Building connected CryptoSlate’s recent analysis of the competing Bitcoin inflows and outflows betwixt BlackRock and Grayscale, I extrapolated the information adjacent further to spot conscionable however agelong BlackRock could prolong its existent mean Bitcoin accumulation.

At a precocious level, BlackRock’s introduction done Bitcoin ETFs is simply a important infinitesimal for Bitcoin’s estimation successful the United States. Along with the different ‘Newborn Nine‘ ETFs, BlackRock’s endorsement is apt to alteration the liquid and precise liquid supplies arsenic much investors summation entree to Bitcoin arsenic a semipermanent investment. Further, it volition summation capitalist assurance for those unfamiliar with blockchain and heighten the credibility of Bitcoin arsenic an plus class, thereby affecting its liquidity and volatility profiles.

Before I spell immoderate further, I privation to adhd a precise wide disclaimer here. The investigation beneath is simply a hypothetical look astatine imaginable accumulation levels from spot Bitcoin ETFs. I person utilized the debut inflows for BlackRock arsenic the yardstick. There is nary warrant these levels volition persist, and if they did, it would precise apt effect successful an summation successful the terms of Bitcoin. The request for Bitcoin is improbable to stay accordant astatine immoderate price, truthful assuming the aforesaid BTC inflows implicit a prolonged play is improbable.

That said, looking astatine the numbers from a purely theoretical standpoint does uncover immoderate highly headline-worthy information points, which tin past beryllium utilized alongside different analyses to place if and erstwhile a proviso crunch is connected the skyline for Bitcoin.

The longer these caller ETFs proceed to get Bitcoin astatine these elevated levels, the amended for semipermanent HODLers and laser eyes.

In my opinion, now, much than ever, HODLing Bitcoin has a existent purpose. The less Bitcoins disposable for acquisition wrong ETFs, the person we travel to a MOASS (Mother Of All Supply Squeezes) wherever Bitcoin moons, not due to the fact that shorts person to cover, but due to the fact that institutions person to bargain Bitcoin connected the unfastened marketplace similar the remainder of the world.

Liquidity successful Bitcoin and BlackRock’s contiguous impact.

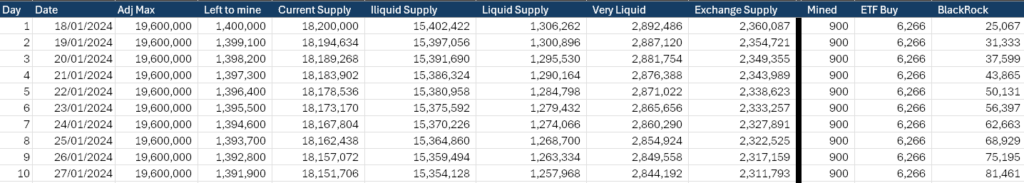

Since the debut of spot Bitcoin ETFs successful the US past week, BlackRock has acquired an mean of 6,266 BTC regular for a cumulative full of 25,067 BTC arsenic of property time. The full acquired by the Newborn Nine implicit just 4 trading days is present astatine 70,000 BTC ($2.9 Billion.) When we see Grayscale, the full Bitcoin nether management is 660,540 BTC ($27.6 billion.)

To recognize the analysis, I’ll archetypal outline the buckets used, arsenic defined by Glassnode data.

“The liquidity of an entity is defined arsenic the ratio of cumulative outflows and cumulative inflows implicit the entity’s lifespan. An entity is considered to beryllium illiquid / liquid / highly liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively.”

More info connected calculating L tin beryllium recovered connected Glassnode’s blog.

- Current Supply: The full fig of bitcoins that person been mined and are presently successful circulation.

- Illiquid Supply: Bitcoins held successful wallets without important movement, suggesting a semipermanent concern strategy.

- Liquid Supply: Bitcoins that are actively traded oregon spent, indicating higher marketplace activity.

- Very Liquid Supply: This class represents bitcoins that are not conscionable traded but are readily disposable for trading connected exchanges wrong a abbreviated timeframe.

- Exchange Supply: Bitcoins held successful speech wallets, acceptable to beryllium traded oregon sold.

The illustration beneath shows the antithetic liquidity cohorts for Bitcoin crossed time. The illiquid supply is by acold the largest sector. However, interestingly, the highly liquid information is greater than the liquid portion, indicating a dichotomy among investors. Bitcoin holders are either hodlers oregon traders, with precise fewer connected the obstruction astir whether to clasp oregon transact with Bitcoin.

Bitcoin liquidity proviso (Source: Glassnode)

Bitcoin liquidity proviso (Source: Glassnode)Now we recognize the liquidity situation, let’s look astatine however the antithetic cohorts stack up. The authoritative max proviso of Bitcoin is 21,000,000 coins. The existent circulating proviso is 19,600,000. According to Glassnode, the full magnitude of mislaid coins is astir 1,400,000; this includes Satoshi’s coins, among others. There are different higher estimates of mislaid coins; however, fixed that this fig has remained comparatively accordant since 2012, I deliberation it is the astir reliable number.

Interestingly, this means that erstwhile we remove the mislaid coins from the maximum supply, we extremity up with the aforesaid fig arsenic the existent circulating supply. While this is purely coincidental for this nonstop infinitesimal successful time, it gives an thought of however it volition consciousness erstwhile each the coins person been mined, astatine slightest successful presumption of marketplace liquidity. Of course, aft each coins are mined, the deficiency of artifact rewards for miners volition adhd different facet to the premix I won’t get into close now. I volition accidental that I judge fees volition beryllium more than enough to proceed to unafraid the web fixed the current absorption Bitcoin is heading in.

| Max Supply | 21,000,000 |

| Current Supply | 19,600,000 |

| Adj. Max Supply | 19,600,000 |

| Adj. Current Supply | 18,200,000 |

| Illiquid Supply | 15,402,422 |

| Liquid Supply | 1,306,262 |

| Very Liquid Supply | 2,892,486 |

| Exchange Balance | 2,360,087 |

The existent proviso tin besides beryllium adjusted to region mislaid coins. The 3 main cohorts to analyse are the liquidity levels, arsenic explained below, and the equilibrium of Bitcoin connected crypto exchanges. The full liquid and precise liquid coins amount to conscionable 4,198,748 BTC ($175 billion,) which accounts for around 21% of the $815 billion Bitcoin marketplace cap.

What if BlackRock keeps buying up each the Bitcoin?

Now, for the amusive portion that you are each speechmaking for What if BlackRock inflows were to proceed astatine the level seen during its debut? While immoderate person bemoaned the motorboat of spot Bitcoin ETFs arsenic a failure, and Bitcoin’s terms has adjacent dropped to $41,300 from its caller precocious of astir $49,000, I deliberation they volition surely extremity up with the ‘egg connected their face,’ arsenic we accidental successful the UK. Here’s why!

Currently, 900 caller Bitcoins are mined daily, and this volition driblet to 450 BTC astir April 18, 2024. Additionally, arsenic I said previously, BlackRock is acquiring astir 6,266 BTC daily. If BlackRock were to effort to bargain straight from miners, this would pb to a nett shortage of 5,266 BTC.

So, it needs to get Bitcoin from determination else. So far, the Coinbase OTC desks person had capable liquidity to soak up the requirement. However, this cannot past forever; determination is nary endless liquidity. The array beneath shows what would hap if BlackRock bought from each cohort with miner participation.

BlackRock Bitcoin inflow rate

BlackRock Bitcoin inflow rateAt its existent rate, implicit the adjacent 10 days, BlackRock would execute astir 81,481 BTC with small to nary important interaction connected immoderate cohort. So, the motorboat is simply a failure?

I don’t deliberation so.

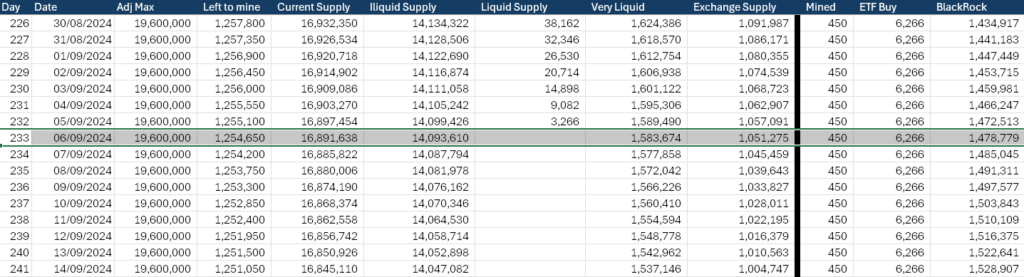

If we widen this down to Sept. 6, 2024, and BlackRock is lone buying from the liquid supply, with miners adding to this cohort and reducing the impact, the full cohort would beryllium absorbed.

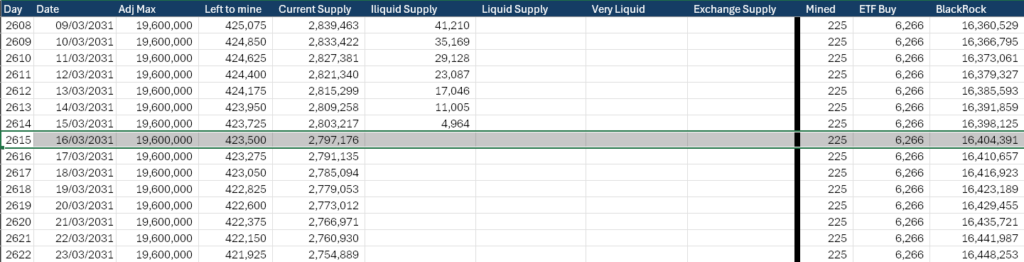

BlackRock acquisition time 233

BlackRock acquisition time 233Let’s transportation on.

To support it bully and clear, each array going guardant volition beryllium nether the pursuing hypothetical scenario.

What if BlackRock bought exclusively from this cohort astatine the complaint it has during the archetypal 4 days and recently mined Bitcoin was besides included, frankincense reducing the interaction of BlackRock’s buying?

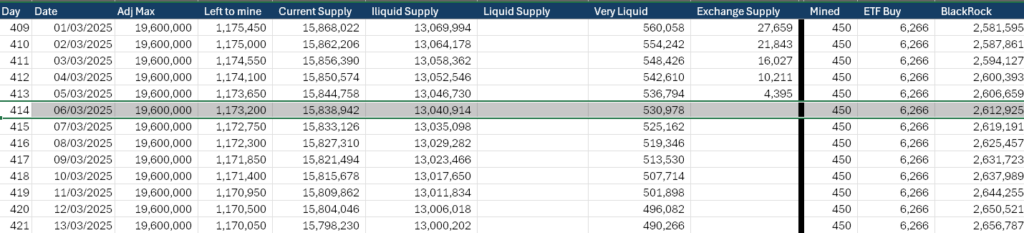

By March 3, 2025, the Bitcoin held connected exchanges would beryllium gone, and BlackRock would person 2.6 cardinal BTC.

Exchange equilibrium absorbed.

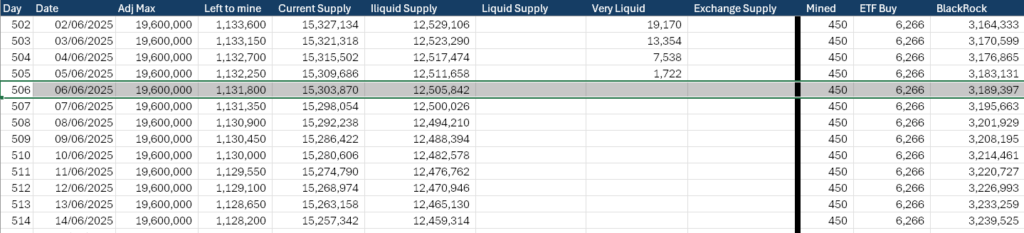

Exchange equilibrium absorbed.The ‘very liquid’ cohort would beryllium absorbed by June 6, 2025. This radical is astir apt the astir easy accessible for BlackRock to find liquidity, and it is inactive conscionable 18 months away.

Very liquid proviso absorbed.

Very liquid proviso absorbed.In conscionable 8 years, by 2032, BlackRock’s Bitcoin holding would beryllium worthy $686 cardinal by today’s standards and dwell of 16,404,391 BTC. This would necessitate it to person recovered a mode to bargain each of the Bitcoin from the ‘illiquid’ proviso and springiness it astir 79% of each Bitcoin successful circulation nether management.

Illiquid proviso absorbed

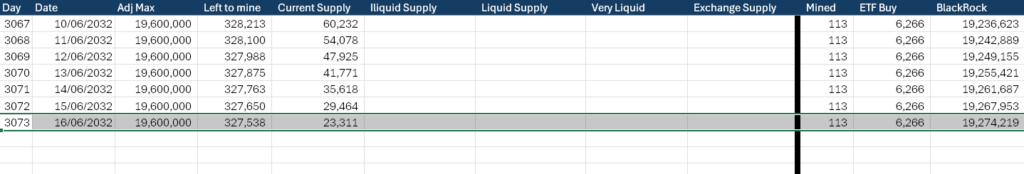

Illiquid proviso absorbedFinally, successful conscionable 3,073 abbreviated days, connected June 16, 2032, BlackRock would person bought each of the Bitcoin successful circulation and yet person to halt its 6,266 BTC per time purchase. Going forward, determination would lone beryllium 113 BTC disposable each time from recently mined Bitcoin, of which determination would beryllium 327,538 BTC near to mine.

BlackRock owns Bitcoin

BlackRock owns BitcoinOf course, fewer of the supra scenarios are going to happen. BlackRock is improbable to beryllium capable to prolong these levels of inflows successful Bitcoin presumption without Bitcoin’s terms either falling importantly oregon request expanding on with price.

For example, 6,266 BTC is worthy $262 cardinal astatine $41,840 per Bitcoin. At $200,000, this magnitude becomes $1.25 cardinal daily. Conversely, astatine $10,000, it is lone $62.6 million.

So unless Bitcoin stays astir $40,000 for the adjacent 8 years, BlackRock is capable to person investors to bargain its ETF astatine the aforesaid pace, and it tin find HODLers consenting to sell, we aren’t going to spot BlackRock instrumentality custody of each the Bitcoin.

However, we tin present commencement to spot what benignant of an interaction accordant Bitcoin ETF inflows tin person connected antithetic parts of the supply. Personally, my Bitcoin is illiquid and remains that way. I spot the benefits of spot Bitcoin ETFs, and I besides spot the proviso crunch that’s coming successful immoderate signifier oregon form. Definitely not today, astir apt not this quarter, but aft that…

CryptoSlate volition proceed to excavation into the numbers and nerd retired connected concatenation for you, truthful if you enjoyed this exploration into Bitcoin supply, delight fto america cognize connected our X relationship @cryptoslate oregon scope retired to maine straight @akibablade.

The station If BlackRock continues 6k BTC regular buys we get a proviso crunch wrong 18 months, here’s why appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)