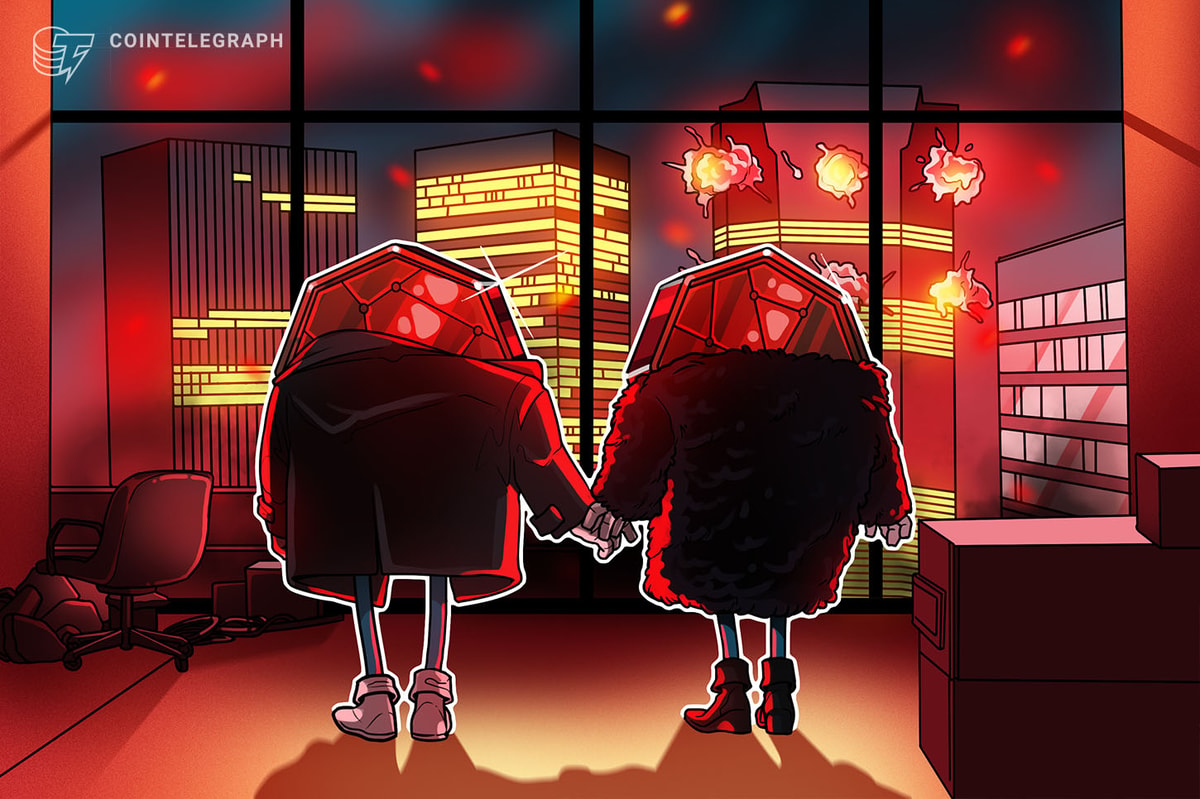

The International Monetary Fund (IMF) is moving to make a level that would service arsenic an interoperability furniture for cardinal slope integer currencies (CBDCs), allowing for settlements among antithetic countries. According to statements from IMF Managing Director Kristalina Georgieva, this would debar the underutilization of CBDCs for home purposes.

IMF Working connected CBDC Cross-Border Integration Platform

The International Monetary Fund (IMF) is gathering a solution to integrate and enactment cross-border payments among cardinal slope integer currencies (CBDC). According to IMF Managing Director Kristalina Georgieva, this would forestall underutilization of these currencies, expanding their usage to planetary markets.

At a conference successful Morocco, Georgieva reinforced the request for interoperability. She stated:

CBDCs should not beryllium fragmented nationalist propositions. To person much businesslike and fairer transactions we request systems that link countries: we request interoperability.

Georgieva besides remarked connected the request for CBDC regularisation connected a planetary standard to enactment this interoperability usage case. The nonaccomplishment to scope agreements connected this taxable would pb to the maturation of cryptocurrencies arsenic a substitute for the void created, Georgieva explained.

The authoritative added that 114 cardinal banks were progressive successful CBDC exploration projects, with 10 already arriving astatine the decorativeness line.

Some CBDC projects are already live. China is already utilizing its CBDC, the e-yuan, to pay salaries successful immoderate regions of the country, portion the Venezuelan petro, a state-issued integer currency, is facing a liquidation amidst a cryptocurrency corruption probe, according to caller reports.

Also, the European Central Bank (ECB) is successful its last phases of deciding connected issuing a integer euro that would beryllium focused connected providing outgo rails to Europeans.

A Case for CBDCs

Georgieva stressed the benefits that the issuance of CBDCs mightiness bring to countries adopting them, stating that if implemented currently, they mightiness “help to summation inclusion” and “strengthen the resilience and ratio of outgo systems.”

The enforcement besides commented that CBDCs could “make cross-border payments and remittances cheaper,” arsenic the outgo of transferring wealth crossed borders stands astatine 6.3%, an manufacture that brings work providers $44 cardinal annually.

Georgieva, who has advocated for anti-crypto regularisation successful the past, established differences betwixt cryptocurrency assets and CBDCs, clarifying that, for her, the second should beryllium backed by assets. Furthermore, she stated that cryptocurrencies backed by assets could beryllium considered concern opportunities, calling unbacked cryptocurrencies “speculative investments.”

What bash you deliberation astir the IMF’s enactment connected a CBDC interoperability platform? Tell america successful the remark conception below.

2 years ago

2 years ago

English (US)

English (US)