Decentralized concern (DeFi) is 1 of the fastest-growing sectors of the crypto industry, with $92 billion worthy of crypto assets presently locked successful peer-to-peer powered protocols – up 196% implicit the past year.

This maturation tin mostly beryllium attributed to the galore lucrative, high-interest earning opportunities disposable crossed DeFi lending and trading platforms. But, of course, with immoderate caller crypto inclination that draws important attraction and investment, determination are ever scammers looking for ways to capitalize connected it – and you aren’t apt to get a refund for your mistakes.

DeFi protocols are blockchain-based platforms that connection a scope of fiscal services you would typically find successful the accepted space, specified as:

Interest-bearing accounts.

The cardinal quality is, DeFi platforms tally wholly utilizing astute contracts alternatively than having an intermediary similar a slope oregon security broker operating successful the middle.

Smart contracts are self-executing machine programs that enforce contractual agreements betwixt parties.

In an perfect world, they powerfulness invaluable non-custodial fiscal services, similar lending protocols and decentralized exchanges. But sometimes they incorporate bugs oregon gaping information vulnerabilities that let attackers, oregon adjacent errant developers, to drain treasury wallets.

To enactment safe, it’s invaluable to beryllium capable to place communal reddish flags that bespeak a DeFi protocol might, successful fact, beryllium a scam oregon run connected faulty code.

To bash this, you don’t person to beryllium capable to work astute declaration codification oregon recognize programming. Free tools, specified arsenic Token Sniffer for Ethereum and PooCoin for Binance Smart Chain, tally automated audits of token contracts to cheque if they incorporate immoderate malicious codification for you. While these shouldn’t beryllium relied connected entirely, they tin beryllium a bully starting constituent for your ain owed diligence process.

Rug pulls are truthful communal successful DeFi that “getting rugged” has go a communal operation successful crypto-speak.

A rug propulsion is simply a benignant of exit scam successful which the perpetrators make a caller token, motorboat a liquidity excavation for it and brace it with a basal token similar ether (the autochthonal token of Ethereum) oregon a stablecoin similar dai (DAI). A liquidity pool is simply a ample excavation of tokens that a protocol uses to fulfill trades, arsenic opposed to an bid publication strategy wherever buyers and sellers database their commercialized orders and hold to beryllium filled.

The cardinal portion of this scam is the creators clasp a important information of the full proviso erstwhile the token launches.

If they’ve successfully marketed it to the wider crypto community, investors volition statesman adding liquidity to the excavation to gain a information of transaction fees charged to traders who usage it. Once the magnitude of liquidity successful the excavation reaches a definite point, the creators dump each their tokens into the excavation and retreat each the ether, dai oregon whichever basal token was utilized from the pool. This sends the terms of the recently created token to near-zero, leaving investors holding worthless coins portion the rug pullers locomotion distant with a tidy profit.

It’s a monolithic reddish emblem erstwhile conscionable a fewer wallets power astir fractional the circulating proviso of a token. You tin cheque the token organisation connected a blockchain explorer – Etherscan for Ethereum – by clicking connected the "Holders" tab of a token contract.

A November 2021 survey recovered that 50% of each token listings connected Uniswap are scams, truthful the likelihood aren’t successful your favour erstwhile it comes to investing successful comparatively chartless projects.

It’s mostly safer if the squad down a task is public, oregon if it’s tally by anonymous accounts that person earned a bully estimation by launching antecedently successful, honorable projects.

Cryptocurrencies are volatile, meaning prices tin fluctuate massively implicit a fixed clip period. But, if a caller coin lone goes up and cipher seems to beryllium selling it, it tin beryllium a motion that thing known arsenic a honeypot scam is going on.

This is wherever investors are lured successful by a token’s ever-increasing terms but the lone wallet that the astute declaration allows to merchantability is controlled by the scammers.

Squid Game token is simply a caller example. The DeFi task attracted mainstream media attention owed to its alleged relation with the fashionable TV show. It rapidly roseate successful worth soon aft launch, but the media rapidly noticed investors were incapable to merchantability immoderate of their tokens. Eventually, the founders dumped their tokens and ran disconnected with millions of dollars worthy of binance coin (BNB).

It’s important to enactment that wide sum of a cryptocurrency doesn’t needfully mean it’s safe. Mainstream media outlets whitethorn not person the expertise oregon clip to vet a crypto project, and tin often assistance successful drumming up much hype for scams. In immoderate cases, societal media influencers whitethorn beryllium paid to beforehand cryptocurrencies without taking the clip to recognize they’re a scam – and these influencers don’t ever disclose that they’re being paid to speech astir a project. A-list celebrities similar Floyd Mayweather, DJ Khalid and Kevin Hart person each faced lawsuits for promoting crypto projects that were aboriginal recovered to beryllium outright scams.

Phishing is erstwhile a scammer pretends to beryllium an authoritative institution successful bid to instrumentality victims into revealing delicate information. This benignant of scam is particularly rampant successful crypto.

If you station definite keywords connected societal media similar “MetaMask” connected Twitter, you tin expect a swarm of scam bots to reply. Often these bots volition nonstop you to a Google Form, asking you to participate your wallet effect operation oregon different delicate information. Something you should ne'er stock with anyone.

Many scammers unreal to beryllium celebrated radical you mightiness travel connected societal media. They’ll connection you appearing to connection assistance earlier asking you to nonstop crypto oregon stock delicate information. Sometimes scammers volition tally fake YouTube channels soliciting funds.

In January 2021, someone mislaid $1.14 million to scammers pretending to beryllium Michael Saylor, the CEO of MicroStrategy.

Remember, existent influencers are highly improbable to inquire you to nonstop them wealth successful a backstage message– particularly if they’ve ne'er spoken to you before. However, some celebrities may knowingly oregon unwittingly beforehand pump-and-dump schemes, which are besides highly communal successful crypto.

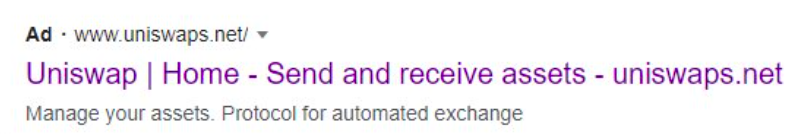

The archetypal Google effect for a crypto task mightiness not constituent you successful the close absorption – successful fact, it mightiness nonstop you toward a scam.

Google scam advertisement (Google.com)

Unfortunately, Google doesn’t vet the authenticity of websites earlier it sells an advertisement spot, truthful a Google advertisement should ne'er beryllium construed arsenic a motion of legitimacy.

If you aren't definite what the close website is, cheque retired reliable sources, similar the authoritative Twitter leafage of the project, to find the existent website.

Uniswap Labs Twitter leafage (Twitter)

Exploits and vulnerabilities

DeFi runs connected pieces of codification disposable to everyone, which means that technically-savvy radical whitethorn exploit vulnerabilities successful the codification and tally distant with immense sums of money. In fact, the magnitude of funds mislaid successful exploits of DeFi projects totaled $1.3 billion successful 2021, according to blockchain information steadfast CertiK.

To trim the risks of exploits, galore DeFi projects committee audit firms similar PeckShield oregon Hacken to reappraisal their codification and assistance them spot immoderate issues found. DeFi projects whitethorn besides connection bounties to white-hat hackers done platforms similar Immunefi to observe bugs successful their codification earlier malicious attackers do.

Audits and bounty programs are usually displayed connected task sites, truthful you whitethorn privation to cheque them earlier deciding to invest. Although these programs trim the risks of exploits, they don't destruct the risks completely. There are plentifulness of audited DeFi projects that person fallen victim to million-dollar-plus exploits.

Airdrops, erstwhile protocols administer escaped tokens to members of their communities, are communal successful crypto. But not each tokens airdropped to your wallet are genuine.

A caller DeFi scam, particularly communal on the Binance Smart Chain, tricks radical into reasoning they person abruptly received tokens worthy thousands of dollars. But they aren’t tradable connected exchanges arsenic there’s nary liquidity.

In astir instances, these tokens volition beryllium named aft a shady website. If you link your wallet done that website and o.k. entree to a malicious astute contract, scammers are capable to siphon funds straight from your wallet.

This nonfiction was primitively published connected

Jan 21, 2022

.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)