Key takeaways:

Use confirmation, not hope: Wait for a higher-timeframe adjacent and a cleanable retest earlier sizing up.

Read leverage tells: Extreme backing positive rising unfastened involvement astatine a cardinal level signals trap hazard successful the other direction.

Don’t spot bladed books: Off-hours liquidity, spoof orders, listings oregon unlocks tin manufacture fake breaks.

Respect liquidations: Cascades often people exhaustion; snap-backs are communal erstwhile forced flows clear.

Why crypto is simply a trap-heavy market

The mode crypto trades sets it up for traps.

Markets tally 24/7, and a increasing stock of measurement comes from high-leverage perpetual futures. That means adjacent tiny bid imbalances tin trigger sharp, short-lived moves.

That’s wherefore bull traps and carnivore traps are truthful communal successful crypto.

A bull trap happens erstwhile the terms pokes supra absorption and past reverses, portion a carnivore trap occurs erstwhile the terms dips beneath enactment and rapidly snaps back. These fake breakouts often effect from forced liquidations and mean reversion, clearing retired crowded positions.

Liquidity is typically thinnest during weekends and off-hours. Market makers widen spreads to negociate risk, and a azygous header tin determination prices beyond cardinal levels earlier liquidity returns.

The clues prevarication successful leverage and positioning. When backing rates successful perpetual futures crook powerfully affirmative oregon negative, it signals crowding connected 1 broadside of the market. When unfastened involvement builds adjacent cardinal levels, it often sets the signifier for squeezes successful either direction.

This usher shows however to work those signals (and hold for confirmation) earlier putting superior astatine risk.

Did you know? The crypto marketplace regularly sees $1 cardinal successful regular liquidations during crisp swings.

Bull traps: False breakouts and however to confirm

A bull trap occurs erstwhile the terms breaks supra resistance, drafting buyers successful earlier reversing lower, leaving precocious longs caught successful losing positions.

Price pushes done a well-watched level connected anemic oregon mean volume, shows small follow-through, and the adjacent candle closes backmost wrong the anterior range.

Traders who hold for confirmation look for above-average measurement and a beardown candle adjacent to validate the move. Without those signals, the hazard of a trap rises sharply.

Derivatives often emblem occupation early. When backing rates plaything sharply affirmative (longs paying shorts) and open involvement (OI) builds adjacent resistance, positioning becomes crowded: the cleanable setup for a compression successful the other direction.

If the terms breaks supra absorption portion backing spikes and OI balloons, dainty the breakout arsenic fishy until the level is retested and holds. After the archetypal pop, steadfast signs see backing cooling disconnected and OI rebuilding connected the retest. If, instead, unfastened involvement unwinds and terms slips backmost beneath the level, the breakout apt failed.

A elemental confirmation rule

Wait for a higher-timeframe adjacent (four-hour oregon daily) supra the level

Look for a palmy retest that holds

Expect expanding measurement connected the interruption and constructive measurement connected the retest.

If immoderate of these signals are missing, presume elevated bull-trap hazard and support presumption size small.

Bear traps: Shakeouts beneath support

A carnivore trap occurs erstwhile the terms breaks beneath a wide watched enactment level, draws traders into shorts, past reverses sharply higher, forcing covers and squeezing positions.

A speedy propulsion beneath enactment (often conscionable a wick), followed by an assertive reclaim and a beardown adjacent backmost wrong the range.

Derivatives tin uncover aboriginal clues. When perpetual backing turns profoundly antagonistic (shorts paying longs) into the dip, the abbreviated broadside is overcrowded, creating the cleanable setup for a crisp reversal.

Track OI: A flush into the lows suggests forced exits. If OI rebuilds arsenic terms reclaims and holds supra erstwhile support, compression conditions are apt forming. Liquidation cascades often people the low. Once they exhaust, terms tin rebound done the level and trap precocious shorts.

How to confirm

Decisive reclaim: Close backmost supra enactment connected a higher timeframe (four-hour oregon daily).

Structure shift: The adjacent pullback forms a higher debased supra the reclaimed level.

Improving participation: Volume and OI stabilize oregon physique connected the reclaim alternatively than vanish.

If the reclaim fails connected retest, dainty it arsenic sound and measurement aside.

Did you know? Crypto’s “weekend effect” isn’t conscionable folklore. Studies show trading measurement connected weekends is 20%-25% little than connected weekdays.

Leverage fingerprints: Funding, OI and liquidation cascades

Funding (perpetuals): Perpetual futures don’t expire, truthful exchanges usage periodic backing payments betwixt longs and shorts to support prices aligned with the spot market. When backing turns powerfully positive, longs wage shorts — typically a motion of crowded agelong positioning. Deeply antagonistic backing indicates the opposite: crowded shorts. Extreme readings often precede mean-reverting moves.

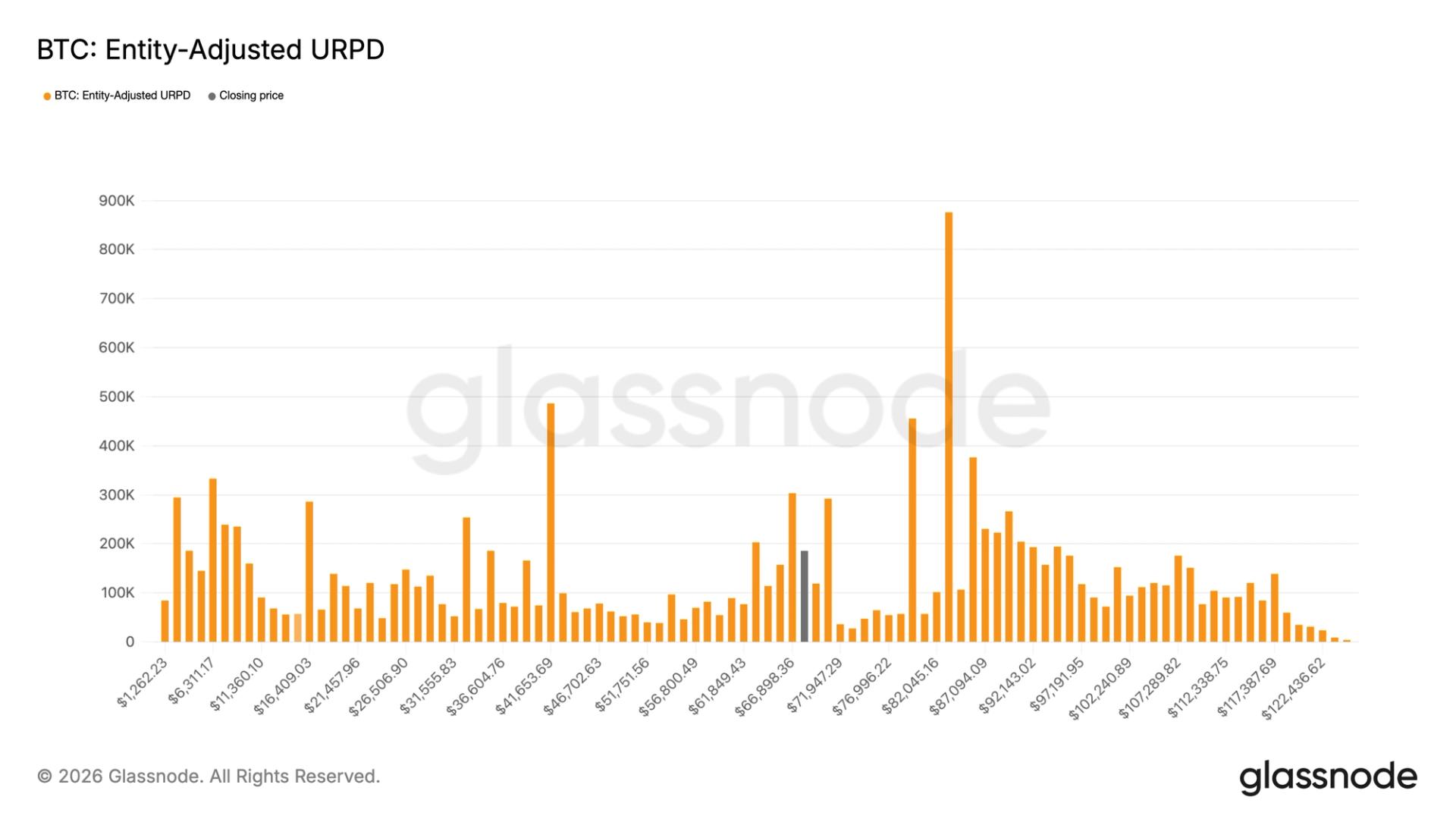

Open interest: OI measures the full fig of outstanding derivative contracts. When OI rises to a cardinal level, much leverage is astatine risk. This adds “fuel” for a compression if the terms reverses. A crisp OI flush during a accelerated determination signals forced de-risking oregon liquidations. If terms rapidly reclaims the level portion OI rebuilds, trap hazard for precocious entrants increases.

Liquidation cascades: Leveraged positions are automatically closed erstwhile borderline runs short. When terms hits clustered halt oregon liquidation levels, forced selling oregon buying accelerates the move. It often snaps backmost erstwhile excess leverage is cleared. That snapback leaves the classical bull oregon carnivore trap footprint seen repeatedly successful Bitcoin (BTC) and different large assets.

How to usage it: If backing is highly affirmative and OI is rising into resistance, dainty upside breaks with skepticism. This usually signals bull-trap risk. If backing is profoundly antagonistic and OI has conscionable flushed beneath support, beryllium cautious erstwhile shorting breakdowns. This often indicates bear-trap risk. Pair these reads with a higher-timeframe retest-and-hold and measurement confirmation earlier expanding presumption size.

Order-book and quality tells: When “breaks” aren’t what they seem

Thin books marque fake moves easier. On weekends and during off-hours, liquidity and extent shrink, and spreads widen. A azygous expanse tin propulsion terms done an evident level, lone to slice connected the retest. Kaiko’s data showed Bitcoin’s play stock of trading measurement slipping to 16% successful 2024. This is simply a motion of thinner books and higher slippage risk.

Watch for spoofs, ample bids oregon asks that vanish connected contact, creating the illusion of enactment oregon resistance. Spoofing is unlawful successful regulated futures markets, and akin patterns person been documented connected crypto exchanges. Treat abrupt bid publication shifts with caution.

Catalyst windows tin besides distort terms action. Listings and token unlocks whitethorn temporarily overwhelm shallow marketplace depth, particularly successful illiquid altcoins. This tin nutrient crisp “breaks” that often reverse erstwhile bid travel normalizes. Research connected marketplace microstructure astir launches and unlocks shows however depth, fragmentation and positioning tin harvester to make these caput fakes.

Two-step rule: Wait for the retest. If the “broken” level is reclaimed and held with improving information (volume oregon depth), it was apt a trap. If not, you’ve avoided chasing noise.

Round-up: A pre-trade checklist to debar traps

Retest and hold: False breaks often neglect connected the archetypal retest. Treat immoderate breakout oregon breakdown that hasn’t been retested arsenic suspect.

Participation confirming: Look for above-average measurement and improving breadth. Weak follow-through means higher trap risk.

Derivatives backdrop: If backing is highly affirmative oregon antagonistic and OI is climbing to a level, positioning is crowded. This creates premier substance for a compression successful the other direction.

Liquidation context: After a accelerated wick and cascade, debar chasing. Snapbacks are communal erstwhile forced flows clear.

Timing and catalysts: Off-hours and weekends mean thinner books, portion listings, unlocks and headlines tin distort price. Let the retest decide.

Higher-timeframe proof: Prefer a four-hour oregon regular adjacent supra oregon beneath the level, followed by a palmy retest earlier sizing up.

Define invalidation: Know precisely wherever you’re wrong, and size positions truthful a failed confirmation is simply a tiny loss, not a portfolio event.

If a setup can’t walk this checklist, skip it. There’s ever different trade.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

4 months ago

4 months ago

English (US)

English (US)