In a caller thread connected X (formerly Twitter), renowned on-chain expert Checkmate provided an investigation regarding the aboriginal trajectory of Bitcoin. Currently, the premier cryptocurrency hovers astir the $60,000 mark, a pivotal infinitesimal that echoes humanities patterns wrong the Bitcoin marketplace cycle.

What Will The Next 6 Months Bring For Bitcoin?

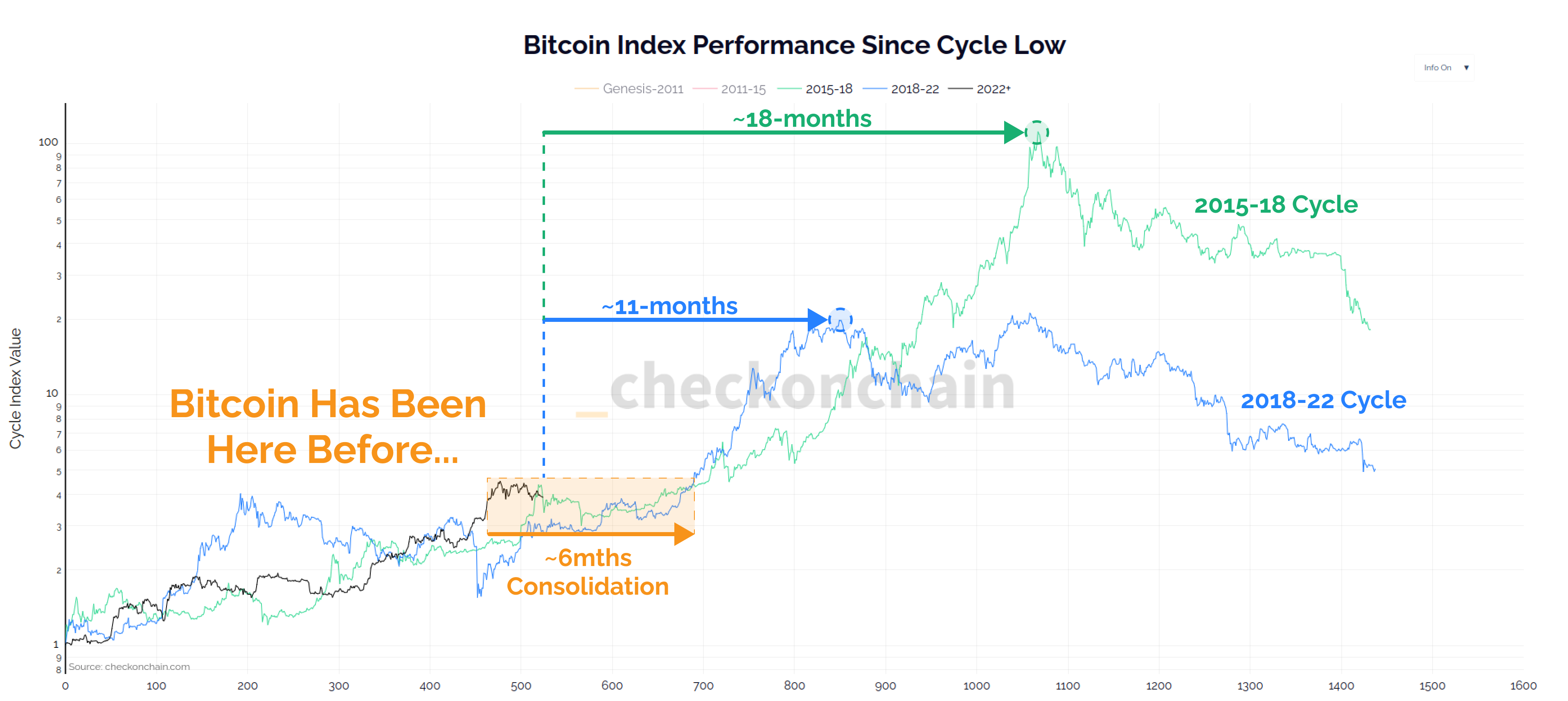

Checkmate argues that Bitcoin is positioned successful a “chopsolidation” phase—a word coined to picture a stagnant yet volatile period. He suggests that this could past astir six months, based connected erstwhile cycles, and perchance usher successful a play of parabolic maturation that could past betwixt six to 12 months. “Bitcoin history tends to rhyme, and frankincense far, this rhythm is nary different,” Checkmate noted. “The opus sung during the past 2 cycles paints astir 6-months of chopsolidation up of us, followed by 6-12 months of parabolic advance.”

Bitcoin Index Performance Since Cycle Low | Source: X @_Checkmatey_

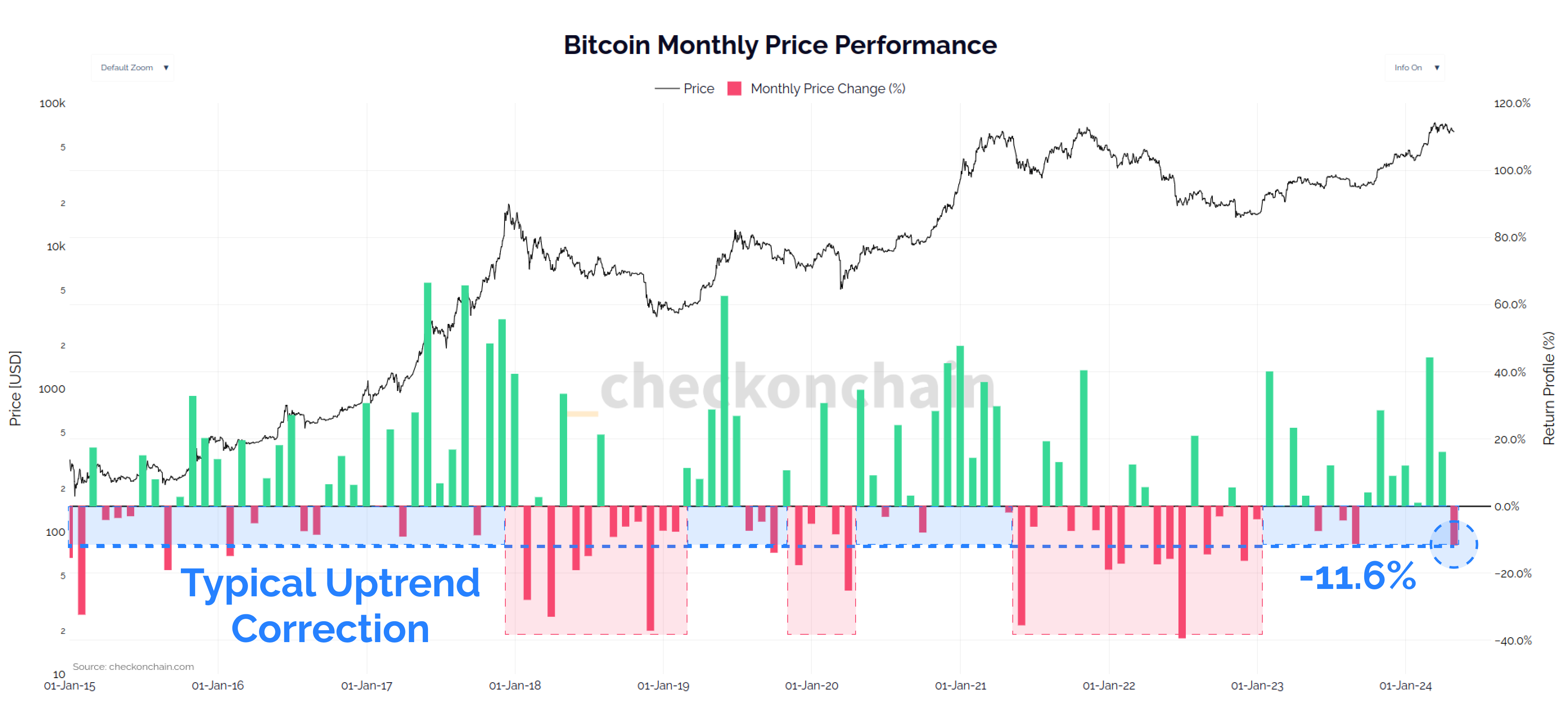

Bitcoin Index Performance Since Cycle Low | Source: X @_Checkmatey_Supporting his analysis, Checkmate refers to April 2021 arsenic a important precocious constituent for Bitcoin for “many bully reasons,” noting that contempt a sizeable monthly driblet of implicit $8,250 successful April, specified movements are emblematic and often signify steadfast marketplace corrections. “It’s an -11.2% monthly pullback, and is highly communal during uptrends, and corrections are steadfast and necessary,” helium stated, reinforcing his assurance successful Bitcoin’s resilience and imaginable for recovery.

Bitcoin Monthly Price Performance | Source: X @_Checkmatey_

Bitcoin Monthly Price Performance | Source: X @_Checkmatey_Further statistical backing comes from humanities information focused exclusively connected Bitcoin halving years (2012, 2016, 2020, and 2024), which Checkmate utilized to exemplify that specified month-over-month corrections are not outliers but alternatively communal occurrences wrong the integer asset’s cyclical trends. The extremity of each twelvemonth post-halving has historically shown beardown performance, supporting the conception that the existent terms constituent could beryllium a precursor to important gains.

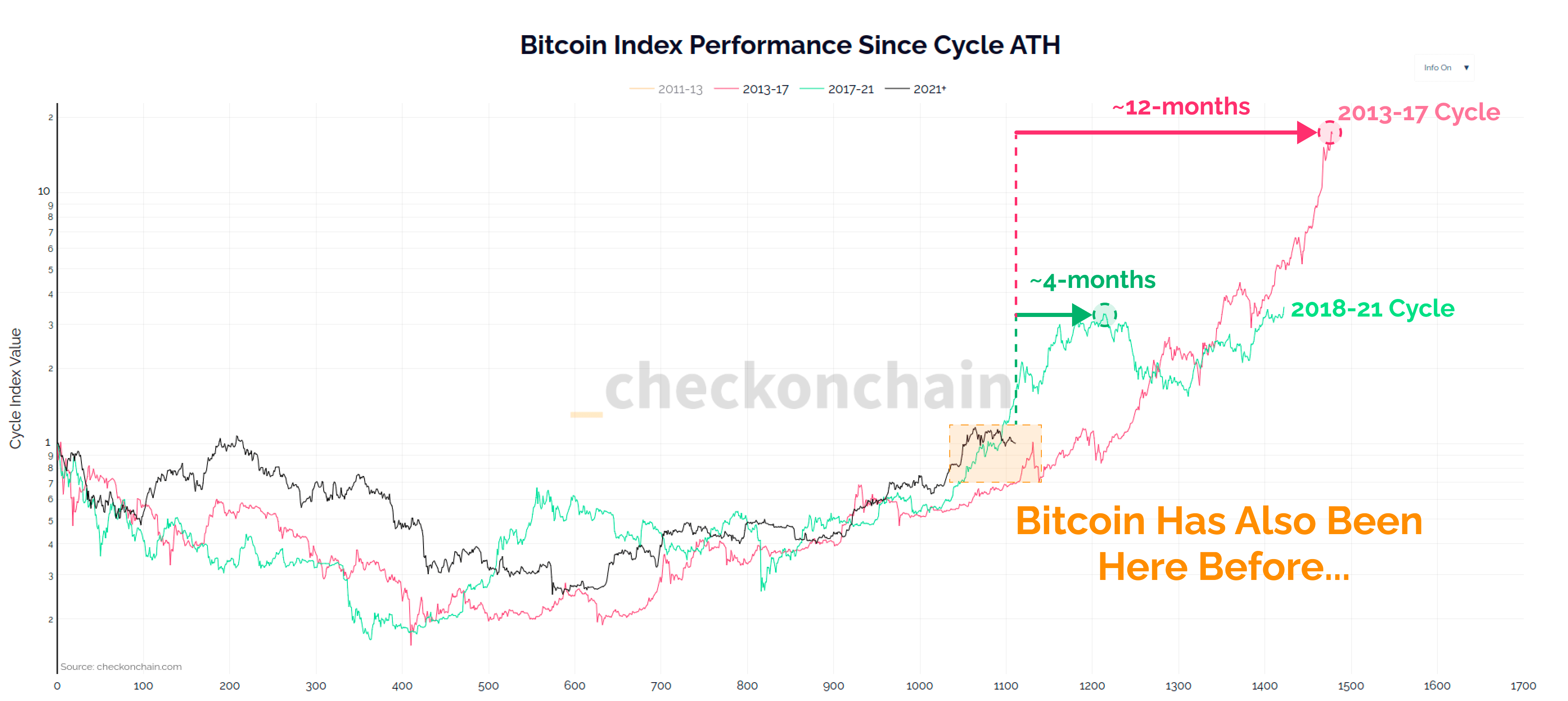

Bitcoin Index Performance Since Cycle ATH | Source: X @_Checkmatey_

Bitcoin Index Performance Since Cycle ATH | Source: X @_Checkmatey_Sell In May And Go Away?

Checkmate besides retweeted a station from Charles Edwards. The laminitis of Capriole Investments commented connected the market’s unprecedented bullishness, implying that a deeper correction is to beryllium expected.

“This is starting to get ridiculous. Bitcoin has not had a tally similar this since inception. We are present 1 time abbreviated of the grounds acceptable successful 2011 for days without a meaningful dip [more than 25%]. If you are not prepared to judge immoderate downside successful this plus class, you shouldn’t beryllium here. Especially now,” said Edwards. His remark highlights the antithetic deficiency of terrible downturns successful the market, suggesting that investors should beryllium prepared for imaginable volatility.

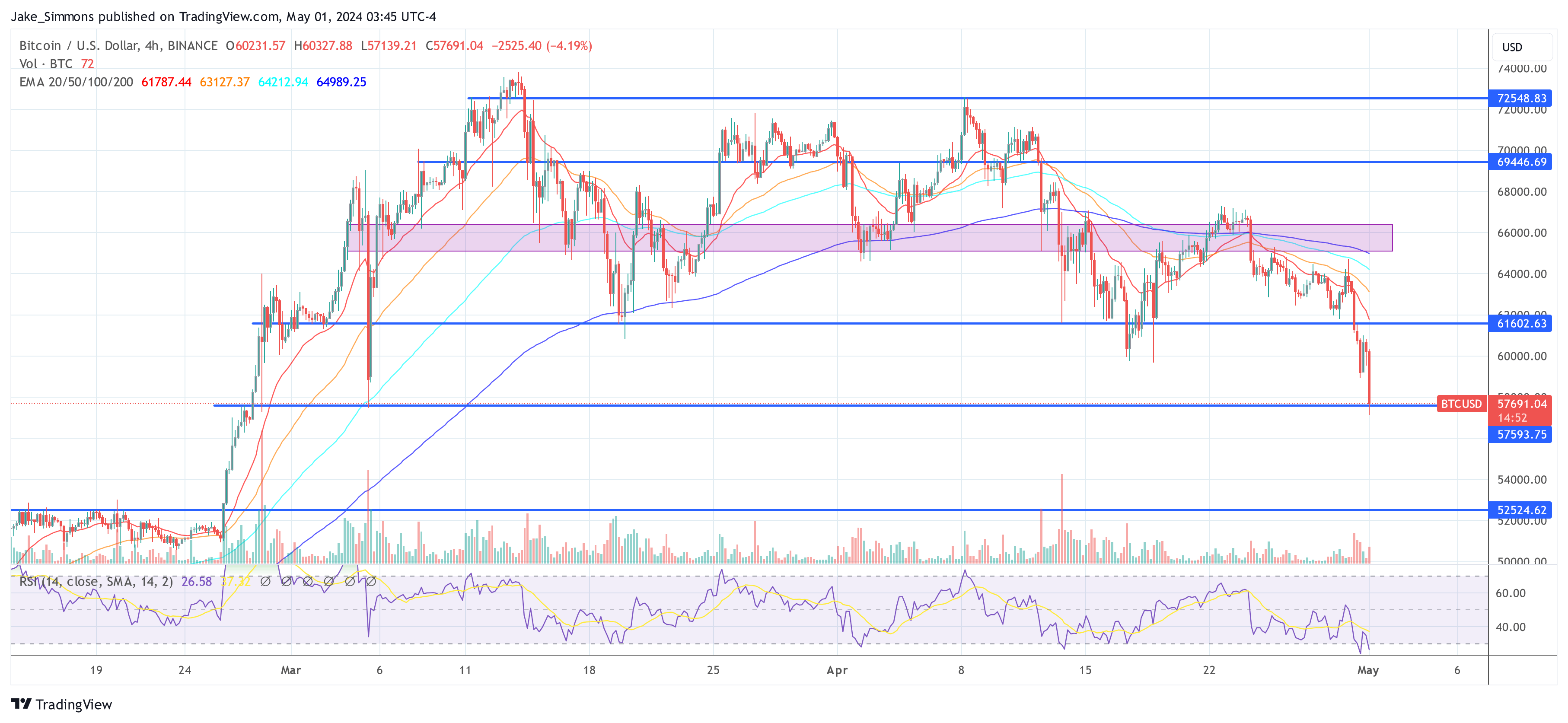

In different station connected X, Edwards added a cautious enactment to the different optimistic outlook. He advised, “Sell successful May and spell away. This looks similar organisation to me. As agelong arsenic we commercialized beneath $61.5K, script (1) is technically much likely. A beardown reclaim of $61.5K would springiness immoderate hopes to the bulls for script (2). A flush would besides beryllium bully for the sustaining continuation of the bull market, the sooner we get one, the amended the agelong opportunities are.”

Bitcoin terms investigation | Source: X @caprioleio

Bitcoin terms investigation | Source: X @caprioleioThis position suggests a strategical withdrawal whitethorn beryllium omniscient successful the abbreviated term, implying that existent marketplace conditions mightiness beryllium much bearish than they look and that a important correction could perchance fortify the market’s semipermanent prospects.

At property time, the BTC plunged to $57,691.

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)