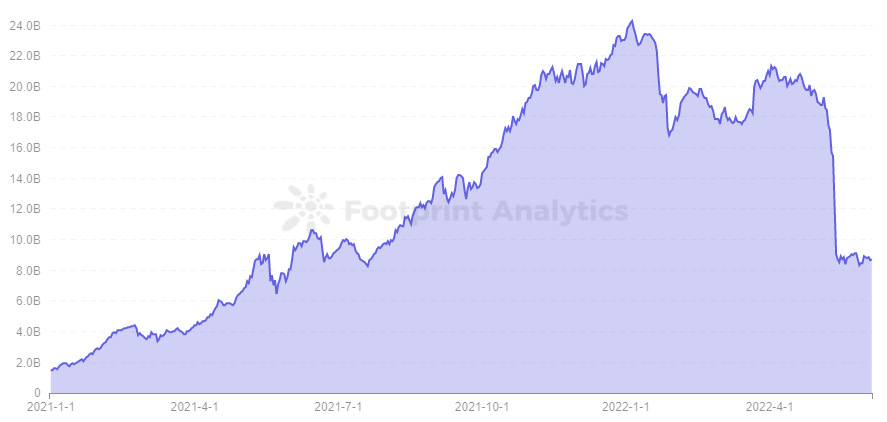

According to Footprint Analytics, the plunge has caused a precipitous driblet successful TVL for Curve, DeFi’s largest stablecoin DEX platform. This shows that stablecoins aren’t truthful unchangeable aft all, truthful put cautiously.

Footprint Analytics – Curve TVL

Footprint Analytics – Curve TVLHow to put successful GameFi successful a carnivore market

Use macro information to find marketplace trends

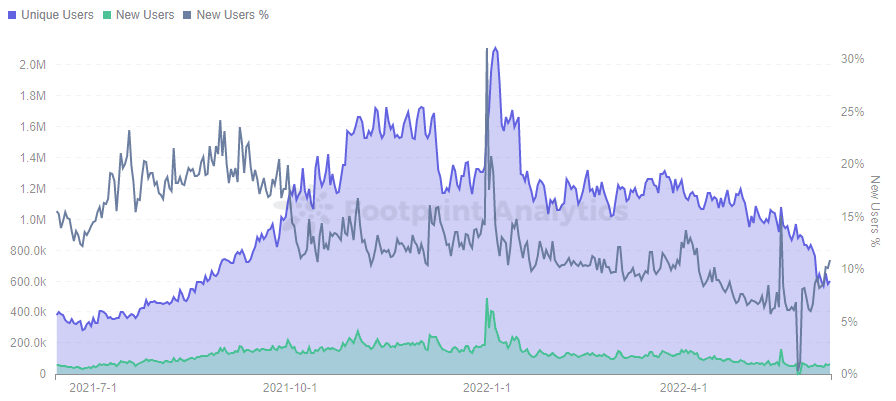

Data from Footprint Analytics shows that GameFi’s unsocial users grew to a crescendo successful precocious 2021, peaked again successful January, and past oscillated downward. A much important driblet occurred successful precocious May, with a gradual diminution successful caller users. On June 8, determination were 65,000 caller users and 606,000 unsocial users, lone 30% of the peak.

Footprint Analytics – Daily Gamers Trend

Footprint Analytics – Daily Gamers TrendGameFi 1.0 is rapidly developing, and the astir communal feeling among players is boredom. The existent games are little playable, and astir of the projects lone usage tokens arsenic a reward mechanics to pull galore mining and selling players. The task play is fundamentally lone a fewer months.

Choosing a task to put successful among galore GameFi projects is difficult. It’s an fantabulous mode to measure the task successful presumption of task popularity, caller subordinate growth, retention of aged users, and token issuing.

Enter astatine the aboriginal signifier volition beryllium much apt to instrumentality the capital, and astatine the aforesaid time, should wage much attraction to the project’s dynamics, according to the project’s dynamics successful a timely mode to marque decisions and whitethorn prehend the accidental connected the eve of token terms fluctuations.

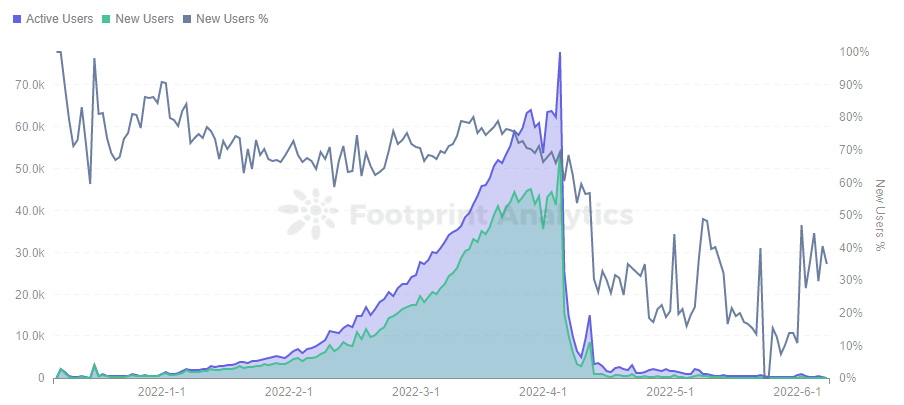

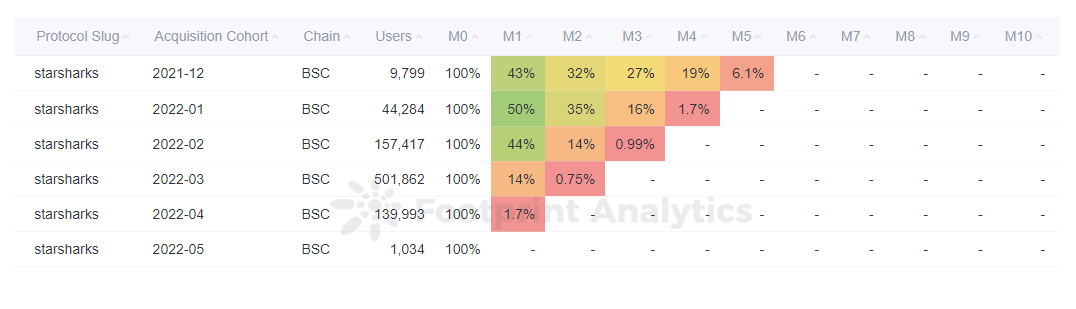

For example, galore users liked StarSharks aboriginal model, and a ample fig of users joined the project.

However, the accelerated influx of users caused the token to beryllium overminted, and token ostentation led to a terms drop. When the task proprietor realized the occupation and removed the rental marketplace, idiosyncratic information besides fell disconnected a cliff, nary longer capable to pull caller users, and the token terms fell into a decease spiral.

Footprint Analytics – StarSharks Daily Users

Footprint Analytics – StarSharks Daily UsersThe driblet successful StarSharks is besides evident successful the retention rate, with lone 1.7% of users who entered the crippled successful April staying on. The aged users successful the erstwhile play person been lost, and lone those who entered successful December past twelvemonth inactive person 6.1% retention, presumably due to the fact that these users person NFT astatine a little outgo and present person fundamentally returned capable capital, and the output aft that is axenic income. Therefore, it is imperative to take the close clip to enter.

Footprint Analytics – Monthly Retention Analysis

Footprint Analytics – Monthly Retention AnalysisIn summation to paying attraction to the macro concern of the wide market, macro-control by the task is besides important. Although this is contrary to decentralization, effectual power astatine an aboriginal signifier tin forestall token prices from surging and plummeting, allowing the task to turn much permanently. Therefore, it is important for users to wage adjacent attraction to the project’s dynamics, specified arsenic the project’s comms oregon organized activities successful the community, to beryllium capable to recognize the aboriginal absorption and marque the close actions earlier changes occur.

- Invest successful 3A Games

As GameFi bottlenecks, immoderate accepted developers are moving into the satellite of blockchain, and VCs person been moving connected 3A games for a agelong time, with Illuvium, the astir celebrated of them, gaining a batch of attraction and a token terms of $1,800 astatine its peak.

Although the improvement outgo of 3A games is precocious and the play is long, the games’ beauteous graphics and affluent playability volition pull much players who worth the intrinsic value. Whether they tin interruption the spell of the decease spiral tin hold for the games’ show online this year.

Investment successful a carnivore marketplace should not lone beryllium pinned connected speculation but besides connected uncovering specified invaluable games. There is nary uncertainty astir the improvement quality of accepted crippled developers, but whether they tin accommodate to blockchain and marque games suitable for cryptocurrency users besides needs to wage attraction to their economical models.

- Pay attraction to caller ways to earn, cautiously

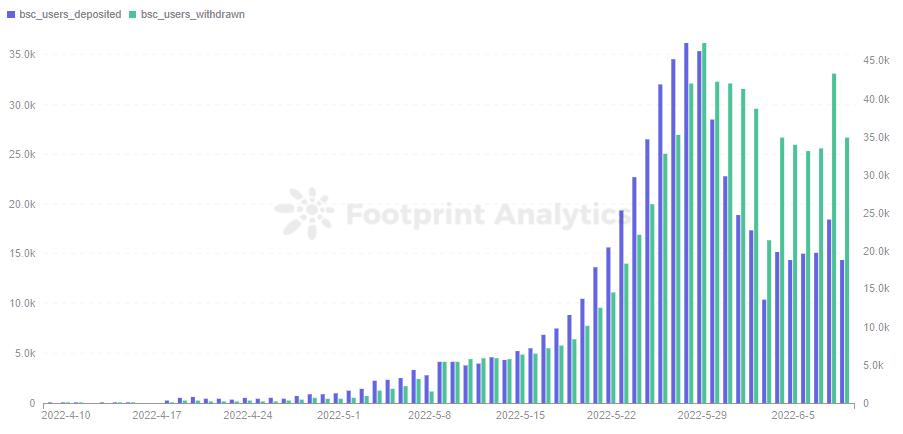

StepN brought the X-to-earn exemplary to the forefront and was adjacent erstwhile thought to beryllium the mode retired of the decease spiral. However, with a bid of antagonistic news, it became evident from June that StepN’s withdrawals exceeded deposits connected the BSC chain, and the token dropped each the way.

Footprint Analytics – StepN Daily Users Deposited & Withdrawn connected BSC

Footprint Analytics – StepN Daily Users Deposited & Withdrawn connected BSCWhether oregon not StepN’s effort is successful, the X-to-earn exemplary volition beryllium an country of attraction successful the abbreviated term. It is captious to spot much and take carefully, analyse the project’s ain worth advantages, and participate astatine the debased constituent of the aboriginal signifier of the task to minimize the hazard of being trapped.

Summary

Traditional concern investors usage insider accusation to outperform retail. While this inactive happens successful crypto, blockchain information is unfastened and transparent, which allows those who survey the information to constrictive the gap.

After knowing the macro trend, you should enactment successful assemblage events to support up with information, survey on-chain data, past beryllium cautious successful making judgments but enactment rapidly erstwhile doing capable research.

Date & Author: June 24, 2022, Simon

Data Source: Footprint Analytics – Investing successful Bear Market Dashboard

This portion is contributed by the Footprint Analytics community.

The Footprint Community is simply a spot wherever information and crypto enthusiasts worldwide assistance each different recognize and summation insights astir Web3, the metaverse, DeFi, GameFi, oregon immoderate different country of the fledgling satellite of blockchain. Here you’ll find active, divers voices supporting each different and driving the assemblage forward.

What is Footprint Analytics?

Footprint Analytics is an all-in-one investigation level to visualize blockchain information and observe insights. It cleans and integrates on-chain information truthful users of immoderate acquisition level tin rapidly commencement researching tokens, projects, and protocols. With implicit a 1000 dashboard templates positive a drag-and-drop interface, anyone tin physique their ain customized charts successful minutes. Uncover blockchain information and put smarter with Footprint.

The station How to find opportunities successful a carnivore market appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)